Ravi Kuchi, Vice-President, Business Development, Indian Energy Exchange Limited

Ravi Kuchi, Vice-President, Business Development, Indian Energy Exchange Limited

The Indian power sector is undergoing a paradigm shift with rapidly increasing renewable capacity addition in the system. Renewable electricity generation has seen over 15 per cent compound annual growth rate over the last few financial years (2016-17 to 2021-22) vis-à-vis a total growth of around 3.5 per cent. India now boasts of the largest installed renewable energy capacity of more than 150 GW (comprising 106 GW renewable electricity and 46.5 GW hydro) and has set a target of achieving 500 GW of renewable energy capacity by 2030, in addition to meeting 50 per cent of its energy requirements from renewable energy.

This expedited growth has been possible due to a favourable policy environment, aided by technological innovations, which have resulted in falling cost curves and renewables achieving/surpassing grid parity. The capacity addition in renewables is primarily driven by long-term PPAs of discoms, either through the competitive route or the earlier feed-in tariff mechanism. However, as the penetration of renewables in the grid increases, new technological and market-based solutions are essential for renewable energy integration and absorption. While hybrid plants (with or without different storage technologies) and distributed solutions are already progressing on the technological front, the recent advent of market-based solutions is providing immense value to renewable energy buyers and sellers, facilitating competitive, transparent and flexible power procurement, with certainty of schedule and time-bound payments.

The exchange-led electricity and renewable energy market provides a diverse spectrum of market-based products and contracts. They include the real-time market (RTM), which began in June 2020, the green term-ahead market (GTAM) launched in August 2020 and the green day-ahead market (GDAM) launched in October 2021. Discoms now have access to real-time exchange-discovered prices to make optimal buy-sell decisions. Also, renewable energy-surplus state discoms, renewable energy generators without PPAs/with expired PPAs, generators who commissioned prior to their scheduled dates, etc., can now monetise their surplus energy immediately and help their counterparts in meeting their renewable purchase obligations (RPOs). With benefits such as transparency and flexibility in procurement that the exchange market segments offer, a pan-Indian green market is facilitating obligated entities such as discoms, open access consumers and captive power plants in fulfilling their RPOs at competitive prices.

GTAM

India’s first exclusive green electricity market commenced at Indian Energy Exchange Limited (IEX) on August 21, 2020. This market now offers options to trade in green electricity for time durations varying from same-day delivery to delivery up to 11 days.

