Power trading has emerged as a viable option for industrial and commercial consumers looking to sell and buy power at competitive rates. The availability of surplus power in the short-term market and the decline in prices in recent years are encouraging an increasing number of consumers to opt for power trading.

Short-term trading contracts can be executed directly between distribution licensees (discoms) or through power exchanges, the deviation settlement mechanism, or bilateral transactions with interstate trading licensees. Power exchanges offer a transparent and easy platform for trading, which has led to their rapid growth in recent years. During the period 2009-10 to 2015-16, the size of the power exchange market grew at an impressive CAGR of 17.8 per cent.

Product offerings

The product portfolio of power exchanges was initially designed to address the spot contract needs of the market through the day-ahead market (DAM). With time, the exchanges added term-ahead market (TAM) contracts and renewable energy certificates to their portfolio. The DAM market includes day-ahead contracts where physical delivery of power occurs on the following day. Under TAM, the power exchanges are allowed to have contracts for scheduled delivery of power up to 11 days. Power exchanges have recently expanded their portfolio to include trading of energy savings certificates by designated industrial consumers.

Size and growth

Of the total electricity generated in the country in 2016-17, the short-term power market accounted for 10.2 per cent (119 BUs) share, while the rest was accounted for by long-term PPAs. At the power exchanges, the total volume of power traded stood at about 41 BUs in 2016-17, an increase of 17 per cent over the previous year. DAM accounted for 97.3 per cent share in the total exchange transactions, while the rest was accounted for by TAM. The weighted average price of power at the Indian Energy Exchange (IEX) ranged from Rs 2.19 to Rs 2.93 per unit in 2016-17, while at Power Exchange India Limited (PXIL), it ranged from Rs 1.97 to Rs 3.01 per unit. The weighted average price at the exchanges has declined from Rs 3.50 per unit in 2014-15 to Rs 2.72 per unit in 2015-16.

