Power demand has been witnessing an increase in recent months on the back of a heatwave and expanding economic activity. Peak power demand also hit a new high. Meanwhile, there are concerns over inadequate coal availability at thermal power plants (TPPs) and the poor performance of discoms, which continue to weigh down the sector. Going forward, clean energy transition, technology upgradation, energy storage solutions and green hydrogen are expected to receive growing attention. Power Line presents the views of leading consultants on the state of the sector and its future outlook…

What is your assessment of the power sector’s progress during the past year?

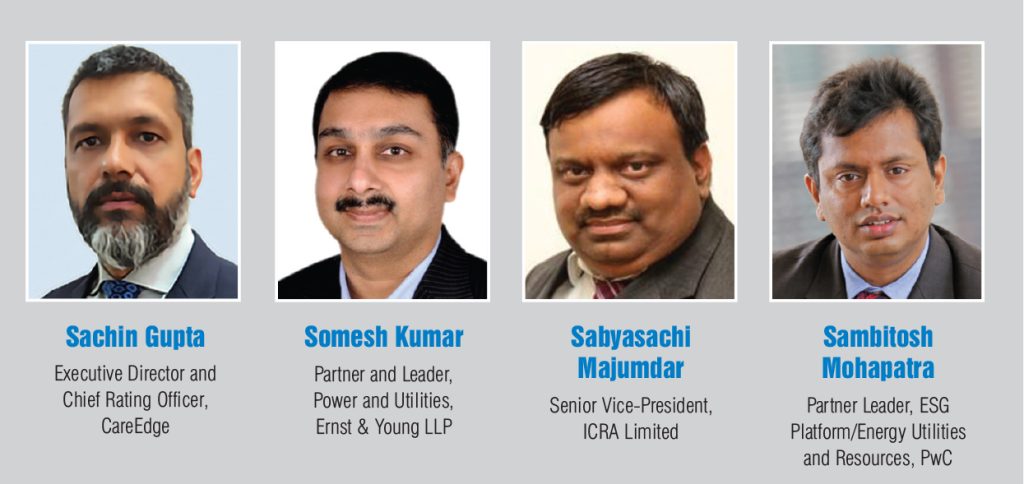

Sachin Gupta

Financial year 2021-22 has been a mixed bag for the power sector. While both the renewable and thermal power sectors reported relatively better numbers, the distribution segment saw below-average performance, bogged down by coal shortages.

Among the positives, energy demand during the year grew 8.2 per cent year on year, backed by a low base, but even in comparison to 2019-20 the growth has been at a healthy 6.9 per cent. At its peak, power demand hit new highs of 200 GW and 210 GW in July 2021 and June 2022 respectively, leading to better utilisation levels among thermal generators, which reported an improved plant load factor (PLF) of 58.87 per cent in financial year 2022 (PY: 54.57 per cent). With 15.5 GW of capacity added during 2021-22, the renewable energy sector led with new installations (PY: 7.7 GW) against the net capacity addition of 17.3 GW in 2021-22.

However, coal shortage continues to be a challenge for the sector. While it is a recurring phenomenon post monsoons (around September) every year, the severity was higher in 2021-22 as many plants had critical levels of stocks for a few days. The shortage was largely attributed to a sudden surge in power demand and exorbitant imported coal prices (which usually make up for any shortfall in domestic production).

As far as the power distribution segment is concerned, while aggregate technical and commercial losses (AT&C) have remained at 21 per cent over the past few years, issues around the increasing revenue gap continue. The widening gap was primarily due to a lack of cost-reflective tariffs and stagnant AT&C losses. The discom overdues problem, which was partially countered with the help of Atmanirbhar Bharat and the liquidity infusion package, has again resurfaced. It should be noted that despite repeated liquidity injections through various government schemes over the past decade, payments by some state discoms continue to be stretched.

