Emission control from coal-based thermal power plants (TPPs) is the key to facilitating a smooth energy transition in India. Renewable energy capacity is growing at a rapid rate and coal-based plants are expected to play a supportive role in balancing the grid at least in the near to medium term, till energy storage is scaled up commercially. It is, therefore, imperative that these plants operate in an environmentally safe manner till the time they are phased out. However, the pace of implementation of emission control equipment in TPPs remains slow even after seven years of notification of the revised norms by the environment ministry in 2015.

The deadline for meeting these norms has been extended many times – from 2017 initially to 2022 and later to 2025 and now finally to 2027. While the extension takes into account the financial and technical challenges faced by generation companies (gencos) in retrofitting TPPs, repeated delays in compliance may make the gencos complacent and impede progress towards the government’s environmental goals.

Revised timelines for emission norms

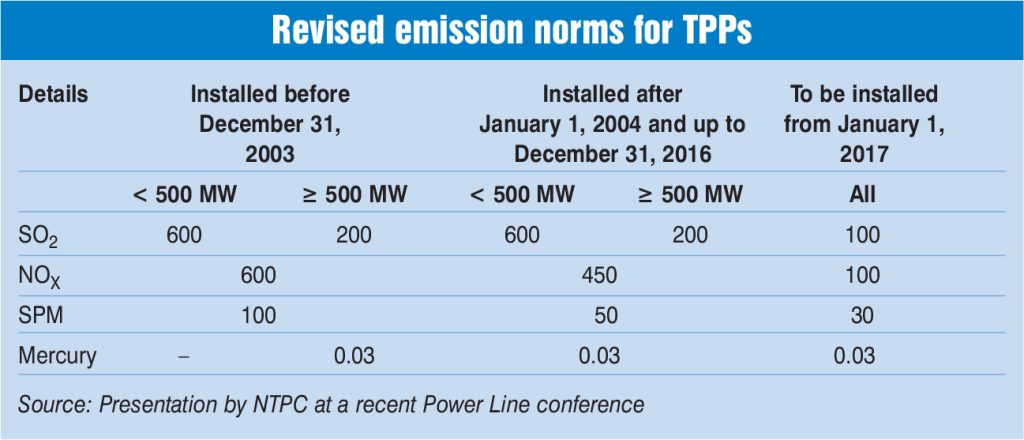

The Ministry of Environment, Forest and Climate Change (MoEFCC) notified the revised emission norms for particulate matter (PM), sulphur dioxide (SO2) and oxides of nitrogen for TPPs in December 2015, mandating TPPs to install emission control systems by December 2017. However, the deadline was pushed to December 2022 for all power stations in the country while power stations in the NCR were required to comply with the revised norms by December 2019.

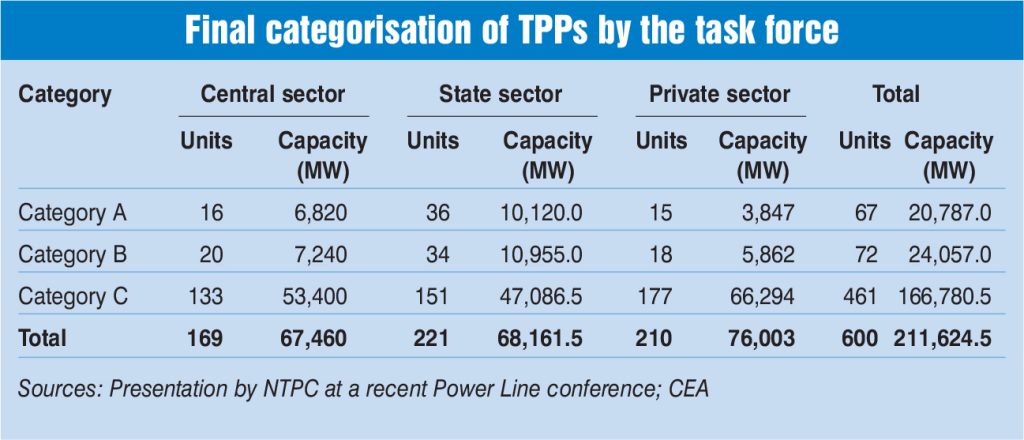

Subsequently, in April 2021, the MoEFCC extended the timelines for complying with emission norms for TPPs by one to three years, and announced the categorisation of plants in three groups through the Environment (Protection) Amendment Rules, 2021. Category A TPPs, comprising plants within a 10 km radius of the NCR or cities that have a million-plus population, are required to meet the emission norms by December 2022. Category B TPPs, comprising plants within a 10 km radius of critically polluted areas or non-attainment cities, have to meet the norms by 2023. Category C includes the remaining plants, which have been given an extension till 2024. In addition to the extension of timelines, the new rules will levy an environment penalty on non-retiring TPPs for non-compliance beyond the timeline. The maximum fine for defaulting plants under Category A is 20 paise per unit, whereas it is 15 paise per unit for plants in Category B and 10 paise per unit for plants in Category C.

As per the final categorisation by the task force constituted by the Central Pollution Control Board (CPCB), 600 coal-based units have been divided into three categories. Accordingly, 67 coal-based units fall under Category A, 72 fall under Category B and 461 fall under Category C.

