The Indian power transmission segment has grown significantly over the years to cater to the rise in generation capacity and power demand, making the country’s electricity grid one of the largest synchronous grids in the world.

The segment is now set for another phase of accelerated growth, primarily driven by the need to evacuate large-scale renewables. With India targeting to meet 50 per cent of its energy needs from renewables and achieve 500 GW of non-fossil fuel capacity by 2030, significant expansion and strengthening of the interstate transmission system (ISTS) and intra-state transmission system will be required.

As a significant step towards successfully achieving the planned renewable energy capacity by 2030, the Central Electricity Authority (CEA) recently came out with a transmission system plan for integration of about 537 GW of renewable energy capacity, which requires significant expansion and strengthening of the ISTS system. As per the report, transmission line length of 50,890 ckt. km and substation capacity of 433,575 MVA at the ISTS level are required for integration of the additional wind and solar capacity by 2030, entailing a total cost of Rs 2,442 billion.

Power Line takes a look at the key trends and developments in the power transmission segment…

Network size and growth

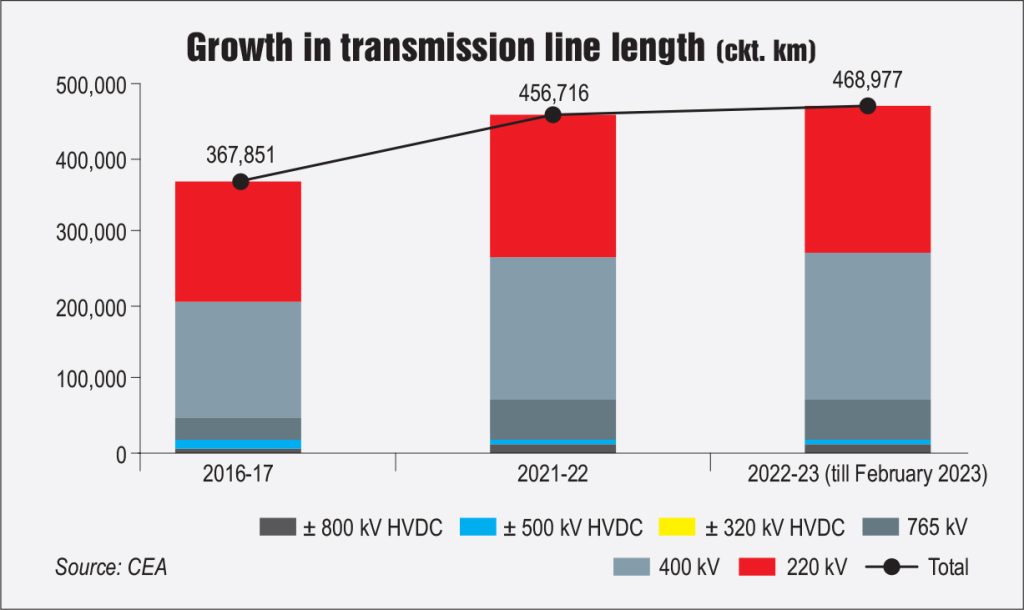

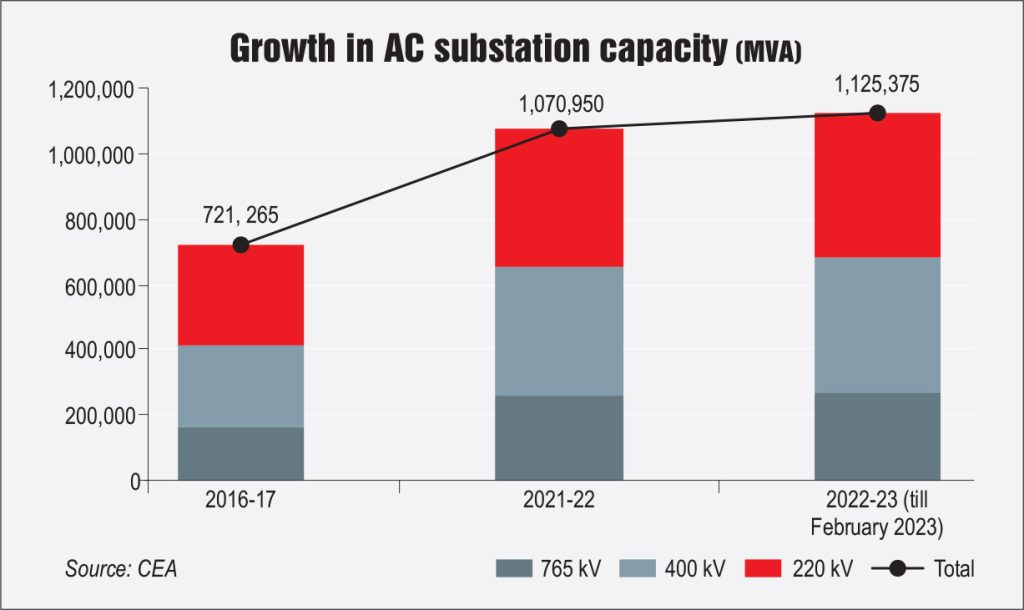

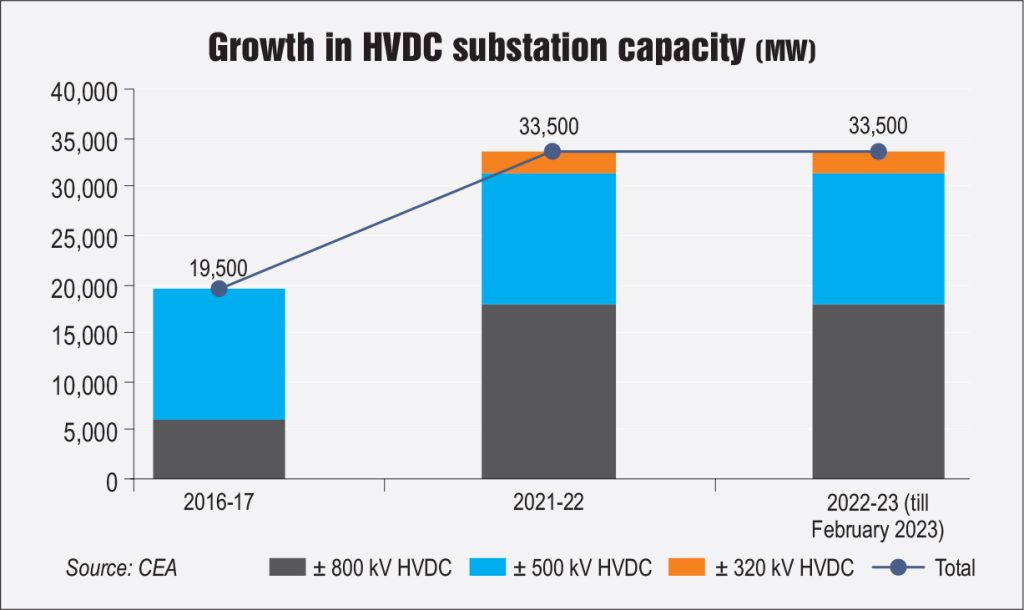

