At the COP26 global climate summit in Glasgow in November 2021, India set an ambitious target to reach net zero emissions by 2070. Further, it announced that it would increase its non-fossil energy capacity to 500 GW and meet 50 per cent of its energy requirements from renewable energy by 2030. Solar power, with a total potential of close to 750 GW, is expected to play a major role in helping the country achieve this target. However, unlike historical trends, the focus will be on not only utility-scale but also rooftop solar, including residential rooftop, to scale up India’s solar capacity.

The country’s installed solar capacity stands at 50,778 MW as of February 2022. Of this, 6,476 MW is rooftop solar based, 1,480 MW is off-grid and the rest is ground mounted. The period April 2021 to February 2022 saw rooftop solar capacity additions of close to 2,036 MW against 7,176 MW for ground-mounted solar. While historically, rooftop solar has been preferred by institutional and commercial and industrial (C&I) consumers, it has now also started gaining traction in the residential segment, which, until recently, was considered a challenging market to tap. The attractive cost economics of solar power, discom-led interventions, government subsidies and increasing environment-consciousness amongst consumers are contributing to this transition.

This article examines the benefits of residential rooftop solar, as well as the enabling policies and uptake trends in this up-and-coming segment…

Attractive cost economics

A 2021 global study found that India has a rooftop solar potential of 1.7 PWh per year against its current electricity demand of 1.3 PWh per annum. The study was co-authored by Priyadarshi Shukla, a professor at Ahmedabad University; Shivika Mittal from Imperial College, London; and James Glynn from Columbia University, USA. Siddharth Joshi, researcher at MaREI, the SFI Research Centre for Energy, Climate and Marine at University College Cork, led this team. The study also found that India is the most cost-effective country for generating rooftop solar energy at an attractive price of $66 per MWh. With the domestic consumer segment accounting for more than 20 per cent of the energy demand in the country, there is immense scope to solarise this space.

The benefit of rooftop solar is that it does not need large tracts of land; it can be deployed on any appropriate roof. Thus, rooftops of houses, corporate buildings, industries and warehouses, school and college campuses, hospitals and other institutions are all suitable for rooftop solar installations, which automatically creates a very large untapped potential market. Further, rooftop solar power is generated and consumed locally, without the need to transmit it over long distances, which is a major concern with utility-scale solar farms.

Rooftop solar is highly versatile with a variety of possible business models, depending on the power offtaker. For instance, in the capex model, the power offtaker owns the solar project and the developer merely installs it for a fee. In the opex model, the developer owns and installs the system at the offtaker’s premises for a mutually agreed solar power procurement tariff. The opex model can also have variations, including a power purchase agreement (PPA) model or a leasing model. The opex model has proven to be highly successful in the C&I solar space, giving developers the opportunity to expand their portfolios, and energy-intensive consumers the choice to reduce their power bills using cost-competitive quality solar power without having to worry about financing or even operating the solar installation.

In some cases, progressive discoms tie up with developers to scale up rooftop solar capacities in specific localities in their areas. A slew of tenders has been witnessed in this space in recent months. Discom-led rooftop solar deployment is one of the major drivers of growth in the residential solar segment. In a few cases, community-based solar power deployment is also being explored, especially in the case of housing societies and resident welfare associations.

Enabling policy framework

Enabling policy framework

To promote growth in the residential rooftop solar space, the Ministry of New and Renewable Energy (MNRE) is implementing the Rooftop Solar Programme Phase II with an aggregate target of 4,000 MW in the residential space, to be implemented by 2022. The scheme was launched in March 2019 and the MNRE is providing central financial assistance (CFA) at different levels to support this programme. For individual households, CFA up to 40 per cent of the benchmark cost is provided for rooftop solar plants of up to 3 kW capacity and 20 per cent for plants of capacity above 3 kW and up to 10 kW. A clarification released in the later part of the year stated that rooftop solar installations of 3 kW to 10 kW capacity would get a subsidy of 40 per cent for the first 3 kW and 20 per cent for the remaining capacity. Installations above 10 kW will get 40 per cent for the first 3 kW and 20 per cent for the next 7 kW. According to the statement, no subsidy will be applicable on rooftop solar systems for capacities above 10 kW. For group housing societies or resident welfare associations, CFA is limited to 20 per cent of the benchmark cost for projects of up to 500 kW capacity used for supplying power to common facilities. The programme is being implemented through discoms and residential consumers seeking CFA need to approach the local discom for installing the rooftop solar plant and obtaining the CFA.

