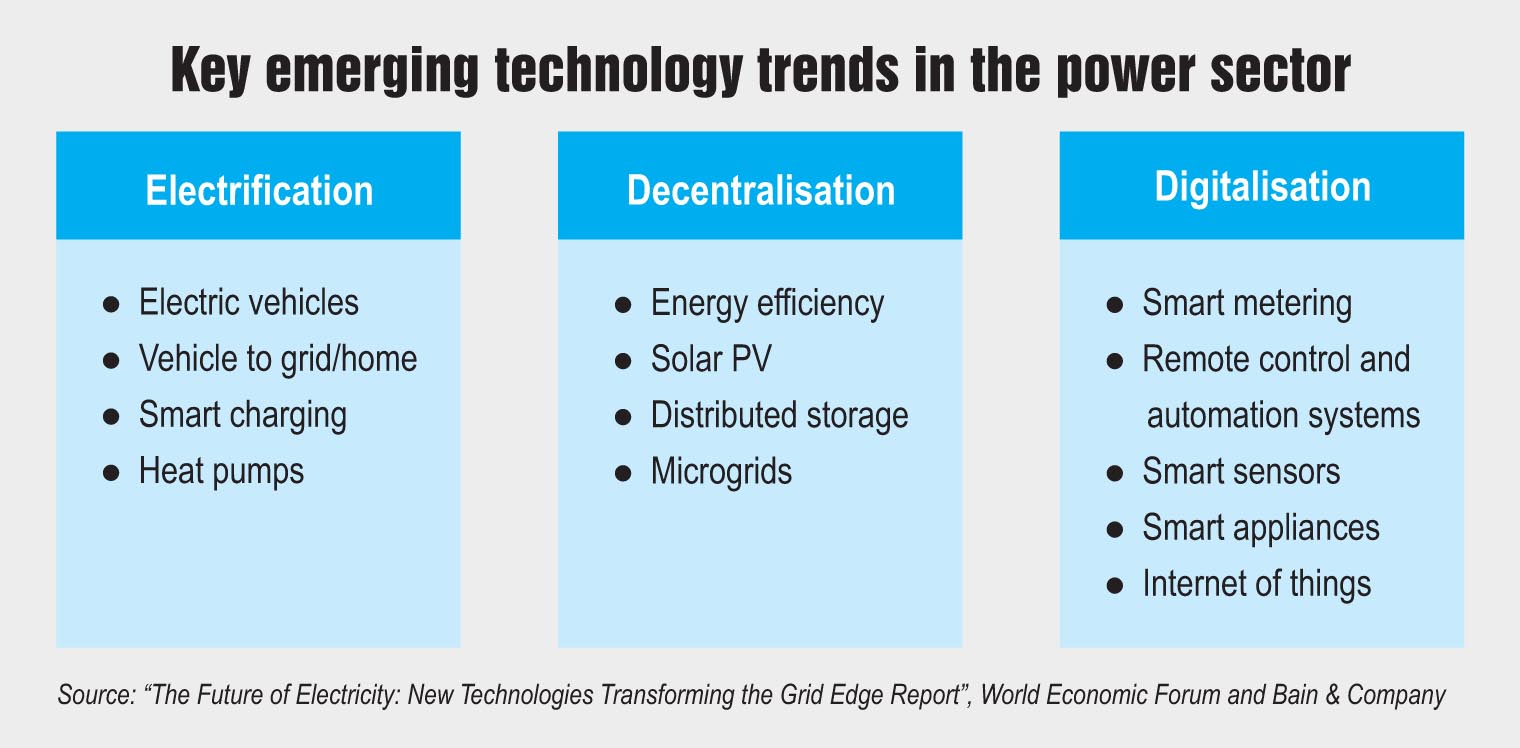

Growing digitalisation and automation in power sector operationsTechnological advancements and innovations driven by rapid electrification of segments like transport, expansion of renewables and digitalisation of the grid are transforming the power sector. With decentralisation, decarbonisation and deregulation, the entire business model of utilities is evolving rapidly and state-of-the-art technologies are making those changes possible that were beyond the imagination a few years back. These technologies are gradually making inroads in the Indian power sector as well. Power Line presents an update on the key technology trends in the power sector…

