Confirming the rumours surrounding the company for almost a year, SunEdison filed for Chapter 11 bankruptcy protection on April 21, 2016, thus commencing the process to restructure the company. This step was taken in light of the huge debt that the company had piled up in recent years following an acquisition spree. In its bankruptcy filing, SunEdison has listed $20.7 billion in assets and over $16 billion in liabilities. These figures include two yieldcos, TerraForm Power and TerraForm Global, although they are not part of the bankruptcy filing. The company sees the bankruptcy filing as an opportunity to address liquidity issues, reduce debt, right-size the balance sheet and support its business going forward.

Based on the company’s filings under Chapter 11, the US Bankruptcy Court has allowed (on an interim basis) the company to continue its ordinary business activities and access up to $300 million as debtor-in-possession (DIP) financing.

Before filing for bankruptcy protection, the company had already secured DIP loans from a consortium of first and second lien lenders. However, some of the company’s creditors and yieldcos have objected to the DIP loan and the case is being heard in the bankruptcy court. According to SunEdison, the new financing will save the company from immediate fire-sale liquidation and support its daily operations during the reorganisation. The creditors, on the other hand, believe that DIP loans would risk the continuance of the company even more as they would give the DIP lenders exclusive rights to liquidate the company. Further, the DIP loans, worth $300 million, are likely to reduce the recoverable amount for the existing creditors by $1.34 billion. Moreover, the DIP loan lenders have a distinct advantage over the existing creditors as they will be the first ones to be repaid in case of liquidation.

The yieldcos are also of the view that the loan will make the situation worse for the company by taking it towards administrative insolvency. However, they are willing to support the loan if SunEdison assures that it will bear its administrative liabilities unfailingly.

Chapter 11 bankruptcy

A bankruptcy filing under Chapter 11 of the US Bankruptcy Code permits the reorganisation of the company under the court’s supervision while it continues to operate in the ordinary course. A Chapter 11 debtor usually proposes a plan of reorganisation to keep its business alive and pay creditors over time.

For SunEdison, filing for bankruptcy under Chapter 11 has meant that the company’s management will continue to maintain control over its day-to-day operations while trying to reorganise its debt and maximise value for all stakeholders. In other words, it has given the company an opportunity to re-emerge as a healthy organisation.

If SunEdison is successfully reorganised under this chapter, it is expected to continue operating in an efficient manner with its newly structured debt; if not, it would be liquidated. However, the probability of the latter is higher. Reports and studies indicate that only 10-15 per cent of Chapter 11 cases result in successful reorganisations, the remaining are either dismissed or converted to Chapter 7 liquidations.

What went wrong?

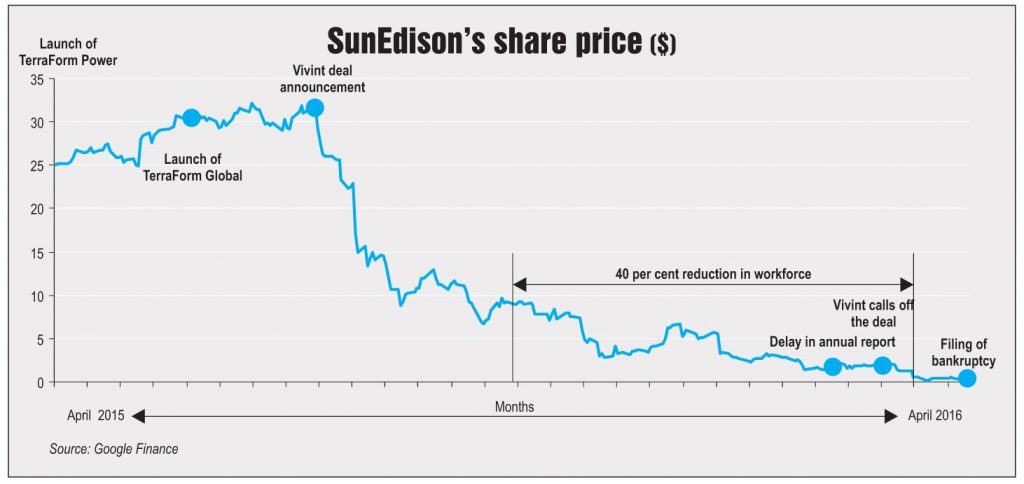

Founded in 1959 as the Monsanto Electronic Materials Company, the company was renamed SunEdison in May 2013, with a change in focus from silicon wafers to solar energy following the acquisition of a privately owned company, SunEdison LLC. SunEdison launched its first yieldco, TerraForm Power, in June 2014, and commenced an expansion drive. Within a year, the second yieldco, TerraForm Global, was launched with a focus on investments in Asia and Africa.

