Electric motors and motor-driven systems account for approximately 70 per cent of the electricity utilised by industries. According to the International Energy Agency’s (IEA) Energy Efficiency 2022 report, as of 2022, 57 countries had established minimum energy performance standards (MEPS) for industrial electric motors. These are largely based on International Efficiency (IE) standards, which categorise motors into five performance levels ranging from IE1 (least efficient) to IE5 (highest efficiency).

Electric motors and motor-driven systems account for approximately 70 per cent of the electricity utilised by industries. According to the International Energy Agency’s (IEA) Energy Efficiency 2022 report, as of 2022, 57 countries had established minimum energy performance standards (MEPS) for industrial electric motors. These are largely based on International Efficiency (IE) standards, which categorise motors into five performance levels ranging from IE1 (least efficient) to IE5 (highest efficiency).

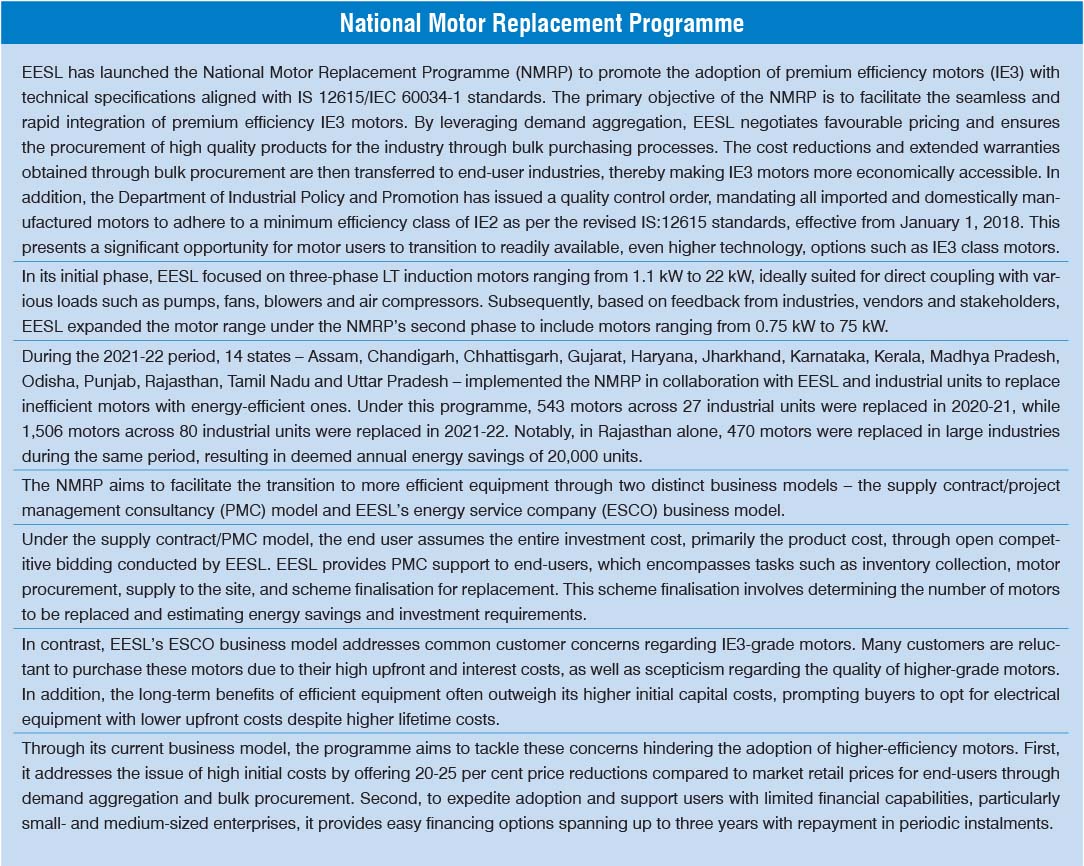

To encourage the uptake of energy-efficient motors within industries, Energy Efficiency Services Limited (EESL) launched the National Motor Replacement Programme (NMRP). The primary objective of this programme is to finance the voluntary replacement of inefficient motors with IE3 motors, as per IS-12615 standards. Some key technological measures that can be implemented to optimise energy efficiency include the use of energy-efficient motors, adjustable speed drives and variable frequency drives to match motor speed and torque with the mechanical load requirements of the system.