Key observations

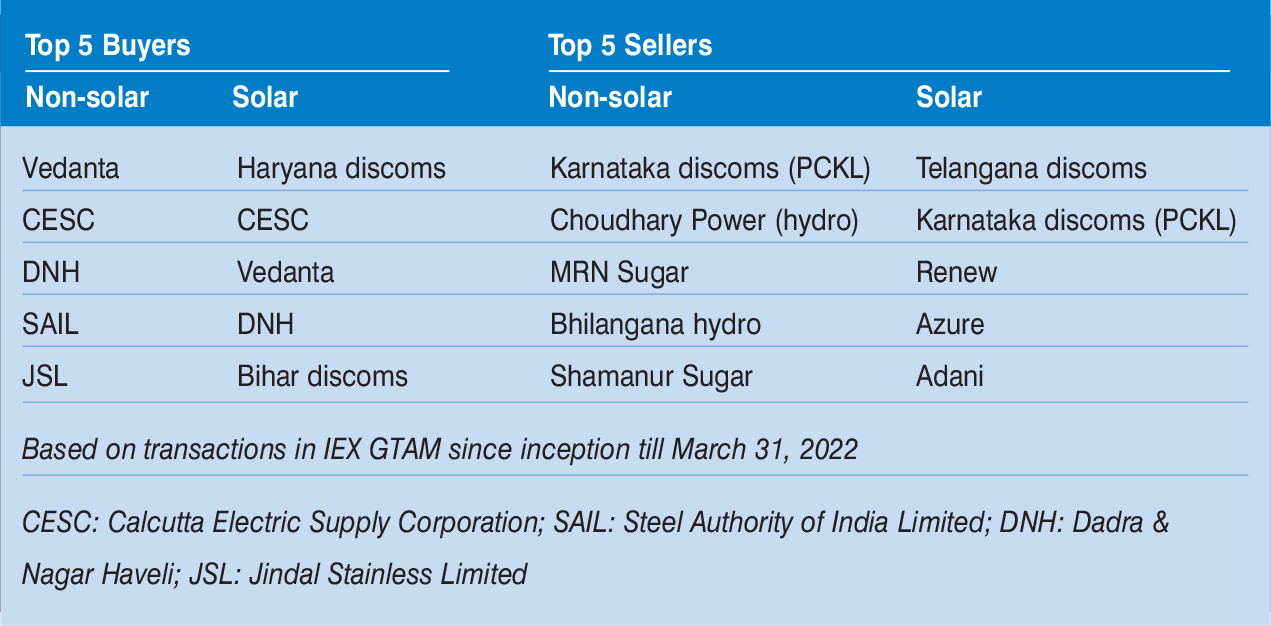

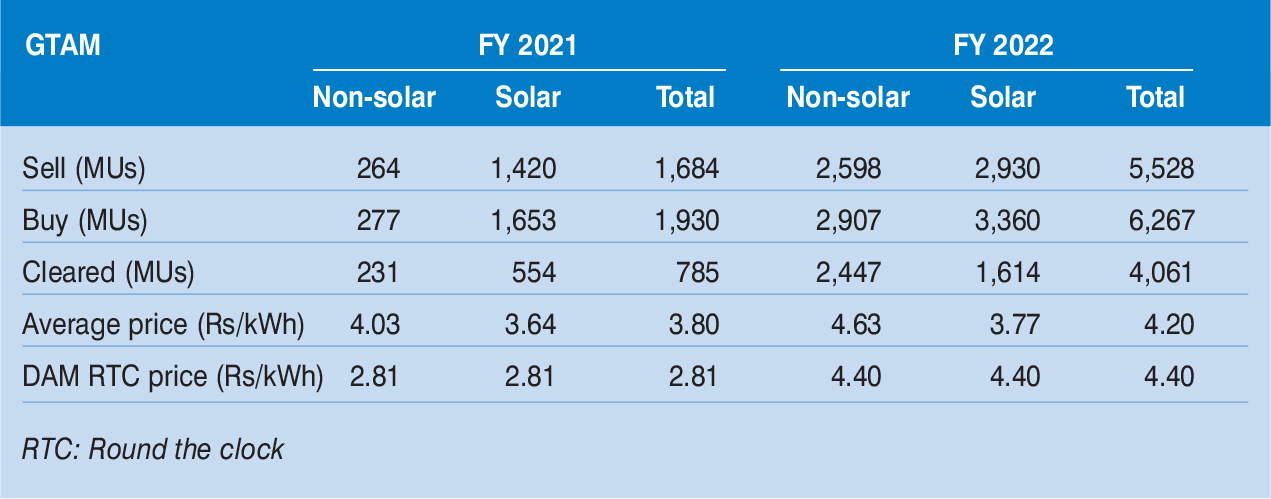

- An excellent response has been received from the market, considering that there has been no pure-play merchant capacity in the renewable segment, to begin with. It must be noted that volumes have increased in financial year 2022 due to the capture of the entire high wind season and increased liquidity with participation from renewable generators and buyers (100 plus participants in financial year 2022).

- Sell side volumes are primarily contributed by Karnataka and Telangana discoms since they can manage their renewable energy surplus on the basis of their portfolio and the prevailing supply-demand scenario of the respective states. However, there has been a gradual increase in the number of generators that are participating in this market (50 plus currently).

- Buy-side volumes are driven by RPO and voluntary targets taken by certain customer segments. Apart from discoms in Bihar, Haryana, West Bengal and Delhi, who look for optimal price points, significant open access volumes have come from the state of Odisha, which offered waiver of cross-subsidy surcharge as well as applicability of only 20 per cent intra-state transmission and wheeling charges for the purchase of green power. Due to these waivers, open access consumers in Odisha such as Vedanta, JSL and SAIL have purchased significantly in these markets. These waivers have been discontinued from April 1, 2022.

