Rajasthan’s power sector has made significant progress on the back of reforms in the past few years. The state has significantly improved its power supply situation (23-24 hours of daily power supply) and achieved 100 per cent household electrification. Further, the discoms’ revenue gap has reduced by more than 50 per cent, from Rs 3.65 per unit in 2014 to Rs 1.56 per unit in 2019, and their aggregate technical and commercial (AT&C) losses have dropped from 28 per cent in 2016 to 22 per cent in 2019.

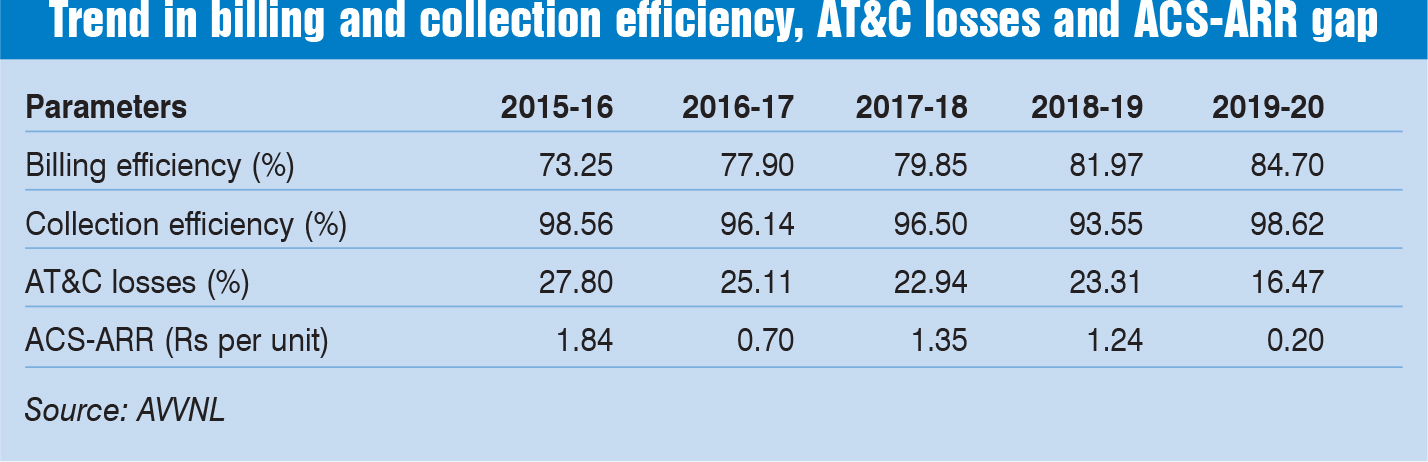

Contributing to the state’s power sector progress is Ajmer Vidyut Vitran Nigam Limited (AVVNL), one of the three state-owned discoms. AVVNL’s rating improved from C+ in 2017 to B in 2019 in the utility rankings by the Power Finance Corporation. The discom significantly reduced its AT&C losses from almost 28 per cent in 2015-16 to 16.47 per cent in 2019-20. Further, the discom has turned around its financial performance and is nearing revenue surplus. A strong area for the discom has been its high collection efficiency, which increased from 93.55 per cent in 2018-19 to 98.62 per cent in 2019-20. Further, it has achieved 100 per cent metering covering all its consumers at the 500 kWh level and 95 per cent of its agricultural consumers.

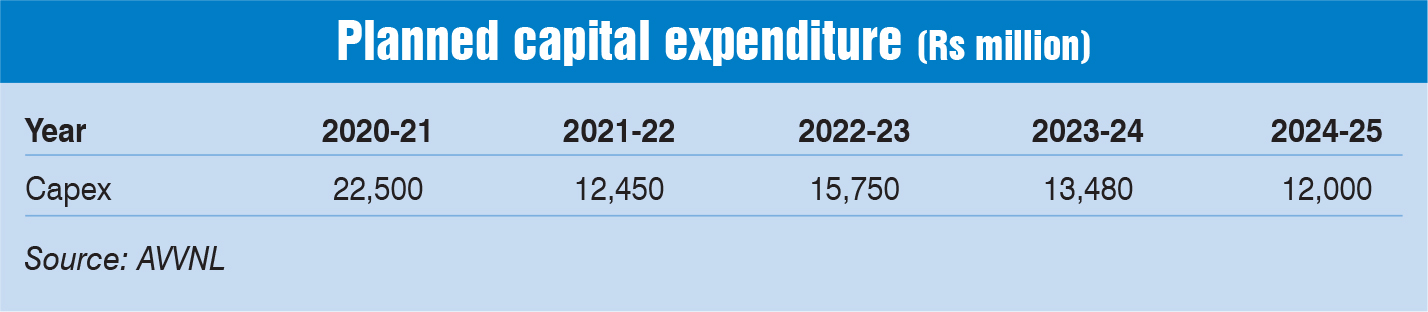

Going forward, the discom is working on significant plans for network augmentation. It plans to implement about 100,000 smart meters by 2025-26 apart from adding network capacity. Overall, it is looking to make a capital expenditure of Rs 76 billion by 2024-25.

