Indian power utilities have always focused on bridging the demand-supply gap and ensuring 24×7 power supply to all consumer categories, but the issue of power quality has never been a priority. Now, with the increasing penetration of renewables, the proliferation of electric vehicles and charging facilities, and the rise of decentralised generation, the stress on the transmission and distribution grid has increased manyfold. This affects the quality of power supply, resulting in performance degradation, premature failure of electrical equipment, and increased systemic and financial losses.

Further, the increased non-linear loads on consumer premises due to greater use of computers, tablets and electronic equipment also affect the quality of power supply. The conventional reasons for poor quality of power can be divided into two categories – natural ones such as lightning, flashover, equipment failure and faults (which account for 60 per cent of power quality problems), and forced ones such as voltage distortions and notches (40 per cent).

Need for quality power

The importance of power quality varies for different stakeholders – utilities, consumers and equipment manufacturers. Even stakeholders in the same group have different perspectives on power quality. For instance, a one-minute voltage interruption in a city like Delhi or Mumbai may not be bearable but even hours of interruption in a village may go unnoticed. The effects of power quality interruption may be more pronounced for industrial and commercial consumers than residential or agricultural consumers.

In technical terms, the power quality of the electrical system refers to the extent of deviation, or the distortion in pure supply waveform, and the continuity of supply. An ideal power supply is never interrupted, is always within voltage and frequency tolerances, and has a noise-free sinusoidal waveform. The most common manifestations of poor power quality include low power factor, harmonic disturbances, load imbalances and voltage variations.

Some of the key power quality parameters are power factor, frequency, reliability (number of interruptions) and restoration of supply (duration of interruptions). Some common power quality problems are supply interruptions, harmonic distortions, transients and imbalances in voltage and current, flickers, voltage sags and swells, and frequency excursions, as well as problems associated with reactive power. Each of these disturbances has different causes and effects. Power quality disturbances can be upstream or downstream and affect customers connected in the same supply network.

Today, consumers want quality power to drive their sensitive equipment. While general electrical loads such as lighting appliances, heating equipment and motors are less sensitive to voltage swells and sags, and more sensitive to supply interruptions, new-age electronic and digital equipment is more sensitive to quality variations. The increased use of non-linear electronic loads leads to power quality problems. These loads are in turn affected by frequency variations.

Today, consumers want quality power to drive their sensitive equipment. While general electrical loads such as lighting appliances, heating equipment and motors are less sensitive to voltage swells and sags, and more sensitive to supply interruptions, new-age electronic and digital equipment is more sensitive to quality variations. The increased use of non-linear electronic loads leads to power quality problems. These loads are in turn affected by frequency variations.

The possible effects of poor power quality for utilities include faults in control devices, mains signalling systems and protective relays, increased losses in the electrical system including transformers, fast ageing of equipment such as motors, failure of capacitors, production losses, and radio/TV/telephone interference.

On consumer premises, voltage sags, spikes, harmonics and interruptions may last for only for a couple of seconds but have the potential to harm equipment, and affect daily operations and the safety and reliability of power systems and personnel. Power quality disruptions often result in outages, stalling production and leading to revenue losses for industrial/ commercial units. In addition, industrial customers are often penalised by distribution utilities for not maintaining their power factor.

Power quality cost

Power quality cost

The cost of power quality issues may run into millions of dollars. As per a report titled Economic Impact of Poor Power Quality in Various Industrial Sectors in India (2011) by the Asia Power Quality Initiative and IIT-Delhi, small industries suffer the most from power quality interruptions while large ones such as iron and steel, cement and heavy electricals are shielded because they have backup power generation or captive power plants.

As per a paper presented at the International R&D Conclave organised by the Central Electricity Authority in February 2018, the direct costs of downtime in India are about $3,128 million per year, of which about 57 per cent are due to voltage sags and short interruptions, while 35 per cent are due to transients and surges.

