Power utilities in the country delivered a mixed performance in 2016-17. The reforms introduced by the government and their effective implementation have led to operational and financial improvement in the distribution segment. Under the Ujwal Discom Assurance Yojana (UDAY), the discoms have recorded a reduction in aggregate technical and commercial (AT&C) losses as well as in the gap between the average cost of supply and average revenue realised. Meanwhile, the majority of transmission utilities have recorded a decline in their transmission losses. The power generation utilities, on the other hand, are facing a declining trend in plant load factors (PLFs).

Power Line presents an overview of the performance of utilities across the power sector during the past year…

Generation

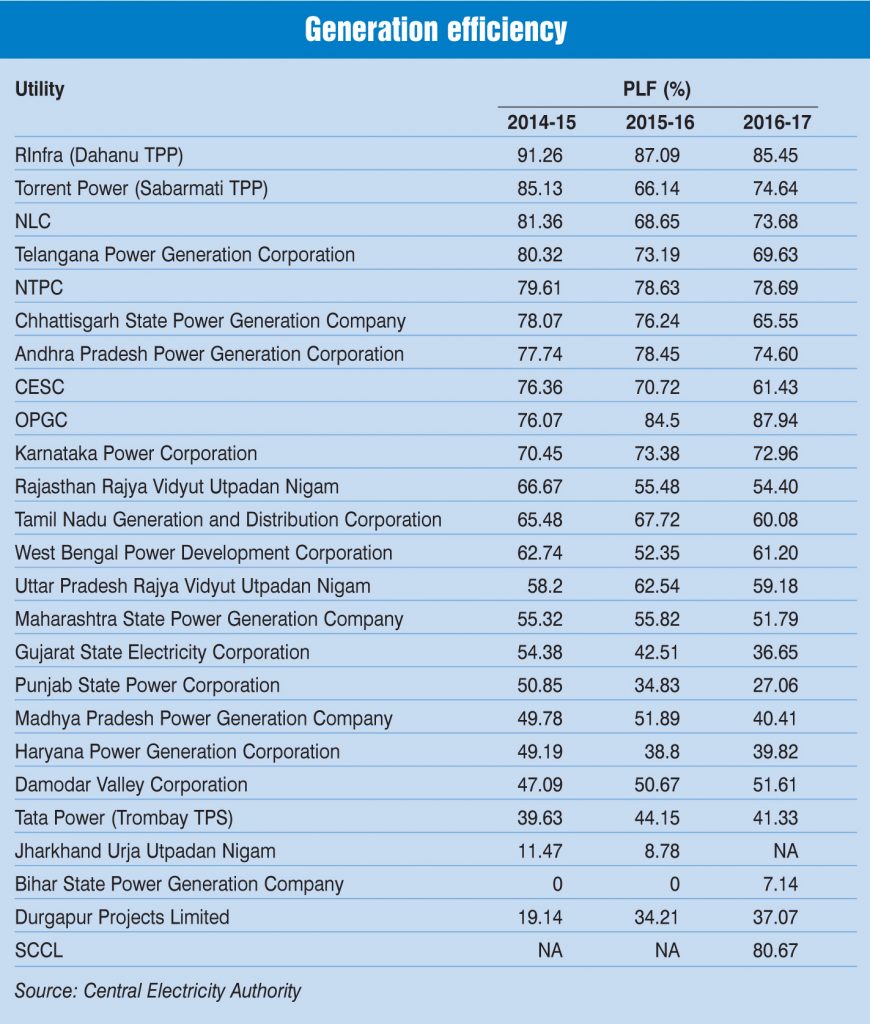

The national PLF for thermal power plants (TPPs) stood at 59.88 per cent in 2016-17, against the target of 60.78 per cent, declining by 2.36 percentage points from 62.24 per cent PLF recorded in 2015-16. During 2017-18 (till July), the PLF stood at 60.39 per cent.

Sector-wise, the average PLF at the central level increased by 0.95 percentage points, from 71.03 per cent in 2015-16 to 71.98 per cent in 2016-17. In contrast, the average PLF of both state and private utilities witnessed a decline for the said time period. In the state sector, the decline was from 56.83 per cent to 54.35 per cent. For private utilities, the decline was from 61.74 per cent to 58.49 per cent. Across the segment, the highest PLFs in 2016-17 were reported by Odisha’s state genco and private major Reliance Infrastructure’s (RInfra) Dahanu plant.

