Going forward, the share of hydropower in the country’s energy mix is expected to increase and thereby help in tackling climate change. In addition to generating clean energy, hydropower has the potential to be used as peaking capacity to complement the integration of more intermittent sources of renewable energy by providing effective means of energy storage. Moreover, mature technologies such as pumped storage can help in load levelling, peak load sharing and managing the stability of the electricity grid in times of erratic demand and supply. With India committing to meet 50 per cent of its energy requirements through renewable energy by 2030 at the COP26 summit at Glasgow, hydropower could see a greater push from the government and developers. However, the segment growth has been tardy owing to factors such as the long gestation period of hydroelectric power projects (HEPs), geological issues, rehabilitation and resettlement issues, local resistance, delays in obtaining environmental clearances, limited offtakers, and time and cost overruns. The government has, however, been working on addressing these hurdles and ensuring that the competitiveness and economic viability of hydropower projects is maintained.

Power Line presents an overview of key trends and recent developments in the hydropower segment…

Segment performance

India has a rich and economically exploitable hydropower potential of 148,700 MW. However, as of December 2021, the installed hydropower capacity (projects over 25 MW) in the country stood at only 46,512 MW. Hydropower held the third largest capacity share in the total installed capacity at around 11.8 per cent in 2020-21, falling from 13.6 per cent in 2016-17.

Ownership-wise, the state sector accounted for the highest share in the installed hydropower capacity at 58.3 per cent, followed by the central and private sectors with 33.6 per cent and 8.1 per cent share respectively. The installed hydropower capacity has recorded a low compound annual growth rate (CAGR) of about 1.1 per cent in the past five years (2016-17 to 2020-21). In contrast, coal-based and renewables-based installed capacities have grown at a CAGR of 2.2 per cent and 16.3 per cent, respectively, during the same period.

