Ashok Sethi, Chief Operating Officer and Executive Director, Tata Power

Ashok Sethi, Chief Operating Officer and Executive Director, Tata Power

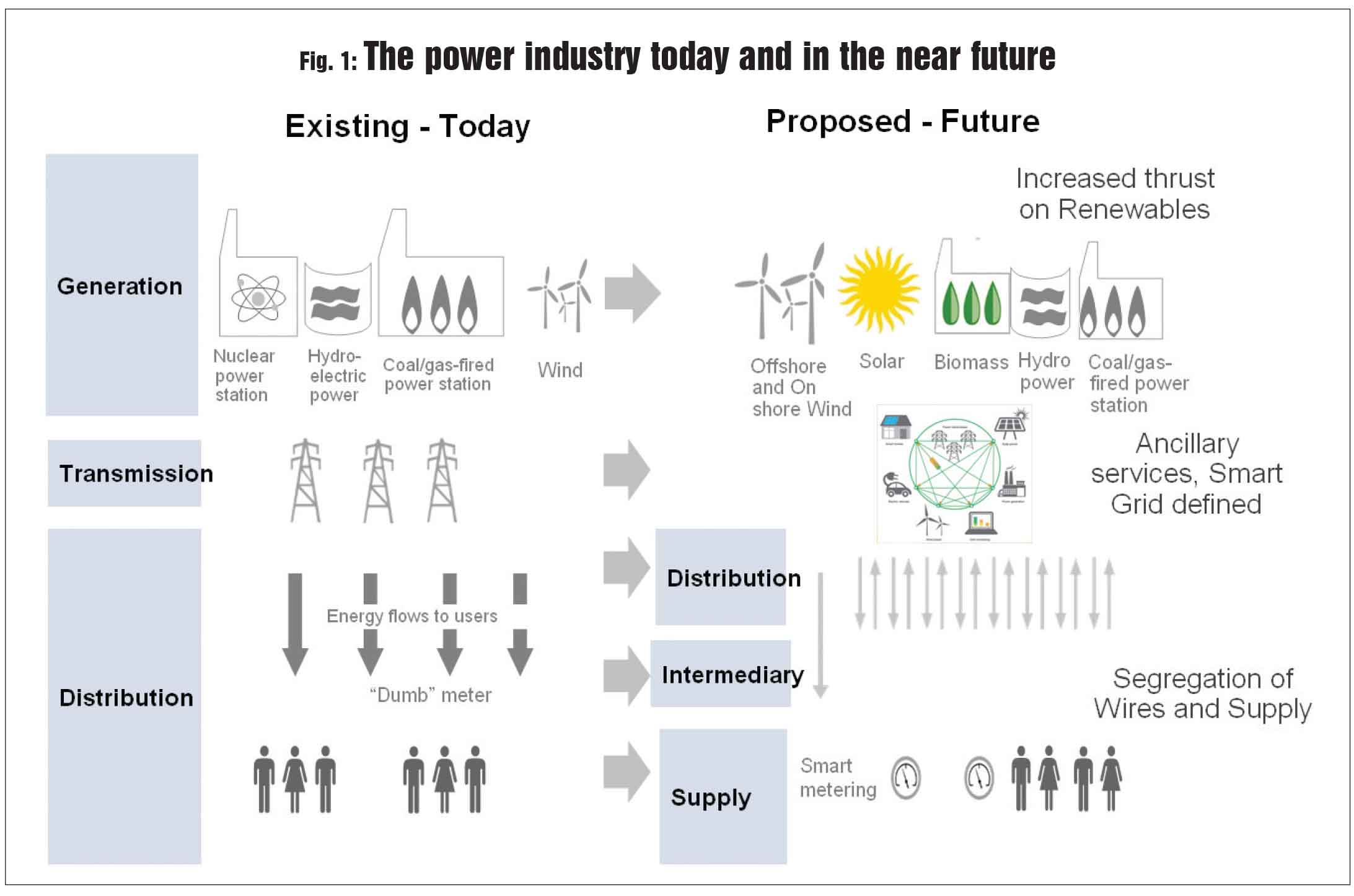

The distribution segment, which is a critical link in the Indian power industry, is tightly regulated today through the Electricity Act, 2003, the National Electricity Policy, 2005 and the National Tariff Policy, 2006. Distribution companies or discoms in the power sector perform the dual roles of laying out the network and of providing retail supply to end consumers. They have a universal supply obligation (USO) and are mandated to supply electricity to all applicants, facing penalty for non-compliance. The Electricity Act also provides more than one retail distributor or discom to service in any one area (city, town, or village) with the intent to introduce competition and bring value to consumers.

