Power distribution remains a weak link in the sector’s value chain. This is evident from the latest discom ratings released in July 2018 by the Ministry of Power (MoP) and the Power Finance Corporation in collaboration with ICRA and CARE. Under the latest exercise, eight discoms witnessed a decline in their ratings from the previous edition while only seven discoms saw an improvement. This is despite the support extended to the sector under various the government schemes, such as the Ujwal Discom Assurance Yojana (UDAY) the Deendayal Upadhyaya Gram Jyoti Yojana, the Integrated Power Development Scheme and the Pradhan Mantri Sahaj Bijli Har Ghar Yojana, for bringing about improvements in the technical, operational, financial and managerial areas of utilities.

The MoP comes out with discom ratings to incentivise discoms to improve their operational and financial performance, facilitate realistic assessment by banks and financial institutions (FIs) of the risks associated with lending exposures to various discoms, and serve as a basis to provide central government assistance to them. The State Distribution Utilities Sixth Annual Integrated Rating report excludes power departments and private discoms. Power Line presents the key highlights of the recent rating report…

Key features

- The latest ratings are for financial year 2016-17 and cover 41 distribution utilities. Based on its review of the integrated rating methodology, the MoP approved certain modifications in November 2017, and a revised method was developed for the calculation of aggregate technical and commercial (AT&C) losses, and parameters such as digital payments and access to supply. The latest ratings have been carried out as per the revised methodology.

- The key parameters based on which ratings have been assigned include operational and reform parameters, financial performance, and external factors like regulatory environment and government support. The operational and reform parameters carry the maximum weightage of 52 per cent. These include AT&C losses, power purchase, cost efficiency, service quality and digital payment facility, access to supply, and renewable purchase obligation compliance. These are followed by financial parameters (33 per cent), such as cost coverage ratio, payables, receivables and timely submission of audited accounts, and external parameters (15 per cent).

- Non-compliance with certain parameters carried negative scores. These include unavailability of audited accounts (up to minus 12 per cent), non-filing of the tariff petition (up to minus 5 per cent), untreated revenue gap (up to minus 5 per cent), increase in AT&C losses (up to minus 4 per cent), non-formation of state transcos (minus 3 per cent), presence of regulatory assets for over three years and non-allowance of carrying costs by the regulator (up to minus 3 per cent), lack of true-up order, non-implementation of automatic pass-through of fuel costs and return on equity norms prescribed by the Central Electricity Regulatory Commission (each up to minus 1 per cent), default to banks/FIs (up to minus 2 per cent) and non-provision of employee-related liabilities or statutory dues in the accounts (up to minus 1 per cent).

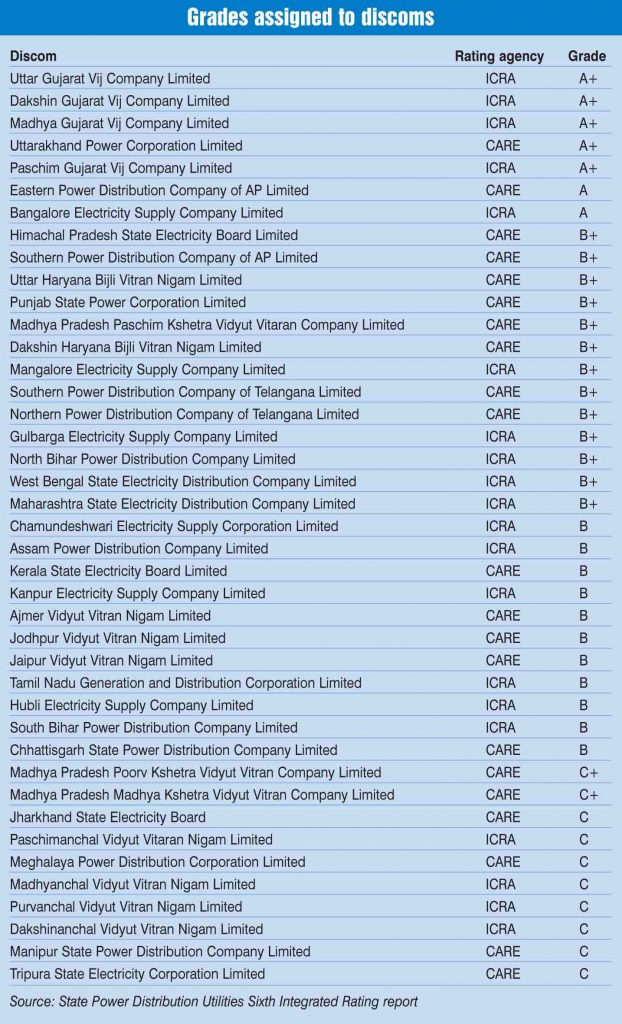

- Based on the above parameters, ratings have been categorised into six grades ranging from A+ to C. The top five utilities with a rating of A+ are the four Gujarat discoms – Uttar Gujarat Vij Company Limited, Dakshin Gujarat Vij Company Limited, Madhya Gujarat Vij Company Limited and Paschim Gujarat Vij Company Limited (PGVCL) – and Uttarakhand Power Corporation Limited. Significantly, Gujarat discoms have retained their leadership position for the sixth consecutive year.

