Power sector financing witnessed several notable developments over the past year. These include the acquisition of REC Limited by the Power Finance Corporation (PFC), the revision of stressed asset guidelines by the Reserve Bank of India (RBI), the resolution of stressed generation projects totalling nearly 4 GW outside the Insolvency and Bankruptcy Code (IBC), and heightened merger and acquisition (M&A) activity in the transmission and renewables space. However, non-performing assets (NPAs) in the power sector have grown significantly. According to a report, “Bolstering ARCs”, by CRISIL and ASSOCHAM, the power sector accounts for the largest share (about 19 per cent) of the Rs 4.1 trillion large NPA accounts, and resolution in the sector has not been significant. That said, the RBI’s revised stressed assets framework is expected to benefit the stressed power sector assets that were operational and on the verge of being referred for insolvency proceedings under the IBC (estimated at Rs 1 trillion as of March 31, 2019). Power Line presents the key trends and developments in the power financing segment over the past year…

Update on stressed assets

The issue of stressed assets arises owing to various operational, regulatory and financial issues in the power sector. These include the absence of domestic coal linkages, lack of power purchase agreements (PPAs), delays in the realisation of receivables from discoms, lack of funds/ capital with developers, sluggish project implementation, and regulatory and contractual disputes. The power sector’s financial issues were compounded when the RBI revised its guidelines on the resolution of stressed assets in a circular dated February 12, 2018. It asked lenders to come up with restructuring plans within 180 days of a company defaulting on repayment and mandated a one-day delay in debt servicing as default. If the banks were unable to implement a restructuring scheme within this period, the case would go for insolvency and bankruptcy proceedings. However, in a big relief to the sector, in May 2019, the Supreme Court held the RBI circular on the resolution of stressed assets as ultra vires. Subsequently, on June 7, 2019, the central bank issued a “prudential framework for resolution of stressed assets by banks”. The revised guidelines have done away with the clause that mandated lenders to start resolution even if there was a one-day default. Under the new norms, defaults are to be recognised within 30 days, during which time the lenders may decide on the resolution strategy, including the nature of the resolution plan and the approach for its implementation. Lenders would have 180 days to implement the resolution plan after the 30-day review period from the date of default.

In order to resolve the issue of stressed assets, the central government also constituted a High Level Empowered Committee (HLEC) headed by the cabinet secretary in July 2018. This came after the Department of Financial Services declared 40 GW of capacity across 34 power plants as stressed, with an outstanding debt of Rs 1.7 trillion in March 2018. The HLEC submitted its report in November 2018 and in March 2019, the cabinet approved most of the measures recommended relating to coal linkages, power sale, etc.

As per the latest estimates, 13 projects aggregating Rs 590 billion are no longer stressed and three projects worth Rs 270 billion are at various stages of resolution. Meanwhile, eight projects with a total investment of Rs 490 billion have been referred to the National Company Law Tribunal (NCLT) but not admitted as yet and 10 projects worth Rs 380 billion have been admitted in the NCLT. The power ministry has reportedly recently asked NTPC Limited to bid for viable projects under the NCLT.

During the past one year, TPPs aggregating 3,950 MW were resolved outside the NCLT – SKS Power Generation’s 600 MW thermal power plant (TPP) (Chhattisgarh), Prayagraj Power Generation Company Limited’s (PPGCL) 1,980 MW Bara TPP (Uttar Pradesh) and GMR Chhattisgarh Energy Limited’s (GCEL) 1,370 MW Raipur TPP (Chhattisgarh). In November 2018, Singapore-based Agritrade Resources acquired SKS Power Generation in a one-time settlement of Rs 21.7 billion with its lenders. In the same month, Renascent Power signed a share purchase agreement with a consortium of lenders led by the State Bank of India to acquire 75.01 per cent in PPGCL, a subsidiary of Jaiprakash Associates Limited. Tata Power International Pte Limited owns 26 per cent stake in Resurgent Power, while ICICI Bank and other investors hold 74 per cent stake. The deal size is estimated at Rs 60 billion. The project is currently in a regulatory dispute as the Uttar Pradesh Electricity Regulatory Commission has asked the new promoters to reduce the tariff. In August 2019, Adani Power acquired 52.38 per cent equity stake in GCEL from its lenders. The balance 47.62 per cent stake was acquired from the GMR Group. The acquisition of GCEL was concluded at an enterprise valuation of about Rs 35.3 billion.

