Coal-based capacity is the largest contributor to power generation in India with a share of 71 per cent in 2020-21. The drawback of the higher share of coal-based power generation capacity is the emission of pollutants such as sulphur oxide (SOx), nitrogen oxide (NOx) and particulate matter (PM). In order to control the level of these emissions, the Ministry of Environment, Forest and Climate Change (MoEFCC) notified emission norms for thermal power plants (TPPs) in December 2015. However, the overall progress in complying with these norms has been slow so far. Bringing much relief to developers, the MoEFCC, in April 2021, notified graded implementation of emission control measures based on the plant’s location and an extension of one-three years in the implementation timeline. As per the final list of categorisation of TPPs released in December 2021 by the Central Pollution Control Board (CPCB), the deadline for complying with the emission norms for nearly 75 per cent of the TPPs in India has been extended up to December 2024. The issue of emissions has gained prominence in light of India’s commitment at the recent COP26 summit held in Glasgow, Scotland. India announced a net-zero emissions target for 2070, backed by strong near-term goals to increase the reliance on renewables. Besides this, it has pledged to cut carbon emissions by 1 billion tonnes and also lower the emission intensity of its GDP by 45 per cent by 2030.

Update on emission norms

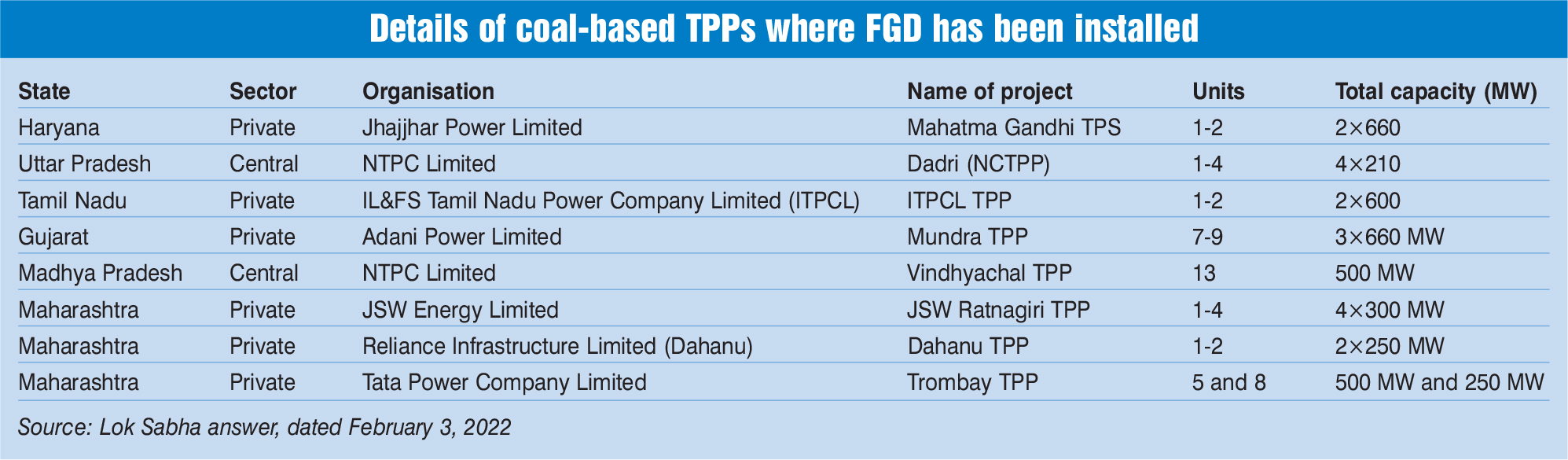

Currently, FGD systems have been commissioned across 20 units aggregating 8,290 MW in capacity. According to the Central Electricity Authority (CEA), as of December 2021, flue gas desulphurisation (FGD) systems have been planned for 439 units, aggregating 168.9 GW to reduce SOx emissions. Of this, bids have been awarded for 157 units aggregating 69,260 MW in capacity. This represents 41 per cent of the total planned capacity. Sector-wise, bids have been awarded for 114 units in the central sector, 31 units in the private sector and 12 units in the state sector, representing 87 per cent, 28 per cent and 8 per cent of the respective sector planned capacity. Apart from this, a notice inviting tender has been issued for 132,167 MW of capacity or 325 units.

With to NOx emission norm compliance, last year the Supreme Court allowed power stations commissioned between December 2003 and 2016 to emit 450 mg per Nm3 of NOx as against a cap of 300 mg per Nm3 earlier. The Ministry of Power (MoP) had proposed this revision because meeting the earlier limit was not possible for TPPs operating at partial load. A NOx emission level of 450 mg per Nm3 can be achieved by combustion modification. To lower the NOx emission, NTPC has awarded combustion modification for over 20 GW of capacity. It has completed combustion modification work at 16 units aggregating 7 GW in capacity. Further, it has awarded combustion modification works for 34 units aggregating 14 GW.

For the control of PM emissions, most TPPs have already installed electrostatic precipitators (ESPs) since Indian coal has a high ash content. However, upgraded systems could be required for the existing projects. In addition, the environment ministry’s decision to do away with coal washing makes it more important for TPPs to invest in efficient PM control technologies. A detailed phasing proposal outlining the plan of action for the augmentation of ESPs for SPM control up to 2024 has been prepared by the CEA. As of June 2021, ESP implementation plans are available for 222 units aggregating 64.5 GW in capacity.