Somesh Kumar

India is eyeing becoming a $5 trillion economy by 2025. It has recently overtaken the UK to become the fifth-largest economy in the world. To continue on this developmental track, a critical role is played by the power sector. India has twin goals – first, to ensure 24×7 adequate and reliable energy access, and second, to accelerate clean energy transition by reducing the country’s reliance on fossil-based energy and shifting to cleaner and renewable energy sources. With such goals in perspective, multiple positive changes have been brought about in the past year such as:

- Moving towards power surplus from power deficit: India has transformed itself from a power-deficit to power-surplus country. From 2014 till November 2021, power generation capacity of 160.8 GW, consisting of 83,920 MW of fossil fuel based and 76,900 MW of non-fossil fuel based capacity, has been added, making India power surplus. Even in August 2022, the peak demand of 195.8 GW was met. It has been possible because of the adequate installed capacity to the tune of 404 GW as of July 2022. It has about 236 GW of fossil-fuel based (coal, lignite, gas and diesel) capacity whereas around 168 GW is non-fossil based (renewable energy, nuclear and hydro). The installed capacity is now close to double the peak demand and India is exporting power to Nepal, Bangladesh and Myanmar.

- Moving towards 24×7 power supply: All states and union territories have signed MoUs with the central government to ensure 24×7 power supply to all households, industrial and commercial consumers and adequate power supply to agricultural consumers. It has been supported by a robust national grid enabling seamless transfer of power from resource-centric regions to load-centric regions. It has led to an increase in power availability in rural areas by up to 21:09 hours and by 23:41 hours in urban areas.

- Placing competition at the heart of power transactions: It has been done by strengthening the power exchanges. Even new products such as the real-time market, green term-ahead market, etc., have been launched.

- Focus on clean energy transition: India has set a long-term target of reaching net zero by 2070. Recently, the cabinet has approved the updated Nationally Determined Contribution (NDC) committed to the United Nations Framework Convention on Climate Change. It also aims to reduce the emission intensity of its gross domestic product by 45 per cent by 2030. The updated NDC also represents the framework for India’s transition to cleaner energy for the period 2021-30. It is being fostered with tax concessions and incentives such as the production-linked incentive (PLI) scheme for the promotion of manufacturing and adoption of renewable energy, creating a platform for India to become a self-reliant and export-oriented nation.

Sabyasachi Majumdar

Electricity demand in India remains buoyant in the current fiscal due to recovery of economic activity and the severe heatwave in the northern and central parts of the country in the first quarter. The demand increased by 18.5 per cent in the first quarter of 2022-23 over the corresponding period in the previous year. This demand is likely to witness a year-on-year growth of 6.5-7 per cent at the end of this financial year. This follows a healthy demand growth of 8.2 per cent in 2021-22, the highest annual percentage electricity demand growth in two consecutive years since 2011-12 and 2012-13. The recovery in electricity demand is expected to improve the all-India average thermal PLF level to 61-61.5 per cent in 2022-23, from 58.9 per cent in 2021-22.

Coal-based independent power producers benefited from a sharp increase in short-term tariffs in the first quarter of 2022-23 despite the adverse impact of high coal prices. A sustained improvement in electricity demand, and in turn, the thermal PLF level remains a critical factor in improving the outlook for thermal generation.

The outlook for the renewable energy sector is favourable, led by continued policy support from the Government of India, strong project pipeline and superior tariff competitiveness offered by wind and solar power projects, both in the utility and open access segments. The installed capacity in the renewable energy segment has doubled over the past 5.5 years, led by strong policy support and tariff competitiveness. Investment prospects are expected to remain strong over the next decade, with a target to reach 450 GW renewable energy capacity by 2029-30 from the current level of 114 GW.

The key challenges constraining growth are on the execution front, mainly associated with land and transmission infrastructure, distribution utility finances and tariff viability concerns, amidst elevated module prices and hardening interest rates. The prices of mono PERC (passive emitter and rare contact) modules have increased by over 40 per cent to 27-28 cent per watt in the past 18 months. This has been mainly driven by a sharp increase in the price of polysilicon and supply chain issues in China due to Covid-19. While supply chain challenges are showing signs of improvement, prices remain elevated amid continued higher prices for polysilicon. This, along with the imposition of customs duty from April 2022, has kept module prices relatively high in India. Notwithstanding the elevated module prices and hardening interest rates, solar bid tariff rates continue to be highly competitive at less than Rs 2.40 per unit, as seen from recent bids. While this is positive from the discoms’ perspective, the ability of developers to make these projects viable remains to be seen.

