Hydropower is perhaps one of the oldest sources of clean power generation in India, but it has failed to grow at the desired pace over the past few years. Hydropower capacity additions have lagged behind thermal as well as renewable energy such as wind and solar. Between 2013-14 and 2021-22, the installed thermal power capacity grew at a CAGR of 4.3 per cent while hydropower grew at 1.8 per cent. In contrast, solar and wind registered a CAGR of 46 per cent and 8.5 per cent during this period. However, the hydropower segment is now gaining traction in light of the country’s net zero ambitions and international climate change commitments. Hydropower is a green energy source that offers storage, flexibility and round-the-clock power, and helps serve peak hours. Therefore, it is expected to play a key role in maintaining grid stability in the evolving energy landscape.

Size and growth

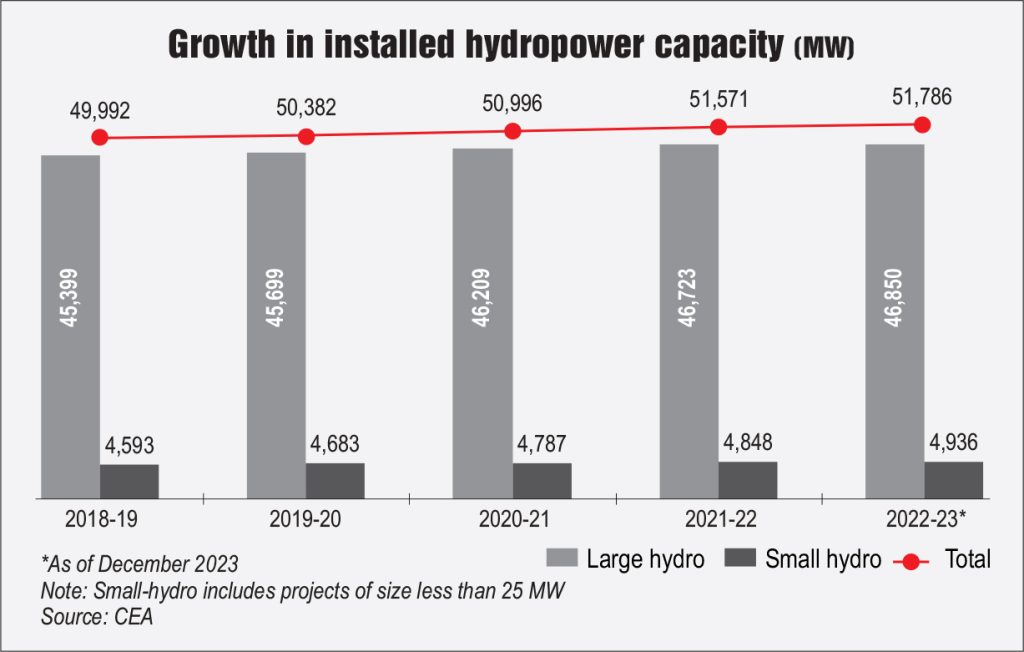

The installed large hydropower capacity in the country stood at 46,850.17 MW as of December 2022. If small-hydro power is added, the overall hydro installed capacity aggregates to 51,785 MW, accounting for a share of 12.6 per cent in the total installed capacity. Some hydroelectric plants (HEPs) commissioned in recent years include Uttarakhand Jal Vidyut Nigam Limited’s Vyasi Units 1 and 2 (2×60 MW), North Eastern Electric Power Corporation Limited’s Kameng HEP Units 3 and 4 (150 MW each), Himachal Pradesh Power Corporation Limited’s Sawra Kuddu HEP Units 1, 2 and 3 (37 MW), L&T Uttaranchal Hydro Power Limited’s Singoli Bhatwari HEP Units 1-3 (3×33 MW), Units 1 and 2 (2×50 MW) of the Sorang HEP in Himachal Pradesh, and Units 1 and 2 (2×56.5 MW) of the Rongnichu HEP in Sikkim.

In terms of generation, hydropower plants generated 151 BUs of electricity in 2021-22, about 0.88 per cent more than the previous year. During April-November 2022, hydropower generation stood at nearly 130 BUs, an increase of about 10 per cent over the same period last year.

Overall, hydropower capacity additions have remained muted in the past with just 2,138 MW of capacity added in the five-year period between 2017 and 2022. Meanwhile, nearly 41.7 GW of solar and 8 GW of wind energy capacities were added during this period. As of March 2022, hydropower accounted for a 30 per cent share in the total renewable energy capacity in the country, while solar and wind accounted for 34 per cent and 26 per cent share respectively. The remaining was contributed by biomass (4 per cent) and small hydro (1 per cent).

Growth drivers

Policymakers have increased their focus on hydro as it is crucial for meeting the country’s climate change commitments of sourcing 50 per cent of energy from renewables and having a non-fossil fuel energy capacity of 500 GW by 2030.

