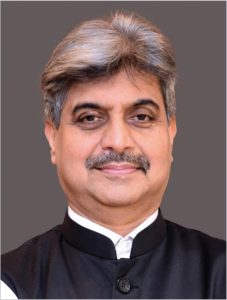

In a recent interview with Power Line, Dr Rajib Kumar Mishra, chairman and managing director (additional charge), PTC India, shared his views on the impact of key recent policy and regulatory developments on the power trading segment as well as the future outlook for the segment. He also spoke about PTC India’s plans to transform itself from an electricity trading company to a solutions provider across the electricity value chain. Excerpts…

In a recent interview with Power Line, Dr Rajib Kumar Mishra, chairman and managing director (additional charge), PTC India, shared his views on the impact of key recent policy and regulatory developments on the power trading segment as well as the future outlook for the segment. He also spoke about PTC India’s plans to transform itself from an electricity trading company to a solutions provider across the electricity value chain. Excerpts…

How do you rate the performance of the power sector in the past one year or so?

The last 12 months have been remarkable for the Indian power sector. We saw landmark regulations that will change the design of the market. These include general network access, ancillary services regulations, deviation settlement mechanism (DSM) regulations, renewable energy certificate (REC) guidelines, green hydrogen policy, and many other small and large policy directives and regulations. This reflects the intent to create a vibrant power sector and has resulted in a new set of opportunities.

The past year has also been historic in terms of the decisiveness and prompt interventions by the policymakers and regulators. The willingness to take tough measures was uniquely demonstrated, be it the decision to allow blending imported coal when coal stocks were under stress, introducing price caps on the power exchanges when prices were escalating, introducing a scheme to clear the huge outstanding of the distribution utilities through a one-time intervention, or barring 13 state utilities from accessing short-term power markets pending their outstanding dues. The resilience of the Indian power sector to deal with increased demand post resumption of economic activity after the pandemic and in the shadow of global commodity inflation and geopolitical conflicts is also something to acknowledge. So, on all fronts, the past 12-month period has been a huge positive for the Indian power sector.

What have been the major highlights of PTC India in the past 12 months?

PTC India has traded record volumes of 87.5 billion units in the previous financial year, 2021-22, and achieved standalone profits of Rs 4.25 billion. Why this is impressive is because unlike other platforms, we are not a single-trick pony. We trade in both over-the-counter (OTC) and exchange platforms and in every segment of the power market. We have short-term, medium-term and long-term contracts and we participate in real-time markets as well. We trade RECs for our clients as well.

We have added to our cross-border contracts including initiating a first-time procurement for Bhutan, traditionally a supplier, from the Indian power markets. We have entered into new framework agreements for sourcing long-term hydroelectricity from Nepal. We have resumed our trade with Bangladesh by substituting the suppliers. We have also made great strides in our consulting/advisory business, adding marquee clients, and completed the acquisition of the consulting/advisory business of IL&FS Energy Development Company Limited. Hindustan Power Exchange (HPX), the third power exchange that we had sponsored, commenced operations in this financial year.

What are PTC’s current cross-border electricity trading volumes? What are its plans for expanding cross-border trade going forward?

Last year (2021-22), we traded 8,043 MUs in our cross-border trade portfolio spanning across three countries – Nepal, Bhutan and Bangladesh. Out of this volume, trade with Nepal and Bhutan accounted for 7,631 MUs and Bangladesh accounted for the balance 412 MUs. The uniqueness of these trades is their bidirectional trading operation. In fact, in the January-March 2022 period, for the first time, we helped Bhutan procure electricity from the Indian power markets.

You will see from our recent announcements, like the SJVN Limited MoU and the NHPC MoU, that we are treating our cross-border power procurement and sale as part of an integrated portfolio. Tying up long-term power procurement from these projects is a part of our strategy to add to the resilience of PTC’s business model based on a bedrock of long-term volumes. We are also exploring setting up market aggregation firms (trading entities and power exchanges) in these countries, either jointly with the domestic entities in these locations or individually, subject to the evolving regulatory regimes in these geographies.

