Renewable energy certificates (RECs) are important market-based instruments, promoting the sale and growth of renewable energy by helping obligated entities such as discoms, captive consumers and open access consumers in meeting their renewable purchase obligations (RPOs). However, the REC mechanism has been designed on the then prevailing market conditions of 2011, when it was introduced in the country. India’s renewable energy capacity stood at around 20 GW at the time. Given that the scenario has changed significantly with renewable energy capacity now crossing the 100 GW mark, the country’s REC mechanism is being revisited by policy and regulatory stakeholders.

The Central Electricity Regulatory Commission (CERC) recently notified the draft Terms and Conditions for RECs for Renewable Energy Generation Regulations, 2022, repealing the earlier REC regulations, which were notified in 2010. A discussion paper was issued by the Ministry of Power (MoP) in June 2021 to overhaul the REC mechanism, which included key proposals such as perpetual validity of RECs and thus no floor and forbearance price for the certificates, 15-year eligibility of renewable energy generators to issue certificates, promotion of new renewable energy technologies, and provision of multipliers.

The CERC’s draft regulations are aimed at addressing the concerns raised by stakeholders during the past one decade and bring in the required flexibility in the REC market. A look at the key highlights of the draft regulations and changes proposed by the CERC in the REC mechanism…

Background of the REC mechanism

The purchase and sale of RECs on the power exchanges started in March 2011. Since then, the non-solar REC and solar REC trading sessions have been taking place once a month. At present, around 1,044 renewable energy projects with a total capacity of 4,506 MW are registered under the REC mechanism. It has also been observed that new investment in REC projects has declined over the period.

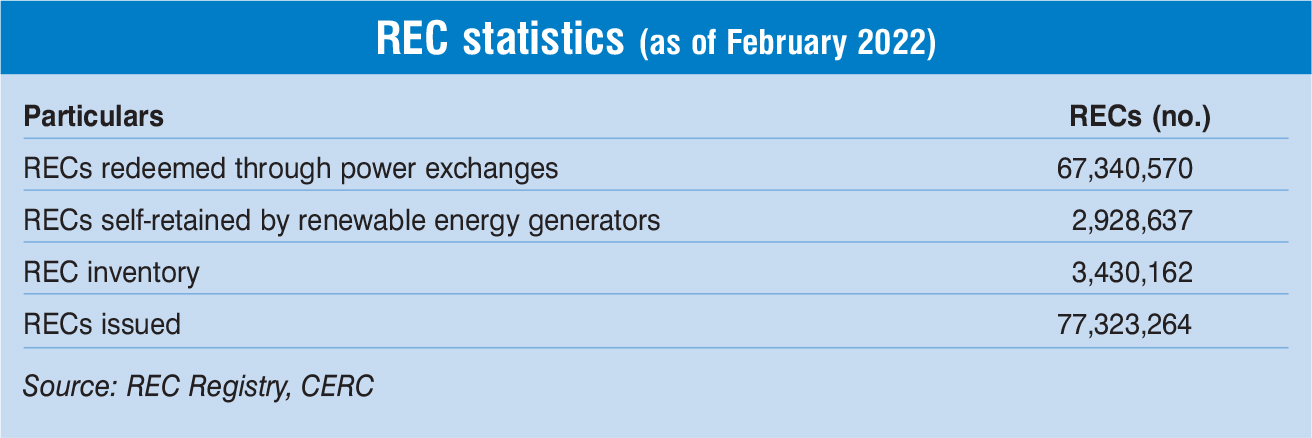

During the past 10 years, an average of 7 million RECs have been issued annually, against which an average 6.1 million RECs have been redeemed through the power exchanges and 0.36 million RECs have been self-retained by the entities. As of February 2022, 77.3 million RECs have been issued, of which 87 per cent have been redeemed and 4 per cent have been self-retained by the entities. The current inventory of RECs stands at 3.4 million as of end February 2022.

Key features of CERC draft regulations

Eligibility for issuance of certificates: Under these draft regulations, renewable energy generating stations, captive generating stations based on renewable energy sources, distribution licensees, and open access consumers will be eligible for issuance of certificates. For a renewable energy generating station to be eligible for the issuance of certificates, its tariff should not be determined or adopted under Section 62 or Section 63 of the Electricity Act, 2003, and the electricity generated should not be sold either through an electricity trader or a power exchange, for RPO compliance. Second, a renewable energy generating station that has not availed of any waiver or concessional transmission charges or wheeling charges, or banking facility of electricity will be eligible for the issuance of certificates. Further, captive generating stations based on renewable energy sources will be eligible for the issuance of certificates provided that the certificates issued for self-consumption will not be eligible for sale. In the case of an obligated entity being a distribution licensee or an open access consumer, that purchases electricity from renewable energy sources in excess of the RPO determined by the state commission, will be eligible for the issuance of certificates to the extent of purchase of such excess electricity from renewable energy sources.

Process for issuance of certificates: The process involves accreditation and registration, followed by issuance, exchange and redemption of certificates. The existing process of accreditation by the state agency for eligible entities connected to the intra-state transmission system has been continued, while assigning the respective regional load despatch centres (RLDCs) the responsibility of accreditation of eligible entities connected to the interstate transmission system. The accredited entity will be eligible for registration at the central agency and the registration of such eligible entities will be valid for 15 years from the date of registration.