Participation

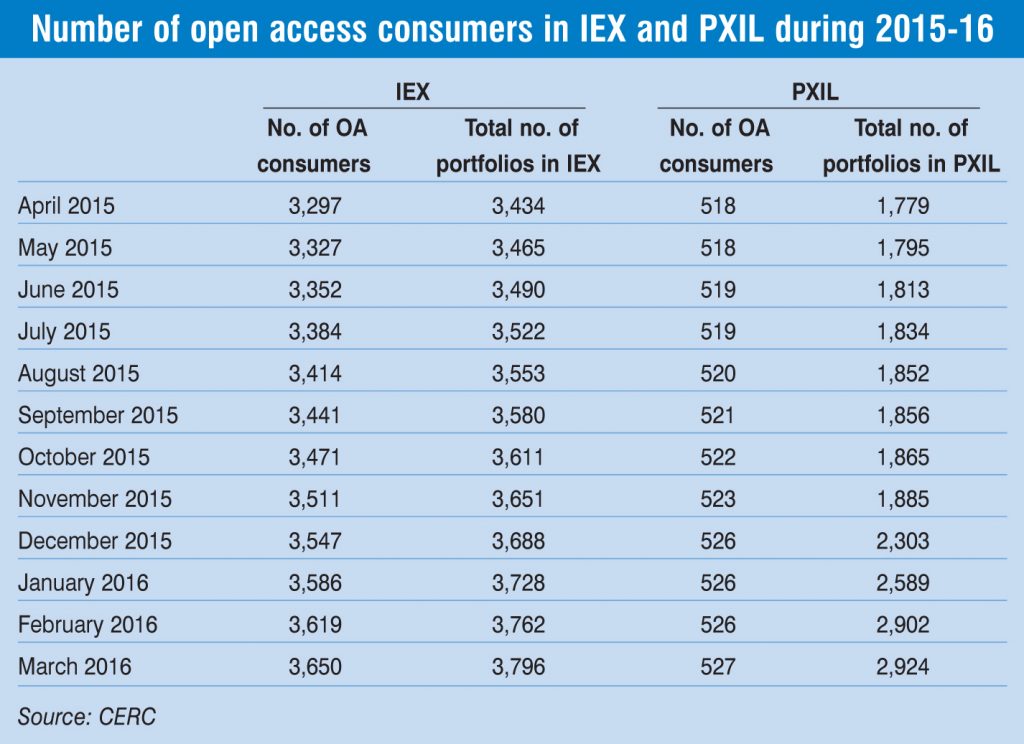

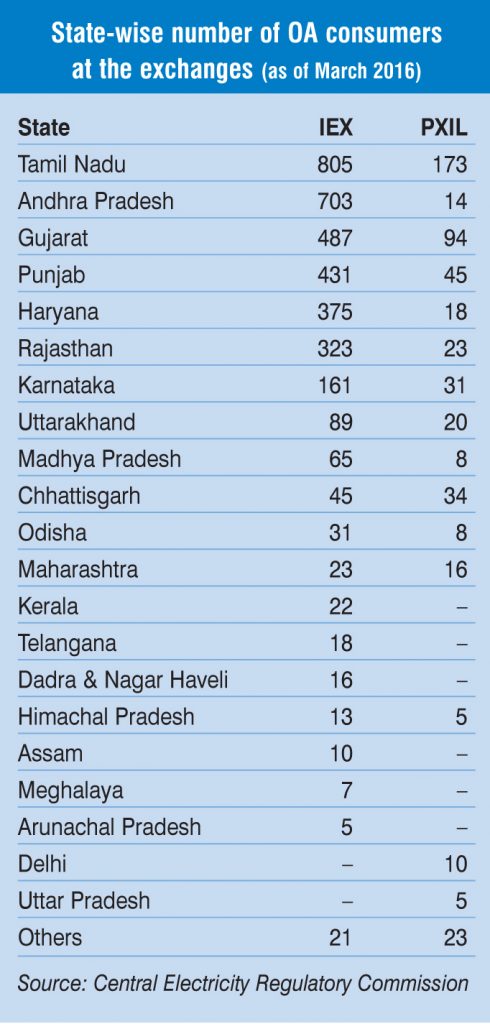

As of end-March 2016, nearly 3,650 open access (OA) consumers at the IEX and 527 OA consumers at PXIL were procuring part of their power requirement through the power exchanges. In fact, the purchase volume of OA consumers at the IEX in 2015-16 was nearly 59.54 per cent of the total volume transacted at the exchange, while at PXIL, the volume procured by such consumers was nearly 57.58 per cent.

In terms of volumes, OA consumers procured almost 20.2 BUs at the IEX at a weighted average price of Rs 2.56 per unit. At PXIL, OA consumers procured 78.78 MUs at a weighted average price of Rs 2.61 per unit.

Key issues and the way forward

Congestion in the transmission network constrains the volume of electricity transacted through the power exchanges. This is because transmission planning is currently carried out on the basis of long-term requirement and not the medium or short term. Although the volume of uncleared electricity (which could not be transmitted due to congestion) has shown a declining trend, it is still substantial. This volume stood at 1.52 BUs during 2016-17, down from 2.16 BUs in 2015-16. An improvement in inter- and intra-regional transmission networks is imperative to reduce congestion.

Besides, challenges in OA implementation hamper short-term transactions. The reluctance of discoms to provide OA to industrial and commercial consumers is a major hindrance to power trading. Also, several states have a high cross-subsidy surcharge, which makes power procurement from other sources unviable.

Besides, challenges in OA implementation hamper short-term transactions. The reluctance of discoms to provide OA to industrial and commercial consumers is a major hindrance to power trading. Also, several states have a high cross-subsidy surcharge, which makes power procurement from other sources unviable.

The lack of demand due to the poor financial condition of several distribution utilities is also a key concern. As discoms are unable to buy power, they resort to load shedding instead. An improvement in the financial health of discoms is crucial for the development of the power trading market. The Ujwal Discom Assurance Yojana is expected to help improve the financial health of the discoms, albeit gradually.

Going forward, with the launch of new products and ancillary services, the share of unscheduled exchange is expected to come down and that of bilateral trade and exchanges is likely to increase. Meanwhile, according to industry experts, the price of bilaterally traded power is expected to reach Rs 4 per kWh in the next three to four years and stabilise thereafter. The evolution of the price discovery mechanism to the more efficient and transparent Discovery of Efficient Electricity Price platform is further likely to drive growth in the short-term power market. The ongoing revamp of the transmission planning process is a positive step in this direction.