The government is working on a plan to revive the gas-based power segment. To this end, in October 2019, the government had announced its decision to launch a new scheme. The proposed scheme will enable stressed gas-based power projects to run on a mix of domestic and imported gas. It is also an attempt to prevent close to Rs 1,000 billion of debt in the power sector from turning into non-performing assets.

The new scheme is expected to benefit projects worth 15,000 MW belonging to Essar Power, Torrent Power, Gujarat State Petroleum Corporation, Reliance Infra, GMR, GVK, and NTPC, and another 10,000 MW of projects operating at a lower plant load factor (PLF) of 25-30 per cent. This scheme is similar to the electronic regasified liquefied natural gas (eRLNG) scheme that helped 31 stranded power projects to restart operations using imported gas two years back.

The industry has been awaiting government action on the revival of the gas-based power assets for quite some time now. Earlier this year, the finance minister in her budget speech for 2019-20 said that the government would implement the recommendations of a high-level empowered committee for the revival of gas-based power plants on the lines of the e-bid RLNG scheme, which was supported by the Power System Development Fund (PSDF).

A look at the state of the gas-based power generation segment, the proposed scheme and its likely impact…

Status check

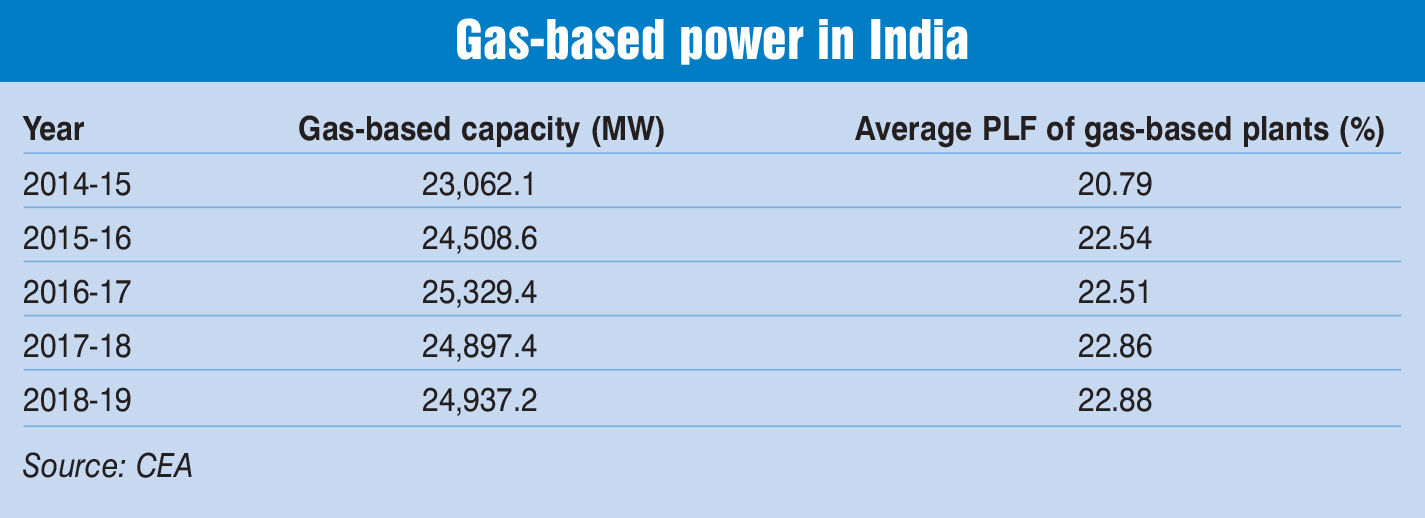

Of the total installed power capacity of about 345 GW, gas-based capacity stands at roughly 25 GW. Although the share of gas-based power in the total installed capacity is 7.2 per cent, its contribution in terms of power generation is only 3.8 per cent. This is due to the fact that 14,305.30 MW of gas-based capacity is stranded due to non-availability of domestic gas and expensive imported gas, which is unaffordable.

According to the Standing Committee on Energy’s report, “Stressed/Non-Performing Assets in Gas-based Power Plants”, tabled on January 4, 2019, the reason behind the segment’s stress is the shortfall in domestic gas production, which has been continuing since 2011-12, with only a marginal improvement during 2017-18.