The demand outlook for domestic solar original equipment manufacturers (OEMs) remains favourable, with strong policy support through the imposition of customs duty on imported cells and modules, notification of the PLI scheme and inclusion of only domestic manufacturers in the Approved List of Models and Manufacturers (ALMM). The policy push is expected to improve the cost competitiveness of domestic OEMs and lead to large capacity announcements by various OEMs and also the entry of new players. The ability of OEMs to achieve backward integration and build economies of scale would be important to remain competitive against overseas suppliers on a sustained basis. The share of domestic OEMs in solar power installations in the country is likely to witness a healthy growth, led by these policy initiatives over the next three to five years.

The thermal segment continues to face challenges owing to the lack of meaningful progress in signing of new long-term/medium-term power purchase agreements (PPAs), delays in payments from discoms, inadequacy of domestic coal availability and a sharp increase in the national coal prices in the recent past. Moreover, tighter environmental compliance requirements remain a key challenge for this segment.

Further, state-owned distribution utilities continue to be in a fragile financial health, due to the high level of AT&C losses, inadequate tariffs in relation to the cost of power supply, delays in subsidy support from the state governments and delays in receiving payments from state government bodies. Their overall debt burden, despite the implementation of the Ujwal Discom Assurance Yojana, is estimated to have increased to over Rs 6 trillion in 2021-22. Considering the highly subsidised power tariffs for agriculture and certain sections of residential consumers, the overall subsidy dependence is estimated to remain high at about Rs 1.5 trillion this year at an all-India level. As a result, discoms in key states continue to report losses, leading to delays in payments to power generating companies and impacting the quality of supply to consumers.

A major area of concern affecting discom finances is the significant delay in the process of tariff determination in many states. The tariff determination process for discoms for 2022-23 remains sluggish, with tariff petitions for 2022-23 being filed by 24 out of 29 states and tariff orders being issued only for 18 states. While the median tariff hike is higher in 2022-23 compared to the past two years, this is likely to remain inadequate, considering the expected increase in the power purchase cost for discoms in 2022-23 due to the rising dependency on costlier imported coal.

Sambitosh Mohapatra

Emerging from the setback of tepid demand and investments due to Covid-19, the past year provided multiple green shoots of sector revival and growth. A few key indicators of the power sector’s progress over the past year have been captured below:

- Demand spurt post Covid-19: The peak power demand in 2021-22 went up to around 203 GW, increasing by 6.4 per cent over 2020-21, driven by the post-Covid recovery of industries, commercial and economic activities, as well as rising per capita consumption. Subsequently in July 2022, the demand surged further, hitting an all-time high of 215 GW. It shows positive signs of demand revival, growth and investments in the sector resulting in improved efficiency of TPPs – all-India PLF went up to 58.9 per cent in 2021-22 compared to 54.6 per cent in the previous year.

- Dampening operational and financial efficiencies: AT&C losses and the average cost of supply (ACS)-average revenue realised (ARR) gap of discoms dipped due to the impact of poor billing and collections during the initial phases of Covid-19. It has impacted payables to gencos, which have gone up to Rs 1,100 billion, creating risks of non-performing assets and slowing down investments.

- Focus on carbon reduction targets, paving the energy transition pathway: With the country surpassing 403 GW of installed capacity, renewable energy (including hydro) has touched 40 per cent of the energy mix. In 2021-22, 15 GW of the total 17 GW added during the year is from renewable energy sources.

In November 2021, during COP26, India put itself on a pedestal by pledging to achieve net zero carbon emission by 2070. The targets for 2030 include ensuring 500 GW of non-fossil-based installed capacity, 50 per cent of energy requirement coming from renewables, cutting down the net projected carbon emission by 1 billion tonnes and reducing carbon intensity by more than 45 per cent. A plan has also been put in place to phase out older TPPs after completion of the PPA tenure or beyond 25 years from the commercial operation date, with guidelines issued for enabling discoms for exiting PPAs from such plants.

The introduction of the Electricity (Promotion of Generation of Electricity from Must-Run Power Plant) Rules, 2021 ensures that renewable energy power plants do not suffer any curtailment or regulation on account of merit order despatch or other considerations. The waiver of interstate transmission system charges for transmission of electricity generated from solar, wind, hydro, pumped storage and battery energy storage system projects till June 2025 will also act as an incentive.

