The distribution transformer industry in the country has grown significantly over the years, with the increase in power generation capacity and the focus on 24×7 power supply leading to significant capacity additions in the transmission and distribution (T&D) network. Various government initiatives aimed at T&D infrastructure improvements have also been key market drivers. These include the Deendayal Upadhyaya Gram Jyoti Yojana, the Integrated Power Development Scheme and the Ujwal Discom Assurance Yojana. Besides this, significant strides have been made on the technology front. Conventional oil-filled transformers are increasingly being replaced with dry-type transformers and advanced smart transformers.

Market size and trends

The total size of the domestic distribution transformer market stood at Rs 64.78 billion in 2017-18, an increase of 11.3 per cent over the previous year. The market recorded a growth index of 11.3 per cent in 2017-18 over 2016-17.

The demand for distribution transformers is largely met by the domestic industry. The import of transformers is marginal and project specific. In 2017-18, while the export of distribution transformers stood at Rs 13.56 billion, import of transformers stood at Rs 4.13 billion. Overall, the import of distribution transformers has registered a negative CAGR of 21.8 per cent during the last five-year period.

The distribution transformer industry is dominated by unorganised micro, small and medium enterprise units across the country. They mainly supply to the state utilities. Besides, there are a few large-scale manufacturing units that have a pan-Indian presence. These units are also engaged in the export of transformers.

Technological advancements

One of the key emerging technological solutions for distribution transformers is ester fluid-filled transformers. As natural ester has high fire points of around 360 ºC, and a flashpoint of 320 ºC, which is twice the fire points of mineral oil, it makes the transformers fire resistant. Besides, is biodegradable in nature, making the transformers environment friendly. Natural ester-filled transformers enhance grid reliability, offer greater safety and increase operational efficiency. They are ideal for densely populated areas. Tata Power was the first utility to install natural ester-filled transformers of 25 MVA capacity in its Mumbai distribution area. Besides, Torrent Power commissioned two 20 MVA, 33/11 kV ester-filled transformers in December 2016. Another emerging technology trend is the dry-type transformers. These transformers do not use any insulating liquid, instead the windings with the core are kept within a sealed tank pressurised with air. These are suited for settings that demand the highest level of security and indoor set-ups such as offices, residential buildings, hospitals, underground transport systems and industries. ABB’s dry-type transformers have been deployed at the Kochi metro station.

Another technology solution that is fast gaining traction is smart transformers, which form an integral part of digital substations and can independently regulate voltage. These transformers are equipped with intelligent electronic devices, and intelligent monitoring and diagnostic features. Besides, they provide web and supervisory control and data acquisition interfaces. The demand for mobile transformers is rising. These are deployed during emergency situations to provide interim grid connection or temporary power supply. These are delivered to the customer/utility in the form of ready-to-connect, complete assemblies and therefore have shorter installation and commissioning time. Some of the other emerging transformer types are 3D triangular wound core transformers (reduce magnet resistance and current and no-load losses), aluminium-based winding transformers (better thermal coefficient of expansion) and solid transformers (allow bidirectional power flow).

Classification based on transformer core

One of the key classifications of distribution transformers is on the basis of the type of core. Distribution transformers can be classified as cold rolled grain oriented (CRGO) and amorphous core transformers. Amorphous core transformers help in significantly lowering the distribution transformer loss levels including no-load losses. Amorphous core transformers offer a 70-80 per cent reduction in no-load losses compared to transformers using CRGO core material for the same rating of distribution transformers. Some of the other classifications of distribution transformers are based on the winding arrangement (concentric/sandwich winding), cooling (oil immersed/dry), electricity supply (single/three phase), etc.

