India’s largest private power transmission player, Adani Transmission Limited (ATL), is on an expansion drive. The company has won several big-ticket transmission projects through the competitive bidding route in the past few years. In the past two years, it has further expanded its portfolio through the acquisition of the transmission assets of Reliance Infrastructure (RInfra) and GMR Energy. ATL currently owns an operational network spanning more than 8,500 ckt. km with state-of-the art technology and network availability, and has another 11 projects under execution. In yet another landmark deal, ATL acquired RInfra’s Mumbai power business in December last year, which includes the generation, transmission and distribution of power for the city. In his first exclusive interview with Power Line, Anil Sardana, managing director and chief executive officer of Adani Transmission Limited, spoke about the company’s performance so far, its growth plans, the challenges ahead and the outlook for the power sector. Excerpts from the interview…

India’s largest private power transmission player, Adani Transmission Limited (ATL), is on an expansion drive. The company has won several big-ticket transmission projects through the competitive bidding route in the past few years. In the past two years, it has further expanded its portfolio through the acquisition of the transmission assets of Reliance Infrastructure (RInfra) and GMR Energy. ATL currently owns an operational network spanning more than 8,500 ckt. km with state-of-the art technology and network availability, and has another 11 projects under execution. In yet another landmark deal, ATL acquired RInfra’s Mumbai power business in December last year, which includes the generation, transmission and distribution of power for the city. In his first exclusive interview with Power Line, Anil Sardana, managing director and chief executive officer of Adani Transmission Limited, spoke about the company’s performance so far, its growth plans, the challenges ahead and the outlook for the power sector. Excerpts from the interview…

What has been Adani Transmission Limited’s growth journey so far?

Given Adani Power’s strong presence in generation and associated transmission over the past decade, and the opportunities in the rapidly growing national grid, we decided to pursue transmission and distribution opportunities with a distinct focus.

As on date, Adani Transmission has emerged as the largest private sector utility in transmission. It has successfully consolidated the assets acquired from GMR Maru and RInfra’s Western Region System Strengthening Scheme assets. Within a short span of seven to eight years, more than 8,511 ckt. km of transmission lines and approximately 14,000 MVA of transformation capacity have been made operational. Besides, an additional 11 projects are under way.

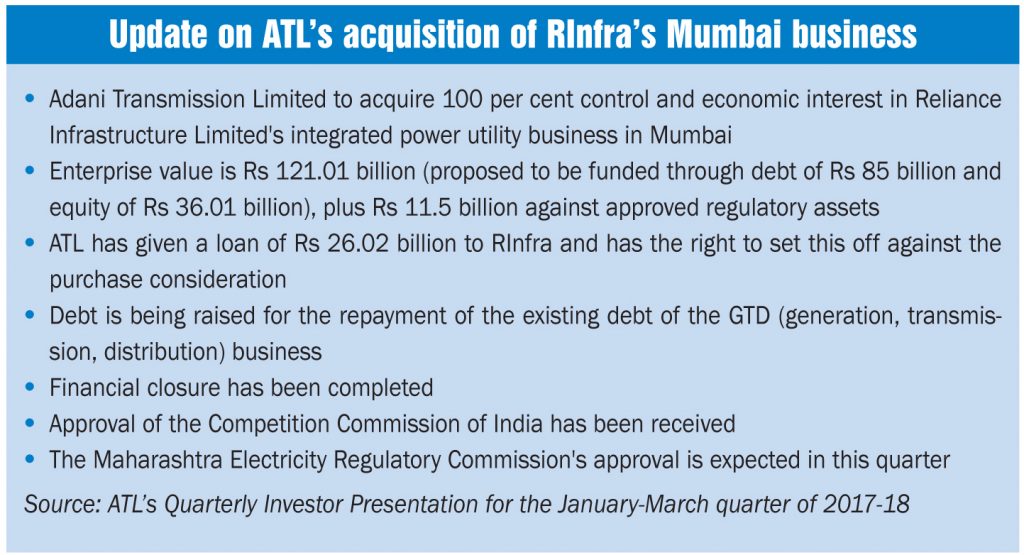

The recent acquisition of RInfra Mumbai’s integrated distribution, transmission and generation business will enable ATL to emerge as a significant transmission and distribution operator with the aspiration to partake in differentiated distribution reforms.

What are your top priorities for ATL in the next one to two years?

ATL aspires to be a significant contributor to the Government of India’s mission to achieve 24×7 power for all. Our prime focus will be on consumer services and 24×7 reliable power supply with benchmark SAIDI (System Average Interruption Duration Index) and SAIFI (System Average Interruption Frequency Index) comparable with the best utilities across the globe.

Amidst the ongoing consolidation of the transmission business, one of the key priorities will be the integration of the Mumbai suburban distribution business over the next few quarters.

With the acquisition of the Mumbai suburban network, ATL’s transmission network will reach around 12,000 ckt. km and its transformation capacity will increase to 19,300 MVA across the country, including high voltage direct current networks. Managing growth and consolidation will remain our top priority, ensuring long-term value creation for our stakeholders.

What are ATL’s plans for the distribution business in Mumbai?