- The market subsegments with maximum liquidity – of around 90 per cent – are day-ahead contingency and intra-day as buyers, in particular, industrial customers look for varying demand profiles that can be forecasted near to delivery, while sellers also prefer to rely on more reliable short-term forecasting to avoid deviation settlement mechanism penalties. The price discovery and matching of bids is based on “Continuous Trade” for intra-day, day-ahead contingency and daily contracts and “Uniform Price Step Open Auction” for weekly contracts.

- Market price trends of the DAM, RTM, solar and non-solar GTAM prices shown below indicate the synchronism and convergence of all these markets and the premium commanded by renewable power in normal scenario (except in high-price periods). Premium for the non-solar segment is generally higher than that of solar since with the former, power is available round-the-clock (RTC) including peak hours or in a higher number of time blocks compared to the latter. This RTC availability is on account of the major seller of non-solar power being karnataka discoms that can offer RTC power from their portfolio of non-solar assets (wind, small hydro, biomass etc.), which better suits the requirements of buyers. Further, a couple of small-hydro and seasonal cogeneration plants also offer higher daily plant load factor vis-à-vis solar power.

HPO and GTAM-hydro

HPO and GTAM-hydro

The Central Electricity Regulatory Commission (CERC), vide its order dated February 2022, approved the introduction of hydropower contracts in the GTAM at the IEX to facilitate hydropower purchase obligation (HPO) compliance of obligated entities. The IEX is in the process of launching this market segment shortly.

- The obligated entities procuring renewable energy through hydropower contracts through the proposed separate window in the GTAM shall be eligible to meet their HPOs.

- Similar subsegments and market rules for hydro (solar, non-solar).

- Hydropower plants, commissioned on and after March 8, 2019 and up to March 31, 2030 and having an installed capacity greater than 25 MW would be able to participate in hydro contracts of the GTAM.

- Till now seven states have issued final HPO regulations – Delhi, HP, Haryana, Rajasthan, Uttar Pradesh, Odisha and Kerala. Eight states have come out with draft regulations – Chandigarh, Chhattisgarh, Daman & Diu, DNH, Goa, Gujarat, Puducherry and Assam.