- The crucial policies and reforms seeded in the past year that will shape the future of the sector: The roll-out of the Revamped Distribution Sector Scheme (RDSS) for improvement in power reliability and quality, reduction in AT&C losses and ACS-ARR gap of public discoms is one such reform. With planned investments of Rs 3,000 billion, the scheme plans to bring in reforms around network infrastructure, governance and technology. The 100 per cent smart prepaid metering is expected to be a key enabler for improving the cash flow challenges and plugging energy leakages in the value chain to drive viability and greater consumer service.

Another important reform is the transition to a wholesale power market for driving competitive energy prices, efficiency and effective utilisation of renewable energy power. For instance, market-based economic despatch – Phase I is expected to reduce the power purchase cost for consumers by at least 5 per cent. Similarly, the green day-ahead market for trading renewable energy power on a day-ahead basis is expected to facilitate the achievement of green targets.

Strengthening of transmission capacity planning by introducing general network access in interstate transmission.

What are the top trends to watch out for in the power sector in the coming years?

Sachin Gupta

Decarbonisation of the power generation segment tops the charts with India’s thrust on it visible in various policies and commitments on global forums. It will be exciting to see how the initiatives by renewable players overcome their existing challenges and progress towards the government’s targets. Particularly in this aspect, the quantum of renewable capacity addition, reduction in the intermittency of renewable power supply through the integration of sources such as thermal, wind and solar, and augmentation of storage methods such as pumped and battery storage will be important for India to achieve its long-term commitments to green energy. Further, the setting up and ramping up of green hydrogen capacities to support the core manufacturing sector and transportation will be important.

In the medium term, technology upgradation, including digitalisation in the distribution segment, will be a key trend. The installation of smart meters, which is one of the pillars of the RDSS, is likely to improve the operational efficiency of discoms. The extent of improvement will have a direct bearing on the financial health of the distribution segment, which will, in turn, positively affect the working capital requirements in power generation.

Somesh Kumar

The power sector is on the cusp of transformation led by 3Ds, that is, decarbonisation, digitalisation and decentralisation. In addition, with the global focus on climate change and sustainability, a shift from traditional energy sources to clean and sustainable sources is unavoidable. One aspect of this shift will be reflected in the wider application of electrification. Hence, the power sector is bound to change. Some of the top trends in the power sector would be:

- Increased focus on clean energy sources: India has a huge economic opportunity in clean energy transition. It is also well placed to become a global leader in renewable batteries and green hydrogen. India has already set a conditional target of net zero emissions by 2070. The Covid-19 pandemic and the geopolitical tussle is a stark reminder that the ongoing energy transition is a boon for India’s long-term energy security, sustainability and self-reliance. The International Energy Agency (IEA) estimates that $160 billion per year is needed, on an average, across India’s energy economy between now and 2030. Even though the focus would depend on the financial assistance and technological transfer from developed nations, the global scenario indicates the need for an increased focus on clean energy sources.

- Enhanced activity in the energy storage space: With an ambitious clean energy target, along with an increase in the number of new technologies such as electric vehicles (EVs) and increased capacity of intermittent renewable energy, there would be a reduction in grid inertia. One way to maintain it is energy storage. BloombergNEF estimates the market to exceed $150 billion annually by 2030, acting as a motivator for Indian market participants also. The IEA outlook 2021 also projects 140-200 GW of battery storage capacity by 2040, which is potentially a third of the total battery storage capacity. With industry players such as Adani and Reliance foraying into this space, a lot of action is expected in the coming future.

- Acceleration of green hydrogen adoption: Hydrogen would also play a role in decarbonising hard-to-abate sectors (manufacturing and transport) and hence, would play a strategic role for India in achieving its net zero goal. India’s Green Hydrogen Policy will also kick-start energy transition efforts. India is also targeting to become a hub for the production and export of green hydrogen under its National Hydrogen Mission. This acceleration is gaining pace because the country is aiming at becoming energy independent by 2047. Currently, India spends over $160 billion of foreign exchange every year for energy imports, which are likely to double in the next 15 years without remedial action. Hence, green hydrogen adoption would accelerate owing to government push, prevailing geopolitical crisis and increased interest from private players.

Sambitosh Mohapatra

Some of the major trends in the coming years shall be as follows:

- Ensuring national-level energy security and sustainability: With increasing demand in the country and taking cues from the energy crisis across other economies such as Europe, Australia, etc., ensuring energy security and sustainability has come to the forefront. With India’s vision to achieve its climate action targets, striking the right balance between dependence on fossil fuels, increasing penetration of intermittent renewable energy power and promoting alternative clean fuels such as hydrogen/ammonia, will be extremely critical.