ATL will continue with the good work being carried out by its existing teams and will strive to enhance customer orientation through the appropriate deployment of digitalisation, technology and differentiators practised by our team members in their association with consumer businesses elsewhere.

What is ATL’s current portfolio of transmission projects? What are some of the significant projects in the pipeline?

As indicated above, the company’s current portfolio of transmission assets makes it the largest private sector company in India. Amongst the significant projects in the pipeline are Fatehgarh-Bhadla Transmission Limited, which has approximately 200 ckt. km of line length at the 765 kV voltage level, a 400 kV substation, and the recently won Ghatampur project worth about Rs 20 billion.

In addition, eight projects totalling a line length of 2,369 ckt. km and transformation capacity of 2,215 MVA, won through tariff-based competitive bidding, are also under execution.

What are some of the key issues and challenges for the company? How are these being resolved?

What are some of the key issues and challenges for the company? How are these being resolved?

For transmission and large infrastructure projects, the critical issues and challenges are land acquisition, right of way and timely clearances. Dedicated teams have been addressing these issues through concerted efforts, remarkable project planning and strong project management capabilities. This has helped ATL in completing most of its projects ahead of time.

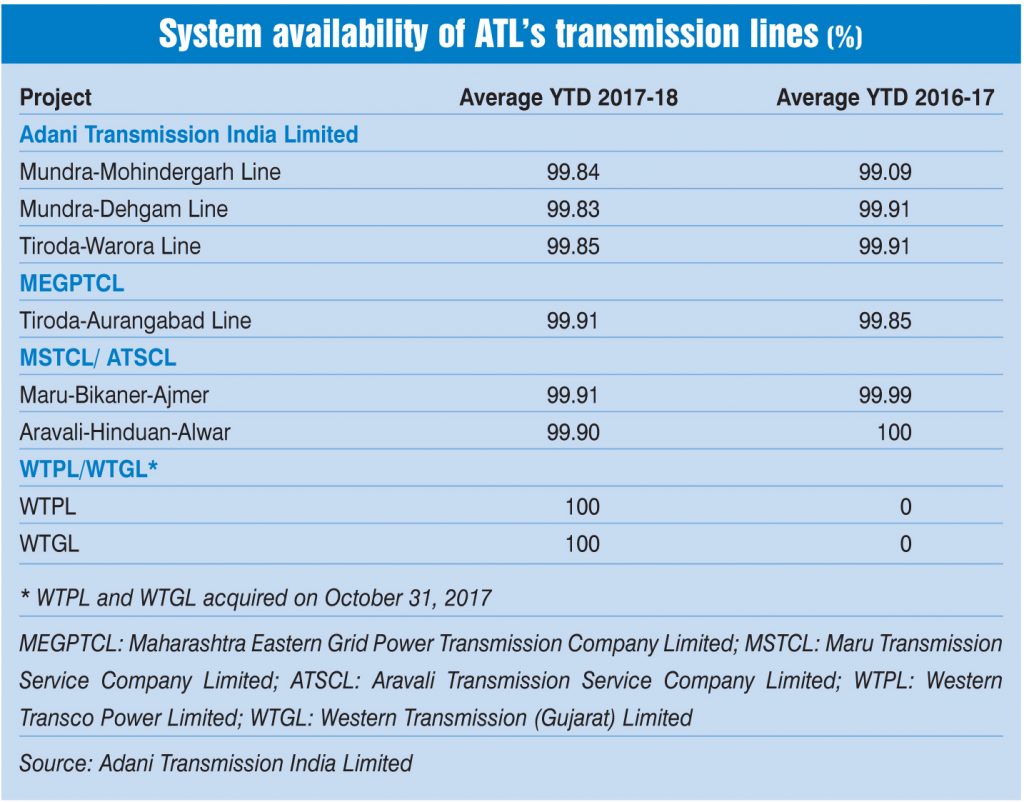

It is also important that once the lines become operational, high availability of assets is ensured. To this effect, ATL has been achieving close to 99.8 per cent network availability.

How would you rate the performance of the power sector in the past year?

It is time we rate the performance of the power sector on the basis of a customer being the key focus of delivery. It is, therefore, important that the the evaluating criteria should be key imperative power. Judging on this basis, there is an urgent need for distribution reforms.

What is your outlook for the power sector for the next few years and how do you see Adani Transmission’s role in it?

What is your outlook for the power sector for the next few years and how do you see Adani Transmission’s role in it?

The Government of India’s focus on achieving “Power for All” has boosted capacity addition nationwide. According to a recent study, India ranks third among 40 countries in EY’s Renewable Energy Country Attractiveness Index.

An investment of approximately Rs 2,600 billion is envisaged by both the central and state governments for strengthening the transmission system during the next five years. In addition to this, the plan of 175,000 MW of renewable capacity addition by 2022 and its evacuation will provide more opportunities for growth.

Similarly, opportunities to reform the last mile delivery to customers and improve the distribution segment by means of technology and a digitalisation interface aimed at providing efficient and cost-effective services to the end-consumers is likely to give players like us tremendous opportunities in the times ahead.

We acknowledge the fact that consumer expectations from a young integrated company will be very high. In order to meet these expectations, we need to ensure that we have world-class processes and systems to serve our customers better than our competitors.