Distribution franchisees are likely to form a key component of the government’s plan to revive the distribution segment. The Ministry of Power (MoP) has reportedly drafted a plan for the states to have multiple private franchisees as power suppliers while the wires business/physical infrastructure will continue to be owned by the state-owned licensees. The plan, if finalised and implemented well, can bring in the much-needed private participation in the distribution segment. NITI Aayog’s “Strategy for New India@75” report, released in November 2018, states that privatising state distribution utilities and/ or the use of a franchise model can help reduce aggregate technical and commercial (AT&C) losses. A more recent report by NITI Aayog, “Diagnostic Study of the Power Distribution Sector” lists the adoption of the distribution franchise (DF) model as a key step towards improving operational performance of distribution utilities. This report was released in April 2019.

Background

The DF model’s genesis in India came about primarily for improving access to electricity for rural communities. This model was given formal recognition with the passage of the Electricity Act, 2003, as a means to encourage private participation in the distribution segment, besides improving electricity access. Since state distribution utilities are not comfortable with shifting all their rights/responsibilities to a private entity, the concept of a franchisee was put into practice. The key difference between a franchise model and a private distribution company is that the capex is not passed on to consumers under the former (DF model), whereas a private discom recovers that expense from consumers.

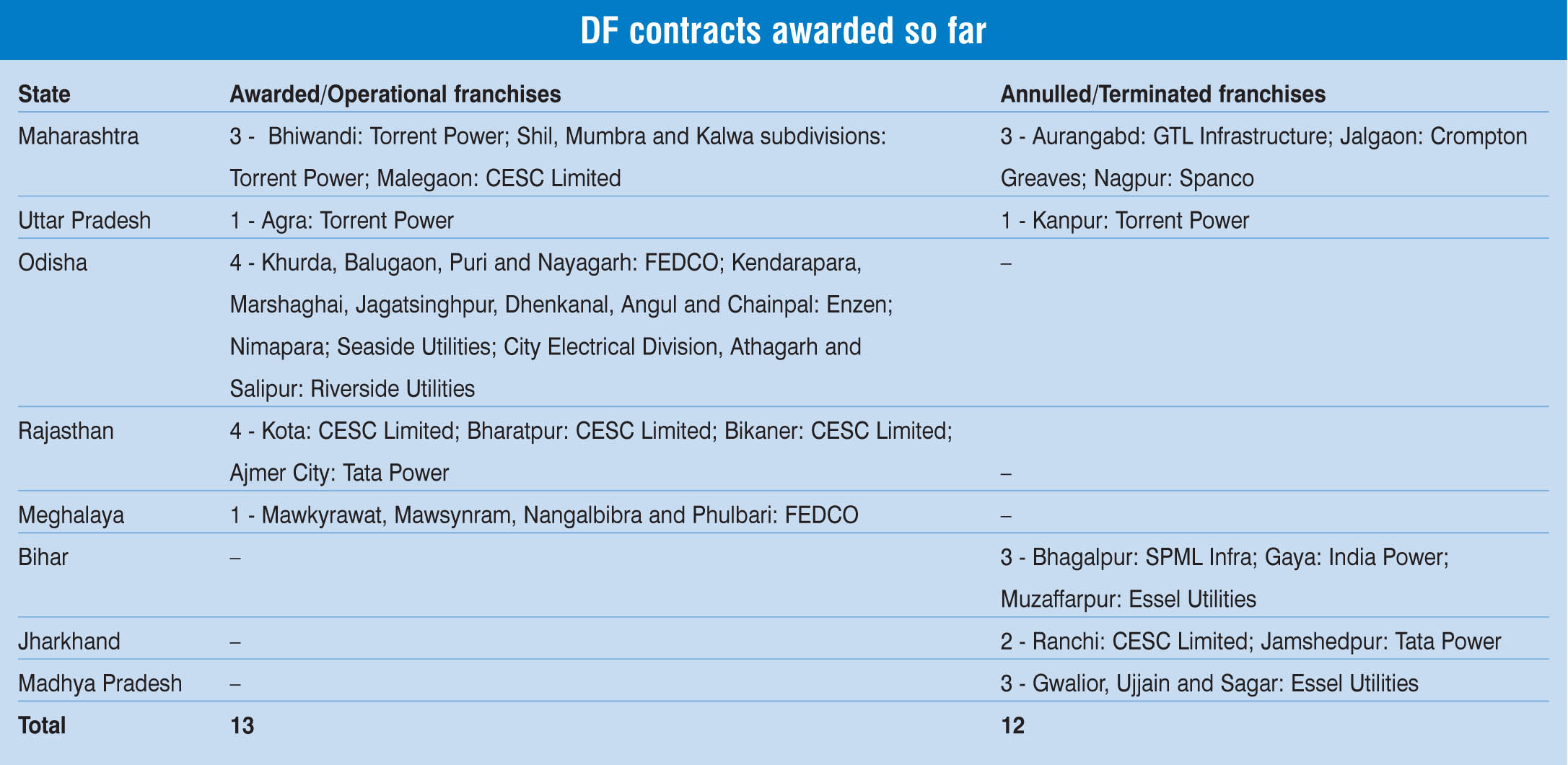

Since 2006, around 25 areas/distribution circles have been awarded to private companies under the DF model. However, only 13 franchisees are operational at present while the remaining 12 have been terminated due to issues ranging from contractual disputes, non-payment of utility dues, non-performance, to resistance from employees. The first DF was awarded to Torrent Power Limited (TPL) for Bhiwandi in Maharashtra in 2006. TPL has been hugely successful in bringing down AT&C losses in Bhiwandi from 58 per cent at the time of takeover to less than 20 per cent in a period of five years. As of 2018-19, AT&C losses in Bhiwandi stood at 14.9 per cent. Other states have tasted limited success with the DF model, primarily on account of the consumer mix (larger rural population base and improper subsidy mechanism), poor data quality, and uneven risk sharing between the franchisee and licensee.

Recent updates

In 2019, DF contracts have been awarded in Maharashtra and Meghalaya. In January 2019, Maharashtra State Electricity Distribution Company Limited (MSEDCL) awarded DF contracts for the Shil, Mumbra and Kalwa (SMK) sub-division (under the Thane urban circle) to TPL and for the Malegaon Corporation Area under the Malegaon circle to CESC Limited for a period of 20 years. In March 2019, Feedback Energy Distribution Company Limited (FEDCO) signed a DF agreement with Meghalaya Power Distribution Corporation Limited for supplying electricity in four of its subdivisions – Mawkyrawat, Mawsynram, Nangalbibra and Phulbari – for 10 years.