- Realisation of early benefits of the RDSS: Given the well-rounded approach of the scheme, measures such as liquidation of outstanding subsidy dues, state government department dues, timely implementation of cost-reflective retail tariffs and takeover of financial losses for some states are expected to bring in some relief in the form of additional cash flows to power utilities.

- Emergence of new/disruptive business models: With large investments planned, disruptive business models such as leasing, totex, design-build-finance-own-operate-transfer, etc., are expected to gain traction to allow quick investments, tackle technology capabilities of the buyer, bring in a wider range of service providers moving beyond the traditional sectoral players, among others.

- Need for a wider range of lower-cost and innovative funding: With new and innovative technologies/solutions planned to be deployed across the power value chain including distributed energy sources, EV charging, distribution automation, smart grids, asset health monitoring devices, etc., access to innovative funding options with low cost would be critical for ensuring grid parity and affordability.

- Active participation of consumers in the power ecosystem: Consumers are being empowered with access to real-time consumption data through smart metering and mobile apps, becoming prosumers and playing a greater role in shaping the energy transition journey. This transition would require the traditionally monopolistic and public sector operated utilities to reshape their traditional way of looking at consumer services and life cycle, moving towards a consumer-centric approach.

What is the outlook for the power sector in the near to medium term?

Sachin Gupta

Power demand is fairly correlated to the economic growth of the country and hence it is expected to sustain with the uptick in economic activity. For financial year 2022-23, according to CARE Ratings, the power demand is estimated to grow at 6-7 per cent.

Better demand prospects and coal shortages have led to firm electricity prices on the power exchange. This trend is likely to continue over the short to medium term with higher power demand, elevated international coal prices and limited capacity additions. Over the past six to nine months, buoyed by robust prices on the power exchange, we have seen significant deleveraging among the companies exposed to merchant markets. Also, a small part of the ongoing consolidation in thermal power markets is due to better cash flows on the back of high prices on exchanges. We expect both trends – consolidation and deleveraging – to continue in the medium term.

While fiscal year 2021-22 saw significant capacity addition that continued in the first quarter of 2022-23 at 4.2 GW (PY: 2.6 GW), we see the near-term module supply challenge for the industry largely driven by tariff (basic customs duty imposition) and non-tariff barriers (ALMM) imposed by the government and capacity constraints domestically. Notwithstanding the equipment supply-related challenges, we believe renewable energy capacity addition would be around 14 GW this year. While a significant bid-out capacity is awaiting execution, the increase or decrease in the pace of renewable capacity additions over the next few years would depend on how fast the domestic manufacturing industry adds up capacity.

Somesh Kumar

The outlook for the power sector in the near to medium term looks positive because of policy and regulatory changes taking place in the country. But this outlook is conditional, based on the implementation of various electricity reforms.

The power sector will continue to grapple with challenges on delayed payment to generators; however, slow progress should not be equated to failure.

Although distribution utilities have been in a perpetual crisis, owing to heavy politicisation and heavy subsidies in the name of votes, their performance kept improving with the completion of each revival package notified by the centre. There were multiple schemes such as the Accelerated Power Development and Reforms Programme, the Restructured APDRP), the Rajiv Gandhi Grameen Vidyutikaran Yojana, the Deendayal Upadhyaya Gram Jyoti Yojana, Saubhagya, etc. A key target of these schemes was to strengthen the sub-transmission and distribution network, metering of infrastructure and IT enablement. These schemes have their own share of positive and negative impacts.

The Ministry of Power has launched the RDSS, which is a reforms-based and result-linked scheme, taking cognisance of learning from the experience of previous schemes.

Going forward, with the implementation of reform-based and result-linked schemes, the targeted reduction in AT&C losses at a pan-Indian level is expected to be 12-15 per cent by 2024-25 and the reduction of the ACS-ARR gap to zero by 2024-25.

Although the RDSS presents a bright picture, along with stringent steps taken by the government to reduce the overdues of gencos from discoms, the fault lines would continue to remain evident till the subsidy burden is shed completely and timely by discoms, pilferages are minimised and reform-based implementation is adequately done.

