While various global energy storage systems have been implemented, pumped storage plants (PSPs) are assuming an increasingly crucial role in supplying peaking power and maintaining system stability across power systems globally. Pumped storage technology stands out as a long-term, technically proven, cost-effective, highly efficient and flexible solution for large-scale energy storage, addressing the challenges posed by intermittent and variable energy generated by solar and wind sources. There has been a surge in interest from private entities, leading to the announcement of several new PSPs. This reflects the pivotal role pumped storage plays in the expansion of renewable energy sources. As the demand for sustainable energy solutions continues to grow, these projects provide a crucial avenue for efficiently storing and managing excess energy generated by renewables.

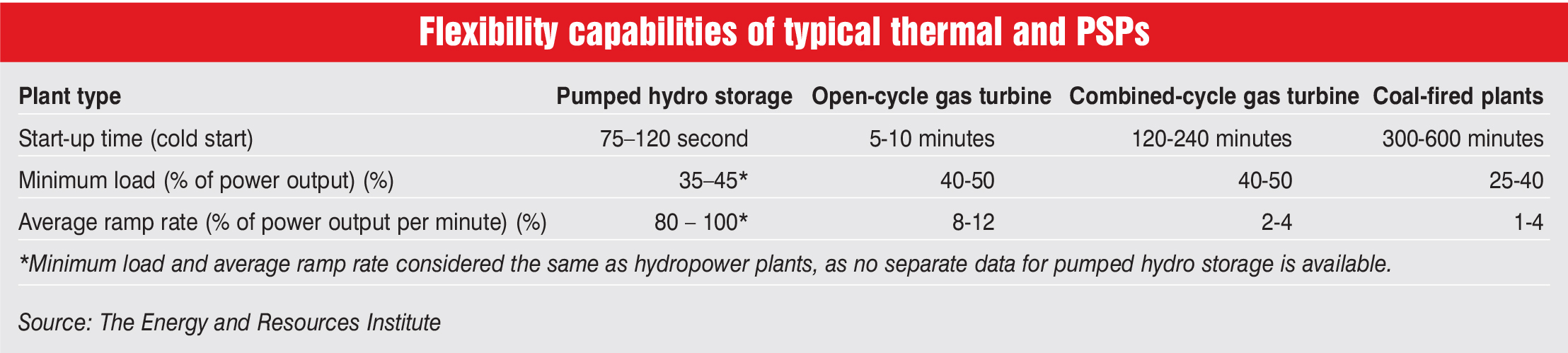

Among the advantages of pumped storage technology are the provision of spinning reserve at minimal cost, the ability to regulate frequency for sudden load changes and the environment-friendly source of large storage capacity. PSPs also offer ancillary benefits such as flexible capacity, voltage support and black start capability. With a lifespan comparable to hydro projects at 40 years, PSPs operate with an efficiency ranging from 70 to 80 per cent, accounting for losses in pumping water into reservoirs. In recent years, off-river PSPs have been gaining popularity due to their significant benefits, including lower capital costs and more operational efficiency. India is currently exploring off-river storage systems, aiming for execution with reduced costs and faster implementation.

Status of PSP development

As per the Central Electricity Authority (CEA), India has eight PSPs, with a total capacity of 4,745.6 MW as of October 2023, installed in various locations across the country including Telangana (2), Maharashtra (2), Tamil Nadu (1), West Bengal (1) and Gujarat (2). However, only six plants with an installed capacity of 3,305.6 MW are working in the pumped mode. The remaining 1,440 MW of capacity across two sites in Gujarat is currently not operating in the pumped mode due to delay in construction of the tail reservoir and vibration-related issues in the system.

Further, there are three under-construction PSP projects with a total capacity of 2,700 MW. Of these, two projects of 1,500 MW are on-river and one 1,200 MW is off-river project. The on-river 1,000 MW (4×250 MW) Tehri Stage II project in Uttarakhand, being implemented by THDC Limited, is likely to be commissioned by 2024-25. It will be the first PSP in the central sector. The other on-river 500 MW (4×125 MW) Kundah PSP Stages I, II, III and IV, being implemented by the Tamil Nadu Generation and Distribution Corporation in Tamil Nadu, is likely to be commissioned by 2024-25.

