As of May 2023, thermal power capacity accounted for a significant share of 56.8 per cent of the total installed base of 417.67 GW. The pace of thermal-based capacity addition has declined considerably due to a growing policy focus on renewables and an increase in stressed assets in the thermal power segment. However, it remains important, as it contributed to nearly 74.6 per cent of the total generation in the country during 2022-23.

In the past two years, there has been a sharp recovery in demand growth, leading to an improvement in the utilisation of thermal assets and an improved plant load factor (PLF). Further, the extension of time for complying with revised emission norms and the realisation of overdue payments from discoms under the late payment surcharge (LPS) scheme are positive developments for the thermal power segment.

Power Line presents the key trends in the thermal power segment…

Size and growth

The thermal power generation capacity has increased from 218 GW in March 2017 to 237 GW in March 2023, recording a compound annual growth rate (CAGR) of 1.4 per cent. As of March 2023, coal accounts for over 89.3 per cent (211.9 GW) of thermal power generation capacity, while gas contributes 10.5 per cent (24.8 GW) and diesel makes up 0.2 per cent (589 MW). Thermal power capacity addition has significantly declined in the past five years, primarily due to generators and lenders shifting away from coal-based projects owing to environmental concerns, and gas-based projects being stalled due to the lack of domestic gas. As per the National Electricity Plan (NEP) 2022-32, a total of 30,667.91 MW of thermal capacity was added during 2017-22, which includes 30,562 MW of coal-based capacity and 105.91 MW of gas-based capacity. Meanwhile, thermal capacity totalling 10,044.3 MW was retired during the same period.

The power generation capacity mix has also undergone changes over the years. The share of thermal power in the overall electricity mix declined from 80 per cent during 2016-17 to 75 per cent during 2022-23. Meanwhile, the share of renewables considerably increased from 7 per cent to 13 per cent during this period. However, in absolute terms, the thermal generation increased from 994 BUs during 2016-17 to 1,206 BUs during 2022-23, recording a CAGR of 3.3 per cent.

The PLF of thermal power plants (TPPs) has shown a mixed trend. It declined considerably – from a peak of 61 per cent during 2018-19 to 53.4 per cent during the Covid-19 pandemic during 2020-21. However, a healthy demand growth due to severe heat waves, the revival of economic activity, combined with limited capacity addition, has led to an improvement in the utilisation of thermal assets over the past two years. Consequently, the PLF has bounced back, reaching 64.2 per cent during 2022-23. On a year-on-year basis, the PLF showed an improvement over the 58.9 per cent recorded in the previous year. However, in the case of gas-based plants, the PLF reduced from 23.8 per cent during 2017-18 to 10.98 per cent during 2022-23, primarily due to fuel shortage.

Captive power

According to the Central Electricity Authority (CEA), the installed generation capacity of captive power plants across industries with a demand of over 1 MW has been estimated at 83 GW as of March 2022. It recorded a CAGR of 9.9 per cent between March 2017 and March 2022. Approximately 61.6 per cent of the installed captive capacity is steam-based, followed by 21.4 per cent diesel based, 8.9 per cent gas based, and the remaining 8.1 per cent comprises renewables and hydro-based plants. Notably, large industries in the metals and mining, cement, and petrochemicals sectors prefer coal-based or natural gas-based plants owing to the economies of scale they offer. Meanwhile, smaller plants (less than 10 MW) are typically based on solar, diesel and other liquid fuels. In recent years, industries have been increasingly focusing on setting up solar-based captives owing to falling capital costs and zero fuel costs.

Recent developments

Scheme for the pooling of tariffs: In April 2023, the Ministry of Power (MoP) launched a scheme for the pooling of tariffs of efficient coal- and gas-based power generating stations whose PPAs have expired. As per the scheme, scheduled to be implemented from July 1, 2023, a genco-wise common pool of power will be created, comprising stations with a lifespan of 25 years or more. Interested state governments or discoms can approach the genco with a letter of intent to requisition power from the common pool for a minimum period of five years. The states/discoms will be billed a uniform capacity charge based on the percentage of allocation and the total capacity charge of power from the common pool.

Renewable generation obligation (RGO): In February 2023, the MoP notified the RGO, which mandates power generation companies with coal- and lignite-based plants having a commercial operation date (COD) on or after April 1, 2023, to establish renewable power capacity equivalent to at least 40 per cent of their plant capacity or procure and supply an equivalent amount of renewable energy. For generating stations with a COD between April 1, 2023, and March 31, 2025, compliance with the RGO of 40 per cent is required by April 1, 2025. Plants with a COD after April 1, 2025 are required to comply with the RGO starting from their respective CODs.

