Generator sets are widely being used as a backup power solution, with diesel being the most preferred fuel owing to its efficiency on account of high energy density, and easy availability. Diesel generator (DG) sets are mostly operated using high speed diesel (HSD), commonly known as diesel. Various other liquids that are used include heavy fuel oil, low sulphur heavy stock (LSHS), producer gas, light diesel oil (LDO), furnace oil (FO), biodiesel and blended fuels. A look at the market trends of the key fuels…

Fuel trends

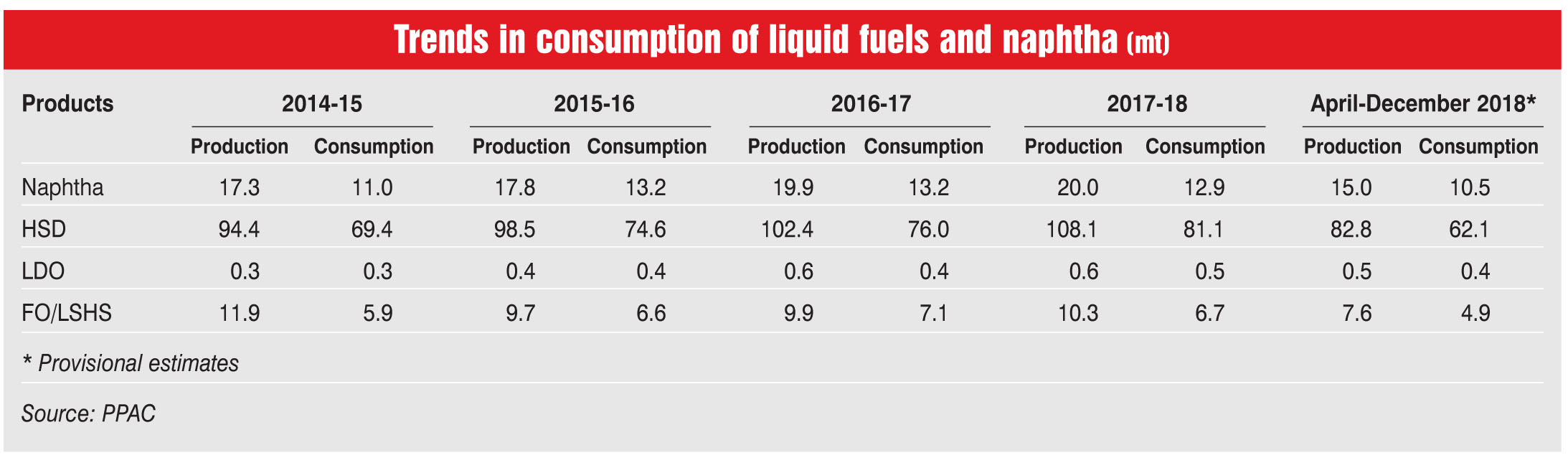

The total consumption of petroleum products during 2017-18 was 206.2 million tonnes (mt), which marked a growth of 5.9 per cent over the 194.6 mt consumed during 2016-17.

According to the Petroleum Planning and Analysis Cell (PPAC) of the Ministry of Petroleum and Natural Gas (MoPNG), the consumption of HSD, LDO and LSHS recorded a growth of 6.6 per cent, 16.6 per cent and 11.6 per cent, respectively, in 2017-18 over 2016-17, while that of naphtha and FO/LSHS declined by 5.2 per cent and 5.5 per cent during the same period. HSD consumption in India during 2017-18 stood at 81.1 mt of the total 206.2 mt of fuel consumption. The consumption of naphtha was 12.9 mt and that of FO/ LSHS was 6.7 mt. LDO accounted for only 0.5 mt of the total consumption.

For April-December 2018, the total consumption of petroleum products stood at 157.4 mt, recording a 2.5 per cent growth. Of this, diesel constituted the highest share of 39.7 per cent or 62.5 mt, followed by naphtha at 6.6 per cent or 10.5 mt and FO/LSHS at 3.1 per cent or 4.9 mt.

On the supply side, the production of petroleum products grew by 4.4 per cent to 254.3 mt in 2017-18 as compared to 243.5 mt in 2016-17.

To that end, the production of HSD grew from 102.4 mt in 2016-17 to 108.1 mt in 2017-18, a year-on-year growth of 5.5 per cent, while LDO remained constant at 0.6 mt. The production of FO/LSHS grew from 9.9 per cent in 2016-17 to 10.3 per cent in 2017-18, recording a growth of 4 per cent. Only a marginal growth was seen in naphtha production from 19.9 mt in 2016-17 to 20 mt in 2017-18.

For April-December 2018, the overall production registered an increase of 4.1 per cent. The total production was 196.7 mt, of which diesel comprised the maximum production share of 83.3 mt or 42.3 per cent, followed by naphtha at 15 mt or 7.6 per cent and a minuscule FO/ LSHS at 7.6 mt or 3.8 per cent.

Power market demand

Power market demand

According to PNG statistics, published by the MoPNG, the total consumption was 81.07 mt, of which about 0.21 mt of HSD was used for power generation. While the consumption of HSD in absolute terms has increased steadily, its share in power generation has reduced over the years. Similarly, 0.14 mt of naphtha was used for power generation in 2017-18; this is about 27 per cent of the total naphtha consumption as against a 38.82 per cent share in 2016-17. Further, only about 0.3 mt of FO was used in 2017-18 for power generation; this is about 4 per cent of the total FO consumption as compared to 5.1 per cent in 2016-17.

Conclusion

While the consumption of fuel, in general, has been on the rise, the end use of liquid fuels and naphtha has remainedlow since 2012-13 in the power generation sector. The overall demand for diesel is expected to grow to about 163 mt by 2029-30, however, its share in power generation is likely to remain low with the increasing displacement of diesel by renewables. At the same time, the demand for diesel for backup power will continue for the operation of critical loads.