In one of the first cases of stressed assets being resolved after the Supreme Court struck down the Reserve Bank of India’s (RBI) February 2018 circular, GMR Infrastructure Limited (GIL) recently executed a resolution for its subsidiary, GMR Rajahmundry Energy Limited (GREL), and its lenders.

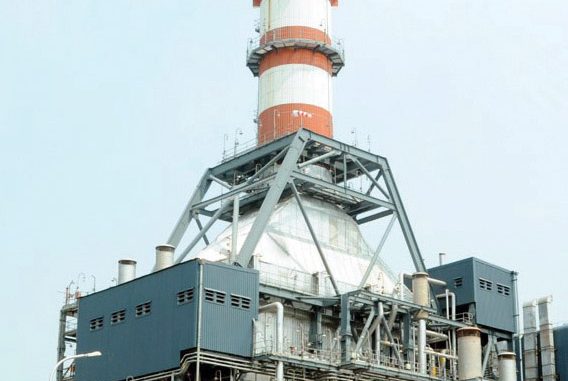

GREL owns a 768 MW (2×384 MW) combined cycle gas-based power project at Rajahmundry, Andhra Pradesh. Although completed in 2012, it has been facing issues related to gas supply since then. It came into commercial operation three years after completion and even at the time, operated at very low levels and soon became non-operational due to the non-availability of gas. The company resorted to strategic debt restructuring in 2016, giving 55 per cent majority shareholding to a lender consortium and increased GMR’s debt to Rs 24 billion. The remaining 45 per cent is being held by the GMR Group. The resolution plan executed now has reduced the debt for GIL and is expected to also help de-risk the group.

Background

The construction of the project was completed in 2012, but its commissioning was delayed due to non-availability of gas after the unprecedented fall in gas production in the KG-D6 basin. The project was fully commissioned on October 22, 2015 after it secured gas through the e-bid RLNG scheme at 50 per cent plant load factor (PLF) for the period October 2015-March 2016 and 30 per cent PLF for the period April-September 2016. The plant began commercial operations for the first time on November 16, 2015 based on the roster decided by the Transmission Corporation of Andhra Pradesh. However, GREL operated at an average PLF of only 20.12 per cent during the year.

The company faced debt payment and operational issues due to non-availability of gas and decided to undertake strategic debt restructuring in 2016. As a consequence, an outstanding debt of Rs 14,139.9 million (Rs 13,085 million of the principal amount and Rs 1,054.2 million of the interest accrued thereon) was converted into equity amounting to a 55 per cent shareholding in GREL in 2017. In January 2018, the consortium of lenders led by IDBI Bank put the equity holding up for sale, but the project failed to find buyers, mostly on account of the continued unviability of gas-based power plants. Meanwhile, GREL submitted a resolution plan to the lenders for the outstanding debt, which was accepted by the lenders in late 2018. This has now been executed.

Resolution plan

The plan has been approved unanimously by the consortium of lenders led by IDBI Bank, which holds a majority 55 per cent stake in the company. As per the plan, the existing debt of Rs 23,530 million has been brought down to a sustainable debt of Rs 14,120 million, of which GIL has already infused Rs 3,950 million towards meeting 20 per cent of the principal and the interest servicing obligations of GREL for the first year. A part of the debt, Rs 11,300 million, will be paid at a 9 per cent rate of interest over the next 20 years, while the remaining debt of Rs 9,410 million has been converted into long-dated cumulative redeemable preference shares carrying 0.1 per cent, which is repayable from the 17th to the 20th year. After the implementation of the resolution plan, the holding structure continues to remain the same, with the lenders being the majority owners of the gas plant holding 55 per cent share and the GMR Group holding the remaining 45 per cent.

According to Kiran Kumar Gandhi, managing director and chief executive of GIL, the debt resolution plan offers a mutually beneficial resolution for the lenders and the company. “It has reduced the debt for the GMR Group and we believe this will de-risk the group substantially. It also offers quality assets built on the ground an opportunity to perform to their potential,” says Gandhi.

Conclusion

GMR believes that gas-based power plants will provide peaking power support to the country’s growing non-conventional energy. Along with this, GMR remains confident about the availability of gas in the years to come. The improvement in gas supply and increase in demand for gas-based power are expected to enhance the performance of the Rajahmundry power plant, thereby enabling the company to meet its obligation towards sustainable debt as well as long-dated preference shares. However, till the uncertainty over natural gas supply – which is necessary to conduct operations to raise finances for meeting short-and long-term obligations – is overcome, the success of the resolution will remain in question.