The Indian electricity market is gearing up to take its next big step. This will be brought about by the implementation of the market based economic despatch (MBED) model, proposed by the Ministry of Power (MoP) in a discussion paper released in June 2021. The proposal is expected to infuse greater liquidity in the power market, as all power procurement and delivery across various contracts, including long-term power purchase agreements (PPAs), will take place through the day-ahead market (DAM) on the power exchanges (PXs). For generators tied in long-term PPAs, there would be hedging arrangements (in the form of bilateral contract settlement [BCS]) for refunding the difference between the market clearing price (MCP) and the contracted price. This will help reduce the exposure to price variability. MBED is a fundamental redesign of the electricity market and requires significant changes to operations, infrastructure and systems for market participants and enabling agencies such as the power exchanges and the Power Systems Operation Corporation of India (POSOCO).

The MoP’s discussion paper outlines a phased introduction of MBED. The first phase involves only the thermal fleet of the country’s largest public sector company, NTPC Limited, to assess the efficacy of the MBED mechanism, identify deficiencies or potential issues that need to be addressed prior to a nationwide roll-out, familiarise stakeholders with the framework, and allow for necessary infrastructure and system build-out and testing before scale-up. The plan is to implement the system from April 1, 2022 after holding wider consultations with the states. The idea is to arrive at a consensus among the key stakeholders, provide an enabling policy framework, and remove any administrative roadblocks in the implementation of MBED.

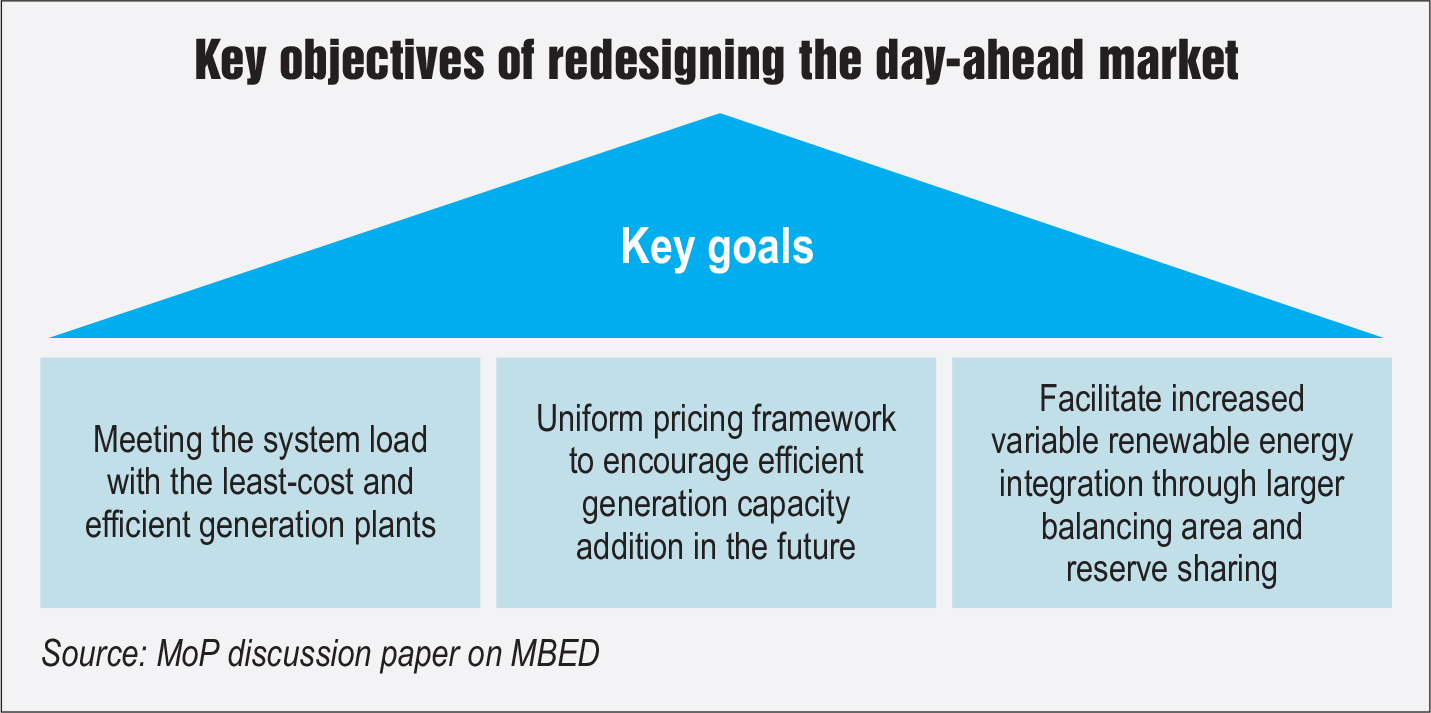

This is not the first time that planners are discussing MBED. The concept was first mooted in December 2018 by the Central Electricity Regulatory Commission (CERC) in a discussion paper that proposed a redesign of the day-ahead scheduling and operation of the electricity market. According to the MoP, the proposed MBED mechanism would be a key step in enabling uniform clearing prices for electricity procurement and transitioning towards a “One Nation, One Grid, One Price” ecosystem. While India has already achieved the goal of “One Nation, One Grid, One Frequency” through the integration of all the regional grids, its true benefit can be realised when the country transitions to a national merit order and countrywide balancing instead of the current practice of siloed self-scheduling and balancing. It also paves the way for wider market reforms (such as the introduction of a capacity market and co-optimisation of ancillary services with energy), as well as for increased renewable energy integration.