How has been the industry response to the new power exchange promoted by PTC India?

We have sponsored the third power exchange, HPX, with best-in-class technology, as a credible alternative to a market segment that has not seen any great innovation from the incumbent players. HPX plans to offer a level of client servicing that will set benchmarks in the industry. Obviously, the first year of operations will be focused on onboarding clients to increase the liquidity on the exchange. HPX has executed cumulative trades of 500 MUs between July 6 and September 1, 2022. It is planning to launch other segments in the immediate future.

What are your views on the Ministry of Power’s proposal to introduce a high-price market segment for DAM (HP-DAM)?

The rationale for this proposal to introduce HP-DAM seems to be to address a scenario that has arisen due to the introduction of a price cap at Rs 12 per kWh by the Central Electricity Regulatory Commission in the market segments of the power exchanges. The underlying premise is that there are generating stations with a variable cost higher than Rs 12 per kWh that are currently unable to participate, and more significantly, there is unmet demand with a willingness to buy electricity at these high prices. We believe that aggregators like PTC can also devise schemes for pooling this high variable cost power and source buyers with marginal demand at such prices. So, we believe that trading licensees should be allowed to structure this solution in OTC markets.

What are PTC’s future plans and top priorities going forward?

PTC is currently morphing itself from being predominantly an electricity trader to a bespoke solutions provider in the electricity value chain. Trading as we know it will also undergo a change with PTC assuming market risks and taking positions. Increasingly, we are focusing on offering solutions for renewable energy participants, both on the supply side and the demand side. We are also focused on structuring solutions for virtual contracts and acting as virtual power plants. Further, we are increasingly investing in cross-border electricity trade both from a tactical (short-term) and strategic (long-term) perspective.

We expect to be a significant player in the electricity derivatives market whenever it gets launched. Further, we want to scale our advisory/consulting business, including in the area of energy portfolio management, which would require technology-intensive solutions. We are also focused on embedding ourselves in the developing value chain of battery energy storage systems and green hydrogen.

What is your outlook for the power trading market, volumes, prices, etc., in the near to medium term?

Trading volumes currently reflect 10 per cent of the overall generation in the country. Trading will pick up only if we have merchant capacities that are either untied or allowed to be sold based on cancellation of contracts or penal mechanisms. Apart from that, stressed assets are being brought into the supply chain through aggregator schemes, which will add to these volumes. We are working on blending thermal power generation with renewable energy to offer RTC electricity, which makes it more marketable. So, we believe that this market will evolve going forward.

Power tariffs vary across buyers based on their unique supply-demand characteristics and seasonal requirements. The price levels being discovered on the ultra-short-term segments of the power exchanges were elevated at atypical levels for the monsoon season (> Rs 4.50 per kWh). In recent times, they remain at elevated levels in excess of Rs 5 per kWh. In peak time blocks, we continue to observe price discovery on the exchanges at the capped price of Rs 12 per kWh. With the resumption of economic activity, high crude and natural gas prices, high imported coal prices and the pick-up in demand, we project price levels to stay elevated as compared to previous years.

What are the biggest issues and challenges facing the power sector? What is the future outlook?

The Indian power sector is evolving and the market design is undergoing a transformation. In my opinion, the biggest opportunity is the reform in the electricity distribution segment, which is being attempted by the introduction of the Electricity Amendment Bill. With general network access, ancillary services regulations, revised DSM guidelines delinked with frequency, we are now looking at a confident and mature grid. With the introduction of new design elements such as storage systems (both pumped storage and battery storage), green hydrogen and financial derivatives, both the complexity as well as the opportunities would increase. Of course, we have technical challenges such as the increasing integration of variable renewable energy into the grid that requires techno-commercial solutions. There is also a need for consistency in regulation by the centre and states as electricity is a concurrent subject. Giving away free electricity is not a sustainable approach either. Despite all these challenges, I am sanguine about the outlook for the Indian power sector. It is a market in transition and the opportunity for growth in the Indian power market is second to none.