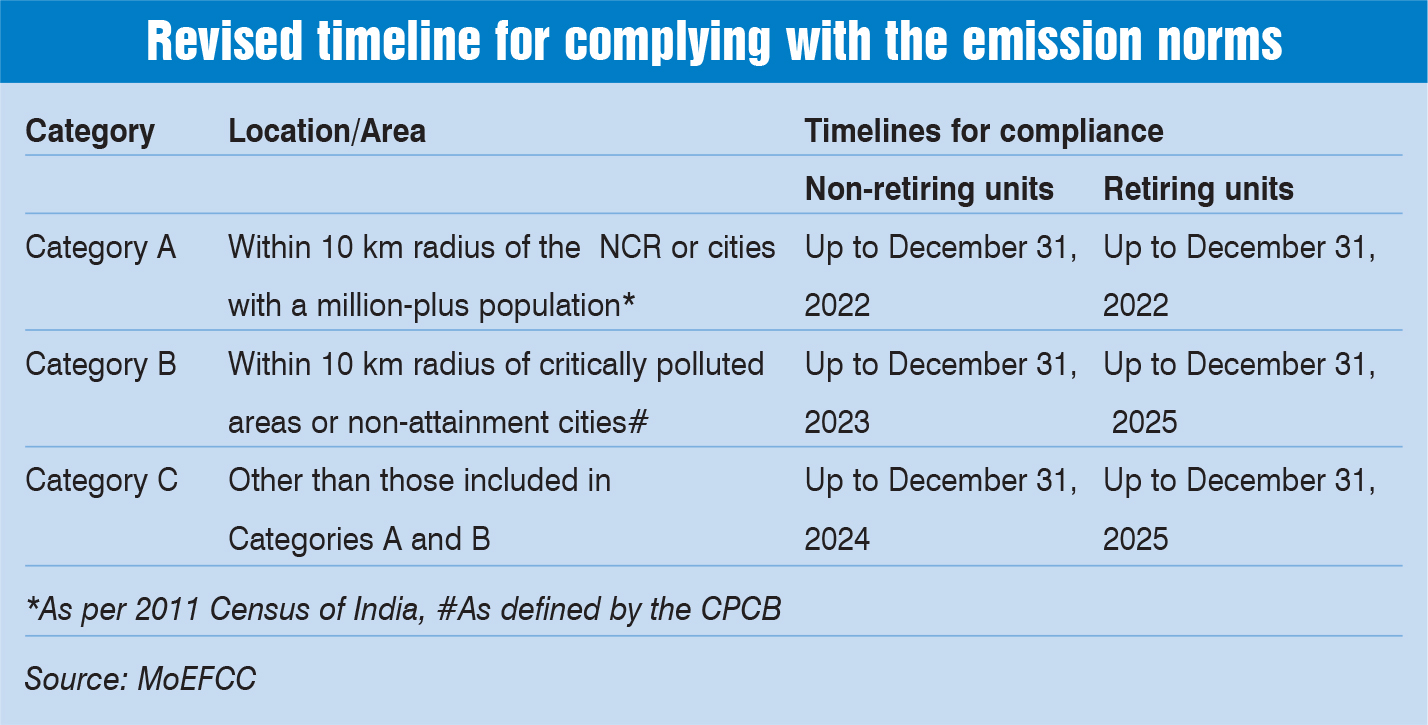

In a key development, in April 2021, the Ministry of Environment, Forest and Climate Change (MoEFCC) extended the timelines for complying with the emission norms for coal-based thermal power plants (TPPs) by one to three years. As per the revised timeline, TPPs within a distance of 10 km from the National Capital Region (NCR) and TPPs in cities with more than 1 million population need to comply with the new emission norms by December 31, 2022, whereas TPPs in non-attainment cities and those within 10 km of critically polluted areas need to comply by December 31, 2023. Meanwhile, TPPs in the remaining areas have to comply with the norms by December 31, 2024. The new rules have introduced a penalty mechanism for non-compliant operations by power plants beyond the specified timeline.

Revised timeline

Revised timeline

As per the Environment (Protection) Amendment Rules 2021, the power stations will be divided into three categories. Category A TPPs, comprising plants within a 10-km radius of the NCR or cities that have a million-plus population, are required to meet the emission norms by December 2022. Category B plants are within 10-km radius of critically polluted areas or non-attainment cities, and have to meet the norms by 2023. Meanwhile, Category C is made up of the rest of the plants, which have been given an extension till 2024. A task force will be constituted by the Central Pollution Control Board (CPCB) to categorise TPPs in three categories on the basis of their location. Apart from this, TPPs declared to retire before December 31, 2025 are not required to meet the specified norms. Such plants need to submit an undertaking to the CPCB and the Central Electricity Authority (CEA) for exemption on the ground retirement. Such plants shall be levied environment compensation at the rate of rupees 0.20 per unit electricity generated in case their operation is continued beyond the date as specified in the undertaking.

