The shortage of domestic natural gas has severely affected gas-based power generation in the country. As of February 2017, the country’s 25,329 MW of installed gas-based power capacity was operating at a suboptimal plant load factor (PLF) of 22 per cent. Meanwhile, ready-to-commission gas-based power plants totalling 4,340 MW are unable to commence operations due to a gas shortage. Against a total domestic natural gas requirement of 87.46 million standard cubic metres per day (mmscmd), an average of only 28.26 mmscmd of gas was supplied to power plants in 2015-16. In this scenario, the government’s Scheme for Utilisation of Stranded Gas-based Capacity, launched in March 2015 for a period of two years (2015-16 to 2016-17), gave a shot in the arm to power plants. While the scheme has not been extended to 2017-18, the government is reportedly working towards a more sustainable long-term solution to revive gas-based power plants.

Background

Gas-based power generation in the country received an impetus following the discovery of natural gas on the western coast (Bombay High) by Oil and Natural Gas Corporation of India Limited in the 1970s and the subsequent commissioning of GAIL (India)’s Hazira-Vijaypur-Jagdishpur gas pipeline in 1987. In the following years, a large number of gas-based thermal power plants were set up along the pipeline, particularly in the northern and western parts of the country. The total installed gas-based capacity in these two regions stands at 11,203 MW and 5,781 MW respectively, as of February 2017.

With the discovery of natural gas in Reliance Industries Limited’s Krishna-Godavari (KG)-D6 block in 2002 and the subsequent commissioning of the East-West gas pipeline, a greater volume of gas was brought into the system in early 2009. With projections of a further increase in gas production at the KG-D6 block, a significant addition of gas-based capacity was planned by developers. However, contrary to projections, gas production from KG-D6 declined considerably due to sand and water ingress. After peaking at about 55 mmscmd in 2010-11, it dropped to 14 mmscmd in June 2013, thereby affecting gas supply to the power sector. Meanwhile, in March 2012, the Central Electricity Authority (CEA) issued an advisory to developers, asking them to not plan gas-based power plants till 2015-16 on account of the decline in natural gas production.

Gas demand-supply trend

Gas supply to power plants increased from about 38 mmscmd in 2007-08 to about 59 mmscmd in 2010-11. However, it declined gradually thereafter, to reach about 28 mmscmd in 2015-16. As a result, the gas deficit in the power sector increased significantly, from about 22 mmscmd in 2010-11 to over 85 mmscmd in 2015-16.

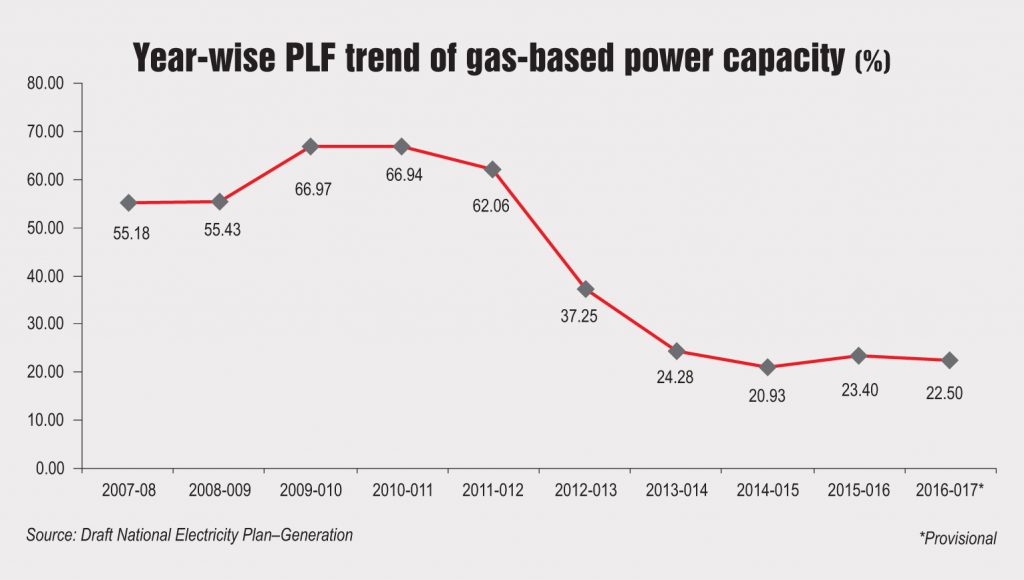

PLF trends

The PLF of gas-based power plants has also declined significantly over the years. It dropped from 66.9 per cent in 2010-11 to 22.5 per cent (provisional) in 2016-17.

