South Asia is blessed with diverse resources. Nepal and Bhutan are rich in hydro resources, while India has both hydro and thermal reserves. The south Asia region can be commercially connected through a seamless market to ensure the optimal use of its resources and use diversity to reduce the cost of power to its citizens and industry. Over the past two decades, the European and American markets have matured to such an extent that their average cost of power in bulk power markets has declined to Rs 2.50-Rs 3.50 per kWh, which is very competitive. In Asia, it has not been possible to keep prices low as the competitive market still has to be tapped. This paper attempts to discover the benefits of creating markets and touches upon the experiences of markets across continents.

Why are regional markets necessary?

Supply security was the first key driver that pushed countries to connect with each other to manage emergency situations. In Europe, North America (Canada) and South Asia (India and Nepal), interconnections were made to manage supply in areas where power could not reach from mainland plants. The other key driver was to increase diversity in the generation mix to ensure power supply around the year. Norway-Sweden, Bel.gium-France, India-Bhutan and several other hydro-rich regions of the world are connected to coal-rich or nuclear-dominant countries to ensure supply security in peak winter (Canada or Norway) or during outages of nuclear reactors (France). Thus, the natural endowment of resources in such regions has persuaded countries to interconnect.

Integrating electricity systems improves reliability for all participants. Historically, this was the initial motivation for building interconnectors and allowing the pooling of expensive resources to maintain frequency. This triggered the emergence of large synchronous frequency areas, thereby lowering the cost of managing load deviations. However, in the next phase of interconnection development, economic transactions have been the key driver.

Most developed power markets have started integrating their electricity markets and liberalising their electricity sectors over the past 20 years. The creation of the Australian Energy Market Operator in Australia, the expansion of PJM Interconnection or Midcontinent Independent System Operator in the United States, the optimisation of seams between independent system operators in the US and Canada, and the creation of the internal energy market (IEM) and south east European regional initiatives in Europe are examples of this process offering a wealth of experience in regional integration. Some of these instances of integration are still work-in-progress. Till two to four years ago, they seemed to have reached a saturation point, but the large-scale deployment of renewables has again led to the re-working of the integration model to maintain system security by managing variable generation sources.

Integrated regional markets

The most common model of market integration is by way of the day-ahead spot mechanism, where both producers and consumers/distributors submit bids for the purchase and sale of electricity for each hour or any other time block of the coming 24-hour period. These bids are then matched and separate hourly prices calculated for the next day (midnight to midnight). Capacity constraints are reported by the member transmission system operators (TSOs). Firstly, a system price is calculated, disregarding capacity constraints. Then, transmission capacities are taken into account. If there are no bottlenecks, the price for all areas is the same as the system price. However, if there is a bottleneck, then some or all areas may have different prices. In this way, players do not pay a premium explicitly for transmission capacity but use market bids to define area prices, which implicitly decide the premium on transmission capacities.

Benefits of integrating power systems in south Asia

Smooth market integration adds to system security: Alternating current (AC) electricity systems have the inherent advantage of automatic power flow in case of a contingency in one system. This automatic support is a positive outcome of an interconnected system. The access to spot electricity markets like day-ahead, intra-day and ancillary helps balance systems better. Integrated day-ahead and intra-day markets help the cost-effective management of power systems. Hydro resources in Nepal-Bhutan and northern India are more suitable in giving an early and fast response to save grid contingencies.

Lower reserve requirement: Market integration over large geographic areas helps pool the capacity resources required to maintain reserve margins. Ensuring access to a broader portfolio of power plants makes it easier to make up for a plant becoming unavailable due to planned maintenance, unscheduled outages or safety concerns. This reduces the cost of maintaining an adequate reserve capacity and increases the reliability of the electric system. Ancillary services for imbalances normally consist of operating reserves (spinning and non-spinning) or secondary reserves. The larger the integrated market, the larger the liquidity in the reserves market. Normally, the spinning reserve requirement is equivalent to the largest unit size or largest contingency.