As of February 2023, the total transmission line length (at the 220 kV level and above) stood at 468,977 ckt. km, the total alternating current (AC) substation capacity stood at 1,125 GVA and the high voltage direct current system (HVDC) substation capacity stood at 33,500 MW.

Between 2016-17 and 2021-22, the line length has grown at a compound annual growth rate (CAGR) of 4.4 per cent, while AC and HVDC substation capacities have grown at 8.2 per cent and 11.4 per cent respectively. In absolute terms, about 88,865 ckt. km of lines, about 349,685 MVA of AC substation capacity and 14,000 MW of HVDC substation capacity have been added during this period.

As of February 2023, the interregional power transfer capacity stood at 112,250 MW. The interregional transfer capacity has grown considerably over the years, from about 75,050 MW in 2016-17 to 112,250 MW in 2021-22, recording a CAGR of 8.4 per cent.

Key policy and regulatory developments

As part of the Union Budget 2023-24, the capital outlay for green energy corridors (GECs), which are being implemented for evacuation of green energy, has doubled to Rs 5 billion. Further, the union budget has announced an investment of Rs 207 billion, including central support of Rs 83 billion for ISTS for evacuation and grid integration of 13 GW renewable energy from Ladakh. Meanwhile, viability gap funding support for battery energy storage systems with a capacity of 4,000 MWh has also been announced.