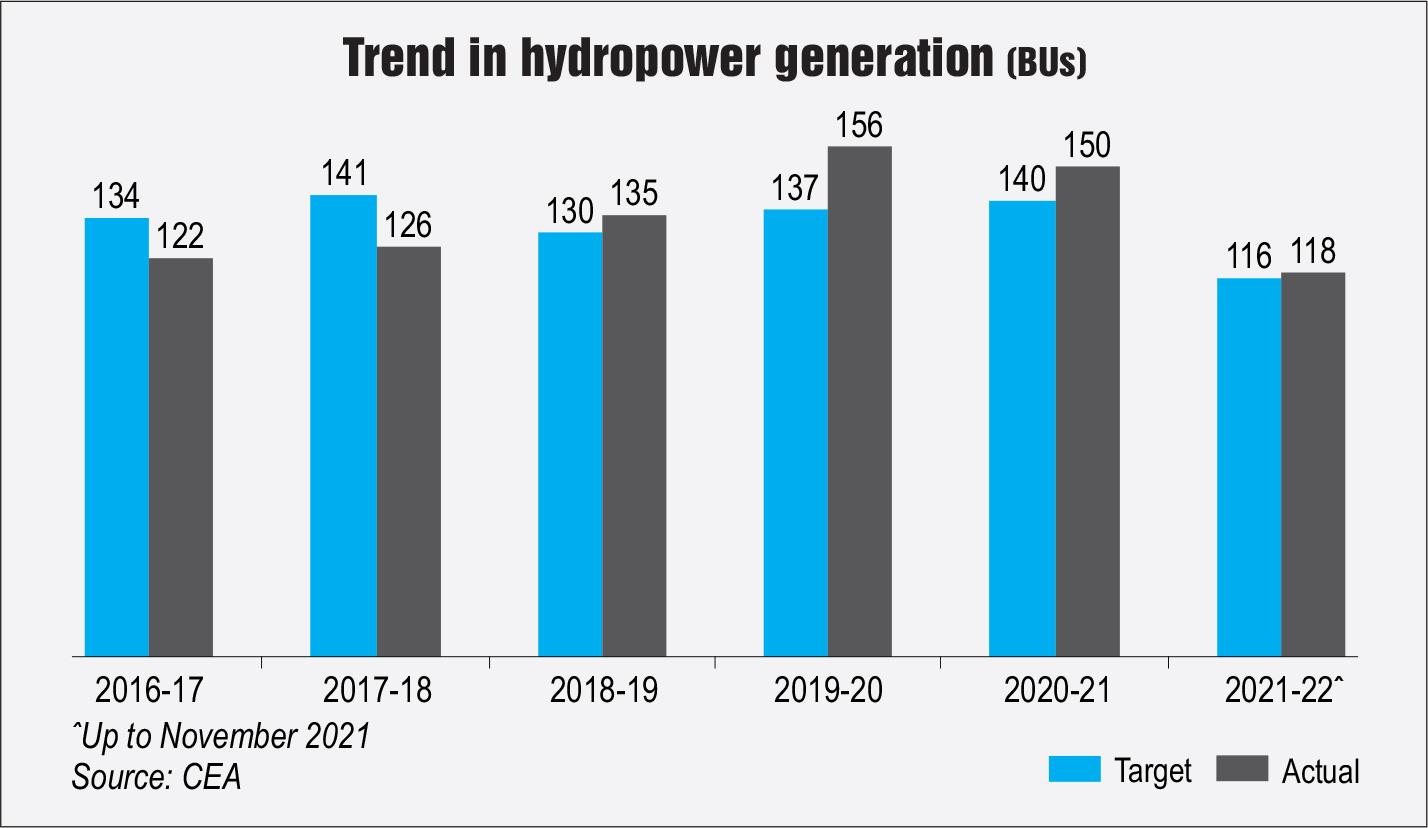

During the past two years (2020-21 and 2021-22), the total capacity addition in the sector stood at 723 MW. Projects commissioned during this period include North Eastern Electric Power Corporation Limited’s Kameng HEP Units 3 and 4 (150 MW each), Himachal Pradesh Power Corporation Limited’s Sawra Kuddu HEP Units 1-3 (3×37 MW), L&T Uttaranchal Hydro Power Limited’s Singoli Bhatwari HEP Units 1, 2 and 3 (33 MW each), Units 1 and 2 (2×50 MW) of the Sorang HEP in Himachal Pradesh, Units 1 and 2 (56.5×2 MW) of the Rongnichu HEP in Sikkim, besides uprating of the Karcham Wangtoo HEP from 1,000 MW to 1,045 MW, and of Units 1, 2 and 3 of the Kalinadi HEP from 135 MW to 150 MW each. During 2020-21, hydropower generation stood at over 150 BUs, marking a decline of around 3.5 per cent from 156 BUs recorded in the previous fiscal, but 7 per cent higher than the target level.

During 2021-22 (as of November 2021), hydropower generation stood at over 118 BUs. Hydropower generation remained largely insulated from the effects of the pandemic due to its must-run status. The share of hydro generation in the total power generation mix remained at around 11 per cent during 2020-21, as compared to 10 per cent in 2016-17.

Recent policy measures

Recent policy measures

The central government has undertaken various measures to promote the hydropower segment. At the COP26 summit, India set a target to augment non-fossil fuel electric capacity to 500 GW and meet 50 per cent of its energy requirements from renewables by 2030. Further, it announced a net zero emissions target for 2070. This is expected to enhance investments and the development of non-fossil fuel sources including hydropower. Some other policy announcements which are expected to benefit the segment are:

HPO: To achieve the target of 30 GW of hydropower by 2029-30, in February 2021, the Ministry of Power (MoP) issued a revised renewable purchase obligation (RPO) trajectory, including a long-term trajectory for large hydropower projects commissioned after March 8, 2019. To recall, in March 2019, the government issued an order detailing various policy measures to promote the hydropower

sector which included hydropower purchase obligation (HPO) being made a separate entity within non-solar RPO. As per the 2021 notification, the RPO has been calculated in energy terms as a percentage of total electricity consumption, excluding the consumption met by hydropower sources. The solar RPO target may be met by power produced from solar power projects. Other non-solar RPOs (excluding HPO) may be met from any renewable energy source other than solar and large hydropower projects. The HPO benefits may be met by the power procured from large hydropower projects commissioned on and after March 8, 2019, and up to March 31, 2030. The HPO liability of the discom could be met out of the free power being provided to the state from large hydropower projects commissioned after March 8, 2019. With this separate HPO, which has a clear mandate for hydropower, there is expected to be greater offtake from hydropower projects.

Waiver of ISTS charges for pumped storage: In June 2021, the MoP issued an order on the waiver of inter-state transmission system (ISTS) charges for pumped storage hydropower plants to be commissioned up to June 30, 2025. ISTS transmission charges shall be waived for such projects for 25 years from their commissioning. The waiver of transmission charges has also been allowed for trading of electricity generated/supplied from pumped storage hydropower plants.

Waiver of ISTS charges for pumped storage: In June 2021, the MoP issued an order on the waiver of inter-state transmission system (ISTS) charges for pumped storage hydropower plants to be commissioned up to June 30, 2025. ISTS transmission charges shall be waived for such projects for 25 years from their commissioning. The waiver of transmission charges has also been allowed for trading of electricity generated/supplied from pumped storage hydropower plants.

Budgetary support for flood moderation: In October 2021, the MoP issued detailed guidelines for budgetary support for flood moderation and enabling infrastructure (roads and bridges) with regard to hydropower projects, with an aim to reduce the tariff levels of these projects. The limit of budgetary support for roads and bridges would be Rs 15 million per MW for projects up to 200 MW and Rs 10 million per MW for projects above 200 MW.

Dispute resolution: In September 2021, the MoP approved the formulation of a dispute avoidance mechanism for construction contracts of central public sector enterprises (CPSEs) executing hydropower projects. The mechanism mandates the appointment of independent engineers, who will have regular oversight over the projects, with open communication with all the key stakeholders.

Proposal to hive off constructed hydro plants to SPVs: In July 2021, the government was reportedly exploring hiving off constructed central sector hydropower plants into special purpose vehicle (SPV) companies under their existing developers to maximise their valuations during stake sale. As per the proposed national asset monetisation pipeline, NITI Aayog has suggested segregating constructed projects and transferring them to an SPV, under the CPSE that owns the projects. The SPVs consisting of constructed projects might be subsidiaries of their respective CPSEs. This would ensure that the aggregate value of the parent and subsidiary company is greater than that of the present developer of the project.

State-level developments

State-level developments

Arunachal Pradesh: In December 2021, SJVN Limited announced its plan to invest Rs 600 billion to set up 5,097 MW of hydropower capacity in Arunachal Pradesh. The company has been allotted five HEPs – the Etalin HEP (3,097 MW), Attunli HEP (680 MW), Emini HEP (500 MW), Amulin HEP (420 MW) and Mihumdon HEP (400 MW), all located in the Dibang basin. These projects are expected to be commissioned in the next 8-10 years. On commissioning, these projects are expected to generate about 20 BUs of clean energy annually on a cumulative basis.

Uttarakhand: In the same month, the central government filed an affidavit before the Supreme Court to allow the completion of seven under-construction HEP projects in Uttarakhand. The seven projects are Tehri Stage II (on the Bhagirathi River), Tapovan Vishnugad (on the Dhauligangan river), Vishnugad Pipalkoti (on the Alaknanda river), Singoli Bhatwari and Phata Buyong (on the Mandakini river), the Madhyamaheshwar (on the Madhyamaheshwar Ganga) and Kaliganga II (on the Kaliganga river). To recall, the Supreme Court had imposed a moratorium on clearing hydroelectric projects in Uttarakhand following flash floods in June 2013.