Existing framework and its limitations

Discoms currently self schedule generation on a day-ahead basis from amongst their portfolio of contracted generators. This results in a suboptimal outcome for the country’s power system, with discoms and consumers bearing relatively high costs. The key issues are:

- Discoms consider only their respective contracted portfolios without visibility regarding the possible availability of lower-cost generation in other states.

- An all-India analysis shows that the country often ends up scheduling costlier generation plants while cheaper generation plants are not fully utilised.

- Instances of states violating the merit order even within their own contracted portfolio of generators is common.

- There is an absence of a uniform price for procurement of power across the country, despite having one unified and integrated grid.

- An inflexible aspect of self-scheduling within state control areas is the inability to share reserves across states, leading to technical constraints in the ex-tent of variable renewable energy that a state can deploy within its boundaries.

A centralised market-based scheduling and despatch system will ensure enlarging the balancing area from the state boundaries to the national boundary, thereby bringing in the desired flexibility for reliably deploying much higher levels of variable renewable energy.

Proposed MBED mechanism

The proposed MBED will function on a day-ahead basis and enable scheduling and despatch of all generation on economic principles, subject to plant and network constraints. The security constrained economic despatch (SCED) mechanism, operational since April 2019, is an extension of the MBED concept and covers system cost optimisation only after final schedules are prepared, and does not alter the commitment of generation units (including the costlier ones) on a day-ahead basis. The proposed MBED will lead to further optimisation as marginal units that are currently committed may not be scheduled at all under MBED, leading to additional system cost savings. During the first implementation phase involving NTPC’s thermal stations, the following changes are envisaged:

Scheduling mechanism: Discoms can continue to self-schedule generators; however, both discoms and generators have to mandatorily participate in the DAM for bidding. BCS would be carried out for the quantum of power that is self-scheduled. Generators must submit offers and be cleared based on the total demand bid in the DAM. The entire demand from NTPC stations will be met by despatching the least-cost generation mix while ensuring that the security of the grid is maintained. Cheaper NTPC plants will be despatched to the maximum while the costlier plants will run optimally as required.

Actions by buyers, sellers and PXs: Generators are required to offer their capabilities in the DAM based on self-determined energy charge rates or variable charges with no adjustments for retrospective revisions in fuel or other changes. A national merit order will be formed and all generators would be subsequently despatched. Discoms or buyers will be required to submit bids for all time blocks of the next day. They may choose to submit fixed demand in each block, which is price inelastic and has to be served. Discoms’ flexible demand in each block will be price sensitive. Buyers and sellers, based on their mutual preference, should submit bids and offers on a particular power exchange. Once the bids and offers are received, the market clearing engine of the PXs will schedule the generating stations following optimal despatch principles. The MCP will be discovered for each 15-minute time block of the upcoming day.

Schedule revisions: Right to revision (RTR) for the complete fleet of NTPC’s plants will cease to exist until the results of the DAM are announced and such RTR will be reinstated for the quantum not cleared in the DAM. Discoms can buy or sell additional power (from contracted capacities) closer to real time through the real-time market (RTM) and correct their day-ahead positions.

Payment and settlement: Discoms or buyers will pay the market operator at the MCP for the day-ahead demand. Likewise, all generators will be paid at the MCP according to the execution of their selected bids. Buyers, under LT contracts, will be refunded the difference between the MCP and the contracted price as per the quantum of power self-scheduled through the BCS. NTPC generators that have long-term contracts will continue to be paid the fixed cost separately outside the market. NTPC can continue to sell the unrequisitioned surplus (URS) power in the market. The net revenue earned by NTPC in this respect will be shared with the concerned beneficiaries equally, subject to a ceiling of 7 paise per unit to the generator and the balance to the beneficiary.

Benefits of the MBED mechanism

The data modelling carried out by the CERC in the past (as part of the MBED discussion paper) and the data simulation run in the DAM and RTM for five days spread across 2020 indicate that MBED yields 4 per cent of benefits in power procurement costs. The proposed MBED pilot with all ISGS stations is expected to yield benefits of more than Rs 50 million per day for entitled sales, which translates into a Rs 18.25 billion reduction in power procurement costs annually. Once the country’s entire generation is mandated to participate, the total estimated savings could be to the extent of about Rs 123 billion or 3.74 per cent. Notably, POSOCO’s Feedback Report of SCED estimates the total reduction in the variable cost of generation due to SCED during the period April 2019 to January 2021 at Rs 16.24 billion, or an average of Rs 9 billion annually. Therefore, there are substantial additional optimisation benefits to be harnessed through the implementation of MBED.