The off-river 1,200 MW (4×240 + 2×120 MW) Pinnapuram project, being implemented by Greenko in Andhra Pradesh, is likely to be commissioned by 2024-25. It is the first of its kind integrated renewable energy project in India, conceived as a GW integrated project with solar, wind and pumped storage components. The project features an offstream closed loop standalone storage system and will have a cycle efficiency of 75 per cent. Meanwhile, construction of the Koyna Left Bank (80 MW) on-river power project in Maharashtra, being implemented by the Water Resources Department of the state, is held up.

The detailed project report for the on-river Turga project (4×250 MW) in West Bengal and Upper Sileru (9×150 MW) in Andhra Pradesh has been concurred by the CEA. Currently, survey and investigation is in progress for 42 projects totalling 53,685 MW. Of these, seven projects of 8,925 MW are on-river projects and 35 projects of 44,760 MW capacity are off-river projects.  Policy push

Policy push

In May 2023, the central government granted a 25-year waiver of interstate transmission system (ISTS) charges for green hydrogen/green ammonia production units, utilising renewable energy and commissioned after March 8, 2019. The waiver applies to projects commissioned by December 31, 2030; projects after this date will incur graded transmission charges. To promote PSPs, the criteria for ISTS charge waiver are now tied to the project award date, effective for construction awarded on or before June 30, 2025.

In April 2023, the Ministry of Power released guidelines to promote PSPs in the country. These guidelines propose market reforms to incentivise ancillary services provided by PSPs, exempt them from free power obligations and streamline environmental clearances for such projects. To facilitate the early development of hydro projects, state governments can directly award projects to central or state public sector undertakings on a nomination basis. PSP projects can also be awarded to private developers through a two-stage competitive bidding process. The Ministry of Environment, Forest and Climate Change, in May 2023, amended the environmental impact assessment notification of 2006 to ease the process of environment clearances for PSPs.

Recent project announcements

In January 2024, NHPC Limited entered into an MoU with Gujarat Power Corporation Limited to develop the 750 MW Kuppa pumped hydro storage project. NHPC has committed an investment of Rs 40 billion for the project, strategically located in Chhota Udeipur, Gujarat. Earlier, in August 2023, NHPC and Andhra Pradesh Power Generation Corporation Limited entered into an MoU to implement pumped hydro storage projects and renewable energy projects in Andhra Pradesh. In the first phase, the MoU envisages implementation of two identified pumped hydro storage projects of a total capacity 1,950 MW. The projects, executed as joint ventures, are Kamlapadu (950 MW) and Yaganti (1,000 MW). Further, in June 2023, NHPC and the Department of Energy of the Maharashtra government signed an MoU for the development of pumped storage schemes and other renewable energy source projects in Maharashtra. The MoU envisages the development of four PSPs aggregating 7,350 MW capacity, namely, Kalu 1,150 MW, Savitri 2,250 MW, Jalond 2,400 MW and Kengadi 1,550 MW.

In October 2023, the Madhya Pradesh government laid the foundation stone of the 1,440 MW pumped hydro storage project in Neemuch district of the state. The project will be established by the Greenko Group in Khemla village, Rampura tehsil, Neemuch district, with an investment of around Rs 100 billion and will be operational by June 2025. The capacity of the project will be increased up to 1,920 MW. This will be India’s largest pumped hydro storage project. When completed, the project will be able to integrate over 7,000 MW of renewable capacity. During the same month, the Uttarakhand government entered into an MoU valued at Rs 150 billion with JSW Neo Energy Limited to establish two PSPs in Almora, each with a capacity of 1,500 MW. The proposed scheme entails the creation of a lower dam/reservoir at a distance of 8-10 km from the Kosi river at Site 1 in Joskote village, Almora, and an upper reservoir at Site 2 in Kurchaun village, Almora, situated approximately 16 km away from the Kosi river. The project will be developed over the course of the next five to six years.

Additionally, in August 2023, Tata Power and the Maharashtra government signed an MoU to develop two large PSPs, with a combined capacity of 2,800 MW, in the state. These projects will be spread across two sites – Shirawta, Pune (1,800 MW), and Bhivpuri, Raigad (1,000 MW), and will entail an estimated investment of Rs 130 billion. Tata Power has a target to start work on both these plants by mid-2024.