In June 2022, the Central Electricity Regulatory Commission (CERC) issued the Connectivity and General Network Access (GNA) to the ISTS Regulations, 2022. This follows the power ministry’s notification on GNA in October 2021, wherein it introduced a new paradigm for transmission planning. The regulations provide a regulatory framework to facilitate non-discriminatory open access to licensees/generating companies/ consumers for use of the ISTS through GNA. Overall, the transition to GNA would provide the much-needed flexibility to state entities in purchasing electricity under contracts of varying durations, without limitations of ISTS network availability. Further, in November 2022, Grid India issued a draft procedure on the allocation of transmission corridor for scheduling of GNA and temporary GNA transactions.

In June 2022, the CERC also notified the draft Indian Electricity Grid Code (IEGC) Regulations, 2022. For stable, reliable and secure grid operation and to achieve maximum economy and efficiency of the power system, the grid code, apart from provisions relating to the role of various statutory bodies and organisations and their linkages, contains extensive provisions pertaining to reliability and adequacy of resources; technical and design criteria for connectivity to the grid; and protection setting and performance monitoring of protection systems, including protection audit.

Meanwhile, the Ministry of Power (MoP) has issued guiding principles for monetisation of transmission assets of the state government-owned transmission undertakings and central public sector undertakings. The MoP has suggested an acquire-operate-maintain-transfer-based public-private partnership model for the monetisation of assets. As per the guidelines, a transco may take up monetisation of its brownfield transmission assets by hiving off assets to be monetised under a new specific special purpose vehicle.

Recently, in March 2023, the CEA has issued a manual on transmission planning criteria. The planning criteria detailed in the manual are primarily meant for planning of ISTS, InSTS and dedicated transmission lines down to 66 kV level. These planning criteria will be applicable from April 1, 2023, and will be used for all new transmission systems planned after this date.

Update on various programmes and initiatives

Green energy corridors: Initiated in 2015, GEC is a key programme for renewable energy evacuation in the country. Under GEC Phase I, 3,200 ckt. km of ISTS lines and 17,000 MVA of substation capacity have been commissioned. The intra-state GEC-I component of 9,700 ckt. km transmission lines and 22,600 MVA capacity substations is expected to be completed by March 2023.

As of October 2022, 8,651 ckt. km of intra-state transmission lines have been constructed and 19,558 MVA of substation capacity has been charged.

The intra-state GEC Phase II scheme, approved by the cabinet in January 2022, envisages intra-state transmission line length of 10,750 ckt. km and substation capacity of 27,500 MVA scheduled for commissioning by March 2026. The transmission scheme is currently under implementation by transmission utilities of seven states – Gujarat, Himachal Pradesh, Karnataka, Kerala, Rajasthan, Tamil Nadu and Uttar Pradesh – for evacuation of approximately 20 GW of renewable power.

Transmission scheme for renewable energy zones: Transmission systems have been planned for major renewable energy potential zones such as the Leh renewable energy park in Ladakh; Fatehgarh, Bhadla, and Bikaner in Rajasthan; the Khavda renewable energy park in Gujarat; Anantapur, Kurnool renewable energy zones in Andhra Pradesh; and offshore wind farms in Tamil Nadu and Gujarat under the recently released CEA Report for Transmission System Integration of 500 GW of renewable energy by 2030.

As per the report, under the “Transmission system for 66.5 GW ISTS connected renewable energy capacity”, a part of the transmission system has already been commissioned (13 GW). The rest is under various stages of implementation/ bidding/planning. Around 19 GW is under construction (slated for commissioning between December 2022 and November 2023); 8 GW under tendering; 10.5 GW to be undertaken for bidding and the rest of the capacity is under various stages of planning. Further, a transmission system has been planned for 236.58 GW (55.08 GW+181.5 GW) of renewable energy capacity, which is under various stages of implementation including approval and tendering.

