It has been two years since the path-breaking Ujwal Discom Assurance Yojana (UDAY) reform was introduced; however, the performance of discoms has not been as expected. In 2017-18, the aggregate technical and commercial losses for UDAY states have remained flat at 20.15 per cent as of March 2018 (as per UDAY dashboard accessed on May 22, 2018), compared to the 20.26 per cent achieved in 2016-17, and only marginally lower than the 23 per cent losses registered in the baseline year, 2015-16.

It has been two years since the path-breaking Ujwal Discom Assurance Yojana (UDAY) reform was introduced; however, the performance of discoms has not been as expected. In 2017-18, the aggregate technical and commercial losses for UDAY states have remained flat at 20.15 per cent as of March 2018 (as per UDAY dashboard accessed on May 22, 2018), compared to the 20.26 per cent achieved in 2016-17, and only marginally lower than the 23 per cent losses registered in the baseline year, 2015-16.

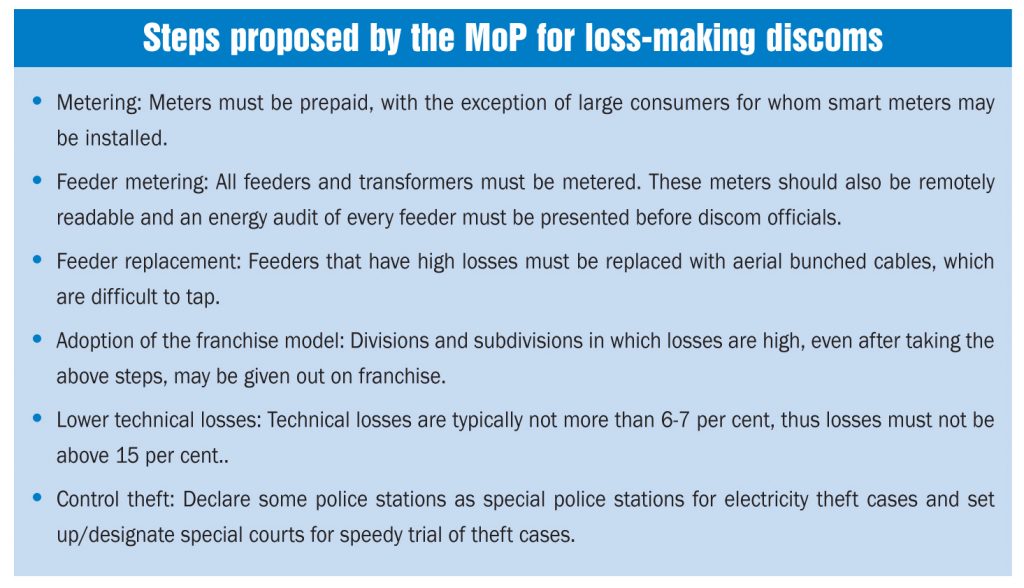

Taking cognisance of this issue, the Ministry of Power (MoP) has given the loss-making discoms a strict March 2019 deadline to get their house in order. In a recent review meeting of the two state-owned financiers – the Rural Electrification Corporation (REC) and the Power Finance Corporation (PFC) – the MoP issued a directive to these companies to restrain lending to discoms with heavy losses (above 15 per cent).

“Many distribution companies are borrowing for both capital and non-capital expenditures. It is also noted that many discoms have persistent losses, and if such losses persist these discoms will not be in a position to repay their loans. No loans will be granted to any discoms that have heavy losses, whether for capital expenditure or non-capital expenditure,” said R.K. Singh, minister of state (independent charge) for power and new and renewable energy. He added that such discoms would need to draw up an action plan for reducing losses which would need to be vetted by the ministry and only then could a discom get a loan.

Experts say that the proposal is promising. “The proposal is indicative of the level of exasperation of the MoP and its resolve to read the riot act to the non-performing discoms in the states. It is a welcome first step. Financial prudence demands that you do not throw good money after bad money. In fact, the financial institutions themselves should refrain from lending to such non-performing entities, and should exercise better oversight in respect of the operational performance of their borrowers” says Anil Razdan, former power secretary.