Besides, hydro is one of the most reliable sources of peaking power and the largest source of flexibility today. Given the growing share of renewable energy, India’s ramping needs are expected to increase significantly by 2030 vis-à-vis 2020 – maximum hourly ramps could climb from 16 GW to 68 GW. Hydropower is extremely versatile and capable of delivering multiple functions – peak load shaving, regulation and frequency response, spinning and non-spinning reserve, voltage support, etc.

Pumped storage plants (PSPs) are beneficial for addressing grid flexibility concerns as they are the least expensive large-scale storage technology on a levellised cost basis. Currently, India’s PSP capacity stands at 4,745.6 MW across eights plants (six of which are working in pumping mode). Meanwhile, three PSP schemes totalling 2,700 MW are under construction and slated to be commissioned by 2024-25. Further, PSP projects aggregating nearly 22 GW are under survey and investigation as per the CEA. Further, India’s growing demand necessitates that all available clean sources of energy are utilised. As per the CEA’s Draft National Electricity Plan (September 2022), the country’s peak demand is set to increase to 272 GW by 2026-27 and to 325 GW by 2029-30 from the current level of 206 GW (December 2022). Similarly, the energy demand is forecasted to increase by 1.6 times from 1,379 BUs in 2021-22 to 2,256 in 2029-30.

Key recent developments

Policy/Regulatory initiatives: In December 2022, the Ministry of Power (MoP) issued an order for the waiver of interstate transmission system (ISTS) charges on transmission of electricity generated from new hydropower projects, for which construction work is awarded and power purchase agreement (PPA) is signed on or before June 30, 2025. The waiver is already available to solar and wind power projects. For hydropower projects that will be awarded construction work and will sign PPAs between July 1, 2025, and June 30, 2026, 25 per cent of ISTS charges will be applicable. For projects that are awarded construction work and have signed PPAs between July 1, 2026, and June 30, 2027, 50 per cent of ISTS charges will be applicable, while projects for which construction work is awarded and PPAs are signed between July 1, 2027, and June 30, 2028, 75 per cent of ISTS charges will be applicable. Further, 100 per cent ISTS charges will be applicable for hydro projects from July 1, 2028. The waiver/concessional charges will be applicable for a period of 18 years from the date of commissioning of the hydropower plants. The waiver will be allowed for ISTS charges only and not losses. It will be made applicable from the prospective date.

On December 30, 2022, the Central Electricity Regulatory Commission passed an order against a petition on the introduction of hydropower contracts in green contingency and green term-ahead contracts and additional term-ahead and green term-ahead contracts beyond T+11 days at the Hindustan Power Exchange (HPX), a newly launched power exchange in the country. Subsequently, the HPX introduced the trading of hydropower contracts in green contingency contracts (green intra-day and green day-ahead contingency contracts) in addition to existing solar and non-solar contracts under the green term-ahead market segment with effect from January 11, 2023. Further, the MoP has recently launched the Large Hydro Active Reach-out (LAHAR) initiative with the objective of informing the public about the benefits of hydropower projects and its positive impact on socio-economic development while allaying fears of negative impacts. In December 2022, the first LAHAR conclave was organised, led by SJVN Limited, wherein hydro PSUs deliberated on challenges in the sector and ways of resolve them.

State sector updates: In January 2023, the Arunachal Pradesh government decided to award five terminated hydropower projects with a generation capacity of 2,820 MW to two central public sector undertakings. These five projects would require an investment of Rs 400 billion in the next five to seven years. Of the five projects, two hydropower projects – Naying (1,000 MW) and Hirong (500 MW) – will be handed over to North Eastern Electric Power Corporation Limited (NEEPCO); and these Emini (500 MW), Amulin (420 MW) and Minundon (400 MW) – to SJVN for development. These projects will provide revenue of around Rs 5 billion per year and around Rs 1 billion for local area development.

In December 2022, the Andhra Pradesh State Investment Promotion Board (SIPB) approved investments worth Rs 239.85 billion in the state including pumped hydro storage projects to be set up by Adani Green Energy Limited (AGEL) and Shirdi Sai Electricals. AGEL will set up 1,600 MW of pumped hydro storage power projects at an investment of Rs 63.3 billion. The company will set up a 1,000 MW plant in Pedakota, Alluri Sitarama Raju district, and a 600 MW plant at Raiwada in Anakapalli and Vizianagaram districts. Work on the project is proposed to commence in December 2024 and the project is set to be commissioned within four years. It will produce around 4,196 MUs of electricity per year. Further, the SIPB has cleared Rs 88.55 billion for hydro storage projects by Shirdi Sai Electricals Limited, which will set up two units with an aggregate capacity of 2,100 MW. The company will set up a 1,200 MW project at Yerravaram and a 900 MW project at Somasila. The work is expected to commence in July 2023 and will be completed in phases by December 2028.

