Despite the share of renewable energy in the generation mix growing from 5.6 per cent in fiscal 2015 to 9.2 per cent in fiscal 2019, coal-based power will continue to be the major source of electricity in the country over the next 5-10 years. In view of this, in December 2015, the Ministry of Environment, Forest and Climate Change (MoEFCC) revised the air emission norms for thermal power projects. The revised norms pertain to particulate matter (PM), sulphur oxide (SOx), nitrogen oxide (NOx) and mercury emissions.

The MoEFCC notified separate standards based on the commissioning date of power stations, categorising them as: plants commissioned till December 31, 2003; plants commissioned between January 1, 2004 and December 31, 2016; and plants commissioned post January 1, 2017.

As per ICRA estimates, these norms have impacted operational coal-based capacity of about 201 GW and under-construction coal-based capacity of around 42 GW. The existing thermal power plants (TPPs) were required to follow the revised norms within two years of the date of publication of the notification. However, after the industry raised concerns over the cost of equipment and other issues, the deadline was extended by five years until December 2022. Up till now, there has been limited progress on norms compliance among thermal utilities and IPPs. A closer look at the status of implementation of the revised emission standards…

Trends in emission levels

Coal-based power plants are the biggest polluters, accounting for the highest SOx and NOx emissions across industries. According to the 2015 IEA study, the power sector in India contributed about 50 per cent of the annual SOx emissions, about 30 per cent of NOx emissions, and 8 per cent of PM emissions.

The MoEFCC reported the average emission factors of pollutants as 7.3 g per kWh for SOx, 4.8 g per kWh for NOx, and 0.98 g per kWh for PM in 2015. Some independent studies have indicated that the impact of pollutants is not limited to a plant site but gets spread over a long distance (more than 200 km) around the plant site.

Plants using imported coal (which has a higher gross calorific value than domestic coal) are likely to report higher SOx emissions, while the ones operating on domestic coal are likely to report higher PM emissions due to the relatively high ash content.

Investment requirements for various technologies

Investment requirements for various technologies

In order to reduce SOx emissions, most of the existing coal-based power plants will need to install FGD systems, which will entail an investment of Rs 5 million-Rs 6 million per MW.

The additional capex required to comply with SOx emission norms is estimated to increase the levellised cost of generation (CoG) for a coal-based power plant by 11 paise to Re 13 paise per unit and, in turn, increase the retail tariffs by 2.1 per cent to 2.4 per cent, according to ICRA. In addition, a generating station will need to be shut down for 30-90 days for FGD deployment. This, in turn, will impact revenue generation during the period.

Of the various FGD technologies, wet FGD is the most efficient for reducing SOx emissions. However, the capital cost as well as O&M cost for wet FGD systems is relatively higher as compared with other FGD systems. While wet FGD systems are more suitable for inland coal-based power plants, seawater FGD systems are apt for coastal power plants.

As per a study conducted by an independent agency, the O&M cost of FGD units is estimated to be around Rs 600,000 per MW per annum; this will increase the levelised cost of power generation from a coal-based plant by 15 paise per unit. In addition, a wet FGD system will have to incur additional cost for reagent (limestone), water consumption and the disposal of a by-product (gypsum). The installation of FGD systems will also increase the auxiliary consumption of power in plants, with estimates ranging from 1 per cent to 2 per cent.

Apart from FGD systems, investment will also be required for setting up selective non-catalytic reduction (SNCR) or selective catalytic reduction (SCR) systems for reducing NOx emissions (which will involve a capex of Rs 1 million-Rs 2 million per MW) and upgrading electrostatic precipitator (ESP) equipment to reduce PM emissions (involving a capex of Rs 1 million-Rs 1.5 million per MW).

Progress so far

The MoEFCC mandated the existing TPPs to follow the revised emission norms from December 2017. New projects, which started operations from January 2017, were required to comply with these norms from the date of commissioning. However, progress in the implementation of the revised emission standards has remained slow due to a mix of reasons, including apprehensions over timely approval for the pass-through of such costs under change in law by regulators, financing challenges, and the timelines involved in the design, supply and installation of systems for complying with the revised norms. Inadequate domestic manufacturing capabilities and non-availability of service/technology providers also act as deterrents.

Coal-based power generating companies have sought the extension of norms compliance deadline from the Ministry of Power and the MoEFCC. The Central Electricity Authority (CEA) has come out with a plan for the installation of FGDs for coal-based plants across the country, wherein the timeline varies from December 2019 to December 2022. However, for the TPPs located in critically polluted areas, including the Delhi-National Capital Region (NCR), the deadline for compliance is December 2019.