A look at how the distribution segment performed in 2017-18 on the AT&C loss front, the power ministry’s plans for bringing these down, and the outlook and challenges ahead…

Performance analysis for 2017-18

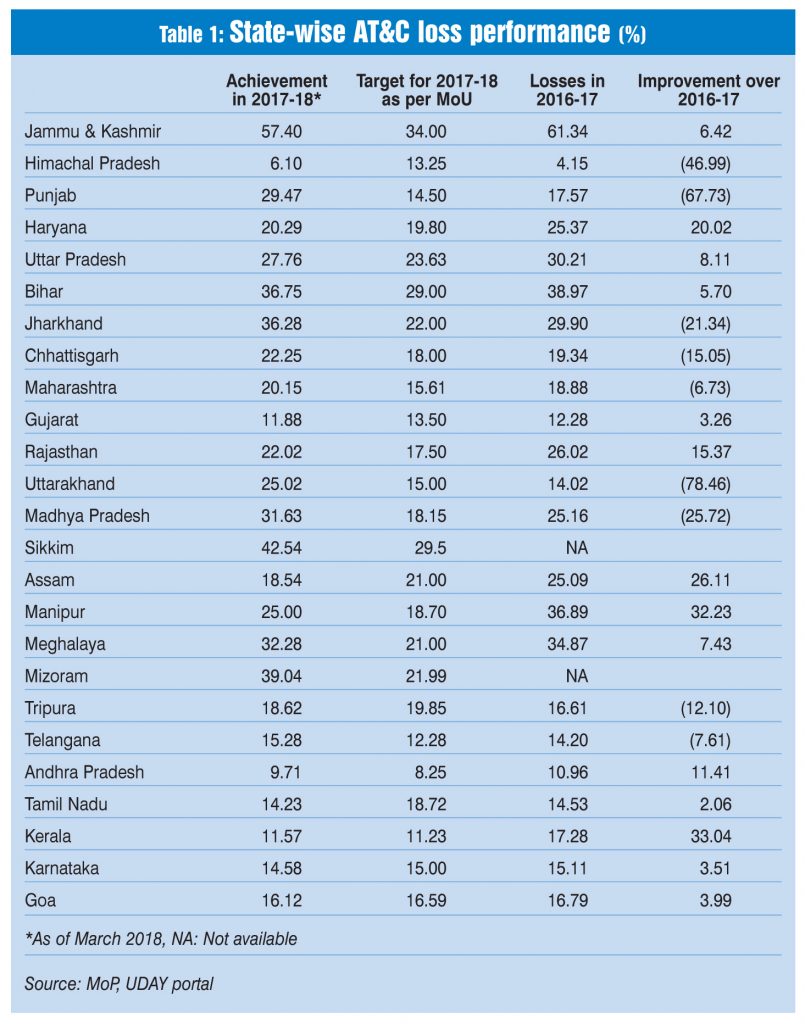

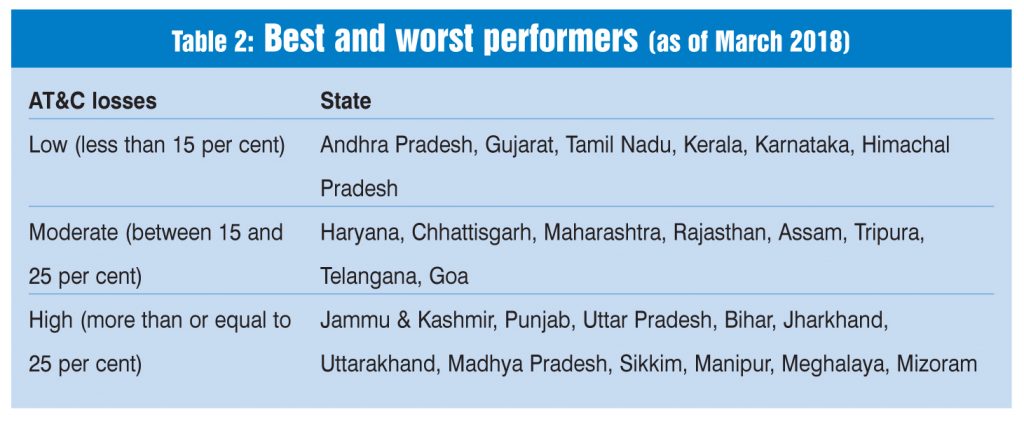

AT&C losses in many UDAY states during 2017-18 worsened in comparison to 2016-17 (see Table 1). Only six UDAY states are operating at or below the benchmark level of 15 per cent AT&C losses, which is the target for the end of the current financial year (see Table 2). A round-up of the performance of states during 2017-18 shows:

- Almost all the states that have joined UDAY are still far from the target of keeping AT&C losses at 15 per cent by 2019, and continue to report significantly high losses.

- As of March 2018, the states with the highest AT&C losses were Jammu & Kashmir (57.4 per cent), Bihar (36.75 per cent), Jharkhand (36.28 per cent), Meghalaya (32.28 per cent) and Madhya Pradesh (31.63 per cent).