Jammu & Kashmir: In January 2021, the union cabinet approved an investment of Rs 52.82 billion for the 850 MW Ratle HEP located on the river Chenab in Jammu & Kashmir. The project is being developed by Ratle Hydroelectric Power Corporation Limited, a joint venture (JV) between NHPC Limited and Jammu & Kashmir State Power Development Corporation Limited (JKSPDCL). An agreement between the promoters was signed accordingly in April 2021 for the incorporation of the JV. NHPC will hold a 51 per cent stake in the JV while JKSPDCL will hold 49 per cent. Another MoU was signed by the two entities in January 2021 for the execution of the Kirthai II (930 MW), Sawalkot (1,856 MW), Uri I Stage II (240 MW) and Dulhasti Stage II (258 MW) hydropower projects.

Pumped storage projects

Pumped storage plants (PSPs) can provide an ideal solution for energy storage and load balancing. It is the only commercially proven technology available for grid-scale energy storage. As of November 2021, there are eight PSPs with a total capacity of 4,746 MW in the country. However, only six PSPs (Kadamparai,

Bhira, Srisailam, Ghatgar, Purulia and Nagarjunasagar), aggregating 3,306 MW in capacity, are working in both generation and pumping modes. The remaining two PSPs (Sardar Sarovar and Kadana Stages I and II), aggregating 1,440 MW, are working only in generation mode. Further, there are three under-construction PSP projects with a total capacity of 1,580 MW – the 1,000 MW Tehri Stage II project in Uttarakhand being implemented by THDC Limited, the Kundah PSP Stages I, II, III and IV (500 MW) being implemented by TANGEDCO in Tamil Nadu, and the Koyna Left Bank (80 MW) in Maharashtra being implemented by the Water Resources Department of Maharashtra, which is held up at present. The detailed project report for the Turga project (4×250 MW) in West Bengal has been approved, while the 1,200 MW Pinnapuram project in Andhra Pradesh is under examination. Further, survey and investigation are in progress for 17 projects totalling 16,770 MW and 14 projects totalling 8,855 MW are at pre-feasibility stage.

Issues and challenges

While hydropower remains an attractive source of clean energy, its development entails a number of challenges. According to the Central Electricity Authority (CEA), 36 HEPs (above 25 MW) which are under development have time/cost overruns. These include delay in environmental and forest clearances, infrastructural constraints at site due to project terrain, geological surprises resulting in change in design, stoppage of work, damage, and remobilisation of resources.

As HEP are site specific and their tariffs depend on location/design parameters and high initial investment, the tariff for new HEPs is relatively higher, which makes the despatch of power from new projects through long-term power purchase agreements difficult. Specific to PSPs, a major drawback of the current pricing mechanism is that it does not take into account the grid flexibility aspects of such projects and because of the generic pricing mechanism, PSPs are not utilised to full capacity.

Further, various state hydropower policies restricting the entry of CPSEs and the dependence on a few contractors are some of the other issues. Further, the benchmark capital cost of HEPs has been rising on the back of the rising cost of inputs such as steel, aluminium and cement. The capital cost has increased gradually from Rs 60 million per MW in 2004 to Rs 160 million per MW in 2018.

