During the past one year, the conventional power generation segment continued to face headwinds, with coal-based plants operating at low plant load factors (PLFs) and stressed assets accumulating due to subdued power demand from the financially stretched discoms. The thermal power segment, moreover, recorded a 49 per cent decline in capacity addition.

To bring the segment back on track, the government is looking to improve thermal plant utilisation, ensure optimal coal utilisation and draw up strategies to bail out stranded assets. A look at the key trends and developments in the generation segment in the past one year…

Growth in capacity

As of end-July 2017, the total installed capacity in the country stood at 330.15 GW. The private sector accounts for a major share of 44 per cent, followed by the state (31 per cent) and central (25 per cent) sectors. Fuel-wise, coal-based capacity accounts for over 59 per cent, while renewables, hydro and gas sources accounted for 18 per cent, 14 per cent and 8 per cent respectively.

In 2016-17, around 11.5 GW of thermal capacity was added in the country, a decline of 49 per cent over the previous year. While coal, hydro, gas and nuclear capacity additions were 10.6 GW, 1.6 GW, 926 MW and 1 GW respectively, capacity addition from renewables was 11.3 GW during 2016-17. Thus, for the first time, renewable capacity addition surpassed all the other sources of generation in the country.

The key coal-based projects commissioned during the year include NTPC Limited’s Bongaigaon thermal power plant (TPP) Unit 2 (250 MW), Mauda super thermal power plant (STPP) II Unit 4 (660 MW), Kudgi TPP Unit 2 (800 MW) and Unchahar TPS Stage IV Unit 6 (500 MW); Singareni Collieries Company Limited’s (SCCL) 1,200 MW Singareni TPP; Sembcorp Gayatri Private Limited’s 1,320 MW coal-based TPP; JP Power Ventures Limited’s Bara TPP Unit 2 (660 MW); IL&FS Tamil Nadu Power Company Limited’s 600 MW project, and RattanIndia Nashik Power Limited’s TPP Phase I Unit 2 (270 MW). Meanwhile, in the hydropower segment, the key hydroelectric plants (HEPs) commissioned in 2016-17 include NHPC’s Teesta Low Dam IV Units 3 and 4 (2×40 MW) and Teesta Urja Limited’s 1,200 MW Teesta III HEP. In the nuclear power segment, the second unit (1,000 MW) of the Kudankulam project in Tamil Nadu was commissioned.

During 2017-18 (April to July) 3,790 MW of thermal power capacity and 1,043.12 MW of renewable capacity was added. The key coal-based plants commissioned during this period include NTPC’s Solapur STPP Unit 1 (660 MW), Meja STPP Unit 1 (660 MW) and Nabinagar TPP Unit 2 (250 MW) (being developed in a joint venture with Indian Railways); RattanIndia Nasik Power Limited’s Nasik TPP Phase I Units 3, 4 and 5 (270 MW each) and Prayagraj Power Generation Company Limited’s Bara TPP Unit 3 (660 MW).

Performance review

During 2016-17, the total power generation from conventional sources (thermal, hydro and nuclear) stood at 1,154.5 GWh, an increase of 5 per cent over the previous year. In 2017-18 (April-July), the total power generation has been 442.35 GWh, recording an increase of 6 per cent as against the same period in 2016-17. Coal-based power continues to be the mainstay of power generation in the country, accounting for 80 per cent of the total generation.