Key trends and growth drivers

The demand for electric motors is on the rise, driven by increasing awareness of energy conservation, increasing adoption of electric vehicles (EVs), ongoing infrastructure development, expansion within the heating, ventilation and air conditioning (HVAC) sector, rapid urbanisation trends, and increasingly stringent regulations governing power consumption.

Industry projections indicate that the electric motor market in India is expected to expand at a compound annual growth rate of 11 per cent between 2023 and 2028, primarily led by increasing industrialisation. With the establishment of new industries and the expansion of existing ones, the need for motors capable of minimising energy consumption and operational expenses has become critical. Energy-efficient motors offer superior efficiency and reduced energy loss, resulting in significant cost savings over their operational lifespan. Consequently, there has been a notable increase in demand for energy-efficient motors across various sectors including power, manufacturing, agriculture, construction and transportation.

The global drive towards decarbonisation has further fuelled the expansion of the energy-efficient motors market. Governments and organisations are implementing policies and initiatives aimed at reducing carbon emissions and combating climate change. In this context, energy-efficient motors play a critical role by reducing energy consumption and minimising the carbon footprint of industrial processes. The adoption of energy-efficient motors is also recognised as a significant step towards achieving the transition to sustainable energy.

Energy-efficient electric motors are widely used in HVAC systems, particularly in commercial buildings. Induction motors are the preferred choice for HVAC applications, with three-phase motors commonly employed in commercial and industrial settings, while single-phase motors are employed in smaller installations. The expansion of the HVAC market is driven by the growing focus on maintaining air quality in indoor environments such as offices and manufacturing facilities. In addition, there is a growing demand for energy-efficient devices, further fuelling the growth of the HVAC sector.

The automation of motor and drive systems has led to more compact designs. Motors have been downsized to fit into tight spaces and meet the size constraints of emerging applications. This trend of miniaturisation is accompanied by significant changes in motor design and construction, including an increase in customised solutions and enhanced networking capabilities between motors and drives. The reduction in motor size in recent years can be attributed to various factors such as innovative design approaches, advancements in materials and enhanced automation capabilities. Engineers now leverage sophisticated simulation software to explore smaller diameter designs, ensuring their viability before implementation. This design flexibility is further supported by the availability of higher-powered magnets, more conductive metals, and stronger components. Achieving these compact sizes requires precise automation processes for tasks such as coil winding and component assembly. Continuous improvements in automation technology have enabled motor manufacturers to consistently produce smaller motors with reduced diameters and lengths.

With increasing domestic demand, the Indian motor industry’s design and manufacturing capabilities are rapidly progressing towards global best practices, particularly the IE3 efficiency standard. This advancement not only ensures economies of scale for higher exports but also fosters additional skilled employment opportunities across various sectors, including technical services, financial services, manufacturing, sales, installation, after-sales services and recycling. Moreover, EESL offers multiple financing options for projects, thereby easing the financial burden on customers. These initiatives are expected to stimulate industry demand and facilitate transformation by making motors available at lower prices compared to current market rates.

Energy efficient motors

Electric motors play a crucial role in both industrial sectors, serving as constant speed drives with low ratings and variable speed drives (VSDs) with high ratings. The concepts of energy efficiency and conservation are closely intertwined. With the rising demand for energy and the uncertainties surrounding oil supply, coupled with fluctuating prices of conventional fuels, energy efficiency and energy conservation have emerged as crucial aspects of both industrial and rural development.