Future outlook and the way forward

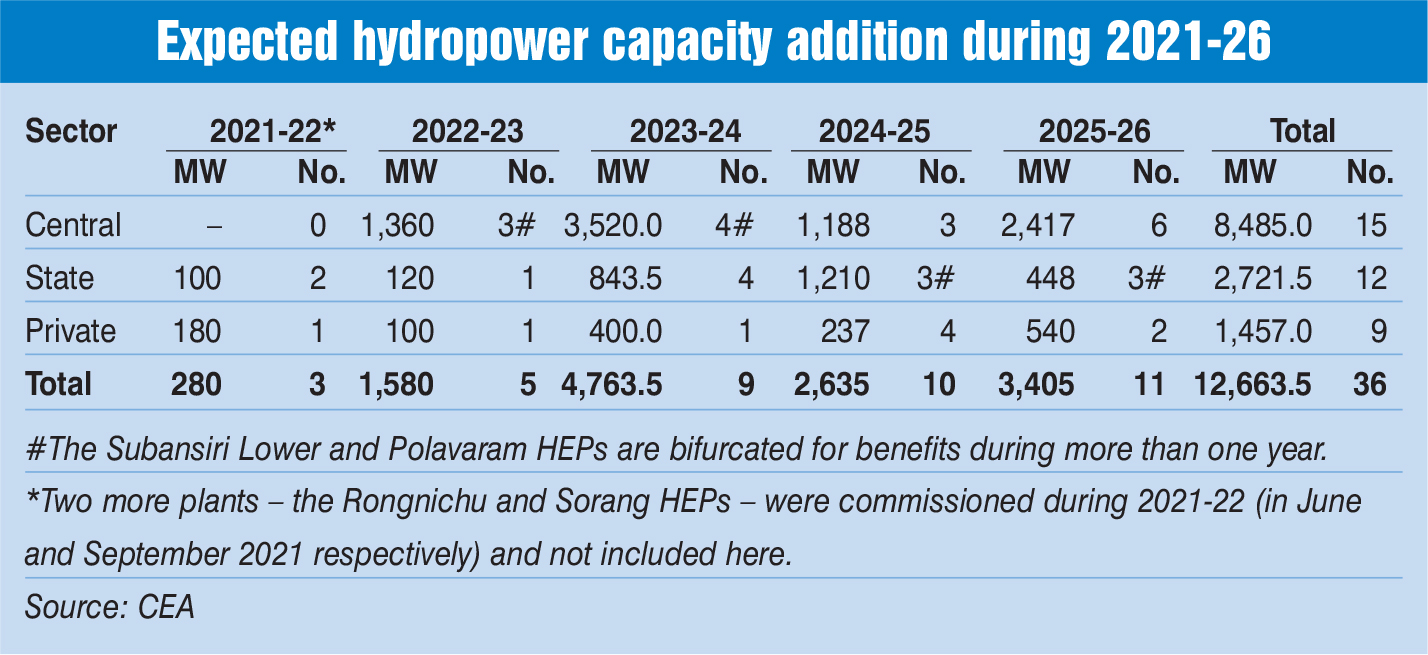

As per the CEA, at present 36 HEPs (above 25 MW) totalling 12,663.5 MW are under execution. Of these, 15 HEPs are in the central sector (8,485 MW), 12 HEPs are in the state sector (2,721.5 MW) and 9 HEPs are in the private sector (1,457 MW). Of these, 26 HEPs totalling 10,577.5 MW are under active construction while 10 HEPs totalling 2,086 MW are currently held up. As per the CEA’s optimal generation capacity mix, the installed hydropower capacity is estimated to reach 76 GW by 2029-30, contributing to nearly 9 per cent of the total installed power capacity. In order to accelerate the development of HEPs, the segment needs to overcome the various challenges. Financial incentives, along with policy and regulatory support from the central and state governments, need to be developed to enhance investor confidence. It is also important to develop a pricing mechanism for each service that pumped storage offers.

In the backdrop of India’s ambitious emission targets and the recent net zero commitment by 2070, hydropower is likely to be an active segment in India’s renewable energy portfolio. Further, the Covid-19 pandemic has demonstrated the significant role that hydropower can play with respect to pumped storage through better load management during periods of fluctuating demand. Therefore, a revived impetus to hydropower can be expected, with a special focus on pumped storage hydropower in the coming years. If developed sustainably, hydropower can not only maintain its competitiveness but also simultaneously complement solar and wind energy as a reliable source of energy storage. The competitiveness, however, will depend on the level of mitigation of the financial, environmental and social risks involved with its development.

Nikita Gupta