Order on blending: In February 2023, the Central Electricity Regulatory Commission (CERC) issued a suo motu order on the blending of imported coal with domestic coal. In order to facilitate the availability of an adequate quantum of coal in TPPs, ensuring smooth and uninterrupted generation and aiding discoms in meeting their universal supply obligation to consumers, the CERC relaxed Sub-Regulation (3) of the Regulation 43 provisions. Accordingly, the first proviso states that prior permission from beneficiaries will not be a precondition for blending up to 6 per cent by weight genco-wise from alternative energy sources, subject to technical feasibility. The operation of the second and third provisos of Sub-Regulation 3 shall be kept in abeyance. These directions will be operative until September 30, 2023, or until further notice.

Revision in biomass co-firing policy: Last month, the MoP revised the biomass co-firing policy to facilitate the purchase of biomass pellets by TPPs at benchmark prices. This price benchmarking of pellets will enable both the TPPs and pellet vendors to establish a sustainable supply mechanism for the co-firing of pellets. The benchmarked price will be effective from January 1, 2024. Following the mandate on co-firing biomass with coal in TPPs, approximately 0.18 million tonnes (mt) of biomass fuel has been co-fired in 47 TPPs, with a combined capacity of 64,350 MW. Of this, over 50,000 tonnes has been co-fired during the first two months of 2023-24, surpassing the previous highest-ever annual quantity. Further, about 114 mt of biomass pellets are at various stages of the tendering process and TPPs have placed a purchase order for 6.9 mt of biomass pellets.

Order to compensate ICB plants for higher running costs: In order to ensure that power producers maintain and operate their plants, generating power for supply to the procurers in compliance with the directions of the MoP under Section 11 (1) of the Act, the CERC, in an order dated January 2023, decided to fully compensate the power producers operating ICB plants for the higher running costs incurred while supplying electricity under forced circumstances. The compensation will cover the costs, along with a reasonable margin of profit.

Flexibilisation: In March 2023, the CEA issued a comprehensive report on the flexibilisation of coal-fired power plants. It highlighted the operating procedure, challenges, retrofits and roadmap for achieving a minimum technical load of 40 per cent. As per the report, the flexible operation of coal power plants can be made technically feasible by upgrading and tuning controls. Further, the report proposed a phasing schedule with a minimum time period of eight years to ensure that 600 units are compliant with the flexibility of up to 40 per cent load and achieve higher ramp rates. The complete refurbishment work is estimated to conclude by December 2030.

Update on emission norms: In September 2022, the Ministry of Environment, Forest and Climate Change extended the deadline by two years for TPPs to reduce sulphur. For coal-based units under Category A, the deadline for emission norm compliance has been extended till December 31, 2024; for TPP units under Category B, the deadline has been pushed to December 31, 2025; and for other TPPs under Category C, the deadline has been extended to December 31, 2026. This extension comes as a major relief for thermal gencos, considering that as of June 2023, flue gas desulphurisation (FGD) systems have been implemented in only 22 units, aggregating 9,280 MW of the total 211.52 GW spread across 600 units. For non-compliance beyond the specified timelines, more stringent environmental compensation measures have been imposed on the non-retiring TPPs.

Issues and challenges

A key challenge faced by coal-based units is the need to adapt to flexible operations as renewables become more integrated into the grid. This implies that plant components will not only deteriorate at a faster rate but will also require higher operations and maintenance (O&M). There will be additional costs owing to an increase in the heat rate and auxiliary power consumption, as well as an upsurge in oil consumption due to the frequent starts/stops. Other challenges include managing the performance of old and vintage units, and tighter O&M regimes.

Another challenge confronting the thermal power generation segment is the shortage of fuel at power plants. Despite a steady increase in coal production to meet the growing demand, logistical constraints often lead to coal shortages, especially during peak power demand season. Further, there are several factors which are impacting/likely to impact the cost of generation of coal-based TPPs, in turn impacting their cost-competitiveness. These include revised emission norms, which entail additional capex and opex; rise in capital costs due to rising equipment costs and delays in execution, putting pressure on capacity charges; Coal India Limited’s upward revision in non-coking coal prices; and the impact of high international coal prices.

Likewise, the shortage of domestic natural gas supply has been a key challenge for the segment. Approximately 24.9 GW of gas-based power plants are either stranded or operating at suboptimal levels due to the unavailability of affordable fuel. The situation has further compounded by revisions in the gas allocation policy, which have placed power plants lower on the priority list. This has led to stranded assets and a greater dependence on imports by operational plants, resulting in higher generation costs and a lower ranking in the merit order despatch list. Further, most power plants tend to operate under the paradigm of long-term PPAs, which lack flexibility due to the volatile fuel price movements. Apart from supply challenges, there are a host of taxation-related issues hampering the operations of gas-based power plants.