Digitalisation in generation

Digitalisation is a key emerging trend in the power sector that is picking up pace in a big way. Digital technologies allow devices across the grid to communicate and provide useful data for the management and operation of generation, transmission and distribution systems. Smart meters, internet of things (IoT)-based sensors, network remote control and automation systems, and digital platforms help in real-time operation of the network and its connected resources.

In the generation segment, digitalisation is mainly carried out for improving power plant efficiency, reducing operations and maintenance costs, lowering unplanned outages and extending the operational life of assets. While generation utilities have been deploying control and monitoring systems, networked communication, etc., for the past few years, new digital technologies such as IoT, cloud-based platforms, advanced analytics, predictive data analytics, asset performance management software and intelligent forecasting solutions are gradually growing in the segment. Also, with the growth of digital technologies in the generation segment, the complete remote operation of power plants has become a reality. A case in point is NTPC Limited’s 800 MW Koldam hydroelectric project in Himachal Pradesh, which is operated remotely from a distance of 400 km from its control centre in Delhi. It is the first HEP in the country to be monitored remotely. The general architecture required for a control and automation system, such as field instruments and drives, input/output modules and controllers, and operator workstations and servers are present at the remote control centre in Delhi.

Transmission technologies

Digitalisation and automation solutions have been steadily growing in the transmission segment too. In recent years, substation automation has emerged as a key growing technology among transmission utilities. Power Grid Corporation of India Limited (Powergrid) has emerged as a leader in technology adoption in substation automation, with state utilities following suit. Powergrid is undertaking remote operation of about 104 substations from its National Transmission Asset Management Centre in Manesar, Haryana, which was commissioned in April 2015. Powergrid is also implementing the wide area measurement system (WAMS) technology across India under its flagship Unified Real Time Dynamic State Measurement (URTDSM) project. In July 2018, GE T&D India Limited commissioned the first stage of the project, which will enable Powergrid to monitor power flow across 110 substations in the northern grid and respond to fluctuations within a fraction of a second. When fully commissioned, the project will be the largest in the world comprising 1,184 phasor measurement units and 34 control centres across the country, and cover over 350 substations in the national grid.

Digital substations, centred around the IEC 61850 protocol, are the next step in substation modernisation. Digital substations comprise smart primary devices and intelligent electronic devices (IEDs) to achieve information sharing and interoperability. Powergid has implemented pilot digital substation projects at Bhiwandi and Neemrana. Based on the experience from these pilots, the company plans to launch similar new projects.

Other emerging technologies include Flexible AC Transmission System (FACTS), which incorporates power-electronics-based static controllers to enhance control and power transferability of the system. Powergrid is installing FACTS devices such as static VAR compensators (SVCs) and static synchronous condensers (STATCOMs) in the interstate transmission system grid. It has already commissioned one SVC in Jammu & Kashmir and four STATCOMs. Further, 11 STATCOMs are at various stages of implementation.

Smart grids in distribution

In the distribution segment, technology initiatives are being taken under the Ministry of Power (MoP)-approved pilot projects as well as the National Smart Grid Mission (NSGM). At present, 12 smart pilot projects are underway across states, with 50 per cent funding support from the MoP. The pilot projects entail installation of nearly 170,000 smart meters, of which 120,000 meters have already been installed. Of the total projects, four have been completed/nearing completion, while the rest are likely to be completed by next month. In addition, three smart grid projects (one in Chandigarh and two in Maharashtra) worth Rs 25 million have been sanctioned under the NSGM, with 30 per cent funding from the MoP. Further, four projects in Kochi, Rourkela, Ranchi and Chandigarh, worth Rs 6.58 billion, are currently under approval. The functionalities being tested in these pilots include advanced metering infrastructure (AMI), outage management system (OMS), peak load management (PLM), power quality management (PQM) and distributed generation.

