India’s transmission segment has made remarkable progress over the years, evolving from a fragmented network into a well-integrated and interconnected grid. The segment has achieved notable progress both in terms of expanding the physical infrastructure of the grid and technological advancements, solidifying the country’s electricity grid as one of the world’s largest synchronous grids.

India’s transmission segment has made remarkable progress over the years, evolving from a fragmented network into a well-integrated and interconnected grid. The segment has achieved notable progress both in terms of expanding the physical infrastructure of the grid and technological advancements, solidifying the country’s electricity grid as one of the world’s largest synchronous grids.

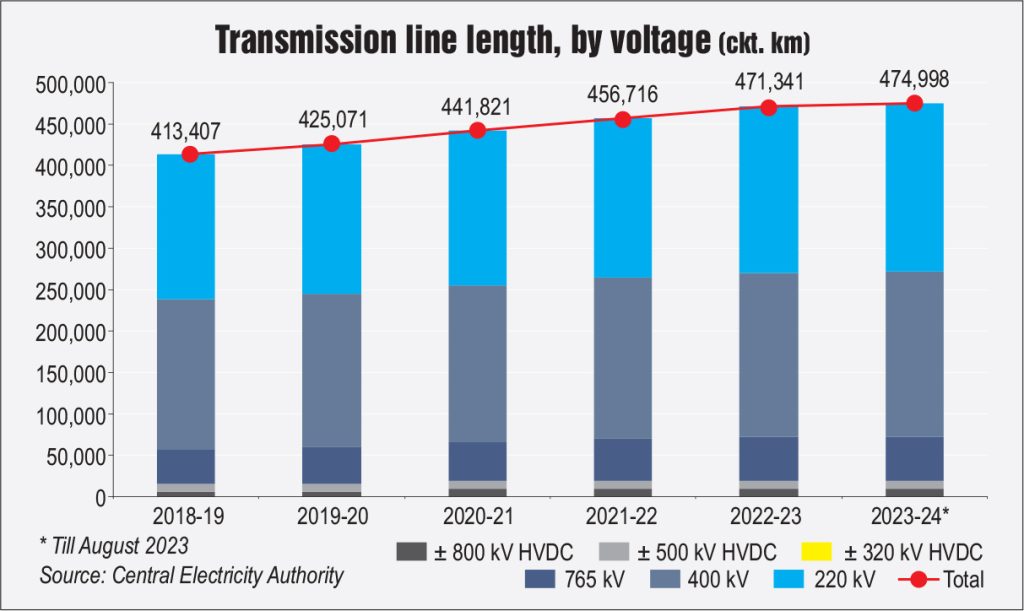

As of August 2023, the total transmission line length (at the 220 kV level and above) stands at 474,998 ckt. km, the total alternating current (AC) substation capacity stands at 1,163 GVA and high voltage direct current system (HVDC) substation capacity stands at 33,500 MW.

Between 2016-17 and 2022-23, the line length has grown at a compound annual growth rate (CAGR) of 4.2 per cent, while AC and HVDC substation capacities have grown at 8 per cent and 9.4 per cent, respectively. In absolute terms, about 103,490 ckt. km of lines, about 425,587 MVA of AC substation capacity and 14,000 MW of HVDC substation capacity have been added during this period. The interregional transfer capacity has also grown considerably over the years, from about 75,050 MW in 2016-17 to 112,250 MW in 2022-23, recording a CAGR of 6.9 per cent.

In addition to the expansion of the physical network, the sector is experiencing a technological revolution as utilities embrace measures like the implementation of flexible AC transmission systems and the deployment of battery energy storage systems (BESSs). These transformations are essential to enhance grid reliability in response to the growing integration of fluctuating renewable energy generation sources.