- The two discoms with a rating of A are Eastern Power Distribution Company of Andhra Pradesh Limited and Bangalore Electricity Supply Company Limited (BESCOM). Meanwhile, 13 discoms have been assigned a rating of B+, which indicates moderate financial and operational capability. Notably, the ratings of Maharashtra State Electricity Distribution Company Limited and Punjab State Power Corporation Limited slid from A to B+.

- The remaining 21 discoms have received a rating of either B (11 discoms), C+ (2 discoms) or C (8 discoms). Thus, half the discoms under study have either below average or low operational and financial capability. The discoms with the lowest rating are Jharkhand Bijli Vitran Nigam Limited, the four discoms of Uttar Pradesh, and the discoms of Meghalaya, Manipur and Tripura.

- Most discoms were not able to recover costs owing to non-cost-reflective tariffs and a substantial increase in expenses. This is indicated by the cost coverage ratio, which remained below 0.9 for most entities (25 out of 41 rated discoms, or 61 per cent).

- The median cost coverage during 2016-17 improved marginally to 0.89 from 0.87 in 2015-16 and 0.85 in 2014-15. Gujarat discoms and Kanpur Electricity Supply Company Limited (KESCO) were the best performers in terms of cost coverage. Overall, only 13 of the 39 discoms (for which data was available for median calculation) showed improvement in their cost ratios, with six of them witnessing an improvement of over 10 per cent. On the other hand, six witnessed a fall of over 10 per cent.

- Five discoms recorded an improvement of over 15 per cent – West Bengal State Electricity Distribution Company Limited, KESCO, Gulbarga Electric Supply Company Limited, Ajmer Vidyut Vitran Nigam Limited and Jaipur Vidyut Vitran Nigam Limited (JVVNL).

- In terms of AT&C losses, 19 discoms or 46 per cent of the discoms showed an improvement during 2016-17 over 2015-16. The median loss level has declined consistently over the past six years to reach 21.8 per cent from 24.2 per cent, 24.82 per cent, 25.08 per cent, 26.19 per cent and 26.55 per cent in the previous five years. Overall, a dozen discoms (29 per cent) recorded AT&C losses of less than 15 per cent.

- The nine discoms that reduced AT&C losses by more than 10 per cent are Assam Power Distribution Company Limited, Madhya Pradesh Madhya Kshetra Vidyut Vitran Company Limited, PGVCL, Hubli Electricity Supply Company Limited, Jodhpur Vidyut Vitran Nigam Limited, Dakshin Haryana Bijli Vitran Nigam Limited, Chhattisgarh State Power Distribution Company Limited, JVVNL and Meghalaya Power Distribution Corporation Limited.

- The six utilities that recorded a deterioration of over 10 per cent in this parameter are Southern Power Distribution Company of Andhra Pradesh Limited, Himachal Pradesh State Electricity Board Limited, Mangalore Electricity Supply Company Limited, Chamundeshwari Electricity Supply Corporation Limited, Maharashtra State Electricity Distribution Company Limited, Madhya Pradesh Poorv Kshetra Vidyut Vitran Company Limited.

- In terms of the regulatory environment, the tariff orders were not issued for four utilities for 2017-18 (as compared to eight in the previous fiscal) across the states of West Bengal, Tamil Nadu, Jharkhand and Tripura. According the previous edition, tariff orders were not issued for the utilities in the states of Kerala, Rajasthan, Tamil Nadu, Assam, Jharkhand and Tripura.

- Only 13 utilities filed their tariff petition for 2018-19 in time during the current rating exercise. The corresponding numbers were 14, 12, 15, 21 and 7 in the previous rating exercises respectively.

- Thirty utilities or 73 per cent submitted audited annual accounts for 2016-17, the same as the previous year.

- The report notes that most of the utilities have shown greater cooperation in terms of submitting information and facilitating discussions. This indicates that discoms are open to transparency.

Like in the past, the latest discom ratings are a mixed bag of varied performances. While some discoms are making steady progress (for instance the Haryana discoms, which have improved financially under UDAY), there is much left to be achieved in terms of the overall segment performance. Each utility must undertake reforms to make the sector commercially viable.