Markets reduce power costs: Cross-border trade contributes to the reduction of overall power costs by exploiting the complementarities between demand patterns and cost differences between electricity systems. In the early days of regional market development, satisfying demand was key. However, in the current market scenario, interconnectors are used for availing cheaper power from neighbouring regions. Britain is currently implementing a 700 km submarine cable with Norway to avail cheaper hydropower. Day-ahead markets are known to create the most competitive power prices. More than 30 countries in Europe, Americas and Asia use the same model. The European Commission (EC) and European Union (EU) have mandated the same model for price convergence across EU countries. A large proportion of integration had been completed by May 15, 2015, covering more than two-thirds of Europe’s power consumption.

Diversity of demand allows better operations and reduced costs: Hydropower sources in Nepal and Bhutan have matching profiles with the Indian summer. Each country’s peak electricity demand usually occurs at different times in neighbouring regions. North India experiences peak demand in summer due to AC loads and kharif crops, whereas Nepal and Bhutan experience winter peaks due to higher heating demand and lower hydro availability. This diversity and seasonal variation in electricity demand means the regions can share resources. Instead of building up capacity that would sit idle for months, sharing resources reduces the need for expensive facilities on both sides of the border. Another advantage of market integration across large areas is that it settles demand variations.

Synergies between generation capacity mixes: There is also little debate that market integration offers benefits in terms of overall despatching costs. The least-cost solution to meet demand during a certain hour is to start with the cheapest generating sources (wind, solar power, run-of-the-river hydro and nuclear) and then call on other units in order of increasing marginal cost. The overall generation cost is lower if power is being despatched over a broader and more diversified portfolio of plants.

India has coal reserves, Nepal and Bhutan have hydro potential and Bangladesh can be a market for surplus. It also has a suitable coastline for imported coal-based plants. Nepal and Bhutan will improve our hydro-thermal mix and help create a better portfolio for our discoms. Countries deficient in cheaper resources (Bangladesh and Pakistan) can rely on neighbouring countries for cheaper power instead of importing fuels.

Electricity markets covering large geographic areas are required to accommodate the deployment of wind and solar power at the least cost: Renewables need to be harvested and transported via wire over vast territories. Their output does not follow consumption and depends on variable wind, sun and exogenous conditions that are difficult to predict. Given the limited and relatively expensive options for storing electricity, it is less costly to integrate variable renewables when tapping into flexible electricity systems over wide areas. Markets provide an easy platform to transact for managing system imbalances. Hydro projects in Nepal and Bhutan can come in handy for such contingencies if we allow them to use spot markets (day-ahead and intra-day).

Jurisdictions with a large proportion of renewables should tap flexible resources beyond borders, provided there is sufficient interconnector capacity. For instance, solar and wind power integration in Germany benefits from flexible hydropower in Switzerland and France, as well as from the possibility of exporting power to them.

Better competition: Market integration increases competition by reducing market concentration. This is relevant for the south Asian market. With 150 GW systems getting connected with 10 GW, 1 GW and 0.25 GW systems, the HHI (Herfindahl Hirschman Index, a commonly accepted measure of market concentration) is reduced, thus improving market competition.

Exports through exchange increase generator welfare: It is generally thought that export through exchange will increase the price for surplus jurisdictions. We must appreciate that in today’s low-price regime, generators are only compensated for their marginal costs and not total costs. The export of surplus power in selling jurisdictions will add to generator welfare. Social welfare is calculated on the basis of the difference between bid value and cleared value. Besides clear advantages like lower generation costs, market integration facilitates price convergence, increasing electricity wholesale prices in low-cost exporting areas.

International experience

The large-scale integration of markets has occurred in almost all continents, except Asia. To understand the journey of large-scale market integration in developed power systems, the ensuing paragraphs give brief details of the process of connecting regional markets in Europe, Americas and Africa.

