In the upcoming Union Budget 2018-19, the government is expected to continue its focus on infrastructure and rural electrification. With the overall objective of increasing the share of clean energy and providing 24×7 power to all, some of the areas that require greater attention are transmission system strengthening, revival of stressed power plants and hydropower development. As the government works on finalising the union budget for 2018-19, industry experts talk about their expectations from it. A look at the industry wishlist…

What are your expectations and wishes for the power sector from the Union Budget 2018-19?

Sabyasachi Majumdar, Senior Vice-President, ICRA Limited

Sabyasachi Majumdar, Senior Vice-President, ICRA Limited

ICRA’s expectations from the Union Budget 2018-19 for the power sector are as follows:

- Measures to improve long-term debt funding for the renewable energy sector.

- Higher budgetary allocation to partly meet the funding requirements in rural electrification and energy efficiency-driven projects.

- Clarity on the import duty/provisional safeguards duty for PV modules.

- Focus on faster execution of grid transmission network strengthening projects, given the increasing share of renewable energy in the energy mix.

ICRA expects higher budgetary allocation to meet the sector’s funding requirements, mainly for distribution strengthening and rural electrification networks, so as to improve and ensure reliable power supply in the country. Further, clarity is awaited on the import duty (or safeguards duty, if any) for PV modules. ICRA further expects measures to be introduced to ensure the availability of long-tenor debt funding at cost-competitive pricing, given the large funding requirements to meet the renewable energy policy target (a cumulative capacity of 175 GW by financial year 2022). In this context, ICRA also expects an increased focus from the government on faster execution of grid transmission network strengthening projects so as to ensure grid stability, given the rising share of renewable energy in the overall energy mix, going forward.

Dr Ashok Haldia, Managing Director and CEO, PTC India Financial Services Limited

Dr Ashok Haldia, Managing Director and CEO, PTC India Financial Services Limited

The infrastructure sector, which, by definition, provides essential services or public goods, requires, more than anything else, an enabling, stable and forward-looking policy environment and a conducive economic ecosystem. The decision for any investor to invest in a particular infrastructure asset hinges on these two critical drivers. The budget should, therefore, focus on alleviating the uncertainties associated with the policy environment and the economic ecosystem, which act as barriers to investment. Having said that, fiscal incentives do play their role in enhancing the returns on these assets, thus attracting more capital. The more the capital attracted, the less costly it becomes, thus reducing the cost of essential services or public goods that the asset provides.

In light of the above, I have the following suggestions:

- The power distribution segment is the most critical element in the entire value chain. The power sector cannot be healthy unless this segment functions well. Unfortunately, despite repeated interventions, the distribution segment remains plagued by the lack of financial and operational discipline. This is detrimental to achieving the renewable energy capacity target of 175 GW by 2022. Many industrial and commercial consumers have made a conscious decision to consume renewable energy under open access. These segments of commercial/industrial consumers are the most profitable for most discoms and also, this is where the discoms hide their inefficiencies and losses. It is no surprise, therefore, that open access approvals are hard to come by, and ad hoc charges like cross-subsidy and additional surcharge are levied, which are too burdensome to encourage consumption/demand of renewable energy. There is an imperative need to remove the legal and regulatory hurdles in open access and address the related infrastructural issues to facilitate market-based growth in renewable energy.

- The per capita consumption of electricity is expected to increase as the country grows. The inefficient tariff structure, where certain segments of consumers are heavily subsidised, will create more problems, if the status quo is to be maintained. As the push factors have not worked, probably a pull factor like incentivising the discoms to rationalise their tariff structures might work. The time has come to rationalise the pattern of cross-subsidisation to include certain segments of domestic and agricultural consumers as well. Also, there might be a case of experimenting/piloting a Direct Benefit Transfer scheme.

- Continuing in the same vein, there is a need to promote the adoption of decentralised energy systems like solar rooftops, which do away with line losses and provide access to electricity to deprived households. It stands high on the sustainability quotient and also reduces the requirement of electricity supply to the otherwise highly subsidised consumers. This could be promoted through schemes such as Unnat Jyoti by Affordable LEDs for All (UJALA), where the capex is undertaken by either the discom or by a government entity like Energy Efficiency Services Limited (EESL) or a private entity and is recovered by the discom through electricity bills. The capex may require some subsidy from the government.

- The renewable energy target of 175 GW also necessitates a spinning reserve. In the absence of adequate reserves of natural gas, hydropower should get its due prominence. Unfortunately, due to various issues, some within and some not within the control of developers, many hydroelectric projects have faced time and cost overruns and are yet to see the light of day. There is an imminent need for intervention from the government in the form of a stimulus, not only to help complete these projects but also to reduce the cost of electricity generation, at least in the initial few years.

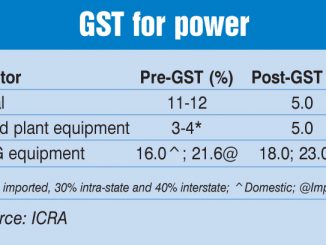

- With respect to the new tax regime, it needs some simplification. Electricity supply has been kept out of the purview of the GST regime. At the same time, the capital goods and services consumed by the sector fall within the purview of the GST Act. Accordingly, power generating companies are not able to claim input tax credit for the GST paid. This increases the procurement cost for distribution companies, thus unintentionally increasing the tariff for consumers. Hence, either the power sector should be brought within the purview of GST to remove the anomaly of multiple incidences of taxes or the GST rate on the sale of goods and services to power projects should be zero.