- While the losses worsened in 2017-18, notably, they had shown an improvement in 2016-17 over the baseline year (see chart).

- Of the participating UDAY states for which data was available, nine states saw an increase in their AT&C losses in 2017-18 over the previous fiscal year. These were Punjab, Himachal Pradesh, Madhya Pradesh, Jharkhand, Chhattisgarh, Tripura, Telangana and Maharashtra. The losses increased by about 7 per cent in Maharashtra and 78 per cent in Uttarakhand.

- The states that significantly improved their AT&C loss performance in 2017-18 over 2016-17 were Kerala (33 per cent decline), Manipur (32 per cent decline), Assam (26 per cent decline), Haryana (20 per cent decline) and Rajasthan (15 per cent decline). Apart from these states, another nine also registered lower AT&C losses vis-à-vis the previous fiscal (see Table 1).

- Only seven states/union territories – Himachal Pradesh, Gujarat, Karnataka, Goa, Tripura, Tamil Nadu and Assam – were able to meet their loss reduction targets for 2017-18. Of these, the best performances was by Himachal Pradesh and Tamil Nadu, which managed to achieve losses lower than 54 per cent and 24 per cent of their targets for the year respectively.

- The biggest misses in targets were by Punjab and Madhya Pradesh. In Punjab, the losses were nearly double the target, while Madhya Pradesh’s losses were 75 per higher than the target.

Tackling the issue

Given that REC and PFC have been extending loans and grants to discoms for the bulk of their investments in schemes such as rural electrification, the Integrated Power Development Scheme (IPDS), the Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY), the Restructured Accelerated Power Development and Reforms Programme (R-APDRP), experts say that the directive to restrain lending will certainly put pressure on the discoms to work on improving their operational performance.

The letter sent to the power ministers of loss-making states with the above advisory also outlines a six-point roadmap for bringing down their losses (see box). (Most of these measures were, in fact, discussed by the union power minister at the state power ministers’ meeting in December 2017.)

The letter also states that appropriate amendments will be made to the Tariff Policy so that the regulators do not allow losses of over 15 per cent while fixing tariffs after March 2019. It reiterates the government’s earlier advisory to discoms that they should bid out all their loss-making areas to private franchisees, for which a standard bidding document has already been circulated by the ministry.

States have already begun adopting these measures to increase efficiency. For instance, Rajasthan has adopted the franchise route proactively and awarded four circles to franchisees since 2016, for which the results achieved have been good. For Kota circle (franchised to private utility CESC Limited), transmission and distribution (T&D) losses have came down from 32 per cent in September 2016 to 27 per cent in July 2017, while for Bharatpur (also given to CESC), T&D losses reduced from 29 per cent in January 2017 to 26 per cent in July 2017. Reportedly, Maharashtra State Electricity Distribution Company Limited (MSEDCL) and Odisha’s GRIDCO are also in the process of inviting bids for some of their circles. Another measure that has been strongly emphasised is prepaid metering, since it has yielded excellent results. A case in point is Manipur, which successfully introduced prepaid metering, resulting in its losses coming down from 72 per cent in 2013-14 to 25 per cent in 2017-18.

Under the Saubhagya scheme, which is aimed at electrifying all unconnected households by December 2018, most of the spending has been earmarked for such meters. Recently, in one of the largest ever procurement drives, Haryana and Uttar Pradesh undertook the task of installing 5 million smart meters through a global tender floated by Energy Efficiency Services Limited (EESL) at the end of 2017. In April 2018, EESL floated the second pan-Indian tender for procuring another 5 million smart meters.

The road ahead

Will the proposal work? “The clamour for reform has almost become a cliché. The need of the hour is to perform. The proposal will work only if, politically and administratively, the MoP and the state governments of the non-performing discoms are prepared to change the management of the discoms in case they fail to perform efficiently,” says Razdan. He adds that a case in point is Delhi Vidyut Board, a consistently non-performing entity which made way for the privatisation of the distribution sector in Delhi and saw substantial technical, operational and financial improvements thereafter.

Operational efficiency improvements are one of the four key components of UDAY (the other three being interest cost reduction, tariff reform and financial discipline). The debt takeover by the state governments has helped reduce the interest burden and financial losses and hence, has improved the discoms’ financial performance under UDAY. However, the inefficiencies due to high AT&C losses threaten to negate the gains under UDAY and discoms could find themselves in another crisis, say sector experts. “If this continues for the next four to five years, the discoms would have piled up huge financial losses, and would revert to the situation prevailing earlier,” notes the power minister.

Reya Ramdev