Electric vehicles

The government’s increasing focus on electric vehicles (EVs) provides an opportunity to optimise electricity consumption and balance the grid, given that appropriate pricing and smart charging solutions are deployed. As the country gears up to meet the target of 100 per cent EV sales by 2030, the demand for EVs charging stations and battery storage solutions is expected to grow exponentially. In March 2018, the MoP clarified that charging stations do not require separate licences, an issue that was ambiguous. The central government has also recently proposed to set up charging stations for EVs at every 3 km in cities and every 50 km on national highways. Further, Energy Efficiency Services Limited (EESL) is working to aggregate demand by procuring EVs in bulk to achieve economies of scale under the National E-Mobility Programme launched in March 2018.

While EV sales have increased considerably in the past two years, charging infrastructure is coming up gradually as the standards and specifications for EV charging stations are still being formulated. Many PSUs as well as private players have proposed plans to set up charging stations. These include NTPC, BHEL, Powergrid, Indian Railways, GAIL, Tata Power Delhi Distribution Limited (TPDDL), Reliance Infrastructure, Fortum and L&T. NTPC has set up charging stations at its offices in Noida and Delhi as well as at its power plants in Talcher (Odisha) and Simhadri (Visakhapatnam). TPDDL has announced plans to set up 10,000 charging stations in Delhi by 2022. In April 2018, BSES Rajdhani Power Limited and EESL entered into a partnership to provide services in the areas of smart and emerging technologies including EVs/EV charging stations. Recently, Maharashtra State Electricity Distribution Company Limited also announced plans to set up 500 charging stations across the state.

Microgrids and energy storage

Microgrids and energy storage

Microgrids or local energy grids with distributes generation sources, typically renewable, with control capabilities, can provide a promising solution to the country’s energy access problem. Microgrids can operate either in grid-connected or isolated modes but in India they are mainly being installed in areas where the grid has not penetrated or is not accessible. The traditional portfolio of microgrid/distributed generation technologies included reciprocating engines, microturbines, combustion gas turbines and mini-turbines. However, new and emerging technology options such as fuel cells, photovoltaics (PV), particularly rooftop solar PV, and wind turbines are now proliferating rapidly. Microgrids have evolved over time, becoming much smarter and making extensive use of renewable sources and advanced technologies.

Microgrids are the most efficient when they are complemented with energy storage and control systems. Energy storage systems (ESSs) play a significant role in addressing the issue of grid stability in renewable energy generation and are an attractive option for both grid-connected and off-grid renewable sources. So far, only pumped storage hydropower has been adopted as an ESS in the country in the past but non-traditional storage facilities can be designed such as electrochemical battery cells, flywheels and compressed air energy storage. While pilots of ESS based on these technologies have been set up in developed countries, there is no project based on non-traditional storage technologies in the country. However, its role is expected to increase with the development of the electricity market and renewable generation and increasing regulatory interventions. Many private companies such as Sterling & Wilson and Wärtsilä have already announced their foray into the ESS segment. Also, AES India Private Limited, a subsidiary of the US-based AES Corporation, and Mitsubishi Corporation are jointly developing a 10 MW utility-scale ESS for TPDDL in Delhi. The Solar Energy Corporation of India has also issued tenders for the development of solar power projects having battery ESS in Leh (Jammu & Kashmir) and the Andaman & Nicobar Islands respectively.

Conclusion

In order to ensure seamless technological transformation of the power sector, policymakers need to redefine existing regulatory frameworks and explore new business models. A plan for the deployment of infrastructure, in line with the needs of the future power systems, needs to be drafted and implemented. Besides, challenges of cyberattacks and information theft need to be taken care of by the utilities. In the present digital age, access to data and managing that data through advanced technologies will drive the growth of power utilities across the generation, transmission and distribution segments.