In addition to the extension of timelines, the new rules will levy an environment penalty on non-retiring TPPs for non-compliant operation beyond the timeline. The maximum fine for plants in Category A that do not comply with the norms by the deadline is 20 paise per unit, whereas it is 15 paise per unit for plants in Category B and 10 paise per unit for plants in Category C.

According to the CSE, about 28 per cent of the total capacity falls under Category A, which has to meet the norms by 2022. Another 28 per cent falls under Category B, which has to meet the norms by 2023. Meanwhile, a major capacity of 44 per cent (89.5 GW across 82 plants) falls under Category C, which has been given an extended deadline till 2024-25. With regard to the penalty, as per the CSE, in terms of per MW cost, the maximum penalty for any plant in category A comes out to be Rs 1.1 million per MW. Meanwhile, for Category C plants, which are already given extended deadlines, the penalty would be only Rs 0.5 million per MW.

To recall, the MoEFCC had revised the emission norms for particulate matter (PM), sulphur dioxide and oxides of nitrogen for TPPs in December 2015, mandating TPPs to install emission control systems by December 2017. However, the deadline was pushed to December 2022 for all power stations in the country in view of implementation issues and challenges. However, power stations in the NCR were required to comply with the revised norms by December 2019. Earlier this year, the MoP requested the MoEFCC to extend the deadline for all TPPs from 2022 to 2024, citing delays due to various reasons, including the coronavirus pandemic and import restrictions.

FGD installations across India

FGD installations across India

According to the CEA’s data, as of February 2021, FGDs have been commissioned and are operational for 2,160 MW of capacity – four units of NTPC’s Dadri project (4×210 MW) and two units at CLP India’s Haryana project (2×660 MW). Meanwhile, bids have been awarded for 155 units aggregating 68,660 MW of capacity. This represents 40.5 per cent of the total planned capacity. Sector-wise, bids have been awarded for 114 units in the central sector, 29 units in the private sector and 12 units in the state sector, representing 76.5 per cent, 21.8 per cent and 7.2 per cent of the total planned capacity. Apart from this, a notice inviting tender (NIT) has been issued for 131,327 MW.

Cost estimate

With regard to the cost of FGD systems, the cost per MW quoted by suppliers like BHEL, GE Power and L&T has varied from a low of Rs 1.93 million per MW to a high of Rs 9 million per MW for the tenders issued by NTPC Limited. The variation can be attributed to the size of the unit, the number of units of the project, the vintage of the project and its locations. Overall, the cost for 500 MW units has largely been in the range of Rs 4.2 to 5.3 million per MW. At Rs 5 million per MW, the levellised cost of generation is estimated to have an impact of 15-16 paise per unit, including the impact of additional O&M cost and higher auxiliary consumption. There will also be additional energy charges towards reagent consumption. The power generation companies will have to pass on the higher cost of generation to the distribution utilities under the change in law mechanism in the PPA.

The Central Electricity Regulatory Commission (CERC) has already identified the expenditure required for compliance with the revised environmental norms as a “change in law” event. Furthermore, in September 2020, the CERC floated a staff paper on the mechanism for compensation for competitively bid thermal generating stations for change in law, on account of compliance with the revised emission standards of the MoEFCC. Based on the comments/suggestions in response to the staff paper, the commission has now floated a draft order on a compensation mechanism for these plants.

Issues and challenges

The FGD market in India is currently evolving and there is limited availability of vendors. The overbooking of suppliers has resulted in an increase in manufacturing time for FGD equipment. There is a dependency on imports from neighbouring countries, and certain import restrictions have also been imposed. With regard to equipment availability, the domestic manufacturing capacity is not adequate for equipment such as booster fans, slurry RC pumps/gas cooling pumps, oxidation blowers, wet limestone grinding mills, slurry pumps, agitators, gypsum de-watering systems, mist eliminators and spray nozzles. Meanwhile, domestic manufacturing is not available for equipment such as borosilicate glass block linings with adhesive and primer for wet stack, spray nozzles, rubber lining for absorber tanks, and auxiliary absorbent tanks and slurry tanks.

Apart from this, there are a number of financial challenges for developers as well. Taking an average price of Rs 5.5 million per MW, the capex requirement for installing an FGD (for 170 GW of existing thermal capacity, 10 GW of commissioned capacity after the preparation of the phasing plan, and 58 GW of under-construction capacity) is estimated at Rs 131 trillion. Private plants, in particular, face funding issues due to stressed balance sheets. Another challenge pertains to the availability of quality limestone and the long distance transportation cost of the raw material. The disposal of residual gypsum is another challenge as a readily available market for by-product is not available.

To conclude, the extension in timeline will provide a relief to TPPs, especially in the private sector, given the challenges faced by these plants in securing funding and equipment to comply with the emission norms. However, going forward, strict adherence to the implementation timeline is desired. To this end, a time-bound approval process for additional tariff under change in law and the availability of equipment from domestic sources are paramount.