In a significant development, power transmission major Power Grid Corporation of India Limited (Powergrid) has commenced its asset monetisation drive by launching the initial public offering (IPO) of its maiden infrastructure investment trust (InvIT) – Powergrid Infrastructure Investment Trust (PGInvIT) – making the company the first state-run entity to do so. Despite the ongoing pandemic the IPO, which was launched in end April 2021, received a strong response from investors. The Rs 77.35 billion public issue was oversubscribed nearly 4.83 times, having received bids for 2.05 billion units against an offer size of 425.4 million units. Subsequently, PGInvIT made its debut on the stock exchanges on May 14, 2021 at a premium of 4 per cent over the issue price. This is the country’s third InvIT to be listed on the bourses after the IRB InvIT (road sector) and India Grid Trust InvIT (also in power transmission).

About PGInvIT

In September 2020, the Cabinet Committee on Economic Affairs gave its approval to Powergrid to undertake monetisation of its tariff-based competitive bidding (TBCB) assets, including those that are either under construction or are to be acquired by the company in the future. The approval covered assets held in existing special purpose vehicles (SPVs) to be monetised through InvITs.

InvITs are emerging as an alternative fundraising route for state-owned companies to meet their financing needs without depending on government support. In her budget speech, the finance minister, Nirmala Sitharaman, stated, “Monetising operating public infrastructure assets is a very important financing option for new infrastructure construction. A National Monetisation Pipeline of potential brownfield infrastructure assets will be launched. An Asset Monetisation dashboard will also be created for tracking the progress and to provide visibility to investors.”

Powergrid filed the draft papers for the IPO of PGInvIT in January 2021. The InvIT was established to own, construct, operate, maintain and invest in power transmission assets. PGInvIT has an initial portfolio of five operational TBCB projects held by different SPVs – Powergrid Vizag Transmission Limited, Powergrid Kala Amb Transmission Limited, Powergrid Parli Transmission Limited, Powergrid Warora Transmission Limited and Powergrid Jabalpur Transmission Limited – consisting of 11 transmission lines, aggregating about 3,699 ckt. km and three substations aggregating about 6,630 MVA. These assets are quite new, with an average remaining life of about 32 years. Powergrid has transferred a 74 per cent stake in these five SPVs to PGInvIT.

IDBI Trusteeship Services Limited is the trustee, while Powergrid is the sponsor of PGInvIT. Powergrid Unchahar Transmission Limited is the investment manager.