Power Line takes a look at the key trends and developments in the power transmission segment…

Policy and regulatory developments

In May 2023, in a key development, the central government granted a waiver on interstate transmission system (ISTS) charges to offshore wind and green hydrogen/green ammonia projects. As per the notification, a complete waiver of ISTS charges was given for offshore wind power projects, green hydrogen/ green ammonia production units using renewable energy (commissioned after March 8, 2019), pumped storage plants (PSPs) or battery storage systems, or any hybrid combination of these technologies commissioned on or before December 31, 2032, for a period of 25 years from the date of commissioning of the project. However, to promote the development of PSPs, the criteria for availing the complete waiver of ISTS charges for PSP projects has now been linked to the date of award of the project rather than the commissioning of the project. This shall be applicable in cases where construction work is awarded on or before June 30, 2025.

In May 2023, the Central Electricity Regulatory Commission (CERC) notified the CERC (Indian Electricity Grid Code) Regulations, 2023. For stable, reliable and secure grid operation, and to achieve the maximum economy and efficiency of the power system, the grid code, apart from the provisions relating to the role of various statutory bodies and organisations and functional linkages among them, contains extensive provisions pertaining to reliability and adequacy of resources; technical and design criteria for connectivity to the grid including the integration of new elements, trial operation and declaration of commercial operation of generating stations and ISTS; protection setting and performance monitoring of the protection systems including protection audit; unit commitment, scheduling and despatch criteria for physical delivery of electricity; integration of renewables; ancillary services and reserves; and cybersecurity.

In April 2023, the CERC notified the Connectivity and General Network Access to the Inter-State Transmission System (First Amendment) Regulations, 2023. Among other things, the amendment adds a new clause and defines general network access-renewable energy as open access to the ISTS granted under these regulations for drawal of power exclusively from renewable sources. Further, it defines temporary general network access-renewable energy as temporary open access to the ISTS granted under these regulations for drawal of power exclusively from renewable sources.

Earlier, in March 2023, the Central Electricity Authority (CEA) issued the new Manual on Transmission Planning Criteria. It had brought out the first Manual on Transmission Planning Criteria in 1985, which was revised in 1994 and then again in 2013. The manual provides the planning philosophy, system modelling, planning margins, various system studies, reliable criteria, substation criteria, criteria for renewable energy plants and more.

In February 2023, the Ministry of Power issued an amendment to the standard bidding documents for procurement of ISTS through the tariff-based competitive bidding (TBCB) process to include provisions for technical qualification requirements with respect to HVDC systems. The amendment mandates bidders to specify their experience in developing projects in the infrastructure sector in the past 10 years, as compared to five years previously. Further, the capital expenditure of at least one project must meet the specified capital expenditure threshold outlined in the bidding documents. This relaxation in the technical requirements for HVDC systems will be effective for a period of two years from the date of issue of the order.

of ISTS through the tariff-based competitive bidding (TBCB) process to include provisions for technical qualification requirements with respect to HVDC systems. The amendment mandates bidders to specify their experience in developing projects in the infrastructure sector in the past 10 years, as compared to five years previously. Further, the capital expenditure of at least one project must meet the specified capital expenditure threshold outlined in the bidding documents. This relaxation in the technical requirements for HVDC systems will be effective for a period of two years from the date of issue of the order.

In March 2022, the CERC Deviation Settlement Mechanism (DSM) Regulations, 2022 were notified. The regulations came into effect in December 2022, repealing the earlier DSM regulations. As per the DSM, 2022, deviation charges are to be delinked from system frequency. In February 2023, the CERC issued new guidelines to supplement the DSM Regulations, 2022, to maintain grid security. The commission added a new category of wind-solar generators and introduced charges for DSM. It also hiked the monetary incentives for both generators and procurers in order to maintain the grid frequency in the safe range of 49.95-50.05 Hz.

Updates on key programmes and initiatives

Green energy corridor (GEC): Initiated in 2015, the GEC is a key programme for renewable energy evacuation in the country. Under GEC Phase I, 3,200 ckt. km of ISTS lines and 17,000 MVA of substation capacity have been commissioned. The intra-state GEC-I component of 9,700 ckt. km of transmission lines and 22,600 MVA of substation capacity is expected to be completed by March 2023. As of October 2022, 8,651 ckt. km of intra-state transmission lines have been constructed and 19,558 MVA of substation capacity has been charged.