The multiple network theory has not progressed broadly across the country, except for Mumbai, where it existed before the Electricity Act, 2003 came into force. Bringing competition in power distribution is a question that one needs to look at in the context of the fragile financial health of this space of the power industry. Today, the sector is plagued by heavy under-recoveries, the key reasons being operating inefficiencies like aggregate technical and commercial (AT&C) losses, lack of technology use, costs, improper power procurement, and vagaries in tariff structure, revision and cross-subsidies.

While reforms in distribution should have preceded those in generation and transmission, it has happened the other way round. In mature markets, multiple suppliers are allowed to supply in an area, but through a common distribution network. This critical reform has been pending in our distribution segment for a while now. The government, over the years, has made several attempts to turn around the power sector with various schemes such as the Deendayal Upadhyaya Gram Jyoti Yojana and the Accelerated Power Development and Reforms Programme, with little or no major impact.

In December 2014, the government introduced the Electricity Amendment [EA] Bill, 2014 in the Lok Sabha but failed to gain traction and win consensus from the states (which is necessary as electricity features on the concurrent list). The Ministry of Power again proposed a revised draft amendment in September 2018. Although progress on the proposed EA has been slow, the power industry is currently on the cusp of an impending transformation with the proposed segregation of the distribution of electricity (supply) from the ownership of the distribution network (wires).

The key changes proposed in the EA that will shape the future of the distribution segment are:

The key changes proposed in the EA that will shape the future of the distribution segment are:

- Segregation of wires and supply businesses

- Formation of an intermediary between distribution lines and end consumers

- Railways and metro rail to become deemed licensees

- Prominent consumer choice – multiple supply licensee (SL) in the supply area

- Ceiling tariff determination by commissions

- Direct transfer of subsidy to low-end consumers

- Penalty for renewable purchase obligation (RPO) non-compliance

- Elimination of surcharge and cross-subsidies

- No requirement of licence to supply electricity by renewable energy generator in any area, by any generator in rural areas and by charging stations for electric vehicles.

However, the proposed EA for the segregation of wires and supply leaves out certain gaps. These are as follows:

- Role, responsibilities and functions of the intermediary company (IC)

- Applicability of Section 131A related to the transfer scheme to private distribution companies

- Timelines for the implementation of the transfer scheme of segregation

- Segregation between SL and a distribution licensee (DL):

- Standards of performance

- Treatment of existing power purchase agreements (PPAs) and power procurement

- Responsibility of providing connections to consumers

- Responsibility of metering and loss in the distribution network.

- Treatment of unrecovered historical costs and losses

- Clarity on USO and power connection sanctioning licensee

- Design principle for ceiling tariff

- Recommendation on consumer categories

- Responsibility of meter management, loss audit, energy accounting and transactional web page platform. It could be an independent body or a company like a state transmission utility under the Southern Regional Power Committee. The company/body will need to have high capability of information technology (IT)-operational technology (OT) application and integration

- Principles of allocation of losses and billing responsibilities

- Defining contestable and non-contestable consumers and categories

- Direct subsidy mechanism and responsibilities

- Transition mechanism and a possible need for incumbent supply company

- Defining areas of supply licensee, which could be state-wise or revenue district-wise

- Mechanism to deal with areas of supply by existing private operators

- Mechanism for business continuity for operating franchisee companies.

