As India’s energy demands continue to grow, the country has recognised the need to diversify its energy mix and incorporate more renewable energy sources. In this context, the Ministry of Power introduced the Green Energy Open Access (GEOA) Rules in 2022, a regulatory framework aimed at facilitating renewable energy procurement by consumers.

The GEOA Rules have established a process that allows consumers to access renewable energy sources, such as solar and wind power, directly from generators or through power exchanges. This framework amends existing regulations and aligns them with open access principles, offering consumers an alternative to conventional power distribution channels.

To be eligible for GEOA, consumers must have a contracted demand or sanctioned load of 100 kW or more either through a single connection or multiple connections that aggregate to the specified threshold within the same electricity division of a distribution licensee. However, captive consumers, who generate and consume their own power, are exempt from this load limitation.

One of the key provisions of the GEOA Rules is a streamlined approval process for open access applications. Nodal agencies responsible for managing these applications must grant approval within 15 days. If this timeline is not met, the application is deemed approved, subject to the fulfilment of technical requirements specified by the relevant regulatory commission.

The GEOA Rules also aim to maintain grid stability by mitigating sudden fluctuations in demand. In addition, they have imposed conditions, such as limiting the number of time blocks up to 12 for changing the quantum of power consumption, to ensure a smooth transition to green energy sources without disrupting the power supply.

Open access status, charges and incentives

The GEOA Rules provide clarity regarding the charges associated with open access, including transmission charges, wheeling charges (distribution charges), cross-subsidy surcharges, standby charges (where applicable), banking charges, and other fees such as load despatch centre fees and scheduling charges.

To incentivise the adoption of clean energy sources, several state rules provide waivers and exemptions on specific open access charges for captive and third-party consumers of solar and wind power. For instance, Chhattisgarh and Odisha have completely waived cross-subsidy and additional surcharge for solar and wind power projects irrespective of the category. Most of the other states have provided 100 per cent waivers on additional and cross-subsidy surcharge for captive solar projects and a certain percentage of third-party projects.

Under the framework, cross-subsidy surcharge and additional surcharge are not applicable if green energy is utilised for the production of green hydrogen and green ammonia. Additional surcharge has also been waived for offshore wind projects commissioned up to December 2032 and supplying to open access consumers.

The rules also include a provision for waiving standby charges provided that GEOA consumers give notice at least one day in advance before the closure time of the day-ahead market on “D-1” day, with “D” being the day of power delivery for standby arrangement to the distribution licensee. The standby charges are capped at 25 per cent of the energy charges applicable to the consumer tariff category.

The implementation of the GEOA Rules has progressed at varying paces across different states in India. As of March 2024, more than 13 states have formulated their green open access regulations aligned with the GEOA Rules.

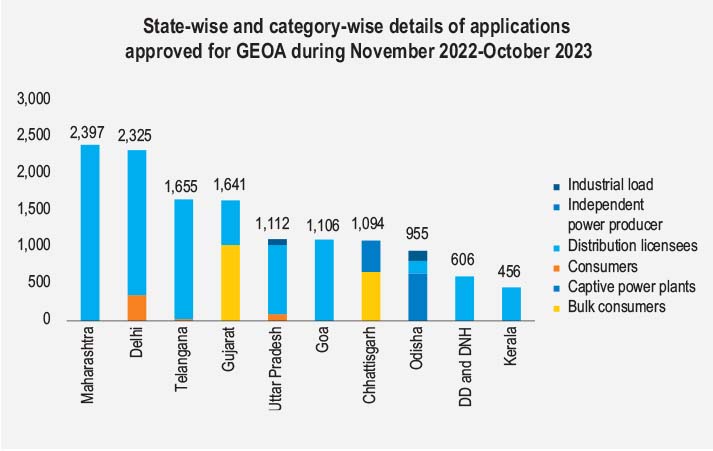

In response to a question in the Lok Sabha in December 2023, the minister of new and renewable energy and power reported that over 16,500 applications for GEOA have been approved across various consumer categories from November 2022 to October 2023.

Utilities account for nearly 80 per cent share of the applications followed by bulk consumers and captive power producers, according to open access data shared by the Grid Controller of India. Maharashtra ranks highest in terms of the number of applications approved for green energy open access. The majority of applications in the bulk consumer category belong to consumers from Gujarat and Chhattisgarh, whereas Odisha and Chhattisgarh together constitute the demand in the captive power consumer category. In the industrial load category, applicants from Odisha and Uttar Pradesh make up the majority of the demand.

Addressing challenges and improving access

Addressing challenges and improving access

While the GEOA Rules aim to facilitate renewable energy procurement, certain challenges persist, requiring strategic solutions to fully leverage the benefits of open access.

Financing challenges: Conventional financial models may overlook the long-term benefits of open access-based clean energy projects. Balance sheet-based lending for smaller companies in the commercial and industrial segment could help address this issue.

Land acquisition and infrastructure: Acquiring suitable land for clean energy projects and addressing connectivity challenges can be a key obstacle. Dedicated land banks, incentives such as subsidised lease rentals and stamp duty exemptions, and seamless grid integration could alleviate these concerns.

Contractual flexibility: Virtual power purchase agreements and the integration of international renewable energy certificates create avenues for enhancing contractual flexibility and market accessibility, enabling corporates and buyers to increase their renewable energy share while mitigating risks.

Infrastructure limitations: Open access solar projects rely on state transmission networks, resulting in the imposition of additional charges by distribution companies. Revisiting tariff structures and incentivising investments in infrastructure to improve connectivity to central transmission lines could reduce reliance on state networks and associated charges.

Concerns with discoms: Discoms may express concerns about revenue loss due to large consumers migrating to open access, as these consumers often subsidise tariffs for low-income and agricultural consumers. Balancing the interests of different consumer segments while incentivising clean energy adoption is crucial.

Despite these challenges, India’s open access initiative has witnessed progress, with the solar open access segment reporting a surge in installations in 2023.

Future prospects

Looking ahead, advancements in technology, innovative financing options and the emergence of storage solutions are expected to contribute to the growth of the open access market.

The Indian market has witnessed significant growth in recent years, with significant capacity additions by independent power producers. The increased focus on climate commitments by corporations and the industrial sector has accelerated the pace of renewable energy adoption, enabled by regulatory advancements like the green open access rules.

While the GEOA Rules represent a step towards promoting renewable energy procurement, their implementation and effectiveness will depend on continued efforts to address challenges, foster innovation and align the interests of all stakeholders involved.

Lavkesh Balchandani