Transparent coal allocations and efficient power generation have been among the key priorities of the government in the recent past. To this end, it has implemented a number of measures including the auction of captive coal blocks, coal linkage rationalisation and automatic transfer of coal linkages from inefficient to efficient plants. In May 2016, the cabinet approved a new policy for coal linkage allocation to increase flexibility in the utilisation of domestic coal linkages.

Policy framework

Under the new framework, all the long-term coal linkages of individual state generating stations would be clubbed and assigned to the respective states (or to a state-nominated agency). Similarly, the coal linkages of individual central generating stations would be clubbed and assigned to the company owning the generating stations. The subsequent allotment of coal among state generating stations, other state power stations, central generating stations and independent power producers (IPPs) would be based on plant efficiency, coal transportation cost, transmission charges and the overall cost of power.

In the case of allotment of coal to an IPP by the state agency, the power from substituted coal would be procured through bidding among the competing IPPs, where the source of coal, quality of coal, quantum of power and delivery point of power would be indicated upfront.

As far as policy implementation is concerned, the Central Electricity Authority will formulate a methodology for the allotment of coal by the state and central sector companies to the generating stations.

Reduction in the cost of power

The policy is expected to lower the cost of power generation and thus the cost of power procurement by discoms. As per ICRA Research, for a generation company, with every 100 km reduction in the distance of coal transportation, the variable cost of coal-based power generation for linkage-based thermal power plants is estimated to decline by about Re 0.90 per unit. This is based on the assumption that the average distance of coal transportation is 600 km, resulting in a transportation cost of Rs 750 per tonne, which constitutes around 35 per cent of the delivered cost of coal. The actual savings in the cost of power would depend on the reduction in the coal transportation distance, given that the linked coal mines are at a distance varying from 100 km to 1,000 km from the end-use plants.

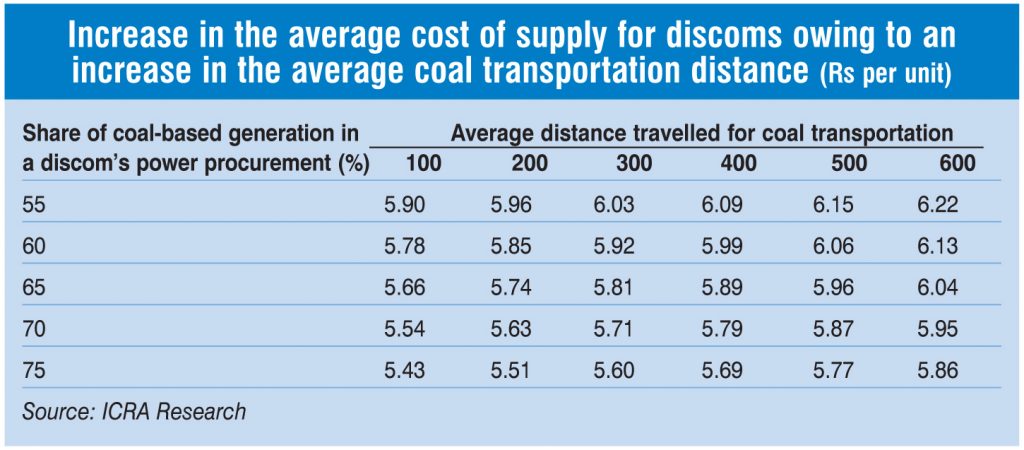

From the distribution utility’s perspective, relief in the cost of power supply would depend on the sourcing mix of coal-based energy as well as the average distance travelled. As per ICRA Research, at a 65 per cent share of coal-based power in the overall power procurement of the discom, the average cost of power supply for the discom varies from Rs 5.66 per unit (100 km) to Rs 6.04 per unit (600 km) depending on the average coal transportation distance for generation utilities.

Other benefits

Besides lowering the generation cost, the new coal linkage policy is expected to lead to efficiency improvements. Under the existing coal linkage policy, coal linkages are allocated to each plant from a particular mine and the coal allocated to a plant cannot be used at another plant of the generating company. Consequently, generating companies continue operating inefficient plants with sufficient coal, lowering the national plant load factor. Another significant merit of the policy is transparency in the allocation of coal. Going forward, coal allotments will be made on the basis of the cost of generation and plant efficiency, among other criteria. However, under the new set-up, it is necessary to ensure that a sufficient quantity of coal is put on offer for IPPs and that the states do not pass on all linkages to state-owned generating stations.

Overall, the new policy is in line with the initiatives envisaged in the Ujwal Discom Assurance Yojana, which include a reduction in power generation costs, an increase in domestic coal supply, coal linkage rationalisation and liberal coal swaps from inefficient to efficient plants. The move is a step in the right direction as it is expected to strengthen the power generation segment and improve the financial performance of distribution utilities.