The intra-state GEC Phase II scheme, approved by the cabinet in January 2022, envisages an intra-state transmission line length of 10,750 ckt. km and a substation capacity of 27,500 MVA, scheduled for commissioning by March 2026. The transmission scheme is currently under implementation by the transmission utilities of seven states – Gujarat, Himachal Pradesh, Karnataka, Kerala, Rajasthan, Tamil Nadu and Uttar Pradesh – for the evacuation of approximately 20 GW of renewable power.

Transmission system integration of 500 GW of renewable energy: One of the key highlights during the past year was the release of CEA’s report titled “Transmission System for Integration of 500 GW Renewable Energy Capacity by 2030” in December 2022. As per the report, transmission systems have been planned for major renewable energy potential zones such as the Leh renewable energy park in Ladakh; Fatehgarh, Bhadla and Bikaner in Rajasthan; the Khavda renewable energy park in Gujarat; the Anantapur and Kurnool renewable energy zones in Andhra Pradesh; and offshore wind farms in Tamil Nadu and Gujarat. According to the CEA, there will be an additional 50,890 ckt. km of transmission lines and 433,575 MVA of substation capacity developed under the ISTS for additional solar and wind capacity, entailing an additional investment of about Rs 2.44 trillion.

Following these additions to the ISTS, the cumulative interregional transmission capacity is likely to be 150,000 MW in 2030. Several HVDC transmission corridors have also been planned for the evacuation of power from large renewable energy potential zones. In addition to solar and wind energy integration, transmission system planning has also been done for about 16,673 MW of additional hydro capacity, likely to be commissioned by 2030 as per the report. The report also contains plans for connecting 10 GW of offshore wind capacity (5 GW each for Gujarat and Tamil Nadu) through submarine cables. The tentative cost for integrating 10 GW of offshore wind capacity in the ISTS network is estimated to be Rs 281 billion.

TBCB update

TBCB update

As of August 2023, 83 ISTS projects have been bid out to public and private players since 2009 under the TBCB mechanism (excluding four projects that have been cancelled or are under litigation). Of these, 32 have been secured by Power Grid Corporation of India Limited (Powergrid) and 51 have been won by private players. Of the private sector projects won so far, 29 have been commissioned and the remaining 22 are under construction. Of Powergrid’s projects, 16 have been commissioned and 16 are under construction. Key private players in the transmission segment include Sterlite Power, Adani Energy Solutions Limited, Indigrid, ReNew Transmission Ventures, and Apraava Energy.

In September 2023, Powergrid won a bid to develop a transmission system for the evacuation of power from the renewable energy zone (REZ) in Rajasthan (20 GW). During the same month, Powergrid received a letter of intent to establish a transmission system for the evacuation of power from the REZ in Rajasthan (20 GW) under Phase III Part H of the state’s transmission project. Earlier, in August 2023, Apraava Energy Private Limited had secured two ISTS projects in Rajasthan. PFC Consulting Limited has transferred two special purpose vehicles, Fatehgarh lII Transmission Limited and Fatehgarh IV Transmission Limited, for the development of a transmission system for the evacuation of power from the REZ in Rajasthan (20 GW) under Phase III Part A3 and Phase III Part A1 respectively. During the same month, Sterlite Power secured a green energy transmission contract for Phase III (20 GW) Part F.

Cross-border interconnections

The existing cross-border interconnections have a transmission capacity of about 4,230 MW. This is planned to be increased to about 6,450 MW progressively over the next few years. Several interconnections are planned between India and neighbouring countries, including a new 765 kV Katihar-Parbatipur-Baranagar link between India and Bangladesh; and the 400 kV new Gorakhpur and new Butwal transmission lines between India and Nepal. Additionally, India and Nepal plan to expand the capacity of the 400 kV Dhalkebar-Muzaffarpur cross-border transmission line to transmit up to 1,000 MW of power, up from the previously agreed upon 800 MW.