According to a study by the Manufacturers Association of Information Technology in 2009, the direct costs of downtime in India are Rs 200 billion per year. Another study by Wartsila India in 2009 estimated that industries in India were spending around Rs 300 billion annually on power backup solutions, gensets and inverters. In 2012, a Federation of Indian Chambers of Commerce and Industry report stated that due to poor power factor, the transmission capacity reduced, resulting in an estimated annual loss of Rs 54 billion on account of unserved energy. This energy could have been provided to users if the average power factor was 0.9.

Present status

Present status

Of late, Indian regulators and utilities have started recognising power quality issues and formulating strategies to address them. In a key development, India’s first national standard on power quality was published by the Bureau of Indian Standards in October 2018.

The notification for IS 17036: 2018, Distribution System Supply Voltage Quality, was issued in the Gazette of India on October 10, 2018. In the same year, the Forum of Regulators launched a report, PQ for Electricity Consumers in India, which lays emphasis on the need for power quality and model regulations. However, not many states have notified dedicated power quality regulations in the country. Recently, in August 2019, the Kerala State Electricity Regulatory Commission notified the (Power Quality for Distribution System) Regulations, 2019. The regulations apply to distribution licensees including deemed distribution licensees, distribution franchisees and all the designated customers of electricity connected at or below the 33 kV voltage level. The scope of these regulations is to specify the main characteristics of power quality at the point of common coupling or at the supply terminals of customers in the distribution system.