Debt market trends

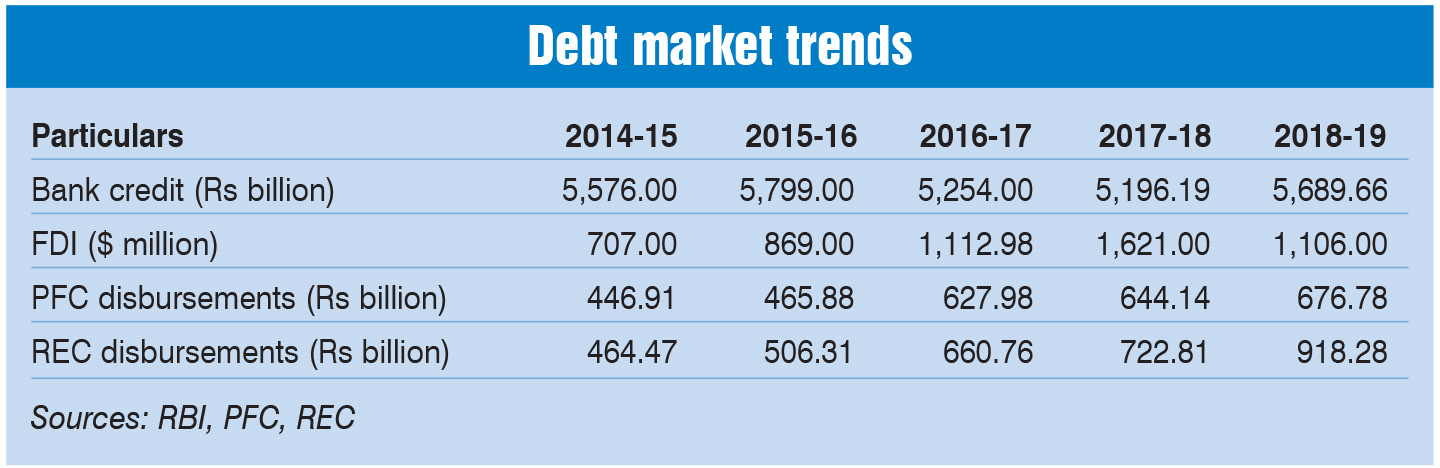

The debt market performed well in 2018-19 with cumulative disbursements from key power sector lenders PFC and REC reaching over Rs 1,595 billion. REC’s disbursements grew by 27 per cent to reach Rs 918.28 billion and PFC’s disbursements grew by 5 per cent to reach Rs 676.78 billion in 2018-19. During 2018-19, REC sanctioned loans worth about Rs 1,159.5 billion, an increase of 7.8 per cent over the previous year while PFC’s sanctions declined by 18 per cent to Rs 952.3 billion.

With regard to lending by commercial banks to the power sector, bank credit stood at Rs 5,690 billion as of March 2019, an increase of 9.5 per cent over the previous year. During 2019-20, bank credit to the power sector was recorded at Rs 5,682 billion, marking a year-on-year increase of 7 per cent. However, foreign direct investment (FDI) inflows in the power sector registered a decline of 31.7 per cent, from $1,621 million in 2017-18 to $1,106 million in 2018-19. This is the first time in the past five years that FDI inflows into the power sector have recorded a decline owing to a weak economic sentiment across global markets.

Equity market updates

In a landmark deal, PFC acquired the Government of India’s 52.63 per cent equity stake in REC Limited for Rs 145 billion. With this, PFC is now the promoter and holding company of REC. The acquisition is a significant move towards sector consolidation and provides inorganic growth opportunities for PFC. The deal has resulted in an entity with combined revenues of over Rs 500 billion, loan assets of Rs 6 trillion, and a profit of over Rs 125 billion.

The equity market also witnessed several other M&A deals over the past year, especially in the transmission segment. In February 2019, Adani Transmission Limited acquired KEC Bikaner Sikar Transmission Private Limited at an enterprise value of Rs 2.27 billion. In June 2019, Essel Infra sold its transmission assets operated under Darbhanga-Motihari Transmission Limited and NRSS XXXI(B) Transmission Limited to Sekura Energy Limited, which is backed by the Edelweiss Infrastructure Yield Plus Fund. In July 2019, Kalpataru Power Transmission Limited (KPTL) entered into binding agreements with CLP India Private Limited to sell its stake in three power transmission assets at an estimated enterprise value of Rs 32.75 billion. The deal is expected to help KPTL reduce its debt and marks CLP India’s entry into the power transmission space. In addition, in May 2019, global private equity major KKR and Singapore’s sovereign wealth fund invested Rs 10.84 billion and Rs 9.8 billion respectively, to collectively own 42 per cent of IndiGrid’s (Sterlite Power’s infrastructure investment trust) outstanding units.

The renewable energy sector continued to attract interest from private equity (PE) investors. During 2018-19, PE activity in the renewable energy sector was at a five-year high. According to Power Line Research, a total of $2,273 million was invested across 13 deals, which is nearly double the previous high of $1,206 million witnessed in 2015-16. In addition, over 24 M&A deals worth close to Rs 323.17 billion were signed in 2018-19.

The primary market remained dry with only one initial public offering (IPO), by Sterling and Wilson Solar Limited (SWSL). SWSL, the solar engineering and construction arm of the Shapoorji Pallonji Group, became the first Indian solar engineering and construction company to go public. In an IPO launched in August 2019, the company received bids for nearly 19 million shares for its IPO of 22.17 million shares, excluding the anchor portion. The issue was subscribed only 0.85 times. In addition, Bajaj Energy Limited filed its papers with the Securities and Exchange Board of India for its IPO.

The way forward

Going forward, NPAs and stressed assets in the power sector are expected to decline as more projects are resolved under the ambit of the NCLT as well as outside it. Also, recent initiatives by the Ministry of Power such as the creation of a trust retention account for certain stressed power plants to utilise their surplus revenue after meeting operating expenses for servicing debt and mandatory maintenance of letters of credit by discoms are steps in the right direction. However, delays in the payment of dues and renegotiation of PPAs by states such as Andhra Pradesh are potential risks for the sector going forward, especially if other states follow suit. In addition, slowing economic growth and distress in the banking sector due to debt defaults by large corporates may affect sector financing in the near to medium term.

Neha Bhatnagar