CEA guidelines on distribution transformers

CEA guidelines on distribution transformers

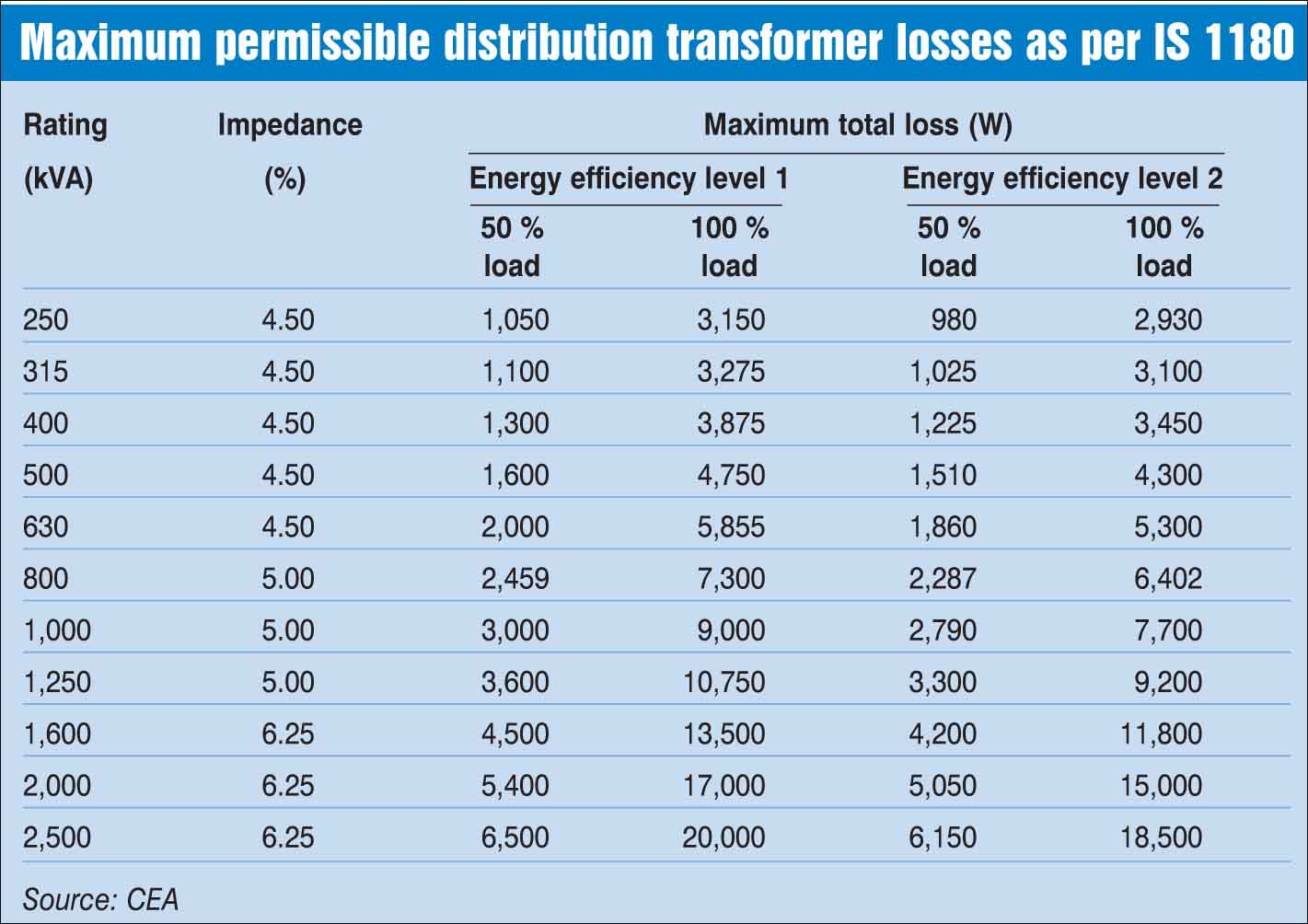

The CEA (Technical Standards for Construction of Electrical Plants and Electric Lines) Amendment Regulations, 2015 require distribution transformers to be designed as per the relevant Indian standards. These transformers need to comply with IS 1180 Part 1 guidelines, which, among other things, specify the permissible loss levels in distribution transformers. Further, they are required to meet the Bureau of Energy Efficiency (BEE) star labelling norms. Therefore, overall, distribution transformers having either a CRGO core or an amorphous core have to comply with the total losses (no-load losses and load losses) at 50 per cent and 100 per cent loading levels specified under the regulations (see table).

Notably, in December 2016, the BEE upgraded the star ratings of distribution transformers and assigned maximum permissible loss limits based on the loading for each rating. In the upgrade, the BEE has made Level 2 category of transformers of IS 1180:2014 as Star 1 category, and Level 3 as Star 2. Further, the BEE has introduced three additional star rating categories – Star 3, Star 4 and Star 5. In order to align with the BEE’s notified losses, the BIS is in the process of amending IS 1180.

Growth drivers

Government schemes are one of the key demand drivers for distribution transformers in the country. These include the Deendayal Upadhyaya Gram Jyoti Yojana and the Integrated Power Development Scheme, which aim to improve the distribution networks in rural and urban area, respectively. Further, the government scheme for 100 per cent household electrification, the Pradhan Mantri Sahaj Bijli Har Ghar Yojana, has given a significant fillip to the demand for distribution transformers. Besides, the Ujwal Discom Assurance Yojana has improved the financial health of discoms, thereby freeing up funds for the augmentation of distribution infrastructure including lines and transformers. Apart from this, the demand for distribution transformers will continue to increase due to the increase in generation capacity, both conventional and non-renewable sources, and the per capita consumption of electricity, as well as emerging segments like electric vehicles. The replacement of old transformers with energy efficient transformers will also drive market demand.

Issues and challenges

The domestic distribution transformer manufacturing industry is facing a number of issues and challenges. One of the key issues pertains to the dependence on the global market for a few raw materials (including CRGO). Suppliers of these critical items still dictate market price and limit India’s opportunities for becoming a global player. Another issue in the segment is the pricing pressure arising from the unorganised market structure. As many manufacturers are slowly graduating to the medium-sized category, the industry is developing an organised participants’ base and manufacturers are shifting towards more aggressive and price-sensitive manufacturing rather than quality manufacturing. Another issue facing the industry pertains to the star ratings requirement from customers. The certification of each product is an expensive process as there are very few testing facilities in the country. Large power transformers are sometimes sent to overseas facilities for testing. Besides this, the industry lacks mandatory guidelines on the installation and maintenance of transformers, earthing practices, loading of transformers, the use of protection equipment, etc.

Net, net, the distribution transformer industry in the country is in the pink of health on the back of growing demand under government schemes and the availability of significant manufacturing capacity. However, in order to ensure continued growth, the issues pertaining to testing facilities for transformers, pricing pressures, etc. need to be resolved.