Energy-efficient motors are characterised by design enhancements specifically aimed at enhancing operational efficiency compared to standard motor designs, and reducing inherent motor losses. These improvements encompass involve the utilisation of lower-loss silicon steel, extension of the core length to increase active material, employment of thicker wires to minimise resistance, employment of thinner laminations, reduction of the air gap between the stator and rotor, use of copper instead of aluminium bars in the rotor, upgradation of bearings, and employment of a smaller fan, among others. In India, energy-efficient motors typically exhibit efficiencies of 3-4 percentage points higher than standard motors.

Optimal selection of copper conductor size plays a key role in reducing resistance, thereby decreasing motor current. Reducing the operating flux density and air gap are effective measures for decreasing the magnetising component of current. Rotor losses, determined by rotor conductors (usually aluminium) and rotor slip, can be mitigated by employing copper conductors, reducing winding resistance and operating the motor closer to synchronous speed.

Core losses, which occur in stator-rotor magnetic steel due to hysteresis and eddy current effects during 50 Hz magnetisation, are significant and account for 20-25 per cent of total losses. Hysteresis losses, dependent on flux density, can be minimised by employing low-loss grades of silicon steel laminations and increasing the core length of the stator and rotor to reduce flux density. Eddy current losses, generated by circulating currents within the core steel laminations, can be reduced by employing thinner laminations.

Friction and windage losses stem from factors such as bearing friction, windage and circulation of air through the motor, collectively constituting approximately 8-12 per cent of total losses. These losses remain constant regardless of the load. Windage losses decrease with the reduction in the diameter of the fan, leading to a reduction in overall windage losses. Stray load losses, which are proportional to the square of the load current, result from leakage flux induced by load currents in the laminations, and typically account for 4-5 per cent of total losses. These losses can be mitigated through careful selection of slot numbers, tooth/slot geometry and air gap.

Energy-efficient motors span a broad range of ratings, with full-load efficiencies 3-7 per cent higher than their standard counterparts. In addition, the mounting dimensions are maintained to facilitate easy replacement. However, due to the modifications aimed at enhancing performance, the costs of energy-efficient motors are generally higher than those of standard motors. Despite the initial investment, the higher costs are often recovered quickly through savings in operating costs, particularly in new applications or when replacing end-of-life motors.

Variable speed drives

A VSD is an efficiency-boosting apparatus that adjusts the speed and torque of operation to match the system’s requirements, thereby minimising energy consumption by the motor during speed adjustments. Typically, this is achieved by coupling induction motors with pulse-width modulated variable frequency drives. Deploying a VSD in the existing motor of a pump, fan, or compressor can typically reduce power consumption by around 25 per cent.

Within the drive, the input power undergoes a transformation process. Initially, the incoming AC power is converted into DC power by a rectifier. This DC power is then directed into capacitors within the drive, smoothing out the electrical waveform to ensure a clean power supply for subsequent stages. Subsequently, the power flows from the capacitors to the inverter, which performs the crucial task of converting the DC power into output AC power suitable for the motor. This pivotal step enables the drive to adjust both frequency and voltage according to the current requirements of the process. Consequently, AC motors can operate at varying speeds or torque levels as per operational demands. Apart from facilitating energy conservation, VSDs help in reducing maintenance expenses, minimising waste and mitigating ambient noise emissions. They also serve as an effective tool for organisations striving to meet their environmental objectives.

Integrating VSDs into motors is another energy-efficient method to enhance motor efficiency. By employing variable frequency drive-based devices, the system efficiency of standard motors can increase significantly, elevating it from 28 per cent to 82 per cent. From a cost–benefit standpoint, installing VSDs in induction motors is highly advantageous. VSDs adjust the speed of an electric motor based on the application’s demands, preventing unnecessary energy consumption and heat release that occurs when the system operates at a constant speed. By conserving energy with each rotation, VSDs contribute to significant energy savings.