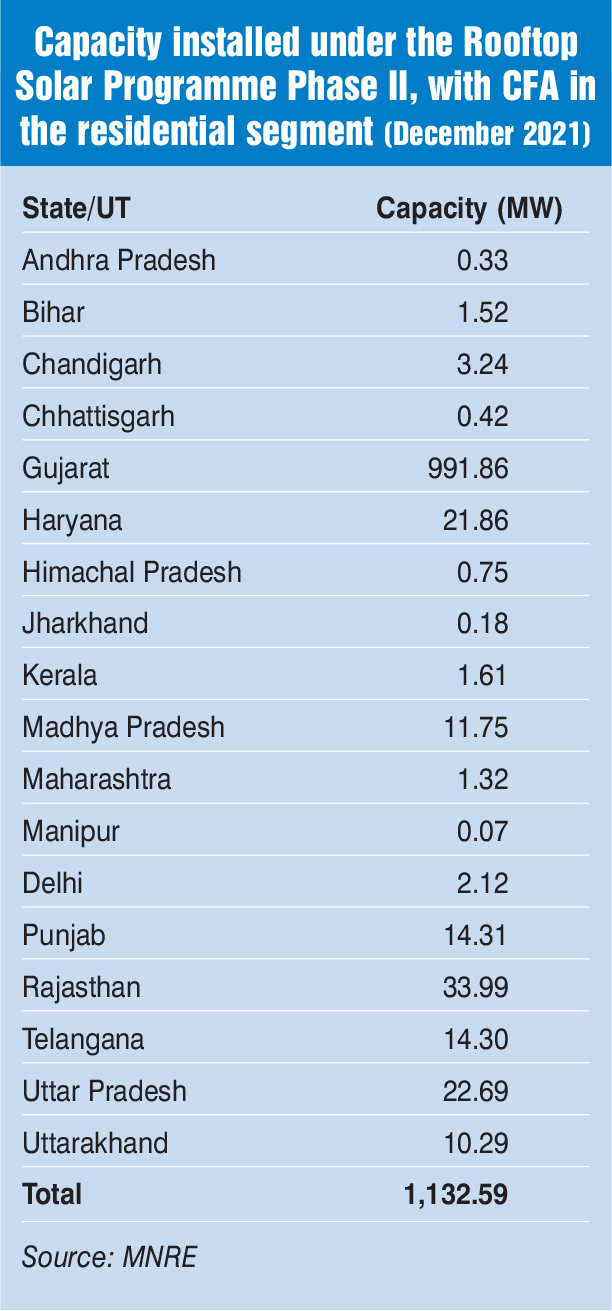

Against the target capacity of 4,000 MW, around 3,300 MW has been allocated to various state implementing agencies based on the demand received from the states. A significant 1,599 MW of capacity has been allocated in 2021-22 and 1,132 MW has been installed as of December 2021, according to MNRE data.

Further, to incentivise discoms to scale up rooftop solar capacity, the same scheme provides progressive incentives to discoms for increases in rooftop solar deployment over the baseline, that is, the cumulative capacity installed at the end of the previous financial year. Under this provision, no incentive is given for capacity addition up to 10 per cent, 5 per cent incentive is given for addition above 10 per cent and up to 15 per cent, and a substantial 10 per cent incentive is given for addition above 15 per cent.

Some important policy developments have taken place early this year to simplify the procedure for residential consumers to set up rooftop solar projects and obtain subsidies. Consumers can either install the rooftop solar plant themselves or get it done through a vendor of their choice through the national portal for applications. This method is in addition to the procedure for installing rooftop solar plants through vendors empanelled by the respective discoms. A national platform will reportedly be set up for registering beneficiary applications and approvals, and for tracking their progress. However, till the time this national platform is ready for use (it is expected to take a month or two), residential consumers will have to go through discoms for setting up rooftop solar plants.

The MNRE has issued a streamlined protocol for residential consumers to avail of this alternative upcoming facility. To obtain the subsidy, households need to inform the discom about the installation and provide a photograph of the system that has been installed. The discom will have to be given intimation of the installation through a letter or on the designated website. The discom will ensure that net metering is provided within 15 days of the information being received. The government subsidy will be credited to the account of the householder by the discom within 30 days of the installation.

In addition, to ensure that the quality of the solar panel and inverter meets the prescribed standard, the government will periodically publish a list of solar panel and inverter manufacturers whose products meet the quality standards, as well as price lists from which householders can select solar panels and inverters.