Other issues constraining the performance of thermal assets include the delayed payment from discoms. In 2022-23, short-term tariffs surged to Rs 5.90 per unit due to increased demand, domestic coal supply constraints and high open market coal prices. As on July 24, 2023, the total dues of discoms towards gencos comprised balance legacy dues of Rs 610.25 billion and current dues of Rs 291.36 billion. While the central government has taken adequate measures to address the current crisis through the implementation of the LPS rules, it is essential to explore sustainable solutions to resolve these issues and prevent the recurrence of such crises in future. Apart from this, the slow resolution of stressed thermal assets poses a major challenge for the sector. It is estimated that approximately 41 GW of coal-based capacity is stressed owing to issues such as the lack of long-term PPAs, insufficient coal linkages and promoters’ inability to secure funding for project completion.

Future outlook

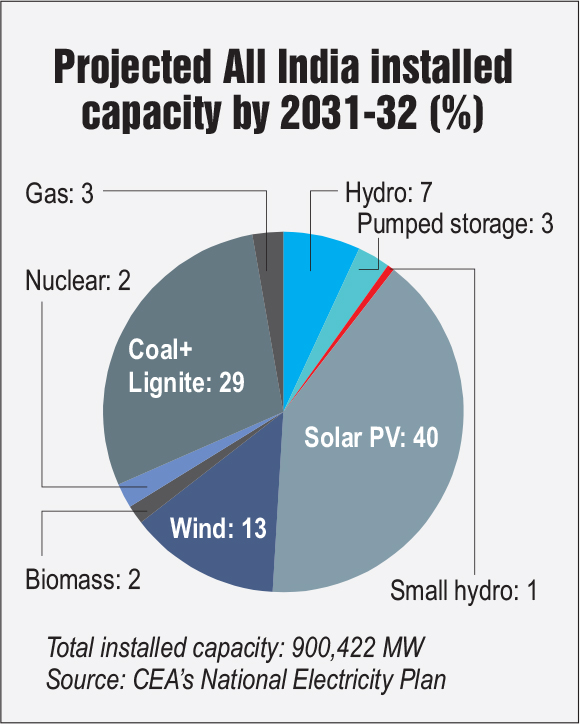

As per the CEA’s NEP (Volume-I) Generation for the period 2022-32, the all-India installed capacity is projected to reach 900,422 MW by 2031-32. This includes 259,643 MW of coal-based capacity and 24,824 MW of gas-based capacity, accounting for 31.6 per cent of the country’s overall installed capacity mix. Apart from the under-construction coal-based capacity of 26.9 GW, the additional coal-based capacity required till 2031-32 is estimated to vary from 19.1 GW to 27.1 GW across various scenarios. Notably, India will not add any new coal capacity in the next five years, except for plants already at various stages of planning.

The domestic coal requirement is estimated to be 866.4 mt for 2026-27 and 1,025.8 mt for 2031-32, besides an estimated requirement of 28.9 mt of coal imports for the plants designed to run on imported coal. The total fund requirement for thermal generation capacity addition is estimated to be Rs 2,184.3 billion for the period 2022-27 and Rs 1,858.55 billion for the period of 2027-32.

Recently, the Uttar Pradesh cabinet approved the construction of the Obra-D TPP, featuring two units of 800 MW each, to be built at a cost of Rs 180 billion in Sonbhadra district. This will mark the first ultra-supercritical TPP in the state and is scheduled to be completed in 56 months. The project will be executed in a 50:50 partnership with NTPC Limited.

With regard to the expected PLF of TPPs, ICRA Research anticipates that the all-India average thermal PLF level will improve to over 65 per cent in 2023-24. However, the thermal PLF would remain under pressure in the long term due to the increasing share of renewables in the energy mix. Meanwhile, short-term tariffs are expected to moderate in 2023-24, given the improved coal supply and moderation in the demand growth. Nonetheless, tariffs are likely to remain higher at approximately Rs 4.50 per unit, as compared to the long-term average of Rs 3 per unit-Rs 3.50 per unit.

Overall, the power generation segment holds a favourable outlook owing to a healthy growth in electricity demand and the implementation of the LPS scheme, which facilitates the recovery of overdue payments from discoms. However, moving forward, there will be challenges arising from the growing share of renewable energy capacity in the overall capacity mix, leading to a growing need for flexibilisation among TPPs.