Key issues and recommendations

Seven key issues have been listed in the discussion paper, along with suggested measures to overcome them.

Relinquishment of the right to revise schedules by discoms: As mentioned above, the paper suggests that the RTR for NTPC’s plants will cease to exist only until the DAM results are announced and be reinstated for the generation quantum not cleared in the DAM. Discoms will be able to meet their day-ahead demand reliably by placing inflexible bids.

Working capital management for discoms: Currently, generators issue a monthly invoice to discoms, which get a 45-day credit period to pay their dues. MBED would require an upfront payment of margin money by discoms to the PXs for the quantum of power procured, which would be a huge burden on them. In the first phase covering the full fleet of NTPC thermal stations, the daily funding requirement is estimated at Rs 1.4 billion-Rs 1.5 billion based on the weighted average cost of Rs 2.14 per unit applied to the 650-700 MUs of average daily energy transacted. To relieve discoms from such huge upfront payments, a centrally designated agency (the Power Finance Corporation or REC) could provide a line of credit to discoms that require such working capital. Discoms could repay the same with interest within 45-60 days from the date of disbursement of each tranche.

Need for price coupling: In case a seller and a buyer who are tied in a long-term PPA go to separate PXs, without the implementation of coupling of exchanges, there would be difficulties in applying the BCS mechanism. There are two possibilities – first, where only one entity gets cleared and the second, where both entities get cleared at different clearing prices. As an interim measure, both the buyers and the corresponding sellers would need to submit bids and offers on the same PX so that they are subject to the same clearing price and liquidity. In the long run, the plan is to undertake price coupling of the PXs, as endorsed in the Power Market Regulations, 2021.

Additional relief for upfront payment by discoms: Currently, discoms receive a rebate of 1.5 per cent and 1 per cent for payments made to gencos within 5 days and 30 days from the invoice date respectively. It is suggested that a total rebate of 2 per cent could be offered to discoms on payment for the quantum of power procured through the exchanges.

Treatment of BCS: The final settlements between generators and discoms would be as per the terms of the contract through the BCS. For the pilot with NTPC’s thermal stations, this could be achieved through a regulatory order outlining the process of adjustment of market-based payments against fixed charges to be paid by discoms.

Reduction in transaction charges levied by the PXs: The substantial increase in transaction charges due to the increase in electricity volumes traded through the PXs under MBED will put an additional pressure on the profitability and working capital requirement of discoms. The paper suggests that either such charges be removed for the self-scheduled quantum of power or reduced concessional transaction charges be levied per unit.

Applicability of transmission charges: In order to ensure that entities that have long-term access do not have to pay the short-term open access (STOA) charges for the quantum of electricity contracted under long-term access and traded through the PXs, the implementation of the general network access (GNA) is recommended. The related draft regulations for the implementation of GNA to the interstate transmission system were notified in November 2017.

Industry reaction and the way forward

MBED is proposed as the next step in the evolution of the Indian power market, to bring in the desired efficiency in power procurement at the national level. As is seen in other parts of the world, a centralised system of power despatch purely on economic principles enables cost optimisation. The phase-wise implementation of MBED is expected to help the participants, PXs and regulators. The previous experience with SCED also provides valuable lessons to the implementers. A particularly notable feature of SCED has been the achievement of pan-Indian optimisation without disturbing the freedom of choice of any utility.

For smooth and effective implementation of MBED, several complex issues need to be addressed. First, given that electricity is on the concurrent list, the central ministry’s mandate to all state discoms to participate in the market without a larger consensus is bound to meet with resistance. Also, a balance has to be maintained in exposing public sector entities to the vagaries of the power market without adequate preparation. If market participation is made voluntary, eventually the states will realise that they are losing money by not being able to procure cheaper electricity from the market due to the lack of proper institutions and systems, and will see reason for getting prepared.

The deadline set for Phase I implementation in the discussion paper is quite ambitious given that several institutions have to make significant changes in their operations, infrastructure and systems. For instance, at the plant level, NTPC will have to switch from the current practice of calculating and reporting variable charges on a monthly basis to every 15-minute block. The power exchanges will have to prepare themselves to handle a majority of the country’s electricity transactions from the current share of 4-5 per cent.

The regulators and system operators have to exercise market oversight and surveillance once all the transactions move to the market. The already financially stretched discoms will have to make extensive organisational-level changes to limit their commercial exposure.

Net, net, MBED per se will promote the market economy and efficiency, but its implementation requires higher levels of preparedness at all levels as well as consensus among all stakeholders.

Swarna Kesavan