Given the competitive and predictable day-ahead market prices, a large number of industrial customers have made forays into the day-ahead market, utilising open access to supplement their offtake from utilities and reduce their effective cost of purchase. Over time, the participation by open access customers has increased significantly, currently accounting for as much as 32 per cent of the overall trade in the day-ahead markets on the power exchanges. This constitutes close to 1 per cent of the overall electricity supply in the country. While relatively low in overall terms, the volumes (about 14 BUs) are significant.

A look at the key trends in the short-term power market and in power trading by open access consumers, the issues and challenges for open access consumers, and the way ahead…

Short-term market trends

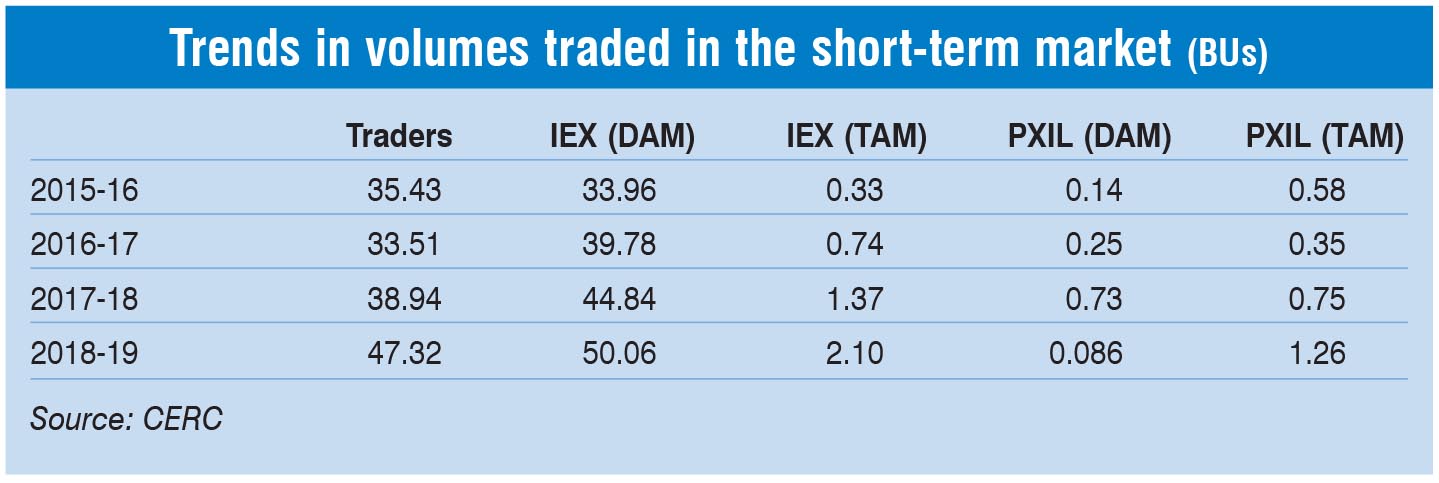

Almost 101 BUs was traded through trading licensees and the two power exchanges, accounting for 75 per cent of the total short-term market trade in 2018-19.

Segment-wise, the volumes traded through trading licensees stood at 47.32 BUs while around 50.14 BUs was traded on the power exchanges. Deviation settlement mechanism (DSM) transactions accounted for 25.13 BUs of the volumes traded while bilateral transactions between discoms accounted for 19.22 BUs.

Power exchanges: During 2018-19, an aggregate volume of 53.5 BUs was transacted through the two power exchanges in the day-ahead market (DAM) and the term-ahead market (TAM). DAM trade accounted for the bulk of the trade at 50.14 BUs, while the remaining 3.36 BUs was through the term-ahead route (that is, 11-day advance).

The bulk of the DAM trade, 50.06 BUs, was transacted on the Indian Energy Exchange (IEX), the country’s first and largest exchange. The second exchange, Power Exchange India Limited (PXIL), witnessed a DAM trade of 86.4 MUs during the year. In the TAM, almost 2.1 BUs was transacted on IEX’s platform, while 1.2 BUs was transacted at PXIL.