Europe

Europe started working towards integrating markets in 1996 with its first energy package. The key driver was the free flow of goods and services across EU member states. The first step was to push member countries to reform their electricity sectors to enable them to create a vibrant and liquid EU-wide electricity market. The first two energy packages issued in 1996 (Directive 96/92/EC) and 2003 (Directive 54/2003/EC) prepared member countries for launching a 19-country market, popularly known as IEM. The Third Energy Package, 2009 (Directive 2009/72/EC) was launched in 2009, with the EC paving the way for the development of an internal EU gas and electricity market. Regulation (EC) 714/2009 specifically identified the need to put in place common rules for these markets to operate effectively. NordPool was the first model of a coupled market in Europe. It started with Norway and Sweden coupling their market through day-ahead auctions in 1994. The Nordic market is now de facto fully integrated, at least at the wholesale level. In 2004, 40 per cent of the total consumption was traded through exchange, which rose to 70 per cent in 2012 and is now approaching 80 per cent. This coupling uses exactly the same model being used by energy exchanges like the Indian Energy Exchange (IEX) in India, inherently optimising use with transmission capacity allocation.

The process of market coupling was emulated in central west Europe (CWE) with French power exchange Powernext (now EPEXSpot) and Dutch counterpart APX working on coupling in 2003. The initial idea was to use the price signals of national markets to determine the most efficient electricity flow between the countries. In doing so, existing lines were used to 100 per cent, liquidity rose and competition increased. In the process, Belgian power exchange Belpex was founded. The Trilateral Coupling between France, Belgium and the Netherlands was launched in November 2006.

Shortly after, planning began for an extension to Germany, Austria and Luxembourg. Together with France, Belgium and the Netherlands, these six countries form the CWE region. The CWE market coupling went live in November 2010. In parallel, a so-called tight volume coupling between CWE and the Nordic countries was set up. This interim solution, as well as CWE coupling, was replaced in February 2014 with the introduction of price coupling in northwest Europe (NWE). It was the first implementation of the price coupling of regions (PCR) solution.

At the time of the launch, NWE covered 15 countries: the six CWE nations, Great Britain, the four Nordic countries, the three Baltic countries, and Poland, via the link with Sweden. In May 2014, they were joined by Portugal and Spain, thanks to the PCR solution, which can easily be expanded. The latest step of power market integration took place in February 2015 with Italy and Slovenia joining the now multi-regional coupling. Today, electricity is traded across 19 European countries, representing 85 per cent of Europe’s electricity consumption.

Power exchanges have served the function of integrator for renewable energy sources. For example, in the Nordic countries, Nord Pool Spot has been successful in integrating different renewable energy technologies in member states with a high share of renewable electricity from hydropower, wind, sun and biomass.

Recent studies have quantified the potential benefits of market integration in Europe at EUR 12.5 billion-EUR 40 billion per year, or a medium value of EUR 6.8 per MWh or 48p per kWh of consumed electricity (Booz, 2013).