The requirement of battery energy storage systems with projected renewable energy capacity is 51.5 GW by 2030. About 33,658 MW a margin is already available in existing/under-construction ISTS substations, which can be used for renewable energy integration. Further, a transmission system has been planned for about 16,673 MW additional hydro capacity likely to be commissioned by 2030. Other planned transmission schemes would be taken up progressively for implementation, commensurate with the renewable energy capacity. Additional transmission systems would be planned, based on the progress of green hydrogen manufacturing and with visibility of additional renewable energy potential sites.

TBCB update: As of February 2023, 68 ISTS projects have been bid out to public and private players since 2009 through the TBCB mechanism (excluding four projects that have been cancelled or are under litigation).

Of these, 23 projects have been secured by Powergrid and 45 have been won by private players. Adani Transmission Limited (ATL) and IndiGrid have won 15 projects each. Of the private sector projects won so far, 29 have been commissioned and the remaining 16 are under construction. Of Powergrid’s projects, 15 have been commissioned and eight are under construction. Another 11 ISTS projects have been awarded through TBCB in the past three months (January to March, 2023) for which construction has not yet begun, of which nine have been secured by Powergrid and two by ATL.

Cross-border interconnections: The existing cross-border interconnections have transmission capacity of about 4,230 MW and this is planned to be increased to about 6,450 MW progressively in the next few years. Several interconnections are planned between India and neighbouring countries, including a new 765 kV link between India and Bangladesh; and 400 kV new Gorakhpur and new Butwal transmission line between India and Nepal. Further, there are plans for the development of an overhead electricity link with Sri Lanka, after the earlier proposal to set up an undersea power transmission link was shelved due to high cost.

Technology focus

The transmission segment is at the forefront of adopting the latest technology. The key drivers for technology advances in cables and conductors, tower designs, transformer and substations have been addressing right-of-way issues, space optimisation, reducing visual impact, lower cost, reducing failure rate, increasing asset life, moving to higher voltages and increasing loadability.

Going forward, India is working towards having a modern and smart power transmission system with features such as real-time monitoring and automated operation of grid, better situational assessment, capability to have increased share of renewable capacity in the power mix, enhanced utilisation of transmission capacity, greater resilience against cyberattacks as well as natural disasters, centralised and data-driven decision-making, reduction in forced outages through self-correcting systems, among others.

These are recommendations made by a task force set up by the power ministry in 2021 under the chairmanship of Powergrid and the CEA, state transmission utilities, central transmission utility, among others as members. The recommendations of the task force have been accepted by the government last month.

The task force has recommended centralised remote monitoring, operation of substations including supervisory control and data acquisition, flexible AC transmission devices, dynamic line loading system, wide area measurement system using phasor measurement units and data analytics, hybrid AC-HVDC, predictive maintenance technique using artificial intelligence/machine learning algorithms, high temperature low sag conductors, process bus-based protection automation and control, gas-insulated switchgear/hybrid substation, cybersecurity, energy storage system, and drones and robots in the construction/inspection of transmission assets.

While short-term to medium-term recommendations will be implemented over one to three years, long-term interventions are proposed to be implemented over a period of three to five years.

Challenges

A major issue faced by transmission developers is limited right of way, especially in urban areas, which often leads to project delays and cost overruns. Further, large-scale integration of renewables poses challenges for grid stability leading to demand-supply imbalance, voltage and frequency instability. Moreover, shorter gestation period of renewable projects vis-à-vis transmission projects may cause stranding of upcoming renewable capacity. Besides, for ageing infrastructure network, upgradation and modernisation need to be undertaken in a phased manner to improve operational efficiency. With the increasing integration and digitalisation of the network, there is an increased threat of cybersecurity breaches.

The way ahead

The cumulative interregional transmission capacity is likely to be around 150,000 MW in 2030. Significant investments are thus required for strengthening and ramping up the country’s transmission infrastructure to meet the future peak load as well as to integrate expanding renewable energy capacity. The roadmap for ISTS transmission capacity development, as outlined in the CEA’s report, will help transport the targeted solar and wind power to load centres and bring the country closer to its clean energy mix goals. In addition to expanding the physical grid, utilities will incre-asingly need to invest in advanced and grid-enhancing technologies to improve capacity, grid resilience and stability, going forward.

Nikita Gupta