Operations and infrastructure growth

AVVNL is responsible for the distribution and supply of electricity in 11 districts of Rajasthan – Ajmer, Bhilwara, Nagaur, Sikar, Jhunjhunu, Udaipur, Banswara, Chittorgarh, Rajsamand, Doongarpur and Pratapgarh. It caters to a customer base of around 5.03 million (as of March 2020). Of these, 4.05 million are domestic consumers, 0.35 million commercial, 0.062 million industrial and 0.52 million are agricultural consumers. The discom has witnessed a growth in demand owing to schemes like Saubhagya. The company’s energy sales have increased by over 3 per cent from 16.7 BUs in 2018-19 to 17.2 BUs in 2019-20. Of the total power sold, 33.86 per cent was sold to agricultural consumers during 2019-20, 23.38 per cent to HT industrial consumers, 23.35 per cent to residential, 7.68 per cent to commercial, 6.57 per cent to LT consumers and the remaining to other consumer categories.

AVVNL’s network grew at a CAGR of about 3 per cent from 295,912 ckt. km in 2015-16 to 351,434 ckt. km in 2019-20. The majority of its line length is at the 11 kV level (144,588 ckt. km), while 16,187 ckt. km is at the 33 kV level, and 19,658 ckt. km are low tension lines.

The company’s substations grew at a CAGR of 8.85 per cent from 448,240 substations in 2015-16 to 629,333 substations in 2019-20. AVVNL’s substation capacity recorded a CAGR of 6.07 per cent from 20,406.57 MVA in 2015-16 to 25,835.81 MVA in 2019-20. The utility has 1,903 substations at the 33 kV level with 9,693.90 MVA of power transformer capacity, and 627,430 substations at the 11 kV level with 16,141.91 MVA of power transformer capacity. Overall, AVVNL has 630,047 transformers in its network, of which 2,617 are at the 33 kV level and the remaining at the 11 kV level.

In terms of metering coverage, almost 99 per cent of its 33 kV and 11 kV feeders have been installed with static meters, while it has achieved 100 per cent smart metering at the 500 kWh level by installing 7,185 smart meters against the target of 6,923.

DF operations

AVVNL signed a distribution franchise agreement with Tata Power in 2017-18. The SPV, Tata Power Ajmer Distribution Limited, commenced distribution and retail power supply in Ajmer city, which includes the City Division I and City Division II areas and has been operating as the distribution franchisee for the past three years. The total area under the franchisee is around 190 square km. Its total consumer base in 2019-20 stood at 151,000 and the total peak demand at 128.64 MW, 14.5 per cent higher than the past year. Its net sales stood at Rs 4.01 billion in 2019-20. Its distribution sales also increased from 465 MUs in 2018-19 to 483 MUs in 2019-20. For enhancing consumer centricity and reliability, various initiatives have been implemented, resulting in improved business performance. There was a 60 per cent reduction in commercial complaints in 2019-20 as compared to the previous year, zero faulty meter pendency within 30 days, reduction in provisional billing from 3.8 per cent in 2018-19 to 1.8 per cent in 2019-20 and increase in digital payment from 19 per cent to 33.4 per cent. The average restoration time of tripping also improved from 6.40 minutes in 2018-19 to 4.22 minutes in 2019-20 (34.1 per cent reduction).

Operational performance

Overall, AVVNL’s AT&C losses have reduced significantly over the years from 27.8 per cent in 2015-16 to 25.11 per cent in 2016-17, 22.94 per cent in 2017-18, 23.31 per cent in 2018-19 and 16.47 per cent in 2019-20.

In terms of overall network reliability, the discom’s system average interruption frequency index stood at 27.63 in 2019-20 as compared to 15.17 in 2018-19. Further, its system average interruption duration index stood at 285.20 minutes in 2019-20 as against 232.11 minutes in 2018-19. Meanwhile, the distribution transformer failure rate decreased from 10.54 per cent in 2015-16 to 9.63 per cent in 2019-20.

To improve its performance, AVVNL has implemented a smart grid pilot project in partnership with the National Smart Grid Mission. The project, covering about 1,000 consumers, was initiated in January 2016 and concluded in March 2017, becoming the first successful smart grid pilot in the country. It recorded total annual savings of Rs 1.3 million against the total capex of Rs 6.7 million, with a payback period of five to six years. Under the project, AT&C losses reduced from 20 per cent to 13.5 per cent. The project helped identify 11 cases of uncollected dues over six months, improving collection efficiency by 1.2 per cent. The automation of meter reading, smart metering and monthly billing reduced the bill generation cycle from 14 days to 5 days, and eliminated meter reading and punching costs. The pilot project enabled condition-based asset maintenance, thus reducing the failure rate of meters by 50 per cent and the failure rate of transformers by 30 per cent.