In September 2022, the MoEFCC once again extended the deadlines for TPPs to cut sulphur emissions by two years. Based on their location, the TPPs now have time up to December 2026 to comply with the emission norms. For coal-based units that fall under Category A, the deadline for emission norm compliance has been extended from December 31, 2022 to December 31, 2024. For TPP units under Category B, the deadline has been pushed from December 31, 2023 to December 31, 2025. For all other TPPs across the country falling under Category C, the deadline has been pushed from December 31, 2024 to December 31, 2026. The TPP units declared to retire before December 31, 2027 will not be required to meet the specified norms for SO2 emissions in case such plants submit an undertaking to the CPCB and the Central Electricity Authority (CEA) for exemption on grounds of retirement. Also, TPPs declared to retire before December 31, 2022 (Category A) or December 31, 2025 (Categories B and C) will not be required to meet the specified norms for parameters other than SO2 emissions, in case such plants submit an undertaking to CPCB and the CEA for exemption on the ground of retirement.

Besides, the new rules state that environment compensation will be levied on non-retiring TPPs, in case of non-compliant operation beyond the timeline. The environment compensation will be Re 0.20 per unit, Re 0.30 per unit and Re 0.40 per unit for 0-180 days, 181-365 days, and 366 days and beyond, respectively.

Progress by TPPs

According to the CEA’s data, as of October 2022, flue gas desulphurisation (FGD) systems for SOX control have been commissioned and are operational for 8,780 MW of capacity across 21 units. Bids have been awarded for 197 units aggregating 88,690 MW of capacity. Apart from this, tenders have been issued for 35,185 MW and feasibility studies have been completed for 18,425 MW.

For the control of PM emissions, most TPPs have already installed electrostatic precipitators (ESPs) since Indian coal has a high ash content. However, upgraded systems could be required for existing projects. In addition, the environment ministry’s decision to do away with coal washing makes it more important for TPPs to invest in efficient PM control technologies. A detailed phasing proposal has been prepared by the CEA, outlining the plan of action for the augmentation of ESPs for SPM control up to 2024. ESP implementation plans are available for 222 units aggregating 64.5 GW in capacity. NTPC is also undertaking the renovation and modernisation of ESPs in around 4 GW of capacity across 13 units.

Mercury control is a co-benefit of the NOX, SOX and PM control technologies that exist as well as sorbent injection technology. The level of control is strongly affected by the type of mercury emitted, the type of air pollution controls deployed, coal type and chlorine levels. At NTPC, mercury analysers for emission and air monitoring have been installed. In addition, the necessary environmental monitoring data has been made available to the central and state pollution control boards, as per their requirements. To further minimise efficiency losses at stations, plant information system-based applications for real-time efficiency and loss calculations have been put in place.

Regarding NOX emissions, the level of 450 mg per Nm3 can be achieved by combustion modification. To lower NOX emissions, NTPC has awarded combustion modification for over 20 GW of capacity. Further, combustion modification in 28 units of around 13 GW including units located in NCR, that is, two units of the Dadri TPP and three units of the Jhajjar TPP, have already been completed. Further, awards for combustion modification have already been given for 50 units of around 21 GW.

Utility experience and challenges

Only a few utilities have installed FGDs in the country so far, NTPC being one of them. The company has implemented FGDs for 1,340 MW of capacity and has been able to achieve 70 per cent reduction in SOX emissions from 4.92 gm per kWh to 0.93 gm per kWh. Given that the company has an expansive TPP footprint, it has awarded FGD capacity for over 60 GW of plants in 2.5 years, which is significant given that the scope of FGD equipment and facilities is comparable to that of a 200 MW TPP itself. The company faced several challenges in FGD implementation such as limited space for equipment installation in TPPs, import restrictions, limited chimney and civil works vendors, lack of foreign technology partners for FGD core equipment and a steep hike in steel prices since March 2020.

State genco Andhra Pradesh Generation Corporation Limited has faced similar challenges. APGENCO’s Dr Narla Tata Rao thermal power station (NTTPS) units have been placed under Category A while the Rayalaseema thermal power plant (RTPP) and the Sri Damodaram Sanjeevaiah thermal power station (SDSTPS) come under Category C. Tenders were invited for NTTPS Stage V (1×800 MW) and SDSTPS Stages I and II (3×800 MW). Only one bidder, BHEL, responded and submitted a bid for the former, while no bidder has responded to the latter. For NTTPS Stage IV (1×500 MW) and RTPP Stage VI (1×600 MW), a technical consultant has been appointed for pre- and post-EPC services. For RTPP Stages II and III, a process for appointing consultants is being taken up. Some of the key challenges faced by the utility are a steep price escalation of FGD capital costs and difficulty in loan tie-up with financial agencies due to uncertainty in the recovery of expenditure.

In the case of private developers, FGD systems at the Nabha Power and Tata Power plants are at advanced stages of construction and are likely to be commissioned within the scheduled time frame. Technology-wise, Tata Power is using seawater-based FGD for its Mundra plant, and wet limestone-based FGD for the Maithon and Prayagraj TPPs. Nabha Power is using jet bubbling reactor technology from Chiyoda. Meanwhile, based on past experiences, CESC Limited has decided to opt for wet limestone-based FGD. The company’s plans are slightly behind schedule because of containment of Chinese imports and supply chain disruptions caused by Covid-19.

Net, net, compliance with emission norms by TPPs has been tardy in view of the challenges, but going forward, gencos as well as other stakeholders must take steps to overcome these hurdles and meet the compliance deadlines.

Neha Bhatnagar