IPO details

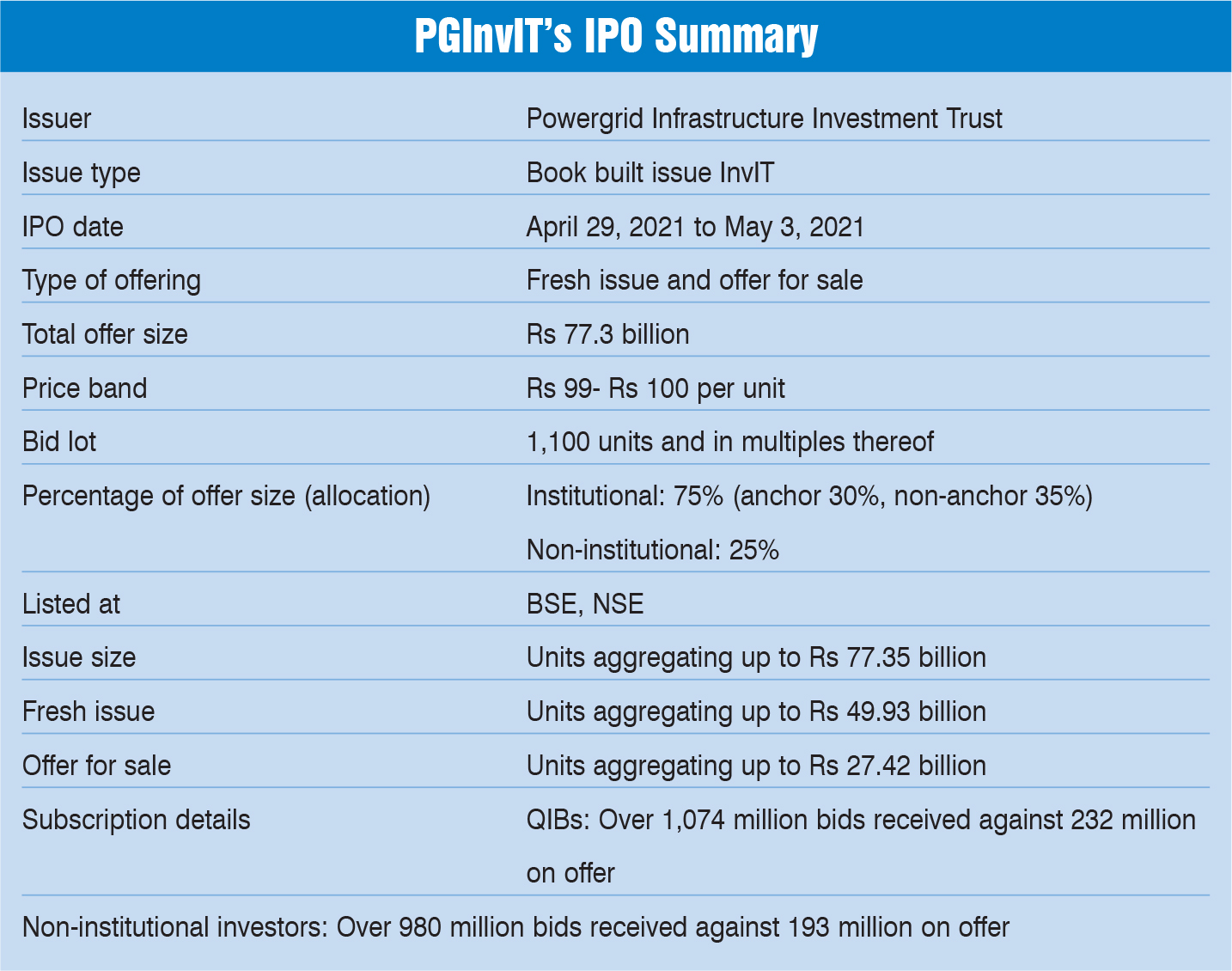

PGInvIT’s IPO opened from April 29, 2021 to May 3, 2021. The price band for the offer was set at Rs 99-Rs 100. The IPO comprised a fresh issue of units worth Rs 49.93 billion and an offer for sale of Rs 27.4 billion. About 75 per cent of the offer was reserved for institutional investors, of which 60 per cent was reserved for anchor investors. The remaining 25 per cent was for allocation to noninstitutional investors on a proportionate basis.

The portion set aside for qualified institutional buyers (QIBs) received 1.07 billion bids against the 232.05 million on offer (oversubscribed 4.63 times), while that reserved for non-institutional investors received 980.36 million bids against the 193.38 million on offer (oversubscribed 5.07 times). Overall, the issue received bids for 2.05 billion units against the issue size of 425.4 million units (oversubscribed by 4.83 times). Powergrid received an amount of Rs 27.36 billion against the sale offer. The net proceeds from the offer are to be utilised for repayment or prepayment of debt associated with the initial portfolio assets.

ICICI Securities Limited, Axis Capital Limited, Edelweiss Financial Services Limited and HSBC Securities and Capital Markets (India) Private Limited were the lead managers to the offer.

Outlook

Despite the economic impact of the Covid second wave and subdued investor sentiment, PGInvIT’s IPO performed exceedingly well, in line with analysts’ expectations. This can be attributed to the backing of a strong sponsor, Powergrid, which is a Maharatna central public sector undertaking that owns and operates 85 per cent of interregional power transfer capacity (as of March 2020). Analysts project that a strong financial position, government support to the sponsor and the critical nature of the power transmission segment, which is governed by an established regulatory framework, will enable the InvIT to finance future growth without substantial dilution to unit holders. Going forward, investors can expect fairly predictable and stable cash flows from the existing five assets under PGInvIT. Investors can expect further additions to the InvIT as Powergrid has a project pipeline worth Rs 225 billion, which will be monetised progressively.