A proper risk management system is critical for the successful execution of any project, but it assumes greater significance in the case of hydro-electric projects (HEPs), owing to the uncertainties involved in their implementation. HEPs are site specific and their timely execution depends heavily on the topography, geography and geological set-up of the site. Besides, limited infrastructure (roads, railways, etc.), difficulties in the transportation of heavy equipment, issues in forest land diversion and public opposition are some of the issues that often lead to cost and time overruns in HEP execution. These uncertainties expose developers to significant risks, which should be mitigated through an appropriate insurance policy. Although all risks are not insurable, some can be mitigated through commercial insurance covers.

Risk profiling and insurance options

Risk profiling of an HEP is critical as it provides a comprehensive understanding of the project’s risks and helps determine which of them is insurable. Further, it provides an insight into insurance cover options for the project, besides helping define the appropriate level of insurance that should be purchased by the developer. The risk management exercise involves the study of construction contracts with a special emphasis on insurance clauses, the identification of risks at various stages and mitigation measures.

Insurance is essentially an instrument of project security minimises the completion risk of the project, enhances project credit and acts as collateral for the investor and the lenders.

The key points to be considered while availing of insurance for an HEP are underwriting information, the phrasing of the insurance policy in accordance with project specifics, deciding the indemnity period and arriving at the sum insured, obtaining details of the reinsurers’ market and weather derivatives.

The insurance policy for HEPs, in general, has warranty clauses related to tunnelling, piling, firefighting and underground cabling. Further, depending on the HEP’s location and design as well as the contractor’s experience, the policy may have conditions regarding construction/time schedule, earthquake zones, construction of dams and water reservoirs, removal of debris from landslides, and safety measures with respect to precipitation, flood and inundation.

Other than the general clauses, conditions regarding silt removal and dewatering, removal of debris, coverage for access roads, continuity of insurance cover for common assets and project extension up to six months at pro rata premium may also be included in the insurance policy.

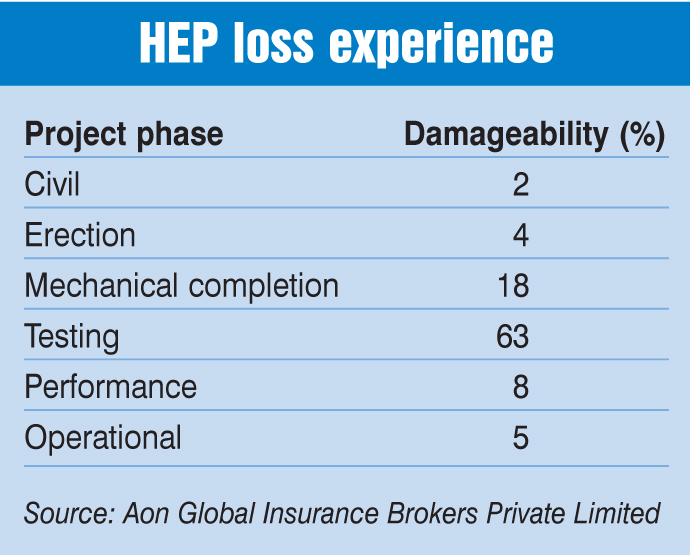

Some of the commonly observed losses in HEPs are devastation caused by earthquakes and landslides, overtopping of the coffer dams due to flooding, access roads being washed away by heavy rains/ floods, silt accumulation due to floods, burial of equipment and tunnel boring machines in slush, third-party physical injury and property damage, and injuries to workers. Insurance policies for HEPs lays special emphasis on possible damages due to natural calamities, the possibility of overtopping of the coffer dams, construction methodology for the tunnel, construction of the transmission and distribution networks, flood protection, safety issues, equipment delivery and local population issues.

Owner-controlled insurance programmes

Owner-controlled insurance programmes (OCIPs) are generally used for large HEPs to cover the wide range of uncertainties that can affect them. OCIPs improve insurance coverage without blowing budgets by consolidating insurance for all project contractors and subcontractors into a single programme. OCIPs also provide efficient control over premiums, claims and insured parties. They offer coverage to maximise protection for a defined time period, allow delayed-start-risk protection, and facilitate the smooth transfer of risk. Further, the payment distribution of claims is easily controlled under OCIPs.

The underwriting data required for OCIPs includes parties’/stakeholders’ information, detailed project description, ground conditions/foundation design and technical specifications of major equipment. Contract conditions, construction schedules, suppliers of major equipment, contractor experience, site plan and selected drawings, and the description of surrounding property are taken into account while underwriting.

Conclusion

Given the delays observed in HEP execution, it is prudent for developers to identify the risks in project development well in advance and outline a comprehensive risk mitigation plan. Selecting an appropriate insurance cover can go a long way in securing developers against uncertainties in HEP execution. n

With inputs from a presentation by Pranav Patel, Executive Vice-President, Energy and Power Generation, Aon Global Insurance Brokers Private Limited, at a recent Power Line conference