In June 2023, Torrent Power Limited signed an MoU with the Maharashtra government for the development of three PSPs of 5,700 MW capacity in the state. The projects would be executed at three sites identified by Torrent – Karjat (3,000 MW) in Raigarh district, Maval (1,200 MW) and Junnar (1,500 MW) in Pune district. All the sites are off-stream and these projects are planned to provide a minimum of six hours of energy storage on a daily basis. The projects would entail an investment of about Rs 270 billion. Torrent intends to execute these projects over a period of five years.

Also, in June 2023, NLC India Limited signed an MoU with WAPCOS Limited to develop hydropower projects, pumped storage and reservoirs. The MoU between the two parties has been signed for carrying out collaborative technical services and advisories for the development of various schemes of pumped storage, reservoir/storage and run-of-the-river hydropower projects in India.

Also, in June 2023, NLC India Limited signed an MoU with WAPCOS Limited to develop hydropower projects, pumped storage and reservoirs. The MoU between the two parties has been signed for carrying out collaborative technical services and advisories for the development of various schemes of pumped storage, reservoir/storage and run-of-the-river hydropower projects in India.

In March 2023, Power Company of Karnataka Limited (PCKL) awarded contracts to JSW Neo Energy and Greenko KA 01 IREP for providing 1 GW of electricity of eight hours per day from pumped hydro storge projects that offer continuous five-hour discharge. JSW Neo Energy won 300 MW by quoting Rs 14.75 million, while Greenko got the balance 700 MW by quoting Rs 14.76 million. The bidders will sign power purchase agreement with PCKL that are valid for 40 years.

In December 2022, the Andhra Pradesh State Investment Promotion Board approved investments worth Rs 239.85 billion for the development of PSPs. Adani Green Energy Limited will set up 1,600 MW of PSPs with an investment of Rs 63.3 billion. The company’s plans include a 1,000 MW plant in Pedakota, Alluri Sitarama Raju district, and a 600 MW plant in Raiwada in Anakapalli and Vizianagaram districts. Work on the project is expected to commence in December 2024, with project commissioning within four years. Further, Shirdi Sai Electricals Limited will set up 2,100 MW of PSPs with an investment of Rs 88.55 billion. The company will develop a 1,200 MW project at Yerravaram and a 900 MW project at Somasila. The work is expected to be completed in phases by December 2028.

The way forward

According to the National Electricity Plan 2023, India is anticipated to require 7 GW per 48 GWh of PSP capacity by 2026-27, 27 GW per 175 GWh by 2031-32 and 90 GW per 540 GWh by 2047. The projected funding for PSPs is estimated at Rs 542 billion for the period 2022-27 and Rs 752 billion for 2027-32. The CEA has identified a PSP potential of 96,529.6 MW in different parts of the country. Region-wise, the western region has the highest PSP potential at 37,845 MW because of the topographical features. Many PSP plants totalling 10,860 MW are likely to yield benefits during the period 2027-32 in the southern region, thereby making it a cost-effective storage alternative there and thus reducing the need for additional battery storage in the southern region for the said period.

The CEA has projected a storage capacity requirement of 74 GW by 2032. To meet this ambitious target, annual completion of around 7,900 MW of PSPs is deemed necessary. Fortunately, there is already substantial interest among developers; however, the critical next steps involve inviting bids and promptly awarding contracts to ensure that storage capacities align with the concurrent creation of renewable energy capacity. To expedite the implementation of PSPs, standard bidding documents may be developed. Notably, the tariff discovered for a 500 MW per 3,000 MWh stand-alone storage capacity, based on a single daily cycle, stands at Rs 4.80 per kWh. If two cycles per day are considered, the effective storage charge reduces to Rs 2.40 per kWh.

Comparatively, the tariff for power procurement from a 500 MW per 1,000 MWh stand alone battery energy storage system (BESS) by Solar Energy Corporation of India Limited is Rs 10.84 per kWh. Given the cost-effectiveness of PSPs over BESS, there is a compelling case for developing grid storage through PSPs. In the coming years, as there is an increasing influx of variable and intermittent renewable energy, PSPs are poised to play a crucial role in supplying balancing power. Given the substantial planned additions to renewable energy capacity in the near future, PSPs are expected to be instrumental in delivering clean and balancing power, effectively addressing the intermittency challenges associated with renewable energy sources.