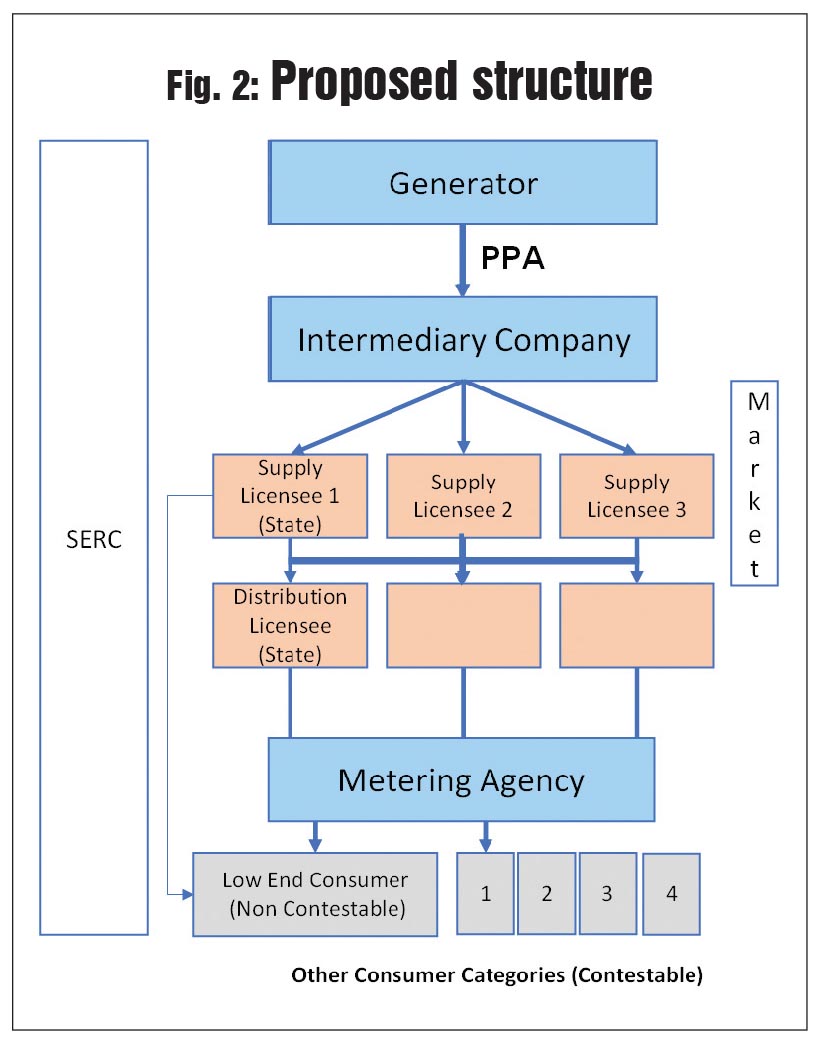

Post segregation, a possible structure could be as illustrated in Fig. 2. Subsequently, state-level merit order despatch of PPAs would be defined by the IC with the lowest-cost PPAs (peak and non-peak demand) to be allocated to non-contestable consumers, under state electricity regulatory commission (SERC) guidelines. Subsidies, if any, will be transferred directly to their individual bank accounts. Post its allocation of the power quantum for non-contestable consumers at a uniform rate, the SERC would set the ceiling tariff for contestable consumers across the state.

The IC would then allocate the balance quantum to SLs based on their demand requirement on average pooled cost principles and excess power (if any) to be sold in the market by the IC. In case of a shortfall in the quantum supplied by the IC, the SL would require to be procured/tied up from the market/generators for a defined period (a 10-15 per cent procured on ST). Allocation of power by the IC could be on a time-block basis in sync with demand-side management (DSM). Since 10-15 per cent of power across the country, as of now, is being procured on a short-term basis, it will help bring in competitive tariff ability between companies.

The IC would then allocate the balance quantum to SLs based on their demand requirement on average pooled cost principles and excess power (if any) to be sold in the market by the IC. In case of a shortfall in the quantum supplied by the IC, the SL would require to be procured/tied up from the market/generators for a defined period (a 10-15 per cent procured on ST). Allocation of power by the IC could be on a time-block basis in sync with demand-side management (DSM). Since 10-15 per cent of power across the country, as of now, is being procured on a short-term basis, it will help bring in competitive tariff ability between companies.

This transition needs to be done smoothly. Hence, there could be a need for the incumbent SL to procure power from the IC for supply as per the original quantum tied up in long term and medium term. Any new licences shall become part of this essential allocation, once they cross a certain fixed threshold of, say, 10 per cent of the market in terms of MUs supplied. The allocation of power by the IC could be in the ratio of peak demands by supply companies. Based on their respective blended power costs, the SL would then be free to offer tariff to consumers subject to the ceiling tariffs in different consumer categories.