Market integration in Africa

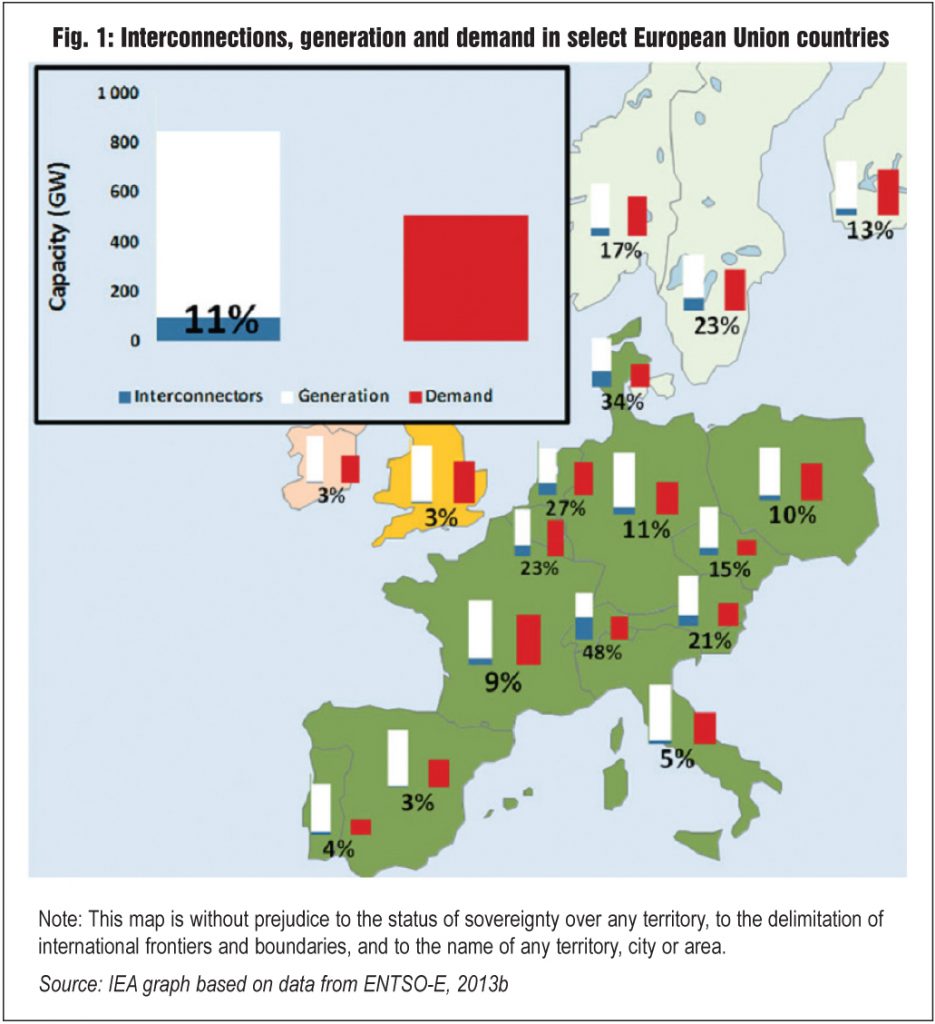

Currently, there are four power pools in the African continent, all at various stages of development (Figure 1). While significant challenges remain in the implementation of these regional systems, there are several reasons why power pools are worth the effort in Africa.

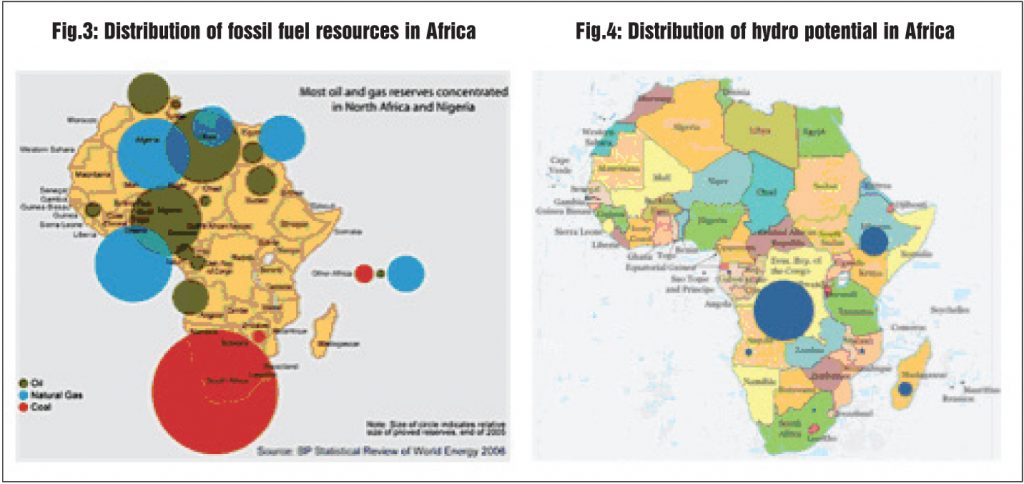

Energy resources are plentiful and non-uniform across geographies (Figures 3 and 4). The Congo river alone has an estimated potential of producing 1,400 TWh per year, equivalent to over three times the annual consumption in all of Africa in 2010. Meanwhile, abundant coal resources are concentrated in the south while most of the natural gas and oil reserves are in west and north Africa. Regional trade could enable resource-sharing among countries and allow resource-rich countries to export power to countries with limited resources and greater diversity in the fuels used for electricity generation. The main barriers in developing a regional pool are conflicting national policies and deficiencies in infrastructure investments, particularly in cross-border transmission lines to permit trade and resource sharing.