Further, there are plans for the development of an overhead electricity link with Sri Lanka, after the earlier proposal to set up an undersea power transmission link was shelved due to its high cost. A detailed project report has been completed and is being reviewed prior to formal approval.

Challenges and outlook

The power transmission segment in India faces a multitude of issues and challenges. The sector continues to grapple with right-of-way and land acquisition hurdles, which is leading to project delays and cost escalations. Land acquisition for transmission corridors is a complex and time-consuming process, often encountering resistance from local communities and environmental concerns. Additionally, the inadequate and outdated infrastructure often leads to transmission losses, reducing the overall efficiency of the grid. These losses result from factors such as technical inefficiencies, theft and subpar maintenance, contributing to financial burdens for utilities. Further, cybersecurity threats pose a growing risk to the segment. As the grid becomes more digitalised, it becomes susceptible to cyberattacks, which could disrupt power supply and compromise grid security. Addressing these challenges is vital to ensure a reliable and efficient transmission network, crucial for India’s transition to clean energy sources.

with right-of-way and land acquisition hurdles, which is leading to project delays and cost escalations. Land acquisition for transmission corridors is a complex and time-consuming process, often encountering resistance from local communities and environmental concerns. Additionally, the inadequate and outdated infrastructure often leads to transmission losses, reducing the overall efficiency of the grid. These losses result from factors such as technical inefficiencies, theft and subpar maintenance, contributing to financial burdens for utilities. Further, cybersecurity threats pose a growing risk to the segment. As the grid becomes more digitalised, it becomes susceptible to cyberattacks, which could disrupt power supply and compromise grid security. Addressing these challenges is vital to ensure a reliable and efficient transmission network, crucial for India’s transition to clean energy sources.

These challenges notwithstanding, with the increase in renewable energy capacity projected to continue, energy storage systems will become increasingly necessary. In order to meet the requirement of round-the-clock power, BESSs will see increased uptake in the transmission segment, as they can be used as a component in both renewable energy generation and transmission. According to the National Electricity Plan (Vol. I), the overall amount of storage needed in 2026–27 will probably be 16.13 GW/82.37 GWh, made up of 8.68 GW/34.72 GWh of BESSs and 7.45 GW/47.76 GWh of PSPs. This storage capacity need is anticipated to rise to 73.93 GW/411.4 GWh in 2031-2022, which will include 47.24 GW/ 236.22 GWh of BESSs and 26.69 GW/ 175.18 GWh of PSPs. Storage as a transmission element can also meet the needs of grid stability and take advantage of economies of scale by building utility-scale energy storage facilities.

Another key trend would be the focus on offshore wind transmission. India has set a goal of installing 37 GW of offshore wind energy by 2030, primarily off the coasts of Gujarat (Gulf of Khambhat) and Tamil Nadu (Gulf of Mannar). Further, the Indian government has taken a proactive stance towards the early construction of infrastructure for the hydrogen economy in the nation. While the planned transmission system will be sufficient for the early green hydrogen production initiatives, as the production increases and more prospective areas for renewable energy become visible, more transmission systems will be designed and prioritised for deployment. Also, to fast-track transmission development, the MoP has set a target of completing the development of 27,000 ckt. km of ISTS lines, under the PM Gati Shakti National Master Plan (NMP) by 2024-25. The proposed transmission projects under PM Gati Shakti NMP are expected to further facilitate evacuation of power from generation projects, improving the reliability of the power system network in the country.

Conclusion

In the coming years, the nation’s commitment to achieving 50 per cent of its electricity generation capacity from non-fossil sources by 2030, along with the increasing contribution of electricity in the overall energy mix, will necessitate substantial investments in both interstate and intrastate transmission networks. With ongoing investments in grid modernisation, capacity expansion, and the integration of technologies, the future outlook for the country’s transmission segment is promising. These initiatives will not only enhance grid reliability, but will also support the government’s ambitious goals of increasing renewable energy capacity and reducing carbon emissions.

Akanksha Chandrakar