Besides installation of emission control equipments, biomass co-firing in TPPs is gaining traction as the blending of biomass with coal can reduce coal dependence in TPPs thereby resulting in corresponding savings in CO2 emissions. The Ministry of Power (MoP) has issued a policy for power generation through co-firing in coal-based TPPs under which TPPs have been advised to mandatorily use 5 per cent blend of biomass pellets, made primarily of agro residue along with coal, on an annual basis. Generating units having certain units under reserve shutdown or not being despatched due to merit order despatch consideration would ensure to increase the percentage of co-firing up to 10 per cent in their other operating units. About 23 TPPs have co-fired biomass pellets so far, and approximately 66,000 mt of biomass has been co-fired till date. Under its Blue Sky initiative, NTPC Limited is implementing projects for biomass co-firing, besides waste to energy projects, farm to fuel for improving air quality, and promotion of circular economy. As of August 2021, 9 plants had begun biomass co-firing at NTPC, and around 42,000 tonnes of agro residue based biofuel had been co-fired. For emission monitoring, NTPC has also installed real time environment monitoring system.

Revised implementation timeline

In April 2021, the MoEFCC extended the timelines for complying with the emission norms for coal-based TPPs by one to three years, based on the location of the plant. As per the Environment (Protection) Amendment Rules 2021, power stations will be divided into three categories. Category A comprises TPPs within a 10 km radius of the NCR or cities that have a million-plus population, and would be required to meet the emission norms by December 2022. Category B comprises TPPs within a 10 km radius of critically polluted areas or non-attainment cities, which would have to meet the norms by December 2023. Category C will be made up of all other plants, which have been given an extension till December 2024. TPPs declared to retire before December 31, 2025 are not required to meet the specified norms in case such plants submit an undertaking to the CPCB and the CEA for exemption on ground of retirement. In addition to the extension of timelines, the new rules will levy an environment penalty on non-retiring TPPs for non-compliant operation beyond the specified timeline. A task force constituted by the CPCB has categorised 596 coal-based units into the three categories. Accordingly, 79 coal-based units (13.3 per cent) fall under Category A, 68 units (11.4 per cent) fall under Category B and 449 units (75.3 per cent) fall under Category C. As a result, nearly 75 per cent of the TPPs in India are not liable to meet the emission norms before 2024.

CEA’s review report on category-wise SO2 compliance timeline

CEA’s review report on category-wise SO2 compliance timeline

A recent report by the CEA on review of the category-wise compliance deadline for SOx control highlighted that the presence of SO2 or NOx level in the ambient air in the area has not been considered in TPP categorisation and ambient air quality (AQI) has not been made the guiding factor. It notes that the areas where ambient air quality is actually critical in terms of SO2/NOx level may not be located in cities/areas as specified, and there is a possibility that these areas may fall under category C. The report also notes that due to paucity of implementation time, any new technology that is being implemented in Category A is expected to be repeated in other categories without adequate assessment of its performance. Sufficient time is required for fine tuning the performance of FGD systems already in operation, and there is not enough time in between the timelines of categories A and B. The report also notes that an unworkable time schedule is creating market scarcity leading to import and jacked up prices which put unnecessary burden on power utilities. The project cost for wet lime based FGD technology varies between Rs 3.90 million per MW and Rs 11 million per MW, which is quite high, around 2.8 times.

The report recommends that there should be a longer duration plan (up to 2035) for adopting the emission norms, especially for power plants falling under Category C. This will help in understanding the performance and effectiveness of the emission control equipment and give time for course correction. It will also help in developing an indigenous manufacturing facility, reducing import of equipment from foreign companies, and avoiding price escalation or market manipulation. Apart from this, the CEA recommends studying the SO2 reduction against CO2 increase in flue gas emission by an FGD system, and accordingly exemption may be given to the units where the SO2 level in ambient air is very less compared to the permissible limit.

Challenges

One of the major issues in the implementation of emission control systems is uncertainty regarding the full recovery of additional capital and operational expenditure to be incurred on the equipment. The Central Electricity Regulatory Commission has proposed a mechanism to recover the cost incurred to comply with the revised emission norms under the change in law provision. However, the tariff compensation assumes the period of recovery of the costs as 25 years; this can adversely impact the returns for developers with plants having a balance useful life of less than 25 years. Apart from this, there is no clarity on the mechanism for the recovery of FGD-related costs for projects that sell power through the short-term market.

Another challenge in the implementation of emission control equipment lies in securing debt financing for projects that do not have long-term power purchase agreements (PPAs), for projects that have unviable tariffs as per their PPAs, or those that have a remaining PPA tenor of less than 12 years. Other issues are the long time taken by regulators to process petitions, possible downgrade in merit order dispatch, import restrictions, and inadequate domestic technology and capacity to meet the demand for emission control equipment. More pronounced are the space constraints faced in installing emission control equipment. Apart from this, the recent soaring of steel prices will affect the cost of FGD systems as well as the implementation timeline going ahead.

Conclusion

Net, net, as India aims to “phase down coal”, TPPs would need to work towards a measurable reduction in emissions in a timely manner. Overall, the emission norm compliance by TPPs has been slow, but going forward, strict adherence to the implementation timeline is desired.