The plants are running at a very low PLF of about 24 per cent, down from 67 per cent during 2009-10. The normative gas requirement to operate power plants at 85 per cent PLF is about 102 metric million standard cubic metres per day (mmscmd), while the total domestic gas allocated to power projects is 87.12 mmscmd. However, the average domestic gas supplied during the year 2017-18 was even lower, at only 25.71 mmscmd.

Of the 31 stranded gas-based power plants, one belongs to the central government, six to state governments, and 24 to the private sector. All these power plants were planned based on the expectation of an increase in domestic gas production, particularly from the Krishna-Godavari D6 field. The committee noted that since these plants were set up on the basis of the government’s assurance regarding the supply of gas, it is the responsibility of the government to help them come out of stress.

The committee noted that as per guidelines issued in 2013 and 2014, gas allocation to the city distribution systems was given higher priority than the power sector and such policy shifts have proven detrimental for the power sector.

Due to the high cost of imported RLNG, the cost of power generation is substantially higher than with domestic gas, which makes it difficult for scheduling in merit order despatch. Apart from the basic cost, value-added tax (as high as 26 per cent), central sales tax and entry tax, pipeline tariff, marketing margins, etc. is levied on domestic natural gas and RLNG.

In the case of RLNG, the regasification process involves an extra cost of $1 per metric million British thermal unit (mmBtu) -$1.5 per mmBtu and a service tax on regasification is also levied. Consequently, the gas price at power plants goes up, it is in the range of $4.0 per mmBtu-$5.5 per mmBtu for domestic gas and $10 per mmBtu-$12 per mmBtu for RLNG.

In the past few years, cheaper power from other sources has become available. In the renewables sector, the recent bids received for solar/wind power projects are less than Rs 3 per kWh. Therefore, the states have been reluctant to buy high-cost power from gas-based plants. However, the current scenario can be improved by increasing the supply of domestic gas to gas-based plants.

Proposed scheme

Proposed scheme

With gas prices remaining soft in the international market, it is unlikely that the new scheme will provide any subsidy to power producers. However, a buffer of Rs 180 billion is expected to be created under the proposed scheme to keep power tariffs lower in the event of a spike in gas prices.

The new scheme would be based on a gas auction mechanism where electricity generating units quoting least government support will emerge as winners. They would be required to offer electricity to discoms at about Rs 4.50-Rs 5 per unit using the fuel being offered to them by pooling domestic gas with LNG.

Under gas pooling, the price of fuel could be brought down, which will allow electricity tariffs to fall below Rs 6 per unit. The subsidy will be given if the price of gas keeps electricity tariffs higher than Rs 5 per unit. Such a subsidy may either be paid directly to generators or the government may evolve a direct benefit transfer type of scheme, thereby transferring the subsidy directly to power users. Also, to maintain the revenue stream of gas-based plants, the government may also allow them to sell a portion of the power generated in the spot market for higher gains. This could help in keeping the tariff under the pooled gas auction scheme low.

The way forward

With the ministry working on the new scheme, the State Bank of India, the country’s largest lender, has sought a long-term policy intervention to revive gas-based plants, financial support from the National Clean Energy and Environment Fund, a “must-run” status for gas-power stations, the reimbursement of fixed costs from the clean energy fund to discoms entering into long-term power purchase agreements with these gas-based facilities, and also appealed for bringing natural gas under the ambit of goods and services tax (GST). Apart from the LNG scheme, there are other policy interventions also that can help the sector. The Standing Committee on Energy observed that while coal has been included and taxed at 5 per cent GST, natural gas has been kept outside its purview. Being a cleaner fuel, the committee proposed to not place natural gas at a disadvantage vis-a-vis other sources of energy such as coal. It recommended that natural gas should be brought under GST like coal, so that the taxes get rationalised and gas becomes cheaper and affordable. Additionally, the government plans to waive customs duty of 2.57 per cent.

Net, net, given that gas-based projects produce clean energy (less CO2 emission, no particulate matter), utilise less resources in terms of land and water, etc., gas is likely to play an increasingly important role in the country’s power sector. Hence, the necessary steps must be taken for the revival of this segment and to prevent the creation of non-performing assets.