Among the central utilities, the Neyveli Lignite Corporation (NLC) was the outperformer, with the highest increase in PLF from 68.65 per cent in 2015-16 to 73.68 per cent in 2016-17. All the power plants of NLC reported increased PLFs. The PLF of India’s largest power producer, NTPC Limited, recorded an almost equivalent PLF of 78.69 per cent compared to 78.63 per cent in 2015-16. The best performing plant of NTPC was the Sipat super thermal power station (TPS) at 91.09 per cent PLF, whereas the lowest performing plant was the Badarpur TPS, operating at 27.61 per cent PLF. Meanwhile, central PSU Damodar Valley Corporation did not record any significant increase in its PLF, and stayed flat at 51.61 per cent from 50.67 per cent in 2015-16.

At the state level, the Odisha Power Generation Corporation (OPGC) was the best performing utility for the second consecutive year with 87.94 per cent PLF recorded in 2016-17, up from 84.5 per cent in 2015-16 and well above than the average state sector PLF and national average. Singareni Collieries Company Limited, which commissioned its first thermal power project in 2016-17, was the second best performing utility with 80.67 per cent PLF. Meanwhile, state gencos of Karnataka and Andhra Pradesh recorded PLFs of over 70 per cent in 2016-17. The state utilities that recorded an increase in PLF during 2016-17 over 2015-16 were OPGC, West Bengal Power Development Corporation Limited, Haryana Power Generation Corporation Limited and Durgapur Projects Limited. Meanwhile, the biggest drop in PLFs was reported by Madhya Pradesh Power Generation Company Limited, declining by 11.48 percentage points. State gencos of Chhattisgarh, Tamil Nadu Generation and Distribution Corporation Limited, Gujarat State Electricity Corporation Limited and Punjab State Power Corporation Limited also experienced a drop in PLFs during 2016-17 over the previous year.

In the private sector, only Torrent Power Limited witnessed an increase in PLF during the review period, from 66.14 per cent in 2015-16 to 74.64 per cent in 2016-17. The PLFs for all other private sector utilities registered a decline. The biggest decline was seen in the case of CESC Limited, which recorded a PLF of 61.43 per cent against 70.72 per cent in 2015-16. RInfra’s Dahanu TPP, which has been the top performer of the country for three years in a row, witnessed a drop of 1.64 percentage points in its PLF, from 87.09 per cent to 85.345 per cent during the same period and slipped to the second position in the country. The PLF of Tata Power’s Trombay TPS also decreased from 44.15 per cent in 2015-16 to 41.33 per cent in 2016-17.

Transmission

For the 24 utilities surveyed by Power Line Research, the transmission losses were in the range of 0.98 per cent to 4.5 per cent in 2016-17. The performance of transmission utilities improved during 2016-17, though marginally. Eight utilities registered an increase in their transmission losses, while six transcos registered a decline and six utilities did not register any change in their loss figures.

Delhi Transco Limited continued to be the best performing transmission utility with network losses of 0.98 per cent. The transcos of Delhi, Himachal Pradesh and Uttarakhand reported the lowest losses of 0-2 per cent.

Transmission utilities that recorded losses of 2-3 per cent during 2016-17 include Madhya Pradesh Power Transmission Corporation Limited, Haryana Vidyut Prasaran Nigam Limited, Punjab State Transmission Corporation Limited and Transmission Corporation of Andhra Pradesh Limited.

The majority reported losses in the range of 3-4 per cent and these included utilities of Assam, Bihar, Chhattisgarh, Gujarat, Jharkhand, Karnataka, Maharashtra, Meghalaya, Odisha, Telangana, Uttar Pradesh and West Bengal. The worst performers were Rajasthan Rajya Vidyut Prasaran Nigam Limited, Tamil Nadu Transmission Corporation Limited and Kerala State Electricity Board Limited, which recorded network losses above 4 per cent.