A growing market

A growing market

With these policy interventions and discoms realising the benefits of rooftop solar to manage their power demand and improve supply, the residential rooftop solar market is finally showing signs of growth. Forward-looking discoms are becoming demand aggregators and tying up with developers to expand rooftop solar capacity while others are helping consumers with financing to set up solar projects. Meanwhile, most discoms are empanelling vendors to make it easy for consumers to select installers.

Perhaps the most laudable efforts have been those of Delhi’s discoms – BSES Rajdhani Power Limited (BRPL) and BSES Yamuna Power Limited (BYPL). In 2018, BRPL launched the Solar City initiative to increase rooftop solar installations in Delhi. In the first phase of the initiative, around 25 housing societies installed solar capacities of 1.5 MW. The tariff discovered through competitive bidding in Dwarka was Rs 2.66 per kWh, which is much lower than the existing electricity tariff charged by the discom. In the later part of 2018, BRPL launched the second phase of its Solar City initiative to cover the residential areas of Shakur Basti with an estimated rooftop solar potential of 15 MW. In November 2019, BRPL partnered with Power Ledger, a blockchain-based renewable energy trader, to launch trials for a peer-to-peer energy trading platform.

Further, under the Suprabha programme led by the World Bank, BYPL approached about 300 housing societies in East Delhi for rooftop solar uptake. The two discoms then partnered with SmartPower to increase uptake of rooftop solar plants at the community level, which entitled consumers to premium financing options for setting up solar systems under a capex model. Further, the excess solar power generated will be purchased by the discoms at a predetermined rate. Other cities such as Chandigarh, Bengaluru, Gurugram, Mumbai and Pune are also witnessing increased uptake of rooftop solar power, with various residential societies in these cities installing rooftop solar projects.

With the success of these programmes, discoms across various states have also started taking significant steps in this area. In March 2021, the Gulbarga Electricity Supply Company invited bids for the development of 10 MW of grid-connected rooftop solar systems with net metering on residential buildings across various regions in Karnataka. The tender was issued under the government’s Soura Gruha Yojane in the districts of Bidar, Kalaburagi, Yadgir, Raichur, Koppal, Ballari and Vijayanagara. The tender was reissued in September 2021. In August 2021, West Bengal State Electricity Distribution Company Limited in-vited bids for empanelling agencies to install 50 MW of grid-connected rooftop solar projects on residential buildings across West Bengal. In October 2021, Gujarat Urja Vikas Nigam Limited decided to extend its residential rooftop solar programme from 600 MW to 750 MW. It agreed to allow registration of residential rooftop solar applications for up to 750 MW of capacity from empanelled vendors for 2020-21 under the SURYA-Gujarat programme.

In another initiative, Tata Power has been contracted by Kerala State Electricity Board Limited (KSEBL) to develop 84 MW of rooftop solar capacity across all districts of Kerala. The project is intended for domestic consumers. Under the agreement, Tata Power will implement projects of 64 MW for individual households and 20 MW for housing societies. The tender for this project was announced by KSEBL in February 2021 under the Soura Subsidy Scheme in the Domestic Sector. Aside from this, Tata Power has set up over 10 MW of installations of 1-5 kW each in the residential segment in Kerala with ANERT, and 32 systems of 5 kW each at the Suvidha Housing Society in Bengaluru. The company also provides attractive financing solutions to attract residential consumers.

Other companies such as Oorjan and Solarify also provide a bouquet of services in the residential solar space, including funding, installation and maintenance.

Outlook

Despite the massive potential for rooftop solar in the residential segment, deployment has been limited so far. The key factors for this slow growth are the lack of awareness amongst consumers about the various government policies and benefits of rooftop solar, preconceived notions about high capital costs and lack of financing options, low residential tariffs, and the fear of getting stuck in bureaucratic problems.

However, most of these issues have been addressed through government incentive schemes as well as financing options provided by various private players and some local discoms. The launch of the national portal for applications will further streamline the processes for applications and subsidies, thereby removing bureaucratic delays. Given that residential tariffs are relatively low, rooftop solar may be more beneficial for high-power-consuming households, large farmhouses and residential societies.

The residential rooftop solar space is growing, slowly but surely. To give this segment a fillip, it is important that the local governments and discoms make residential consumers aware of the available schemes through media promotions and roadshows. This will go a long way in realising the untapped potential of the residential rooftop solar segment.