By Ravinder Singh Dhillon, Former CMD, Power Finance Corporation Limited

By Ravinder Singh Dhillon, Former CMD, Power Finance Corporation Limited

A healthy and profitable electricity distribution sector plays a vital role in India’s continued economic growth and its goal of becoming the third largest economy by 2029. The sector must ensure affordable and reliable power supply to all consumers while maintaining liquidity across the electricity value chain. The distribution sector has seen tremendous progress in the past decade, with notable achievements in rural electrification and network expansion for achieving universal access. The average duration of supply has increased from around 12.5 hours in rural areas in 2014-15 to around 21 hours in 2022. In urban areas, the supply has reached around 23.5 hours. The whole country has been connected through a single National Grid, enabling power transmission from any part of the country to another. This ensures increased power supply hours and reduced load shedding.

Since 2020-21, the Ministry of Power (MoP) has undertaken several result-driven reforms in order to steer the distribution sector towards financial sustainability. The primary objective is to bring about intrinsic improvements in the sector, including the reduction of aggregate technical and technical (AT&C) losses, improved reliability of supply and timely payment of genco and transco dues. The flagship Revamped Distribution Sector Scheme (RDSS) earmarked a funding outlay of about Rs 3 trillion to state discoms for the achievement of loss reduction targets. Along with RDSS, the ministry has implemented other decisive measures such as the Late Payment Surcharge (LPS) Rules and prudential lending norms. With the introduction of the ground-breaking LPS Rules, 2022, the MoP has been able to tackle the legacy issue of overdue payments to gencos and transcos. The rules set out a clear path for liquidation of these outstanding payments by converting them into EMIs after freezing the payable surcharge. They impose stringent penalties in cases of non-payment of EMIs or the current bills raised by gencos or transcos after a 75 day-period. This is being implemented through the PRAAPTI portal developed by PFCCL, a 100 per cent subsidiary of PFC Limited. Further, mechanisms have been put in place to incentivise discoms, state governments and regulators to improve financial prudence in the sector, and direct investment towards reducing losses, resolving legacy issues and streamlining the tariff setting mechanism.

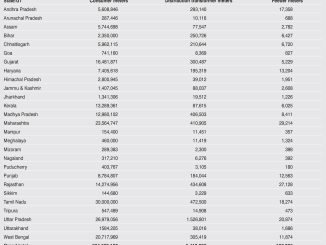

These reform measures have started showing positive results, as reported in the 11th Integrated Annual Ratings of Discoms published by PFC Limited. The sector has recovered from the impact of Covid-19 and demonstrated significant improvement in key financial parameters. The gap between expenditure and income on a cash-adjusted basis (ACS-ARR gap) reduced from Rs 970 billion in the financial year 2020 to Rs 530 billion in the financial year 2022, despite a volume growth of 8 per cent during the same period. AT&C losses, which had increased from 19.5 per cent in the financial year 2020 to 21.5 per cent in the financial year 2021, declined significantly to 16.4 per cent in the financial year 2022. The debt service coverage ratio has also turned positive, with positive sectoral earnings before interest, taxes and amortisation of Rs 540 billion in the financial year 2022 compared to a negative Rs 130 billion in the financial year 2021. Payable days (to gencos and transcos) and receivable days (from consumers) have reduced to 163 days and 142 days, respectively, which is comparable to the pre-Covid levels. The state governments have also improved their aggregate subsidy disbursal to over 100 per cent in the financial year 2022, while substantially clearing arrears. This improvement in subsidy disbursal is very important as more than 20 per cent of the sector’s revenues come from state subsidies. Karnataka, Rajasthan, Madhya Pradesh and Maharashtra have shown significant improvement in subsidy disbursement, and the absolute cash-adjusted gap in these states have collectively improved by about Rs 400 billion over 2020-21. Discoms have achieved a commendable 96 per cent collection efficiency, driven by initiatives such as digital billing and collection, AI-based meter reading tools and use of default tracking software. Rajasthan, Telangana and Madhya Pradesh have exhibited significant reduction in AT&C losses, driven by improvement in collection efficiency. MESCOM, CHESCOM, GESCOM (Karnataka), CESC (West Bengal), AVVNL (Rajasthan), AEML (Mumbai) and NPCL (Noida) have delivered good profits, with revenue realised on a cash basis exceeding the cost of power supply by more than 50 paise per unit in the financial year 2022.