Financial highlights

AVVNL reduced its revenue gap from Rs 1.24 per unit in 2018-19 to Re 0.20 per unit in 2019-20. In 2019-20, the discom’s total revenue stood at 146.16 billion, a 10.94 per cent increase over the previous year. The company registered a growth of 69.09 per cent in its net profits to stand at Rs 7.88 billion in 2019-20 as compared to a net profit of Rs 4.66 billion in 2018-19. Meanwhile, its average rate of power procurement increased from Rs 4.44 per unit in 2018-19 to Rs 4.80 per unit in 2019-20. Its payback period was 216 days in 2019-20. The utility recorded a capex of Rs 24.05 billion in 2019-20, recording a CAGR of over 27 per cent from 2015-16 to 2019-20. Its debt-equity ratio stood at 1.32 in 2019-20 as against 1.69 in 2018-19.

Future plans

AVVNL and another Rajasthan discom, Jodhpur Vidyut Vitran Nigam Limited, are planning to deploy 188,000 smart meters in their respective discom areas of Rajasthan. For this, central PSU Energy Efficiency Services Limited has issued a tender in February 2021. Meanwhile, AVVNL is implementing the central government-funded IPDS. Of the Rs 4.93 biilion approved by the government for the scheme to the discom, Rs 2.03 billion has been released for the utility as of March 19, 2021. The majority of the funds (Rs 2.01 billion) have been released for system strengthening works, while the rest will be used for smart metering, ERP, RT-DAS and IT enablement (Phase II) projects.

Also, in January 2021, AVVNL floated a tender for distributed grid-connected solar systems for agricultural consumers under component C of the Pradhan Mantri Kisan Urja Suraksha evam Utthan Mahabhiyan. The company plans to install 479 distributed solar systems at 29 select feeders on a turnkey basis.

Investment plans

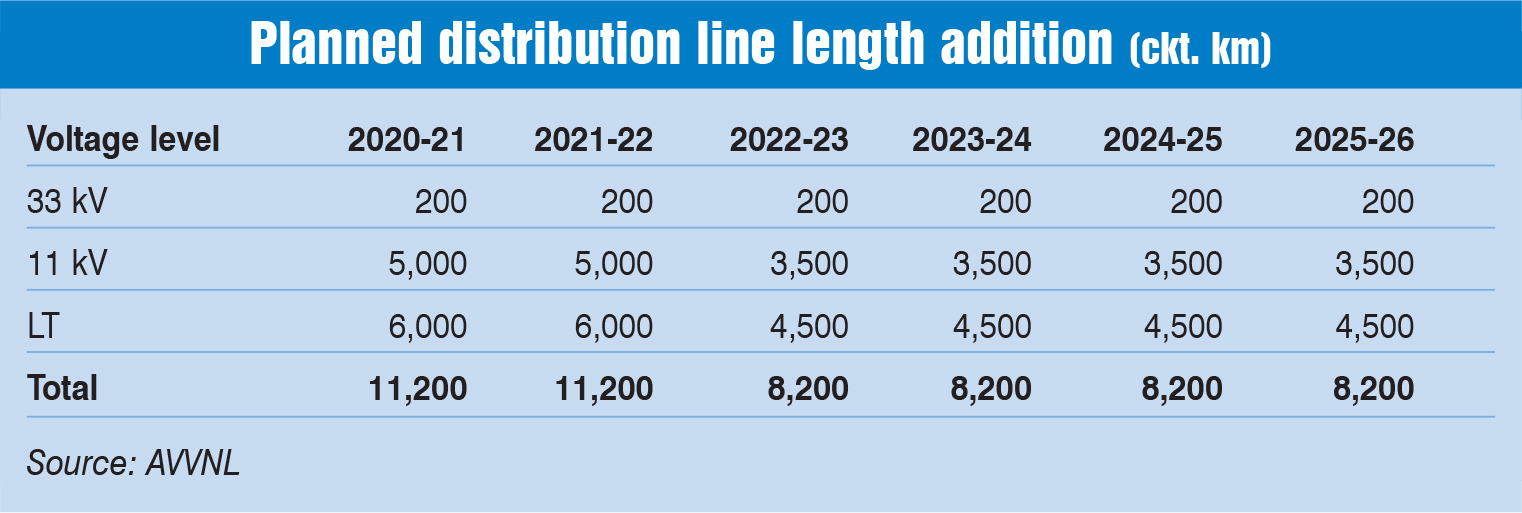

AVVNL plans to incur a capex of Rs 76 billion by 2024-25. In terms of network additions, it plans to add a transformer capacity of 3,900 MVA by 2025-26. In addition, AVVNL is planning to add 55,200 ckt. km of distribution line length and 25,040 substations by 2025-26.

In sum, AVVNL’s various planned initiatives are expected to improve the utility’s performance and modernise its network, which will help the discom to continue on its loss reduction trajectory.