The average price of electricity traded through the exchanges was Rs 3.78 per unit during 2018-19 as compared to Rs 3.45 per unit during 2017-18 and Rs 2.50 per unit in 2016-17. At the IEX, the prices ranged from Rs 3.28 per unit to Rs 6.13 per unit during this period, while at the PXIL, the prices ranged from Rs 3.14 per unit to Rs 6.50 per unit. As per recent IEX data, for 2019-20, the prices in April and May were Rs 3.22 and Rs 3.34 per unit respectively.

The average price of electricity traded through the exchanges was Rs 3.78 per unit during 2018-19 as compared to Rs 3.45 per unit during 2017-18 and Rs 2.50 per unit in 2016-17. At the IEX, the prices ranged from Rs 3.28 per unit to Rs 6.13 per unit during this period, while at the PXIL, the prices ranged from Rs 3.14 per unit to Rs 6.50 per unit. As per recent IEX data, for 2019-20, the prices in April and May were Rs 3.22 and Rs 3.34 per unit respectively.

Traders: Around 47.32 BUs was transacted through traders during 2018-19, compared to 38.94 BUs in 2017-18 and 33.5 BUs in 2016-17.

As of March 2019, there were 37 registered interstate trading licensees, of which 23 were engaged in short-term trading. PTC India, with a 30 per cent share in volumes transacted through traders during February 2019, was the market leader. The other major traders were the Arunachal Pradesh Power Corporation, Manikaran Power, Kreate Energy, GMR Energy Trading, Tata Power Trading Company and NTPC Vidyut Vyapar Nigam Limited.

In 2018-19, the average price of electricity transacted through traders was Rs 4.32 per unit, as compared to Rs 3.59 per unit in 2017-18.

In 2018-19, the average price of electricity transacted through traders was Rs 4.32 per unit, as compared to Rs 3.59 per unit in 2017-18.

Open access consumers’ participation trends

Power procurement by industrial consumers through the power exchanges began in 2009. The number of open access consumers grew from 1,859 in 2010-11 to more than 4,800 in 2017-18.

Open access industrial consumers bought 14.73 BUs of electricity, which formed 32 per cent of the total day-ahead volumes transacted on the power exchanges during 2017-18.

