Although the development of the electric vehicle (EV) market has been marginal in India as compared to established markets in Europe, North America and China, it has gained notable traction in recent years. Various business models are being explored and tested for commercial viability. While India does not have any mature or proven successful business models for EV charging yet, some models are being tried widely, including public-private partnership (PPP), facilitation through discoms, urban local bodies (ULBs), power generators and public transport corporations set up by automakers. A mix of public and private charge point operators (CPOs) is currently leading the development of public charging infrastructure. A look at various business models being adopted for EV charging infrastructure …

Business models

Various business models have emerged for EV charging infrastructure, including ULB-operated infrastructure, PPPs, utility-anchored charging infrastructure, transport company, fleet operator and auto company owned and operated infrastructure. According to a Deloitte study, in the nascent Indian market, PPP-led and public transport corporation models are ideal as both risk levels and initial investments are low in these cases. Due to the limited availability of charging stations, fleet operators have also opted for setting up their own facilities. Moreover, at present, many CPOs and developers are taking initiatives to install captive charging stations in commercial spaces on their own to increase visibility, bring confidence amongst EV buyers and address the range anxiety issue to some extent. Some of the business models:

Led by ULBs: ULBs such as municipal corporations and area development authorities own and operate charging stations, while electric utilities provide the infrastructure and technical support. Some private entities can also be part of the collaboration to set up charging stations. For this, public land, aggregated from different government and public sector bodies, is provided for the installation of charging facilities. Under this set-up, the facility could operate at a fixed rate for park and charge, with revenue distributed between entities.

Led by public transport corporations: EV charging stations can be set up at areas designated by public transport corporations such as bus depots and parking lots. These can help meet charging demands of the electric fleet. Under this set-up, cab and autorickshaw aggregators will pay the utility charging fees.

PPP: A private entity is responsible for financing the charging station installation, operations and maintenance in this model and the utility takes care of the land and electricity infrastructure. The charging rate is fixed using a competitive process and both investment (except land) and revenue risks are borne by the private operator. With a fixed charge, irrespective of the utilisation rate of the charging station, electric utilities are assured a fixed revenue.

Anchored by discoms: In this model, an electric utility or discom owns the charging station and operates it either directly or through their franchisees (or contractors). Charging facility assets form part of the regulated assets of the discom, which is responsible for the electricity distribution as well as operations and maintenance of the facility.

Facilitated by transport aggregators or corporates: Fleet operators require charging facilities for their EV fleets. In this case, land is provided by the fleet operator, who may own or lease it. The adoption of e-fleets is witnessing an increasing trend across big corporations. The need to meet sustainability targets and demand from employees mean fleet managers are turning to EVs. However, the business case of fleet EV adoption is a key driver. The advantages of this model include low maintenance costs, attractive utilisation rate of charging points, thus making the investment viable.

Owned by charge point developers: A CPO installs and maintains charging stations, so that drivers can charge their EVs. In this, CPOs can either own and operate a set of charging stations, or simply operate them for third parties. The operational role of the CPO involves purchasing charging stations, installing hardware and maintaining the network connection. The operator is also involved in setting prices for charging infrastructure use and managing the connection to e-mobility service providers.

Initiatives being taken in the Indian market

Currently, Energy Efficiency Services Limited’s (EESL) subsidiary, Convergence Energy Services Limited (CESL), is supporting the roll-out of public charging infrastructure in India. In a recent development last month, CESL announced the list of selected agencies for the installati-on of 124 battery swapping stations, 352 standing chargers for electric two- and three-wheelers and 1,294 standing DC fast chargers for electric four-wheelers across eight cities. These will be built under a build-own-operate model valid for eight years. Under this tender, CPOs will be given a right to use the sites provided to them by CESL for setting up and operating the charging infrastructure in the area. This business model is a shift from the earlier mode of business where CESL was responsible for investing, owning and operating these stations. With this tender, CESL has under implementation 1,770 EV charging stations. Apart from EESL, various other PSUs such as NTPC Limited, Rajasthan Electronics and Instruments Limited and Bharat Heavy Electricals Limited have announced plans to implement EV charging stations on a massive scale across the country. Meanwhile, oil PSUs that are seen to be in a strategic position to build charging infrastructure, especially on highways and expressways across the country, are letting CPOs set up their charging stations at retail outlets. Oil marketing companies such as Indian Oil Corporation Limited, Bharat Petroleum Corporation Limited and Hindustan Petroleum Corporation Limited have pledged to use their outlets to cumulatively set up 22,000 EV charging centres by 2025. Discoms such as BSES, Tata Power Delhi Distribution Limited and Bangalore Electricity Supply Company Limited are proactively partnering with several market players for setting up charging stations and battery swap points in their areas of operation. The National Highways Authority of India is also working closely with the government to build charging infrastructure on national highways. It plans to cover 35,000-40,000 km of national highways, with charging stations, by 2023. Additionally, charging station network developers such as Fortum, Magenta Power, Volttic and TecSo Charge Zone have developed their own charging platforms for managing their EV charging networks. Further, vehicle original equipment manufacturers (OEMs) are collaborating with CPOs for providing existing and upcoming buyers with assurance regarding public charging points. For instance, vehicle OEMs such as Hero Electric, BYD India and Ather Energy have tied up with CPOs such as Charge Zone and Magenta ChargeGrid.

Tariff design and policy support

Tariff design and policy support

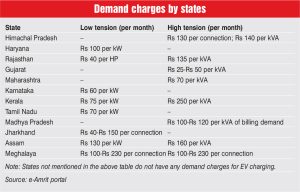

There is significant variation across states in terms of tariff design. A few states have introduced demand charges, which include Gujarat, Haryana, Karnataka and Maharashtra, while some states have notified only energy charges, such as Andhra Pradesh, Delhi, Chhattisgarh, Telangana and Uttar Pradesh, among others. Each state sets its own rates for distinct consumer groups, therefore, the two sides of the tariff, energy and demand charges, differ from one another. The fixed or demand charge for an electricity connection is levied on the sanctioned load for the connection or the maximum power demand registered during the billing period, which must be paid irrespective of the actual power usage. Energy charges are the variable component of an electricity tariff, applied on the total volume of energy/electricity consumed during the billing period. Further, in January 2022, the Ministry of Power issued revised guidelines with the intent of channelling private investment towards EV charging infrastructure and ensuring that EVs are charged at competitive tariffs. According to these guidelines, tariff for electricity supply to public charging stations (PCSs) will be a single-part tariff and will not exceed the average cost of supply until March 31, 2025. The same tariff will be applicable to battery charging stations. Also, the tariff applicable to domestic consumption will be applicable to domestic charging. There will be a separate metering arrangement for PCSs, so that consumption may be recorded and billed as per tariffs for EV charging stations. Discoms may leverage funding from the revamped distribution sector programme for the general upstream network augmentation necessitated by upcoming charging infrastructure in various areas. As per new guidelines, land available with the government or public entities will be provided to install to a government or public entity on a revenue sharing basis at the fixed rate of Re 1 per kWh.

The way ahead

In sum, multiple EV charging business models are available at present, in the same region and/or city. The industry will have to adopt the model that best meets its requirements and will also have to come up with innovative models, going forward, to adapt to the changing market dynamics.

Nikita Gupta