Sector coupling, along with the rise in renewable capacity additions, would continue to open avenues for increase in renewable power demand and decarbonisation. The integration of renewable energy with the mainstream power supply (with open access playing a major role), along with the necessity to improve energy efficiency, will harmonise the industrial and non-industrial sectors that would be coupled or linked together to decarbonise the power sector. The sector coupling of transportation, industrial and commercial consumer segments would play a critical role in decarbonising India’s economy. Sunrise sectors such as green hydrogen, EVs, green fuels, etc., will play a critical role in this. Further, renewable energy 100 targets and commitments by corporates would play a vital role in the required “pull” that would naturally come for commercial and industrial players.

Leveraging India’s distinct advantage to produce low-cost, round-the-clock renewable power, complemented by falling electrolyser costs, will boost green hydrogen production as well as power demand from renewables. In order to meet the 5 million tonne green hydrogen production target by 2030, India would need 115 GW of dedicated renewable power.

Further, utilising renewable power for charging EVs would play a major role in stabilising the grid, as grid variability due to renewable energy can be conveniently absorbed in the mobile batteries. Nevertheless, tenders for standalone battery-based energy storage systems are seeing a rise in India and would aid in utilising the stored energy on a “on-demand” basis to suit the peak and off-peak power demand, which would also help in decarbonising the power sector.

However, the imposition of cross-subsidy surcharge, additional charges and other components of open access charges would remain the key impediments to decarbonising the power sector, at least till such time as the electricity amendment act that sparks competition among discoms is enacted in spirit. Open access charges should not deter the growth in absorption of renewable energy capacities. The need of the hour for discoms is to have a long-term master plan to assess multiple scenarios that would involve re-engineering of their existing PPAs to meet the existing and future demand at the least cost and optimise the capital investment plan of the sector.

Further, the state generation companies need to find avenues to improve their revenue sources through various initiatives such as third-party sale of surplus unscheduled power, improvement of demand-side management receivables and also grab opportunities to earn from the ancillary services market.

Sabyasachi Majumdar

In its budget for 2021-22, the central government had announced the launch of a “reforms-based and results-linked” scheme for the distribution sector, with the objective of improving the financial health and operational efficiency of discoms by reducing AT&C losses. Subsequently, the RDSS was notified in July with an overall outlay of Rs 3.03 trillion. This is inclusive of a budgetary grant/support of Rs 976.31 billion, spread over a five-year period. Under the scheme, AT&C losses are sought to be brought down to 12-15 per cent by 2025-26, through smart metering and distribution infrastructure upgradation, including the segregation of agricultural feeders. As of April 2022, the government has approved proposals of 13 states under this scheme, with a financial outlay of around Rs 1.62 trillion. The timely implementation of projects under the RDSS, including the smart metering programme, remains key to improving discom efficiencies.

On the whole, the on improving operational efficiency, timely issuance of tariff orders with adequate tariff revisions and timely subsidy payouts are necessary to ensure the financial sustainability of the discoms. A strong political will and support from the state governments is needed to achieve this objective.

Sambitosh Mohapatra

- Energy transition: India being the world’s fourth-biggest carbon dioxide emitter, for the first time, has expressed a concrete target year for achieving net zero. However, the path ahead is steep and large-scale investments along with support from the forerunners would be paramount.

- Building a resilient and reliable utility ecosystem: With electricity expected to play a catalyst role in the economy, ensuring resilience of the infrastructure and ecosystem to natural hazards, calamities, cyberthreats, etc., while maintaining service standards around reliable and quality power, would be extremely critical.

- Digital transformation: Technology is evolving as a major disruptor across the utility space. In the power sector, smart metering is a forerunner of this digital transformation journey. Data from consumer smart metering, coupled with various other utility legacy systems, can drive valuable and actionable insights for utilities. This will drive the entire digital value chain of advanced artificial intelligence/machine learning platforms and information technology/operational technology systems. Smart metering acts as a gateway to a huge ambit of untapped downstream market opportunities such as distributed energy resources, home automation, EV charging, demand response, in-house feedback systems, etc.

- Improved governance among utilities: With new technologies/business models kicking in, utilities might need to relook at their organisation structure to map existing competencies, corporate governance norms, key performance indicators, rewards/incentive mechanism, performance monitoring framework, etc., and realign them to build a future-ready and sustainable organisation.