However, there is still much ground to cover before we can cheer. The sector remains loss making, with AT&C losses for some discoms exceeding 25 per cent. There is a need to halve payable days to gencos and transcos as well as receivable days. State governments must clear subsidy arrears of Rs 660 billion. The overall debt levels in the sector must be reduced.

Under RDSS, the installation of prepaid smart meters can bring down AT&C losses, improve billing accuracy and create transparency for consumers. Pre-payment will help reduce working capital requirements and reduce receivable days, especially from institutional consumers. For instance, various government departments have outstanding dues of Rs 600 billion as of March 31, 2022. The target of installing 250 million smart metres will make it the largest smart meter programme globally. This programme is being implemented in TOTEX mode, which integrates the system creation and maintenance under a single vendor. RDSS also links eligibility and quantum of fund disbursement with the achievement of pre-determined goals. The goals encompass various trajectories for reducing AT&C losses, settling payables to gencos and transcos, clearing subsidy arrears, liquidating regulatory assets, ensuring timely publication of tariff orders, etc. Upon the completion of RDSS, we expect the sector’s billing efficiency to reach over 90 per cent and AT&C losses to fall below 12 per cent.

In another significant initiative, the government has made energy audit and accounting mandatory for all discoms. This will enable discoms to analyse their power supply and billing in detail, identify areas of energy theft and unmetered power supply, track sale to subsidised consumers and improve accountability. With the implementation of smart metering infrastructure including DT meters and communicable feeder meters, and mandatory energy accounting, the sector would witness a complete automation of energy accounting.

Going forward, there is a need to reform tariffs and the tariff setting mechanism. Some states continue to have high levels cross-subsidisation, where industrial and commercial consumers heavily subsidise agriculture and residential consumers. This practice should be limited and disincentivised. Like in the petroleum sector, the automatic pass-through of fuel costs should be implemented in the distribution sector, allowing discoms to immediately recover changes in the input cost, rather than waiting for the next true-up cycle. In many states, distribution loss targets set by regulators are very stringent, leading to billing losses of Rs 200 billion every year. The MoP is working with state electricity regulatory commissions to align distribution loss targets with RDSS targets. The sector has Rs 1.6 trillion of unpaid regulatory assets, concentrated in the states of Tamil Nadu, Rajasthan and Delhi. While the creation of new regulatory assets has been halted, states and discoms need to work with their regulators to devise their liquidation plans.

Discoms must accelerate their capital investments for the smart meter roll-out, develop advanced data analytics capabilities and focus on reducing their AT&C losses. State governments also need to ensure stronger fiscal discipline, disbursing full subsidy amounts and clearing past arrears in a timely manner. The states should be mindful when providing free electricity or increasing the quantum of subsidy, as these steps are bound to negatively impact the liquidity and financial viability of discoms and state finances. System improvements and strengthening should be scientifically based on system studies that clearly demonstrate additional sales and reductions in losses and help in the The selection of optimal substation locations and their capacities. This aspect has to be prudently followed in the planning exercise carried out by discoms.

India’s per capita power consumption is expected to grow manyfold in the coming decades, driven by universal access, economic development and improvement in living standards. It is estimated that an additional distribution network equivalent to that of the European Union will be required over the next 20 years. The electricity distribution sector must be modern and financially viable to respond to challenges, leverage opportunities including electric mobility and increased renewable integration, and provide the highest level of customer service. The distribution sector stands at the cusp of a turnaround and improvements are already underway. The sector reforms have been tailored to tackle the most pressing issues such as reducing AT&C losses, streamlining the disbursement of state subsidies, providing funds for capital investment and energy accounting. Further, efforts are being made towards setting cost-reflective tariffs and de-politicising the tariff setting mechanism. This is the right time for all relevant stakeholders to join hands and build upon the emerging momentum.