TPL has been awarded the DF contract for the SMK area by MSEDCL based on the competitive bidding process for a period 20 years. The 65 square km area is part of MSEDCL’s Thane Urban Circle and is emerging as one of the preferred real estate investment destinations with promising growth prospects. The bid levellised input power purchase stood at Rs 4.87 per kWh (benchmark levellised input power purchase was Rs 4.82 per kWh). The AT&C loss for the base year (2016-17) was around 47 per cent with input energy of 677 MUs and net sales of around 376 MUs. The company aims to reduce AT&C losses to below 12 per cent by the 15th year. TPL expects to invest Rs 3 billion by way of capex in the franchised area over the 20-year period. Of this, Rs 1.5 billion will be invested in the first five years. TPL is expected to upgrade the infrastructure, improve quality of supply and lower AT&C losses, and MSEDCL is obliged to supply input power at annual input rates as agreed to under the DF agreement. TPL is likely to begin operations in the SMK area in the third quarter of 2019-20.

CESC’s subsidiary Malegaon Power Supply Limited is expected to take over DF operations in Malegaon in 2019-20 and focus on improving quality, reliability and consumer services, as well as on reducing distribution loss. CESC plans to invest about Rs 1.5 billion over a period of 20 years in Malegaon. The company has laid out a Rs 200 million per annum capex plan for the first five years of operations and an about Rs 30 million per annum plan from the sixth to the 20th year of operations. The current distribution loss in the area is 44.76 per cent and CESC plans to take stringent measures to bring it down.

FEDCO has started serving 75,000 customers across the four subdivisions of Meghalaya. The company has already started working towards the provision of better consumer services and supply reliability. In September 2019, FEDCO launched DL Onboard, its technology-based new service connection app for making the process of securing electricity connection seamless and paperless. A 24×7 smart centralised call centre has been operationalised to take care of consumer grievances.

Upcoming opportunities

Upcoming opportunities

In March 2019, Tripura State Electricity Corporation Limited notified request for proposal (RfP) for the appointment of input-based distribution franchisee for five electrical divisions – Mohanpur, Sabroom, Kailashahar, Ambassa and Manu. The duration of the DF contact is five years and the franchisee’s scope of work includes metering, billing, collection, and energy purchase at the quoted annualised input rate trajectory; the operations and maintenance of the distribution network in the franchisee area; and the installation/replacement of consumer meters, DT meters and boundary meters.

Maharashtra, Rajasthan and Madhya Pradesh are the other key states that are exploring the DF model for performance improvement. Meanwhile, Odisha is making another attempt at privatising its distribution utilities with the Odisha Electricity Regulatory Commission (OERC) issuing a notice inviting bids for selling discom licenses of North Eastern Electricity Supply Company of Odisha Limited, Western Electricity Supply Company of Odisha and Southern Electricity Supply Company Of Odisha Limited. The RfP documents for the same were on sale till October 25, 2019. Earlier, in 2018, the OERC had invited bids for the sale of Central Electricity Supply Utility of Odisha wherein private majors such as Tata Power, the Adani Group, TPL and the Greenko Group had evinced interest.

The way forward

The way forward

With the MoP planning to include the DF model in the revised tariff policy, the future outlook of distribution franchisees looks promising. The government’s intent is to pave the way for the compulsory adoption of the model among discoms. The existing model is also being tweaked to ensure greater participation. The existing model mandates capital infusion by franchisees, which the government now feels is unworkable and needs modification. Even if a state is performing well overall, the DF model can be adopted in high AT&C loss areas to reduce losses and improve performance. Although the DF model has seen mixed results so far, it holds significant potential for improving discoms’ operations.