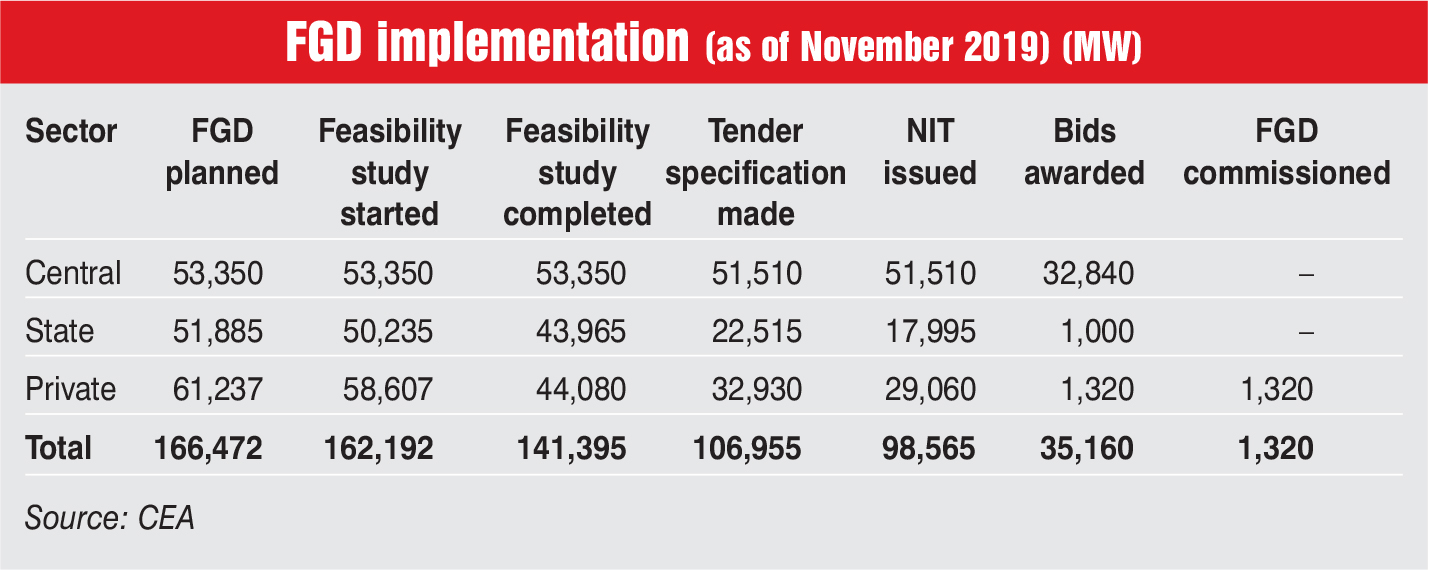

The CEA has prepared an FGD installation phasing plan of 166,472 MW (for 440 units) and ESP upgradation plan for 63,425 MW (220 units).

With respect to FGD implementation, about 85 per cent of coal-based power projects, where FGD is proposed to be implemented, have completed feasibility studies and about 59 per cent of the coal-based TPPs have issued tenders. However, the bids awarded remain low with only 21 per cent of the planned coal TPPs awarding the contracts and only about 1.3 GW deploying FGD systems, as of November 2019.

In the case of TPPs located in the NCR, progress remains tardy. There are 33 thermal plants with a total capacity of 12.7 GW around NCR that have to comply with the revised emission norms by December 2019. Of these, only two have installed FGD units and only 11 have awarded the contracts for FGD deployment (up to November 2019).

Meanwhile, the ESP upgradation plan has been prepared for 65,925 MW (231 units). A total of 71 GW (270 units) of capacity was found to be PM non-compliant. Of this, around 63 GW (220 units) of capacity has submitted the implementation plan to upgrade ESPs to meet the new PM norms.

With regards to NOx emission norms compliance, TPPs installed before December 31, 2003 are mandated to limit their emissions to 600 mg per Nm3. For plants installed between December 31, 2003 and December 31, 2016, the limit is fixed at 300 mg per Nm3 and for those installed after December 31, 2016, it is 100 mg per Nm3. However, the MOEFCC has, in-principle, agreed to change the NOx norms for TPPs installed between January 1, 2004 and December 31, 2016 from 300 mg per Nm3 to 450 mg per Nm3. Further, the revision of the NOx norms for TPPs installed after January 1, 2017 is under consideration by the environment ministry.

Issues and concerns

Securing funding for capex in a timely manner remains a challenge, given that a number of IPPs are already facing stressed finances. Moreover, many of these projects lack long-term PPAs, which is a key constraint in raising funds from banks or the bond market.

Recently, the Finance Commission told the power ministry that the proposal to award utilities Rs 835 billion in incentives to install equipment to curb emissions is “unviable”. On the technology side, SCR systems required for reducing NOx emissions have not been found to be suitable for high ash Indian coal. Also, space constraints, the use of ammonia for operating SCR systems, availability of limestone, which is a key raw material for operating FGD systems, and the disposal of gypsum (a by-product generated from FGD systems) are the key bottlenecks in the installation of such systems.

Net, net, concerted efforts are needed by all the power sector stakeholders to address these challenges and make thermal power units compliant with the new emission norms.