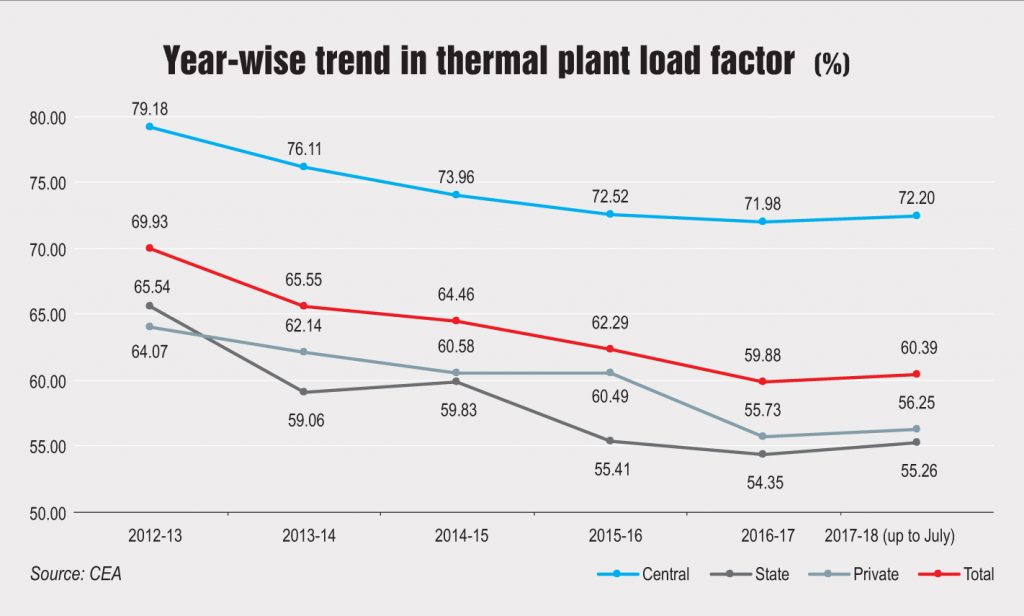

During 2016-17, while the PLF for coal-based power plants stood at 59.64 per cent (a 2.44 percentage point decline over the previous year), gas-based plants recorded a PLF of 22.51 per cent (almost the same as the previous year). Further, in 2017-18 (up to July 2017), the all-India PLF stood at 60.39 per cent (coal at 60.25 per cent and gas at 22.57 per cent). Broadly, the low PLFs can be attributed to the poor discom health, competition from cheaper renewable energy sources and the shortage of gas.

Stressed assets

The power sector is witnessing a build-up of stressed assets in the thermal power generation segment. As per latest data from the Department of Financial Services, Ministry of Finance, around 34 TPPs are under stress with an estimated debt of about Rs 1.77 trillion as of July 2017. The build-up of stressed assets in the sector is due to a host of reasons such as non-availability of fuel supply arrangements, absence of power purchase agreements (PPAs), promoters’ inability to infuse equity and falling electricity prices at the exchanges.

In order to tackle the situation, the Ministry of Power (MoP) is currently mulling over several proposals. The government is looking at the possibility of forming a national asset management company, a special purpose asset reconstruction company with sponsorship from the government, which would take over the project from the banking system for its recovery and rehabilitation. The MoP is also considering tweaking the medium- and short-term PPA norms for stressed assets to eliminate the contractual requirement of paying a fixed cost (by the discom) even if no power is purchased. Another possible solution that the government is considering is to conduct a public auction of stressed assets through major state-owned banks. Besides this, the acquisition of stressed TPPs by PSUs is being explored.

Coal supply

With better operational efficiency and grant of land and environmental clearances, Coal India Limited (CIL) managed to increase its coal production at a compound annual growth rate of 4 per cent between 2012-13 and 2016-17 to reach 554 million tonnes (mt). This has led to an increase in coal availability at power plants and a significant decline in coal imports in the country. In 2016-17, coal imports stood at 190.95 mt, a decline of 6.37 per cent over the previous year. Further, during April-June 2017, coal imports were recorded at 52.74 mt (provisional), an 8.1 per cent decline over the corresponding period in the previous year.

Apart from this, key coal-related policies have been announced in the past year. One of them is the new coal linkage policy, SHAKTI, for the transparent allocation of coal linkages via auctions. Under this, CIL/SCCL will allot linkages to independent power producers (IPPs) through auctions. In August 2017, CIL floated the first tender to provide coal linkages under Scheme for Harnessing and Allocating Koyala Transparently in India. Another significant policy development was the notification of the methodology for implementing flexibility in the use of domestic coal allocated to states by IPP plants. The state supplying coal will invite tariff bids from IPPs for the use of domestic coal and the IPPs will in turn supply power to the state.

Other developments

Other key developments in the power generation segment include the final verdict on the long-standing issue of compensatory tariffs. In March 2017, the Supreme Court issued an order disallowing Tata Power Company and Adani Power to charge compensatory tariffs, on account of the Indonesian coal price hike, for their power plants in Mundra, Gujarat. The court had set aside earlier orders by the Appellate Tribunal for Electricity (April 2016) and the Central Electricity Regulatory Commission (CERC) (December 2016), which allowed compensatory tariffs to the two companies and directed the CERC to adopt a fresh approach to resolve the matter. However, the CERC, in September 2017, has allowed compensation to Tata Power for change in the cost of electricity generation arising from revisions in domestic taxes and duties.

In another development in March 2017, the MoP amended the Mega Power Policy, 2009, for 25 provisional mega power projects aggregating 32 GW. The time period for furnishing the final mega certificates to the tax authorities has been extended to 120 months (instead of the earlier 60 months) from the date of import, to avail of the benefit of importing duty-free equipment.

Outlook

At present, the coal-based project pipeline is weak with no new projects in the pipeline. The draft National Electricity Plan (NEP), released in December 2016 by the Central Electricity Authority for the period 2017-22, has indicated that no new coal-based capacity addition is required over the next decade as coal-based capacity of 50,025 MW is already under construction. These plants are likely to yield benefits during 2017-22, and will fulfil the capacity requirement for the period.

In the gas-based segment, no new plants, except the ready-for-commissioning/ under-construction gas-based power plants totalling 4,340 MW, are expected to be commissioned during 2017-22, owing to the shortage of gas. Meanwhile, in the hydro segment, about 11.79 GW of capacity was under construction as of March 2017 and is expected to be completed by 2021-22. The future pipeline of hydro projects includes 15.3 GW of hydro capacity to be added during 2017-22, while another 12 GW is expected to be added during the 2022-27.

Net, net, the past one year has been stressful for the conventional power generation segment. Government policies and schemes, focusing on improving the operational performance and undertaking optimal coal utilisation, are expected to improve the scenario in the near future.