Distribution

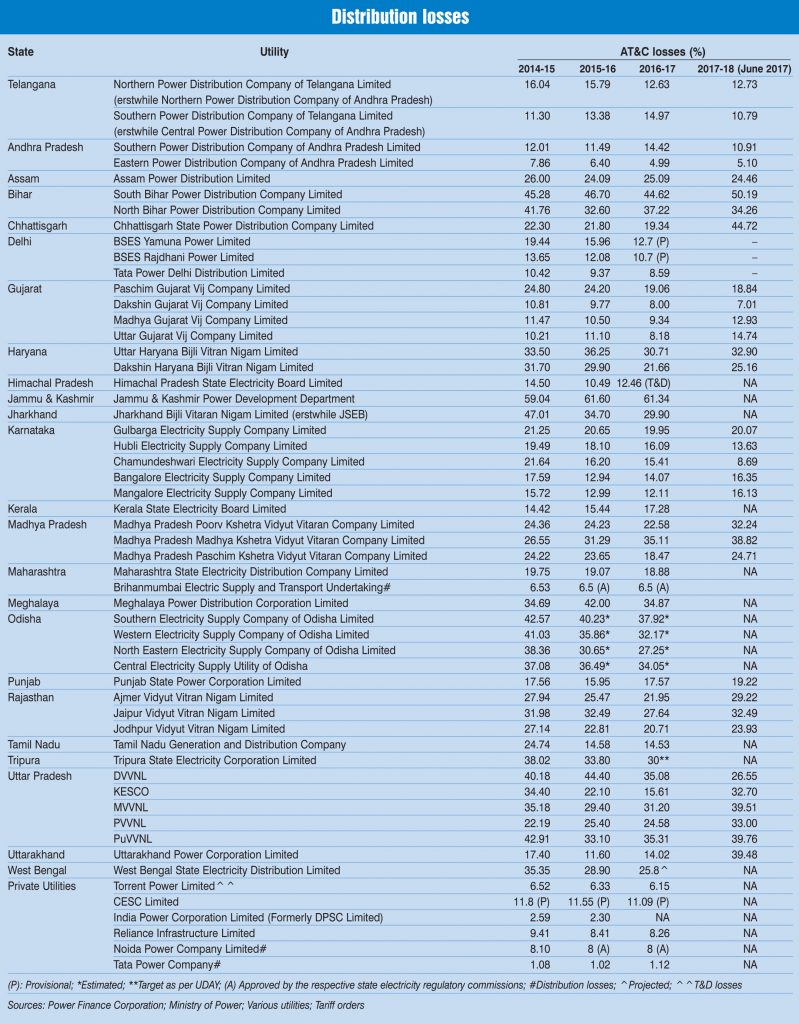

The AT&C losses tracked by Power Line research for 55 discoms (including private discoms) ranged from as low as 1.12 per cent to as high as 61.34 per cent during 2016-17. Among the state utilities, Eastern Power Distribution Company of Andhra Pradesh Limited was the best performer with AT&C losses of 4.99 per cent in 2016-17. The state utilities of Gujarat (excluding Paschim Gujarat Vij Company Limited) reported consistently low distribution losses in the range of 8 per cent to 11.47 per cent during the three-year period from 2014-15 to 2016-17.

Other state utilities that reported AT&C losses less than 15 per cent during 2016-17 are Mangalore Electricity Supply Company Limited, Northern Power Distribution Company of Telangana Limited, Southern Power Distribution Company of Telangana Limited, Himachal Pradesh State Electricity Board Limited, Uttarakhand Power Corporation Limited, Bangalore Electricity Supply Company Limited, Southern Power Distribution Company of Andhra Pradesh Limited and Tamil Nadu Generation and Distribution Company.

The worst performers in 2016-17 were the state utilities of Jammu & Kashmir, Odisha and Bihar, witnessing high AT&C losses of 32.17-61.34 per cent. Other utilities that recorded AT&C losses above 30 per cent during 2016-17 included Uttar Haryana Bijli Vitran Nigam Limited, Madhyanchal Vidyut Vitran Nigam Limited, Dakshinanchal Vidyut Vitran Nigam Limited, Purvanchal Vidyut Vitran Nigam Limited, Meghalaya Power Distribution Corporation Limited and Madhya Pradesh Madhya Kshetra Vidyut Vitaran Company Limited.

Private sector utilities have consistently reported low losses over the past couple of years. The best performer among these has been Tata Power Company Limited (Mumbai distribution) with a distribution loss of 1.12 per cent in 2016-17, which is lower than the 1.02 per cent recorded in the previous year. Other private utilities like Torrent Power Limited, Noida Power Company Limited and Reliance Infrastructure Limited (Mumbai) also performed well with distribution losses in the range of 6.15 per cent to 8.26 per cent.

Conclusion

Although the performance of the Indian power sector has seen improvement in response to policy initiatives taken by the central government, there is a lot of ground that is yet to be covered. The generation segment is still weighed down by a number of unaddressed issues such as declining PLFs and stressed thermal power assets, and discoms are still recording AT&C losses as high as 61 per cent. As the viability of investments across the sector largely depends on the operational performance of power utilities, a closer monitoring of the various schemes is required for attaining the desired results.