In September 2022, the Himachal Pradesh government invited global bids for two HEPs with a total generation capacity of 520 MW in Lahaul valley of Lahaul-Spiti district. Initially, the bids were invited three years ago but the company that was allotted the project did not start work. The projects include the 400 MW Seli HEP and the 120 MW Miyar HEP.

Company/Project updates: In January 2023, the Cabinet Committee on Economic Affairs approved the investment for the 382 MW Sunni Dam hydroelectric project in Himachal Pradesh by SJVN. The estimated cost of the project is Rs 26.15 billion including Rs 138 million as budgetary support from the Government of India to set up enabling infrastructure. Ex-post facto approval has been given for cumulative expenditure amounting to Rs 2.46 billion incurred till January 2022. The project cost includes the hard cost amounting to Rs 22.46 billion, and interest over construction and financing charges of Rs 3.59 billion and Rs 91.5 million respectively. The revised cost sanctions for cost variations due to quantity changes (including additions/alterations/extra items) and time overruns caused by the developer will be capped at 10 per cent of the sanctioned cost.

In December 2022, SJVN’s arm SJVN Green Energy Limited and GRIDCO Limited announced a joint venture (JV) to develop a 1,000 MW HEP and a 2,000 MW solar project at an investment of Rs 200 billion in Odisha. An MoU was signed for developing the projects through a JV company. The projects will enhance the green generation capacity and assist in meeting the renewable purchase obligation target of Odisha. Further, the projects will offer employment opportunities, support local businesses, reduce carbon emissions and help in sustainable development of the state.

In November 2022, NEEPCO inaugurated the 600 MW Kameng hydropower station located in Arunachal Pradesh. The project has been developed at a cost of more than Rs 82 billion. The project has two dams and a powerhouse with four units of 150 MW each to generate 3,353 MUs of electricity annually. This will make Arunachal Pradesh a power-surplus state with huge benefits to the national grid in terms of grid stability and integration and balancing of solar and wind energy sources in the grid. The project will contribute to the projected hydro capacity addition of 30,000 MW by 2030.

In October 2022, JSW Energy Limited, through its wholly owned subsidiary JSW Neo Energy Limited, entered into an MoU with the Maharashtra government for setting up the 960 MW Pane (Raigarh) PSP in the state. The company, through its green growth vehicle JSW Neo Energy, has been securing key resources for hydro PSPs in various resource-rich states for projects with a targeted capacity totalling up to 10 GW. With the signing of the MoU, the company has secured resources for around six GW of hydro PSPs with the Governments of various states – Maharashtra, Chhattisgarh, Telangana and Rajasthan.

In August 2022, the Greenko Group secured a loan of Rs 55 billion from the Power Finance Corporation off-river power storage project at Pinnapuram in Kurnool, Andhra Pradesh. This project is a component of Greenko’s integrated renewable energy project (IREP) in Pinnapuram. Under the IREP’s first phase, a standalone pumped storage component of 1,200 MW will be developed along with solar and wind power generation components of 1,000 MW and 550 MW respectively.

In July 2022, NHPC Limited signed an MoU with the Damoder Valley Corporation (DVC) to explore the formation of a JV for exploring and setting up hydropower and pumped storage projects. The MoU heralds a new beginning in cooperation between the two power sector organisations for harnessing hydropower and pumped storage projects as energy storage solutions to meet the national objective of 500 GW of renewable energy by 2030 and net zero emissions by 2070. The MoU envisages the joint development of mutually identified projects.

Issues and future outlook

The CEA’s draft NEP projects hydro capacity additions (including small hydro but excluding imports of 5,856 MW) of over 20 GW each during 2022-32 (10 GW each in 2022-27 and 2027-32). This is a tenfold increase from the present level and requires policy support in the form of a well-defined remuneration mechanism for hydropower and PSP projects, affordable financing, streamlined processes for obtaining environment clearances, and development of off-river potential. The current challenges affecting the sector include a dearth of financially sound civil contractors, resettlement and rehabilitation issues, and geological surprises, which lead to considerable time and cost overruns for HEPs. Nearly 1.2 GW of HEPs are currently stalled because of varying issues. Since civil works constitute a major part of the overall time and cost of an HEP, it has always remained an area of concern and the government is planning to take measures like easing the cash flow to contractors and relaxing the qualification requirements to address the problem. In addition, much of the hydroelectric potential in the country lies in climate-vulnerable regions (60 per cent of our 145 GW hydro potential lies in Himachal Pradesh, Uttarakhand and Arunachal Pradesh).

Net, net, hydropower has immense potential and steps must be taken to resolve the issues plaguing the sector while ensuring the sustainable development of projects.

Neha Bhatnagar