An eligible entity is required to apply for the issuance of certificates within six months from the corresponding generation. Within 15 days from the date of receipt of the complete application for issuance of certificates by the eligible entities, the central agency will issue the certificates or reject the application recording reason for such rejection and intimate the same to the concerned entity. The certificates will be issued on the basis of the electricity generated and injected into the grid or deemed to be injected in the case of self-consumption by the eligible captive generating stations based on renewable energy sources.

An eligible entity is required to apply for the issuance of certificates within six months from the corresponding generation. Within 15 days from the date of receipt of the complete application for issuance of certificates by the eligible entities, the central agency will issue the certificates or reject the application recording reason for such rejection and intimate the same to the concerned entity. The certificates will be issued on the basis of the electricity generated and injected into the grid or deemed to be injected in the case of self-consumption by the eligible captive generating stations based on renewable energy sources.

The central agency will maintain a registry of certificates. In addition to the existing system of transactions of certificates through the power exchange, the proposed regulations allow transactions of certificates through electricity traders at a mutually agreed price. The number of certificates intended to be sold through electricity traders will be informed in advance to the central agency. The certificates once exchanged through the power exchange or through electricity traders and used for RPO compliance by the obligated entities shall stand redeemed.

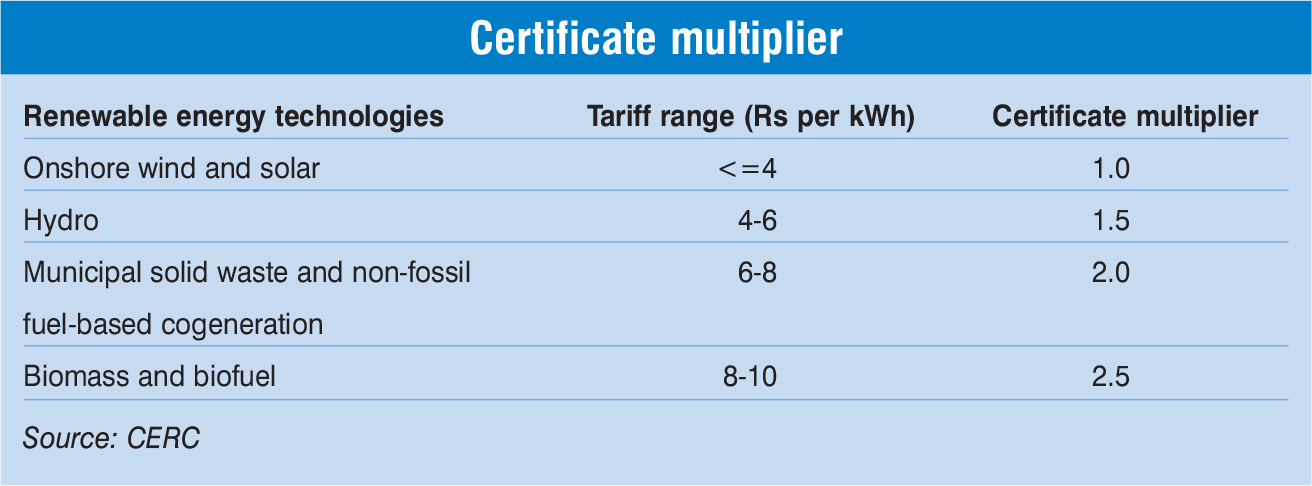

Denomination and pricing of certificates: Each certificate issued under these regulations will represent 1 MWh of electricity generated from renewable energy sources and injected or deemed to be injected into the grid. The CERC has proposed that renewable energy-based projects will receive a common certificate, but will be differentiated by the number of certificates using the certificate multiplier based on the maturity level and cost of a particular renewable energy technology. This will ensure that the REC market is not fragmented and all technologies are equitably compensated. A certificate multiplier will also provide the required support for new and innovative technologies in its nascent stage of development. The draft regulations propose to assign the multiplier by comparing the levellised tariff for various renewables-based projects as determined or adopted by the regulatory commissions.

The certificates will be issued as per the assigned certificate multiplier. The draft regulations propose that a multiplier will be assigned for a period of three years from the effective date of these regulations. The certificate multiplier for other renewable energy technologies, not covered here, will be notified by the commission on a case-by-case basis. Further, the multiplier may be revised, based on the review of the maturity level and the cost of various renewable energy technologies. The draft regulations also make a provision for grandfathering, as the certificate multiplier once assigned to a renewable energy generating station will remain valid for a period of 15 years from the date of its commissioning.

The certificates will be issued as per the assigned certificate multiplier. The draft regulations propose that a multiplier will be assigned for a period of three years from the effective date of these regulations. The certificate multiplier for other renewable energy technologies, not covered here, will be notified by the commission on a case-by-case basis. Further, the multiplier may be revised, based on the review of the maturity level and the cost of various renewable energy technologies. The draft regulations also make a provision for grandfathering, as the certificate multiplier once assigned to a renewable energy generating station will remain valid for a period of 15 years from the date of its commissioning.

The draft does away with floor and forbearance price for certificates. Instead, the price for the certificate will be as discovered in the power exchange or as mutually agreed between eligible entities and electricity traders. The commission will intervene only under certain circumstances such as sudden volatility in certificate prices or sudden changes in transactions volume. Further, the draft does not categorise certificates as solar and non-solar.

Conclusion

The objective of multipliers is to promote new investment in renewable energy projects. Further, new renewable energy technologies such as offshore wind, pumped storage hydropower and hydrogen will see easy market entry going forward.