North Eastern Electric Power Corporation Limited (NEEPCO) is a central public sector undertaking (CPSU) set up in 1976. It generates about 40 per cent of energy requirement of the Northeast India and over the years, has been working towards tapping the region’s enormous potential. Its installed capacity now stands at 1,732 MW and it is among the few CPSUs to have a portfolio comprising hydro, thermal as well as renewable energy sources.

NEEPCO reached a significant milestone with the commissioning of two units (2×150 MW) of the Kameng hydroelectric project (HEP) in Arunachal Pradesh, despite various challenges faced due to Covid-19 in June and July 2020. The plant has recently completed 1,000 MUs cumulative power generation. On the commissioning of the balance 300 MW, the plant will be able to generate 3,353 MUs annually. Further, on completion of the remaining two units (Units 3 and 4), the project will become the largest hydropower plant in the Northeast.

Kameng HEP

All the major works required for the commissioning of the 600 MW (4×150 MW) Kameng project were completed by February 2018 and two hydro generating turbines of Units 1 and 2 were put on trial mechanical run on March 8, 2018 and March 10, 2018 respectively. However, leakages in the penstocks were noticed on March 12, 2018, as a result of which penstock rectification works had to be undertaken. Rectification works of Penstock I feeding two units was completed on October 9, 2019. Thereafter, Units 1 and 2 of the HEP, totalling 300 MW, started commercial operations with effect from June 17, 2020 and July 1, 2020 respectively.

Meanwhile, rectification works of Penstock II, feeding Units 3 and 4, are in progress. Work was suspended on March 23, 2020 due to the countrywide lockdown, but resumed from April 23, 2020. Considering the present rate of progress, Penstock II is expected to be ready by October 2020 for the commissioning of Units 3 and 4. The cumulative expenditure incurred up to March 31, 2020 was Rs 79.46 billion, of which, Rs 6.85 billion was spent during 2019-20.

On the challenges faced by the project, V.K. Singh, chairman and managing director, NEEPCO, remarked at a recent Power Line conference, “The head race tunnel (HRT) layout was challenging, with 8.5 km tunnelling without any adit in between. The major portion of the HRT is aligned in a deep hill with cover in the range of 0.8-1.2 km causing high vertical and horizontal rock stress on the tunnel support.” He further added, “The penstock/HPT should preferably be laid underground, and standard, proven and internationally accepted contract documents such as FIDIC should be adopted for this type of complex hydro project.”

Background and current operations

In November 2019, NEEPCO became a subsidiary of power major NTPC Limited, following the Cabinet Committee on Economic Affairs’ in-principle approval for strategic divestment. The government divested its shareholding of 100 per cent in NEEPCO and transferred management control to NTPC Limited on March 27, 2020. As a part of the transaction, NTPC will acquire 100 per cent of the issued and paid-up share capital of NEEPCO.

NEEPCO’s current installed capacity comes from seven HEPs aggregating 1,200 MW, three gas-based projects aggregating 527 MW and a solar project of 5 MW. The total generation from these plants stood at 6,282.82 MUs during 2019-20, and an actual plant availability factor (APAF) of 79.61 per cent was achieved in 2019-20.

The seven HEPs are the 405 MW Ranganadi HEP (Arunachal Pradesh), the 200 MW Kopili HEP (Assam), the 110 MW Pare HEP (Arunachal Pradesh), the 75 MW Doyang HEP (Nagaland); the 60 MW Tuirial HEP (Mizoram), the 50 MW Khondong HEP (Assam) and the recently commissioned 300 MW Kameng HEP (Arunachal Pradesh).

Generation from these hydro plants, including the recently commissioned Kameng HEP, was 3,051.71 MUs in 2019-20, down by 2.21 per cent from the 3,120.57 MUs generated in 2018-19 (without the Kameng HEP). During 2020-21 (till September 2020), 2,361.82 MUs have been generated by the seven HEPs.

NEEPCO’s thermal portfolio comprises the 291 MW Kathalguri combined cycle power plant (CCPP) in Assam, the 135 MW Agartala gas turbine CCPP and the 101 MW Monarchak CCPP in Tripura. In 2019-20, NEEPCO generated 3,224.46 MUs of thermal power, about 8.52 per cent higher than the 2,971.39 MUs generated in 2018-19. During 2020-21 (till September 2020), 1,325.23 MUs of power has been generated by these thermal plants.

In the renewables segment, the company operates a 5 MW solar PV plant located on the premises of the Tripura gas-based power project, Monarchak, in Tripura. It is the largest grid-interactive solar plant in the north-eastern region. The project was implemented by Bharat Heavy Electricals Limited at an estimated cost of Rs 495.2 million. The plant has been operating commercially since February 2015. The plant generated 6.65 MUs during 2019-20 (with a capacity utilisation factor of 15.08 per cent) as against 7 MUs in the previous year.