Integrating VSDs into motors is another energy-efficient method to enhance motor efficiency. By employing variable frequency drive-based devices, the system efficiency of standard motors can increase significantly, elevating it from 28 per cent to 82 per cent. From a cost–benefit standpoint, installing VSDs in induction motors is highly advantageous. VSDs adjust the speed of an electric motor based on the application’s demands, preventing unnecessary energy consumption and heat release that occurs when the system operates at a constant speed. By conserving energy with each rotation, VSDs contribute to significant energy savings.

Every motor consumes electricity to deliver torque and speed. When the torque or speed exceeds desired levels, mechanical controls intervene to regulate output, leading to inefficiencies characterised by material and energy wastage. Ideally, a motor’s speed should precisely match the demands of the process it serves. Without effective speed control mechanisms, substantial energy is squandered, which proves detrimental to business interests.

Industry estimates suggest that reducing the speed of a fan or pump motor from 100 per cent to 80 per cent using a VSD can result in energy consumption savings of up to 50 per cent. For instance, in fan applications, VSDs regulate airflow based on demand rather than abruptly halting it when operating at full capacity. Pumps, fans and compressors represent industrial motors where VSDs are commonly installed due to their frequent and intermittent utilisation driven by varying time, temperature and output requirements.

Issues and challenges

The energy-efficient motor market is facing several challenges, complicating its growth trajectory. Despite its expansion, the market faces the hurdle of higher upfront costs, which can deter potential customers, especially in sectors sensitive to pricing. Furthermore, a lack of awareness about the long-term benefits of energy-efficient motors impedes market expansion, as consumers often prioritise immediate savings over sustained efficiency gains. Retrofitting older equipment with these motors poses additional challenges, necessitating intricate and costly system modifications. Regulatory ambiguity and inconsistent enforcement of energy efficiency standards add to market barriers, compounded by technical limitations and performance trade-offs associated with certain motor technologies.

Moreover, energy-efficient motors often demand higher quality materials, advanced manufacturing processes, and additional testing and certification to ensure efficiency. These factors contribute to increased production costs for manufacturers, consequently raising prices for end-users. On average, energy-efficient motors command a premium of around 20 per cent compared to standard motors, although actual costs may vary depending on the specific manufacturer and market competition. However, purchasing energy-efficient motors in bulk quantities may enable buyers to negotiate lower price premiums. Despite the benefits, some buyers may remain unaware of the advantages of energy-efficient motors and hesitate to pay a premium for a technology they do not fully comprehend.

Overcoming these obstacles requires collaborative efforts among stakeholders, including governments, regulatory bodies, industry associations, manufacturers and end-users to foster a conducive environment for energy-efficient motor deployment.

The way forward

India’s electric motor industry is poised for robust growth in the coming years, buoyed by the rapid expansion of the country’s industrial sector. Initiatives such as the production-linked incentive (PLI) and phased manufacturing programme have spurred indigenous manufacturing, catalysing growth in the manufacturing industry. Government-led programmes such as Make in India, the Smart Cities Mission and AMRUT have further propelled the sector’s development. Looking ahead, the emerging EV sector, advancements in robotics technology for industrial automation (including the manufacturing and food and beverage sectors), machinery and tools manufacturing, and the home appliance industry are anticipated to create several opportunities in the Indian manufacturing industry, contributing towards achieving a trillion-dollar market, driven by innovation and efficiency. The future looks promising for Indian electric motor manufacturers, with abundant opportunities ahead. With continued technological advancements and effective strategies in place, manufacturers can capitalise on the growing demand through innovative and efficient products.

Moreover, the increasing industrialisation and decarbonisation initiatives have created a favourable market environment for energy-efficient motors. The increasing adoption of energy-efficient practices and ongoing decarbonisation efforts will further drive the market growth momentum. These developments present significant opportunities for companies operating in the energy-efficient motor market to expand their business footprint and contribute towards building a more sustainable future.

Akanksha Chandrakar