Of the gas-based capacity of 23,075 MW monitored by the CEA (as of 2015-16), about 20,210 MW is connected with major gas pipelines/the gas grid while the rest is connected with isolated gas fields. Of the capacity connected with the gas grid, almost 40 per cent is based on gas supplied under the administered pricing mechanism, 34 per cent is based on gas from the KG-D6 block, while the remaining capacity of 5,271 MW has been commissioned without any gas allocation. During 2015-16, the gas grid-connected capacity achieved an average PLF of 19.55 per cent after receiving 18.75 mmscmd of gas. Meanwhile, the capacity connected with isolated gas fields received 9.51 mmscmd of gas and achieved an average PLF of 50.57 per cent. The average PLF of the entire gas-based capacity stood at 23 per cent in 2015-16.

Scheme for Utilisation of Stranded Gas-based Capacity

Taking note of the languishing gas-based power plants, the government launched the Scheme for Utilisation of Stranded Gas-based Generation Capacity in 2015-16. Under the scheme, imported regasified liquefied natural gas (R-LNG) was supplied at a reduced price to stranded and partially stranded gas-based power plants, selected through a reverse bidding process. In the auction, the plants that sought the lowest per unit subsidy support for the sale of power to discoms were selected, thereby placing a premium on efficiency. The support from the Power System Development Fund (PSDF) was fixed at Rs 35 billion for 2015-16 and Rs 40 billion for 2016-17.

The scheme also provided for a waiver on taxes and levies on the R-LNG being imported for power plants in order to reduce the price of gas. Under the scheme, the procedure for availing of the customs duty waiver on imported LNG for power plants was streamlined. Also, exemptions were provided on value added tax, central sales tax, octroi and entry tax on R-LNG. In addition, the scheme had a provision for the waiver of service tax on the regasification and transportation of the e-bid R-LNG. Further, the pipeline tariff charges were reduced by 50 per cent and the marketing margin by 75 per cent on e-bid R-LNG. Meanwhile, power developers were asked to forgo the return on equity, and transmission charges and losses were exempted for stranded gas-based power projects.

So far, four rounds of LNG auctions have been held wherein gas-based units of NTPC, Gujarat State Electricity Supply Company, CLP India, Torrent Power, GVK Industries, Lanco Power and GMR Energy, etc. have benefited. In the fourth and last round of the scheme, which was concluded on September 3, 2016, nine stranded plants were allocated 9.93 mmscmd of e-bid R-LNG. PSDF support ranging from Re 0.21 per unit to Re 0.22 per unit was secured by successful bidders in the fourth round.

While the scheme was successful in reviving gas-based power plants to some extent, it expired in March 2017. States such as Gujarat, Maharashtra and Andhra Pradesh have reportedly expressed reluctance to buy power from these plants, owing to high tariffs of Rs 4.50 per unit.

The way forward

As per the draft National Electricity Plan released by the CEA in December 2016, except the ready-for-commissioning/ under-construction gas-based power plants totalling 4,340 MW, no other plants are expected to be commissioned during the Thirteenth Plan period (2017-22), owing to the shortage of gas.

Given the benefits of gas-based power plants in efficiently balancing the grid and reducing emissions, the government needs to make strong efforts to revive domestic gas production and/or look at importing natural gas. Lack of concrete initiatives in this regard may result in existing and under-construction gas-based plants turning into non-performing assets. Thus, there is a need to incentivise exploration and production of domestic hydrocarbon resources. At present, the natural gas prices in the country (at about $2.48 per million British thermal units for April-September 2017) are inadequate to cover the cost of production. Besides, given the natural gas glut in the international market and the decline in prices, long-term gas import contracts can be looked at as a viable option.