Financial performance

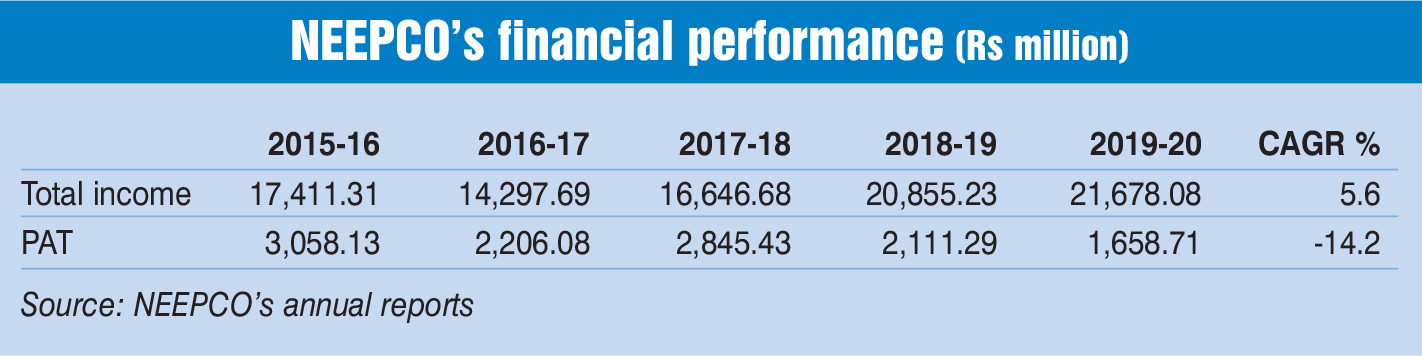

During the past five years (2015-16 to 2019-20), the company’s total income increased at a compound annual growth rate (CAGR) of 5.6 per cent, from Rs 17,411.31 million in 2015-16 to Rs 21,678.08 million in 2019-20. NEEPCO’s profit after tax (PAT) decreased from Rs 3,058.13 million to Rs 1,658.71 million during the same period, indicating a decline in CAGR of 14.2 per cent. In terms of year-on-year performance, NEEPCO’s total income increased by about 3.9 per cent in 2019-20 from Rs 20,855.23 million in 2018-19. The company’s PAT decreased by 1.4 per cent in 2019-20, from Rs 2,111.29 million a year ago.

Upcoming projects

Apart from Units 3 and 4 of the Kameng HEP, NEEPCO has a number of other projects in its pipeline. It is developing 235 MW of hydro capacity at the Wah Umiam HEP in Meghalaya – 50 MW in Stage I, 100 MW in Stage II and 85 MW in Stage III. The project is at the survey and investigation stage and is scheduled to be commissioned in five years from investment approval. Efforts for land acquisition are being made with the concerned authorities for Stage III, which have been obstructed due to local opposition. Efforts are also being initiated for the identification of beneficiaries and the finalisation of power purchase agreements (PPAs) including cross-border trading for power sale from the project. Stages I and II are located on the upstream of the Wah Umiam Stage III HEP and were allotted to NEEPCO on March 12, 2019. Thus, the entire Umiam basin has now been allotted to NEEPCO for development. The memorandum of association (MoA) is under finalisation. The pre-feasibility report (PFR) will be finalised and preparation of the detailed project report (DPR) will be taken up after the signing of the MoA.

In a bid to contribute to a low-carbon future, the company is planning to build a 200 MW solar power plant in Dhenkanal in Odisha. In-principle approval has been obtained from Odisha’s state agencies, while that from the Ministry of Power (MoP) is awaited for the start of project-related work.

NEEPCO also has around 4,200 MW of planned hydro capacity through joint ventures (JVs), which include the 3,750 MW Siang Upper Stage II HEP, the 330 MW Kurung HEP and the 120 MW Dibbin HEP, all in Arunachal Pradesh. Of these, the Siang HEP is a JV between NEEPCO, NHPC and the state government, and is currently on hold as per the advice of the MoP, through letters dated November 18, 2015 and February 2, 2016, till a decision is taken with regard to the development of the Siang Upper Stages I and II HEP (6,000 MW and 3,750 MW) in a single stage or in two stages.

Meanwhile, the Kurung HEP is a JV between NEEPCO and the Arunachal Pradesh government. The PFR has been prepared by NEEPCO and the pre-investment approval from the MoP will be processed on a revisit of the MoA.

The Dibbin HEP is being developed by NEEPCO and KSK Energy Ventures Limited. NEEPCO is in the process of exploring the scope and opportunity for ensuring the viability of the project.

To achieve the goal of universal electrification in the country, NEEPCO has carried out rural electrification works in the state of Tripura under the Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya) on behalf of Tripura State Electricity Corporation Limited (TSECL). The works are being undertaken in the two districts of Sepahijala and South Tripura, at an estimated cost of Rs 399.7 million and Rs 549.6 million respectively.

Coping with Covid-19

Since electricity generation and sale are essential services, NEEPCO ensured the availability of its power plants to generate power and continued to supply power during the lockdown period. At the same time, NEEPCO has continued to implement strict measures for the prevention of Covid-19 in all offices, establishments and township colonies.

Further, with the MoP’s directive to the Central Electricity Regulatory Commission (CERC) to reduce the late payment surcharge (LPS) rate, NEEPCO’s LPS for 2020-21 is expected to be reduced by

around Rs 8.8 million. In line with the MoP’s directive, the company has proposed to allow rebate at the rate of 25 per cent to discoms for the lockdown period. This is likely to result in a reduction in revenue from operations for 2020-21 by around Rs 426.7 million.

NEEPCO’s renewable energy power station has not been impacted due to Covid-19 as the station has been accorded must-run status by the Ministry of New and Renewable Energy. In the case of thermal stations, the company does not foresee any eventuality and financial impact on account of any unfulfilled minimum offtake commitments under fuel supply agreements.

The road ahead

Under a recent MoU signed with NTPC for 2020-21, NEEPCO has targeted to achieve electricity generation of 6,600 MUs during the current fiscal and plans to incur a capital expenditure of Rs 9.65 billion during the year. Further, it aims to achieve revenues of Rs 25 billion from operations and procure 25 per cent of the total purchase from the government e-marketplace.

Net, net, NEEPCO’s robust operational and financial performance in the past, coupled with the transfer of stake to NTPC, should provide the company synergies for growth.

Nikita Gupta