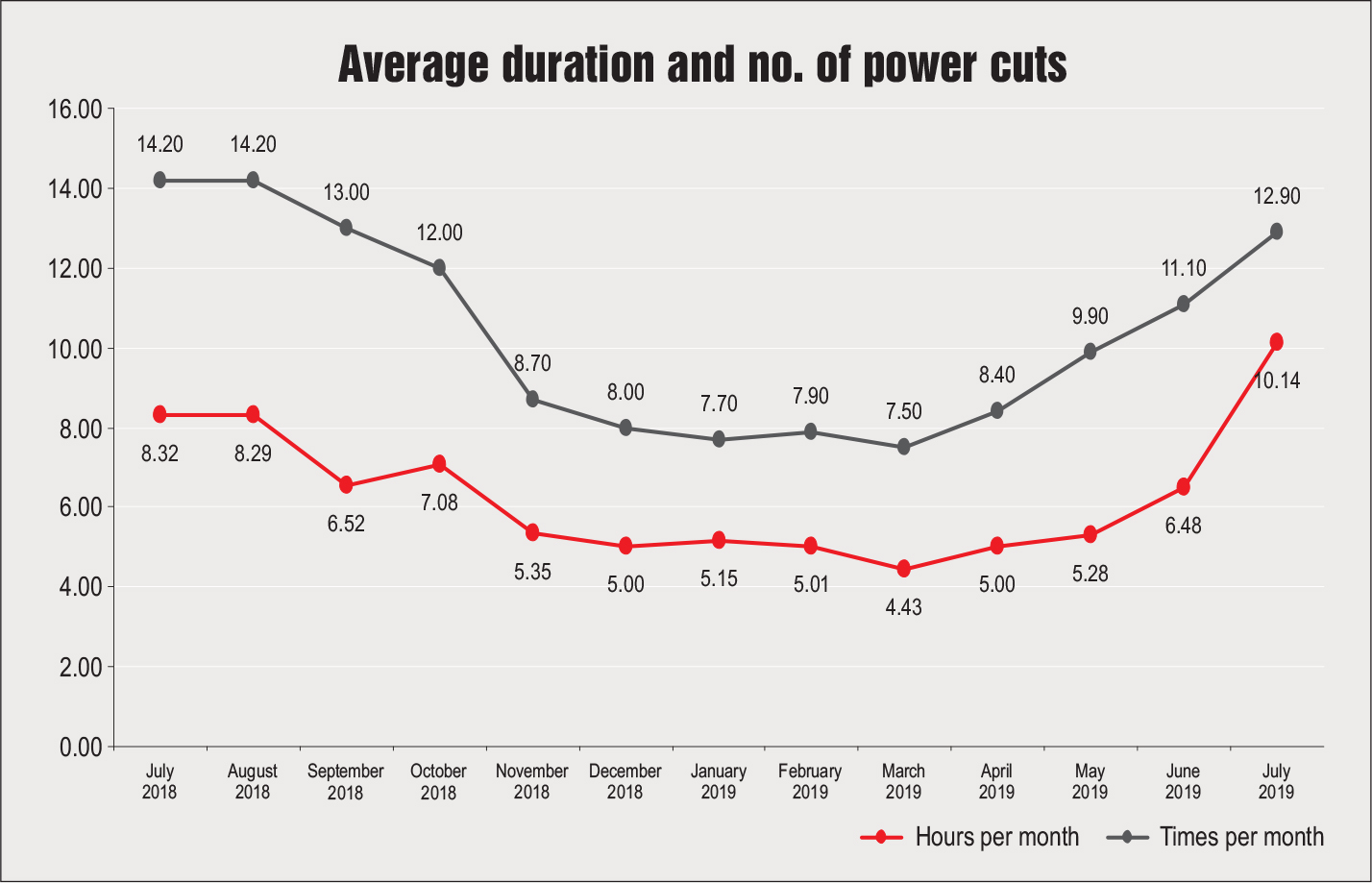

As per data from the URJA web portal, the average duration of power cuts was in the range of 4.43-10.14 hours per month from July 2018 to July 2019. The average number of power cuts ranged from 7.5 times per month to 14.2 times per month. In terms of states, Andhra Pradesh ranks first with the least average duration of power cuts (1.15 hours) and Karnataka ranked last with the highest average duration of power cuts (33.4 hours) in July 2019. In terms of the average number of power cuts in a month, Andhra Pradesh recorded the lowest number (2.6 times) while Uttarakhand recorded the highest number (49 times).

As per data from the URJA web portal, the average duration of power cuts was in the range of 4.43-10.14 hours per month from July 2018 to July 2019. The average number of power cuts ranged from 7.5 times per month to 14.2 times per month. In terms of states, Andhra Pradesh ranks first with the least average duration of power cuts (1.15 hours) and Karnataka ranked last with the highest average duration of power cuts (33.4 hours) in July 2019. In terms of the average number of power cuts in a month, Andhra Pradesh recorded the lowest number (2.6 times) while Uttarakhand recorded the highest number (49 times).

Power quality market

As per industry estimates, the global power quality equipment market is expected to grow at a compound annual growth rate of 6.5 per cent, from about $29.74 billion in 2017 to $40.85 billion in 2022. North America is expected to dominate the global power quality equipment market, investing in various protection systems for electrical infrastructure development and grid restructuring. However, the Indian power quality equipment market is still at a nascent stage. This is because utilities have historically focused on increasing generation and improving T&D networks. This presents a huge opportunity for growth in this space.

As per Power Grid Corporation of India Limited’s (Powergridre) port titled “Swachh Power – A glimpse of Power Quality in India”, released in September 2015, the total investment required in the initial phase of power quality improvement across the industrial, domestic and commercial loads is estimated at Rs 248.4 billion. The cost of devices that help mitigate power quality issues depends on the load requirement and may vary from Rs 4,000 per amp to Rs 17,000 per amp. The devices include dynamic voltage restorers, voltage sag correctors, active power filters, automatic power factor controllers and D-STATCOMs.

Conclusion

Power quality is likely to take centre stage in the years to come with growing consumer awareness and regulatory intervention to improve the quality of supply. The high cost of power conditioning devices and lack of skilled manpower in utilities are some of the key challenges in improving power quality. In addition, utilities do not have enough data to make the right investment decisions to mitigate power quality issues.

Thus, there is a need to take steps to include power quality issues in the aggregate revenue requirement of licensees and training must be organised for utility personnel to help them identify and deal with power quality problems. Further, the nationwide installation of smart meters can help in gathering data related to power quality from consumers. Also, regulators need to mandate discoms to start tracking, measuring and displaying power quality performance data in the public domain. The discoms should also start identifying consumers that contribute significantly to power quality issues in their networks by installing monitoring equipment.