Incorporated in 2007, post the unbundling of the erstwhile West Bengal State Electricity Board, West Bengal State Electricity Distribution Company Limited (WBSEDCL) serves a consumer base of around 20.78 million (as of March 2021) and accounts for more than 80 per cent of the power supply in the state. Besides power distribution, WBSEDCL is responsible for hydro generation in the state.

WBSEDCL has consistently registered profits. The discom’s revenue gap has reduced by 50 per cent, from Re 0.02 per unit in 2016-17 to just Re 0.01 per unit in 2020-21. It achieved a high collection efficiency of 100 per cent in 2018-19, with only a marginal decline in 2019-20 and 2020-21, owing to the Covid-induced lockdown in March 2020. The discom is working towards reducing aggregate technical and commercial (AT&C) losses, which have reduced from 28.96 per cent in 2016-17 to 21.35 per cent in 2020-21. WBSEDCL secured the B+ rating in the 9th Annual Integrated Rating of State Distribution Utilities by the Ministry of Power (MoP).

Network growth

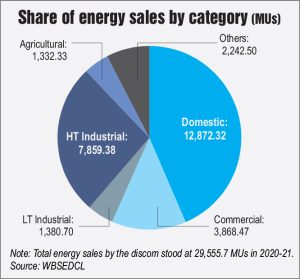

WBSEDCL is responsible for the distribution and supply of electricity across the state except parts of Kolkata, Howrah and Asansol. It caters to a customer base of around 20.78 million (as of March 2021). Of these, 18.34 million are domestic consumers, 1.93 million commercial, 0.11 million low tension (LT) industrial, 0.003 million HT (high tension) industrial and 0.34 million are agricultural consumers. The discom’s energy sales have increased by 6.68 per cent from 27,706.19 million units (MUs) in 2017-18 to 29,555.7 MUs in 2020-21.

WBSEDCL’s line length grew at a compound annual growth rate (CAGR) of about 2.55 per cent from 497,018.47 ckt km in 2016-17 to 549,677.64 ckt km in 2020-21. The majority of its line length is at LT line level (355,910.19 ckt km), while 176,283.45 ckt km is at the 11 kV level and 17,484 ckt km is at the 33 kV level during 2020-21.

The company’s distribution transformers grew at a CAGR of 6.24 per cent from 241,222 transformers in 2016-17 to 307,287 transformers in 2020-21. WBSEDCL’s transformer capacity recorded a CAGR of 8.74 per cent from 19,922 MVA in 2016-17 to 27,849 MVA in 2020-21. The utility has 1,868 distribution transformer at the 33/11 kV level with 12,719 MVA transformer capacity, and 305,419 distribution transformer at the 11/0.433 kV level with 15,130 MVA transformer capacity. Overall, WBSEDCL has 712 substations in its network at the 33/11 kV level.

The company’s feeders have achieved 100 per cent of its metering coverage, while it has achieved 20.9 per cent of metering at its distribution transformers.

On the generation side, WBSEDCL currently owns and operates the 900 MW (4×225 MW) Purulia pumped storage hydro project, which has been operational since 2007-08. During 2020-21, the project generated 1,306.44 MUs of electricity against the Central Electricity Authority’s target of 1,200 MUs. The project has achieved an average plant availability factor of 96.59 per cent and an average cycle efficiency of 77.46 per cent against a design cycle efficiency of 75.5 per cent during 2020-21.

Operational performance

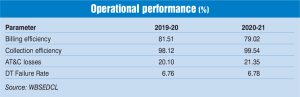

While WBSEDCL’s AT&C losses remain high, they have shown a significant improvement over the years from 28.96 per cent in 2016-17 to 27.33 per cent in 2017-18, 22.97 per cent in 2018-19, 20.10 per cent in 2019-20 and 21.35 per cent in 2020-21. WBSEDCL recorded a billing efficiency of 79.02 per cent and a collection efficiency of 99.54 per cent during 2020-21.

In terms of the overall network reliability, WBSEDCL’s system average interruption frequency index stood at 131.73 in 2020-21 as compared to 128.72 in 2019-20. Further, its system average interruption duration index improved to 86.59 hours in 2020-21 as against 99.53 hours in 2019-20. Meanwhile, the distribution transformer failure rate decreased from 7.85 per cent in 2016-17 to 6.78 per cent in 2020-21.

Financial performance

WBSEDCL’s revenue gap has decreased from Rs 0.019 per unit in 2019-20 to Rs 0.011 per unit in 2020-21.

During 2020-21, the company recorded a revenue of Rs 228.31 billion, an increase of about 38.32 per cent over the Rs 165.06 billion in the previous year. The company’s net profit decreased by around 23.89 per cent and stood at Rs 480.5 million in 2020-21 as compared to a profit of about Rs 631.3 million in the previous year. The utility’s capital expenditure stood at Rs 35.99 billion in 2020-21, increasing at a CAGR of 25.06 per cent from Rs 14.71 billion during 2016-17.

As of March 2021, the company’s outstanding debts stood at Rs 152.62 billion and the debt-equity ratio stood at 3.9. Its payback period was 119 days in 2020-21. The total expenditure stood at Rs 261.45 billion and the power purchase cost contributed the largest share of expenditure at Rs 212.52 billion or 81.29 per cent. In the year 2020-21, WBSEDCL’s return on equity and return on net worth stood at 2 per cent each. While the company’s return on capital employed stood at 30 per cent.

The discom booked a subsidy of Rs 13.74 billion but received Rs 13.65 billion in 2020-21. The earnings before interest, taxes, depreciation and amortisation stood at Rs 19.79 billion in 2020-21.

Future plans

The discom has planned a capex of Rs 131 billion for 2022-23 to 2024-25. This will be mostly spent on upgradation and modernisation of the distribution infrastructure with information and operation technology integration.

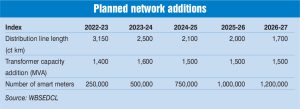

In terms of network expansion, the company has planned an addition of 11,450 ckt km distribution lines, and transformer capacity of 7,500 MVA between 2022-23 and 2026-27. It has also planned 2,050 ckt km of underground cabling by 2026-27. Further, the company plans to install 3.7 million smart meters between 2022-23 and 2026-27.

In January 2022, the World Bank extended a $135 million loan to WBSEDCL to improve efficiency and reliability of electricity supply in West Bengal. The project aims to strengthen distribution networks, invest in smart-grid technologies and ensure financial sustainability of WBSEDCL. The project will be financed by the West Bengal government and loans from the Asian Infrastructure Investment Bank and the World Bank. The $135 million loan from the International Bank for Reconstruction and Development is a variable spread loan that has a maturity of 17 years, including a grace period of seven years. As part of the project, HVDS and AB Cabling would be undertaken in around 13 highest loss-making districts (where eight districts have AT&C losses higher than 25 per cent) besides construction of GIS substations, technology and capacity upgrades in WBSEDCL’s communication infrastructure and implementation of distribution automation technologies, among other things.

WBSEDCL will also be implementing the Revamped Distribution Sector Scheme, which was launched in July 2021 by the MoP to help discoms improve their operational efficiencies and financial sustainability.

On the renewables front, the company plans to develop a 200 MW solar park project at Goaltore, Paschim Medinipur with financial assistance worth Rs 6 billion from KfW Germany. The first phase (125 MW) of the project is expected to be commissioned by June 2024.

Conclusion

Going forward, WBSEDCL has ambitious capex, capacity addition and technology upgradation plans in place that will assist in achieving its aim of becoming more commercially viable and self-sustaining in future, in addition to providing reliable power to consumers.