GDAM

GDAM

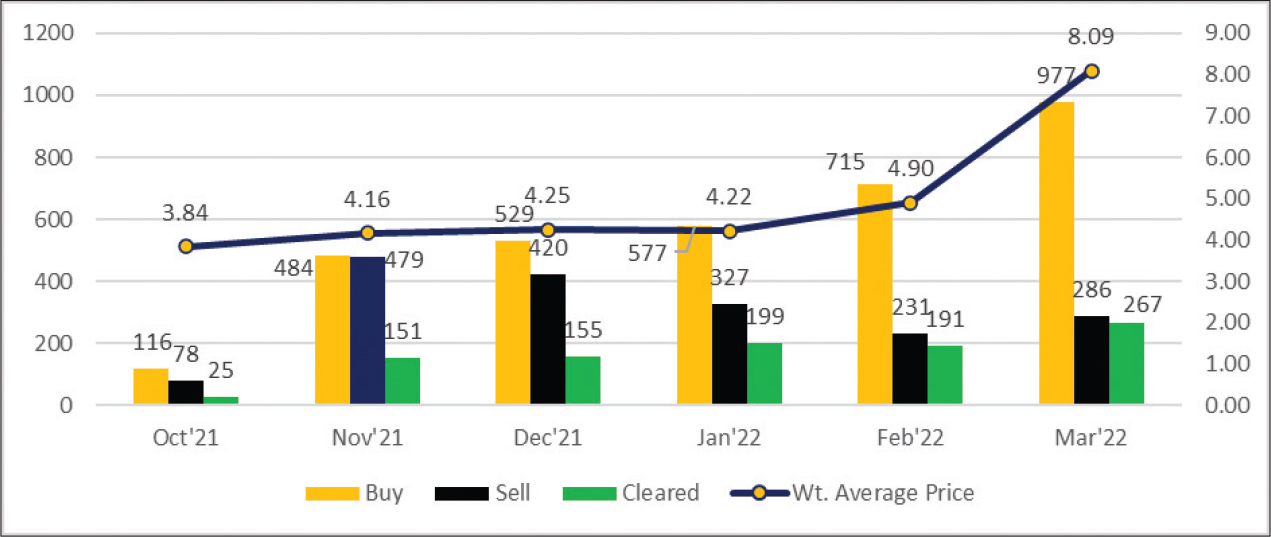

The GDAM segment commenced at the IEX on October 26, 2021, as part of the integrated DAM, where discoms and consumers can fulfil their green power requirements in collective markets. While all other processes remain the same, the market volume and price discovery are prioritised for green bids. Bidders have the option to bid for renewable and conventional power separately and additionally, participants can carry forward uncleared bids from the green market into the conventional market at a premium – or discount – as they deem fit. As on March 31, 2022, the market has accomplished a trade of 920.4 MUs, with an average daily buy of 21.6 MUs and an average daily sell of 11.6 MUs, with an average market clearing price of Rs 5.29 per kWh.

With the advent of the GDAM, currently, renewable energy generators and sellers have got all options to participate in the market. Further, the RTM, with its excellent liquidity, is functioning as the market of last resort. As a case in hand, there are certain renewable energy generators who are bidding under both the GTAM and GDAM segments and are clearing the uncleared volume in the RTM, acting as a price taker.

Green market enablers

Green market enablers

Although the performance of green markets has been promising, the following market enablers will go in a long way in making the market realise its full potential:

- ISTS waiver implementation: The Ministry of Power, vide its order dated June 21, 2021, has waived off ISTS charges for power traded in the GTAM and GDAM till June 30, 2023. However, the same is yet to be implemented by the CERC.

- Dynamic interchangeability between green power and REC: Currently, only non-renewable energy certificate (REC) generators can participate in green markets and no REC gets accrued to sellers when the bid is carried forward from the green market to the conventional market. Providing such flexibility will go a long way in increasing market liquidity as well as options for renewable energy generators, which would result in more trust on the market/merchant route for renewable energy generation.

- Fungibility among different categories of RECs: The recent draft of the CERC REC regulations indicates multipliers among RECs based on different technologies. However, clarity is required over fungibility in RPO compliance as well.

- Allowing renewable energy generators to buy from RTM to manage renewable energy intermittency.

- Uniform forecasting and scheduling (F&S) regulations: Currently, 18 states have issued their F&S regulations, which are indispensable for better day-ahead scheduling of demand/ generation and effective grid operation. It is to be implemented in all states.

- RPO compliance: Although there has been an outstanding increase in the percentage of renewable energy in the country’s energy mix, the RPO compliance targets of many states and captive customers are still not met.

- Parity for market-based option: Availability of renewable energy banking and various waivers given at intra-state renewable energy generation impedes optimal market development. As mentioned earlier, markets provide a better route for renewable energy integration and these should be at least treated at par, if not with more priority.

The way forward

The way forward

The introduction of exchange-based green markets, along with RTM, and their encouraging performance in terms of liquidity, competitive price discovery and premium commanded by the green market segments , has built a strong case for bringing more merchant renewable capacity into the system.

Green markets provide a better route for renewable integration and will help achieve the target of 25 per cent share from spot markets, as mentioned in the draft National Electricity Policy, 2021.

Further, markets act as a stepping stone for new green power procurement models being envisaged – such as virtual PPAs and contracts for difference – and have the potential to fast-forward advances in renewable energy forecasting algorithms, which will help address the key concern of buyers and grid operators, which is the unpredictability of green generation.

In the long term, significant renewable purchase compliance targets, coupled with voluntary green targets committed to by a whole host of industrial and commercial customers, will continue to act as a driver for green merchant capacity addition. The above-mentioned market enablers and support from the lending community will go a long way in meeting India’s ambitious renewable targets. N