SunEdison bought a number of existing contracts as well as new contracts (by underbidding) to develop wind and solar plants, and also acquired various companies. Along with TerraForm Power, SunEdison acquired First Wind, a utility-scale wind developer, for $2.4 billion in November 2014. In December 2014, the company acquired Capital Dynamics and in July 2015 it bought the UK-based Mark Group, a residential solar panel installer.

In July 2015, the company signed two more agreements – one with Invenergy to acquire 930 MW of wind projects for $2 billion and another with Vivint Solar for $2.2 billion. The deals, however, disappointed investors and invited a lot of criticism. Investors began to lose confidence, feeling that the deals may falter and worsen the company’s weak balance sheet.

The company was at its peak in mid-July 2015, when it was worth over $9 billion, excluding the debt of over $11 billion. TerraForm Power and TerraForm Global were valued at over $3 billion and $2 billion respectively. The company hit a rough patch at the end of July 2015. Its per-share price dropped by over 99 per cent, from around $33 in July 2015 to 15 cents in May 2016. At the time when the company filed for bankruptcy protection, the stock was trading at 34 cents a share.

This was largely the result of the acquisition spree, which drove the company into deep debt, thus resulting in investor scepticism. In a short span of two to three years, the company spent over $18 billion on acquisitions and raised $24 billion in debt and equity. However, the new projects did not offer the value the company had estimated while the acquisitions loaded its balance sheet with debt long before they could prove profitable.

At present, SunEdison faces about two dozen legal claims, mainly from shareholders who have accused the company of misleading them about its financial position. SunEdison had declared $1.4 billion of cash in September 2015, when its cash position was much worse. Reportedly, the company had only $100 million in cash as of November 2015. The company also failed to close a number of announced acquisition deals, including the Vivint deal. The deal was terminated by Vivint itself in March 2016. Meanwhile, about 40 per cent of the company’s workforce was laid off between October 2015 and March 2016. The company also delayed the filing of its annual report for 2015 citing material weaknesses in its financial reporting controls.

Fallout from the bankruptcy

For SunEdison

The company’s future looks grim as it is fast running out of cash and missing interest payments. SunEdison’s financial troubles have imperilled a number of ongoing projects. Globally, SunEdison has over 800 projects in backlog/the pipeline, aggregating 7,800 MW. Of the total capacity, only 2,884 MW is under construction. With the filing for bankruptcy, the fate of these projects could be in jeopardy. The company has sold off or is trying to sell some of these projects while trying to line up new financing for others.

For yieldcos

With SunEdison filing for bankruptcy, the future of its yieldcos has also become uncertain. Technically, the company’s bankruptcy would not lead to bankruptcy of TerraForm Power or TerraForm Global. Both the yieldcos own operating assets that generate cash, which should enable them to negotiate a solution with the creditors. However, a number of financing deals of the yieldcos have clauses tied to SunEdison’s health; hence, the risk of defaults remains. The stocks have been witnessing a downward trend since the second half of 2015 as investors have become increasingly cautious over the companies’ ability to finance their projects. Moreover, neither of the two yieldcos has been able to submit its annual report for 2015, resulting in delisting from NASDAQ. The companies are now required to submit a plan to regain their status.

For India

SunEdison has around 700 MW of solar capacity commissioned in India and a further 1.5 GW is under development. With the country’s total solar capacity at 7 GW, this represents a sizeable portion, and hence the bankruptcy can affect the market adversely. Moreover, the dramatic drop in solar tariffs in India has already raised concerns for investors about the projects’ quality and sustainability. For this, SunEdison has also been partly blamed given its low bid of Rs 4.63 per unit for a 500 MW solar plant in Andhra Pradesh last November.

For the solar market

SunEdison’s exit is unlikely to influence the renewable energy market too much because of the presence of other large players. Moreover, SunEdison failed not because of its technology, but because of its appetite for growth, its strategic decisions and ineffective business model. The solar power sector is still likely to continue to grow. However, SunEdison’s fall will certainly caution the government as well as project officers to ensure that only bankable bidders engage in the bidding process.

What’s next

While the situation is a cause for concern, given the amount of assets that the company owns, it is still possible to salvage it. For now, it is a wait-and-watch situation, which could lead to either the remaking – or the end – of the once largest renewable energy developer.