India has well established manufacturing facilities for the main plant equipment like boilers, turbines and generators (BTG), and the current industry size is estimated to be over 30 GW. However, the general slowdown in the power sector has led to a decrease in orders for such equipment, leading to a major underutilisation of the existing manufacturing facilities. During the past three years, the average power project awards have been less than 9 GW against the annual rate of 25-30 GW between 2007-10. Delays in power projects and lack of investor interest in the sector due to structural issues have led to fewer projects in the pipeline. While a few contracts have been awarded by the central and state sector utilities, there have not been any significant new orders from the private sector.

However, an estimated 22 per cent of Indian coal-based generation plants are over 25 years old and will need to be upgraded for performance and efficiency, which requires BTG equipment. This requirement, especially for the replacement of old thermal power plants (TPPs) with new supercritical units, lends optimism to suppliers.

Market overview

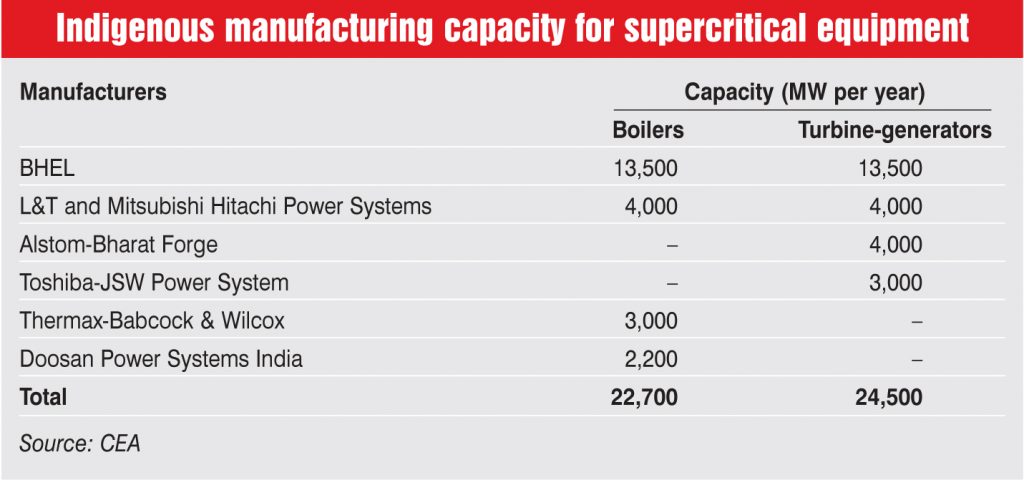

Bharat Heavy Electricals Limited (BHEL) has the largest share of the indigenous manufacturing capacity, at 20,000 MW. BHEL’s power division secured orders worth Rs 385.29 billion for 9,221 MW of power projects during 2015-16, taking BHEL’s market share to 74 per cent. These orders include 10 turbines and generators and 12 steam generators for supercritical sets, which are a record number for a single year. The largest single order in the past year was made by the Tamil Nadu State Generation Company, valued at Rs 179.5 billion, for its Yadadri project for five 800 MW units. BHEL also won the contract for the first private sector TPP project awarded in the country over the past four years. The order was made by Megha Engineering and Infrastructure Limited for Unit 1 of the 525 MW Tuticorin Stage IV project.

Much of the growth in the equipment industry’s capacity has been attributed to the introduction of the bulk tender concept. Back in 2009, bulk orders for supercritical units for NTPC Limited and Damodar Valley Corporation were approved by the government. These orders incorporated the mandatory requirement of indigenisation of manufacturing of supercritical units by the successful bidders as per a pre-agreed phased manufacturing programme (PMP). Encouraged by the bulk orders awarded by the government with mandatory PMP provisions, most joint ventures (JVs) today are in an advanced stage of completion of their manufacturing facilities. The JV between Larsen & Toubro (L&T) and Mitsubishi Hitachi Power Systems has the second largest equipment manufacturing capacity, with 4,000 MW each in boilers and turbine generators. However, L&T claims that due to intense price competition, it was unable to win any significant project order in 2015-16. Other major players in the market include Alstom-Bharat Forge, Toshiba-JSW, Gammon-Ansaldo, Thermax-Babcock & Wilcox, BGR-Hitachi, and Doosan-Chennai Works.

Challenges and outlook

The thermal power sector as a whole faces a number of challenges, ranging from delayed environmental clearances, dearth of fuel availability and increased difficulty in obtaining water linkages to limited access to long-term funding. In such a situation, new projects are less likely to be commissioned. Therefore, there is a diminished demand for BTG equipment. Further, the dependence on large imports of raw materials, castings and forgings, tubes and pipes of alloy steels, and cold-rolled grain-oriented steel for BTG equipment is also a limiting factor. Going forward, BTG equipment suppliers rest their expectations for the gradual inflow of orders on the requirement for new supercritical units. Nearly 10,180 MW of new supercritical units have been proposed to be set up in the public sector, in place of the retired old subcritical units totalling 5,228 MW. Further, compliance with the new environment norms by the TPPs is likely to improve market prospects. According to ICRA’s estimates, the capex requirement of Rs 1.2 trillion for the operational TPPs to comply with the revised pollution norms would also boost the capital goods sector’s order inflows.