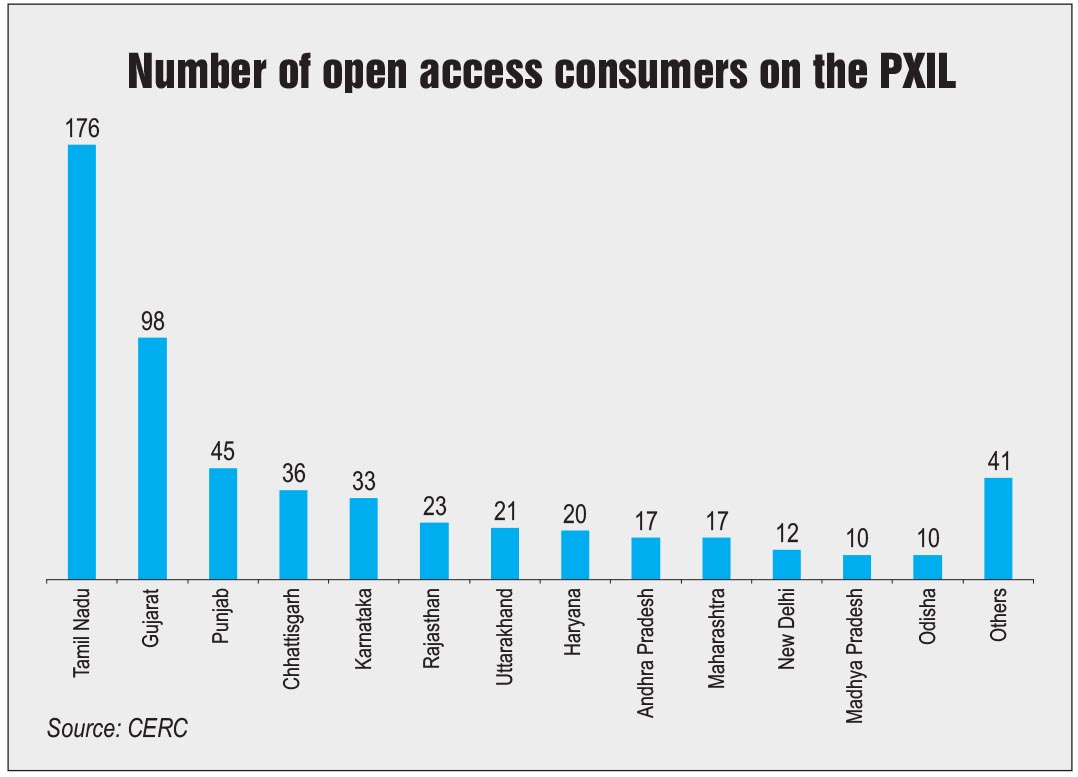

In 2017-18, about 4,248 open access consumers procured 14,728 MUs of electricity through the IEX platform. These consumers were mostly located in Tamil Nadu, Andhra Pradesh, Gujarat, Haryana, Punjab, Rajasthan, Karnataka and Uttarakhand. The weighted average price of electricity bought by open access consumers at the IEX was lower (Rs 2.92 per kWh) than the weighted average price of total electricity transacted through the IEX (Rs 3.42 per kWh).

At the PXIL, about 559 open access consumers procured 6 MUs of electricity through the PXIL platform in 2017-18. These consumers were mostly located in Tamil Nadu, Gujarat, Punjab, Chhattisgarh, Karnataka, Rajasthan, Uttarakhand and Haryana. The weighted average price of electricity bought by open access consumers at the PXIL was lower (Rs 2.79 per kWh) than the weighted average price of the total electricity transacted through the PXIL (Rs 3.80 per kWh).

At the PXIL, about 559 open access consumers procured 6 MUs of electricity through the PXIL platform in 2017-18. These consumers were mostly located in Tamil Nadu, Gujarat, Punjab, Chhattisgarh, Karnataka, Rajasthan, Uttarakhand and Haryana. The weighted average price of electricity bought by open access consumers at the PXIL was lower (Rs 2.79 per kWh) than the weighted average price of the total electricity transacted through the PXIL (Rs 3.80 per kWh).

REC market

Open access and captive power plant (CPP) consumers also participate in the renewable energy certificate (REC) trading process in order to meet their renewable purchase obligations. According to a Power System Operation Corporation report, in 2017-18, almost 39.2 per cent of the total traded RECs were purchased by such consumers (with the remaining being procured by discoms). In 2017-18, the number of open access and CPP consumers participating in REC trading at the power exchanges stood at around 1,045 against only 351 in 2011-12.

Key challenges and the way forward

Key challenges and the way forward

Open access was introduced to promote competition and open up the market for electricity trade. However, challenges in open access implementation have hampered short-term transactions by industrial consumers. State discoms are reluctant to part with high-paying consumers. This leads to the imposition of high open access charges in the form of additional surcharge and cross-subsidy surcharge.

Moreover, discoms have imposed wheeling charges on purchases in the open access market. This is unwarranted as most of the big industries have extra high voltage connectivity and hence they do not fall within the discom’s network. In cases where the distribution network is not used, consumers should not be liable for wheeling charges and losses for such open access transactions.

There is also a wrongful levy and collection of regulatory asset charges, even though these are not applicable to open access consumers. Also, open access consumers are restricted by discoms to schedule open access power for the complete 24-hour period a day. Hence, open access consumers cannot procure power as per their full requirement.

Further, industry watchers say that open access is being allowed by discoms at will. In situations of surplus, restrictions are imposed on the import of power by open access consumers and in situations of deficit, restrictions are imposed on the export of power by generators. In both cases, open access consumers are getting adversely impacted. Going forward, progressive steps by states for facilitating open access will help industries become more competitive and improve overall.