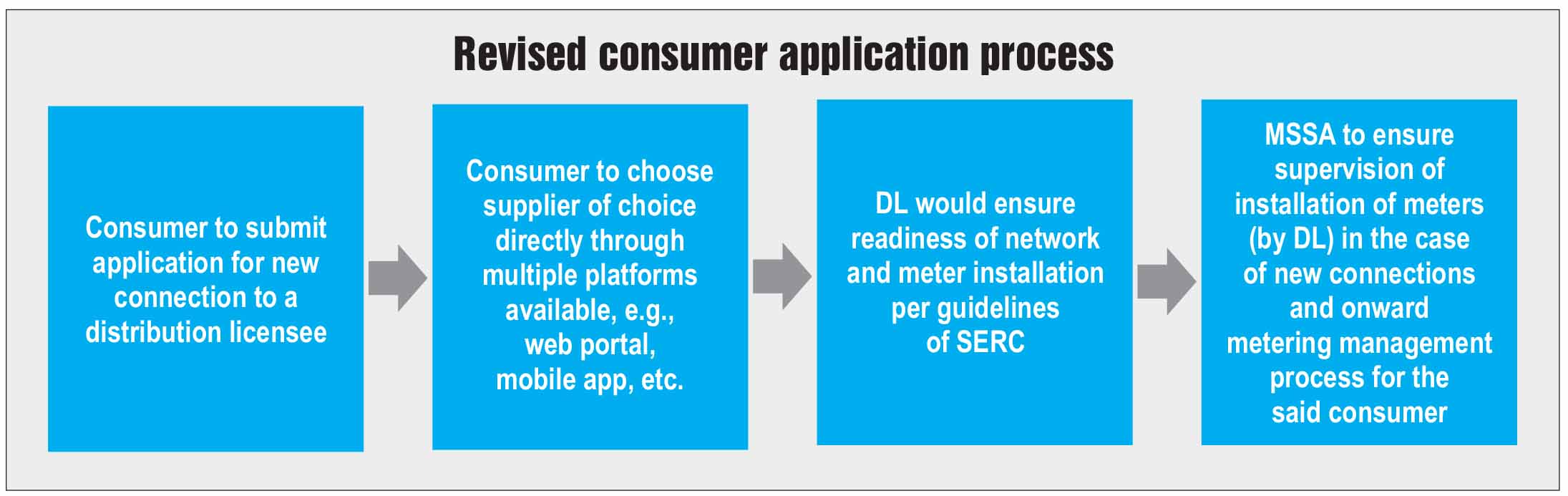

Further, it is envisaged to have a state-owned metering and support service agency (MSSA) that will provide meter management services to all such as SLs, be responsible for energy accounting including smart metering, accounting of technical loss (for DLs)/commercial loss (for SLs), provide support services for new connections and maintenance of portal/mobile application (if any) for SL selection.

While asset ownership and activities related to installation/replacement of meters will be under the DL, service charges for the MSSA, as prescribed by SERCs, will be collected by the SL and transferred to the MSSA. This arrangement will ensure the impartial and accurate metering, energy accounting and loss allocation through a third party. The MSSA will also maintain the web portal for supply transactions online.

The successful implementation of wires and supply segregation will result in a host of benefits for all the stakeholders and will result in an enhanced business focus on network development (distribution business) and power supply (supply business).

The successful implementation of wires and supply segregation will result in a host of benefits for all the stakeholders and will result in an enhanced business focus on network development (distribution business) and power supply (supply business).

Distribution licensees

- Cleaner balance sheets with all the existing assets, since almost all under-recoveries pertain to the power procurement process

- Reasonable rate of return on its investment without any risk of power procurement cost

- Responsible only for monitoring and extending the network to enable supply of power to consumers, as per the standard of performance specified by the regulator.

Supply licensees

- Very low investment requirement for business. Existing trading licences may migrate to become SLs.

- Minimal regulatory compliances other than not breaching ceiling tariffs

- Regulatory asset charges (RAC) under SL control

- Possibility of access to competitive power through stressed assets

- Increase in the area of operation

- New supply licences could be provided on an annual basis

- Unrequisitioned surplus quantum could be introduced by the IC to ensure short-term power availability for variations in load of the supply company.

Consumers

- Low-end/Non-contestable consumers get the benefit of the cheapest power in the state with a direct transfer of subsidy

- Contestable consumers have a choice of SL and have access to competitive tariffs

- Significant elimination of other charges like RAC

- Separate metering and support management company is expected to result in the reduction of AT&C losses.

Generators

- Control on the recovery of fixed and variable costs

- Chances of allocation of competitive power from stressed assets will increase

- Possibility of tie-up of untied power.

Thus, enactment of wires and supply segregation put forth in the Electricity Act amendment will be a turning point in the history of distribution segment reforms. While the actual implementation of the amendment may take some time, it would be prudent to start creating the necessary mindset shifts and be prepared with well-thought-out processes and systems. It is also important for us to touch base with other countries that have already made progress in this direction and imbibe their learnings so that when a changeover takes place in India, it is as efficient and seamless as possible.