In some cases, these power pools have led to national reforms. For example, the Regional Electricity Regulators Association (RERA), the regional regulator for the Southern African Power Pool (SAPP), was created when only four nations (out of 15) had national regulators. Now, 12 member countries have national regulators, and because these institutions had been created alongside RERA, new national regulations and practices are already consistent with regional rules. For the first 10 years of the SAPP, there was no regional regulator and disputes were often resolved between utility companies themselves.

The way forward

In south Asia, only India has day-ahead markets being run by two power exchanges: IEX and Power Exchange of India Limited. IEX, with 99 per cent liquidity, is transacting about 4,000 MW (100 million kWh or MUs). Countries that have interconnections with India can use these markets to buy or sell power in the most competitive manner. Nepal, Bhutan and Bangladesh, which have limited spare interconnection capacities of 50 MW, 150 MW and 50 MW respectively, can use these markets. In comparison with the current market volume of 4,000 MW, the possible volumes of other neighbours at only 50-100MW is about 2.5 per cent each. Moreover, these eligible countries (with interconnectors) with peak loads of 1.5 GW, 0.5 GW and 10 GW are very small compared with the Indian peak load of 150 GW. Again, no other country is more than 7 per cent of the Indian market. Therefore, at present, there is no need to have a power exchange or market within these countries. They can connect to the liquid Indian market without disturbing it in any significant manner.

Generally, regional markets in Europe have coupled their national power exchanges after they evolved individually. The regional integration of these wholesale markets also took place, popularly known as PCR or IEM. In Africa, the reverse happened, with national level wholesale markets in nine African countries in South Africa evolving after the evolution of the regional market or power pool known as SAPP. In South Asia, very different conditions are prevailing, with the liquid market maturing before other national-level competitive wholesale markets have begun to evolve. So, it is logical that smaller neighours connect with matured markets and liquid markets function as regional markets. IEX, trading 100 MUs daily, can well operate as a regional market for south Asia.

Transmission requirements

Insufficient interconnector capacities among markets, system operators or countries can create a bottleneck, limiting optimisation across a region. Building more infrastructure presents many benefits in terms of increased competition and ease in managing supply security and reliability.

Full market integration does not mean having a single wholesale electricity price for the entire integrated market at all times. Congestion across seams causes price differentials. Dealing with this would require getting rid of network congestion and investing in transmission network infrastructure. It should be acknowledged that transmission capacity will most probably not suffice to achieve this perfect vision of the electricity market. There are several reasons for this.

First, while the transmission network needs to be expanded, eliminating all congestion is generally too costly. If some transmission lines are congested for some hours in a year, that should not be treated as a reason for network addition. Second, with the development of variable renewables, power flow has become more dynamic. It is less costly to accept a certain degree of optimal congestion, which will occasionally lead to differences in electricity prices.

Coordination forums for integrated operations

Integrated operations require integrated institutions. Coordination forums for at least two market functions will be essential: Regulators and TSOs. It is proposed that for the South Asian region, we can have forums like SAFER (South Asian Forum of Electricity Regulators) and SAFTSO (South Asian Forum of Transmission System Operators). They can at least be mandated to sort out issues affecting optimal market operations and grid security. In Europe, the EU has created ACER (Agency for the Cooperation of Energy Regulators) and ENTSO-E (European Network of Transmission System Operators) through a mandate in 2009. South Asian countries need to work closely to develop the market to its full potential. Eventually, it will be end-consumers who reap the rich dividends from the integration of markets.

Rajesh K. Mediratta,

Rajesh K. Mediratta,

Director,

Business Development,

Indian Energy Exchange