Adani Power Limited (APL) has emerged as the country’s largest private sector thermal power producer in less than 15 years. The company, which ventured into power generation in 2006 with its Mundra thermal power plant (TPP) in Gujarat, has expanded its footprint across the entire power value chain with a generation capacity of 12.45 GW.

In recent years, it has rapidly increased thermal capacity through a series of value accretive acquisitions. The latest feather in its cap is the acquisition of 49 per cent stake held by the US-based AES Corporation in the state-owned Odisha Power Generation Corporation (OPGC), which has a capacity of 1.7 GW. Prior to this, the company acquired GMR Chhattisgarh Energy Limited (GCEL) as well as Korba West Power Company Limited (KWPCL) with a combined operational capacity of nearly 1.9 GW. In another key development, the company has signed a 25-year power purchase agreement (PPA) with the Madhya Pradesh government, ending a five-year lull in the signing of long-term contracts in the thermal power segment.

Portfolio and operational performance

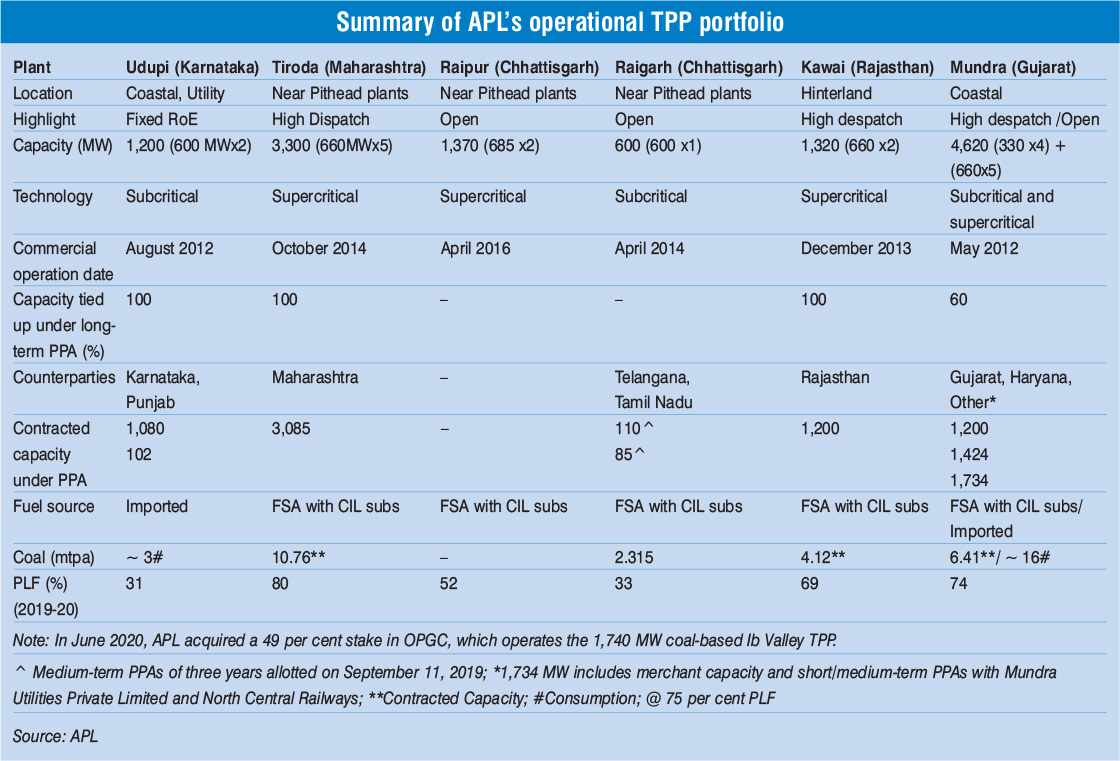

APL operates six coal-based power projects and one solar power project aggregating 12,450 MW, as of March 2020. These projects are the 4,620 MW Mundra TPP in Gujarat, the 3,300 MW Tiroda supercritical TPP in Maharashtra, the 1,320 MW Kawai supercritical TPP in Rajasthan, the 1,370 MW Raipur supercritical TPP in Chhattisgarh, the 600 MW Raigarh subcritical TPP in Chhattisgarh and the 1,200 MW Udupi TPP in Karnataka. Of these, the Raipur TPP was acquired by APL from the GMR Group in August 2019, the Raigarh TPP was acquired from KWPCL in July 2019, and the Udupi TPP was acquired from LancoInfratech in April 2015.

The acquisition of the Raipur and Raigarh TPPs was completed in 2019-20. For the 1,370 MW Raipur project, APL acquired a 52.38 per cent equity stake in GCEL from a consortium of lenders and the balance 47.62 per cent equity stake was acquired from the GMR Group. The acquisition of GCEL was concluded in August 2019 at an enterprise value of around Rs 35.3 billion. Post acquisition, the asset is under Raipur Energen Limited (REL). For the 600 MW Rajgarh project, APL completed the acquisition of KWPCL under the Insolvency and Bankruptcy Code in July 2019 at an enterprise value of about Rs 10.04 billion. The project is linked with a 2.315 million tonnes per annum (mtpa) long-term fuel supply agreement (FSA) with Coal India Limited. KWPCL is now renamed Raigarh Energy Generation Limited (REGL).

The company’s flagship project, the 4,620 MW Mundra TPP located in Kutch district, is one of the largest single-location projects in the world. It was commissioned in phases during 2009-12. It comprises four 330 MW subcritical units and five 660 MW supercritical units. The project has several firsts to its credit. Unit 1 (660 MW) of the project was the first supercritical generating unit to be commissioned in the country and was completed in a record time of 36 months from inception to synchronisation. The TPP is also the first in the country to be registered under the clean development mechanism of the United Nations Framework Convention on Climate Change. However, the project, which meets part of its coal requirement via imports from Indonesia, ran into trouble following a hike in Indonesian coal prices in 2010 leading to under-recovery of fuel costs. After years of litigation at the Central Electricity Regulatory Commission (CERC), Appellate Tribunal for Electricity (APTEL) and the Supreme Court as well as intervention by the Gujarat government’s high-powered committee, in April 2019, the CERC approved the revised PPA pass-through of the increased cost of imported coal for the Mundra TPP, providing the much-needed relief to the company. In addition, the company operates the 40 MW Bitta solar power project in Kutch, for which it has signed a PPA with Gujarat UrjaVikas Nigam Limited.

APL recorded an improvement in its operating performance in 2019-20 due to better domestic coal availability in Tiroda and Kawai, and incremental generation by the Raipur and Raigarh TPPs post acquisition. During 2019-20, APL’s average plant load factor (PLF) increased to 68 per cent from 64 per cent in 2018-19. The company generated 69.1 billion units (BUs) of energy in 2019-20, an increase of 18.11 per cent from the 58.5 BUs generated in the previous year. It sold 64.1 BUs of energy in 2019-20, an increase of 16.12 per cent over the 55.2 BUs in 2018-19. At 27.19 BUs, the Mundra TPP accounted for 42.4 per cent of sales during 2019-20.

Notably, about 86 per cent of the company’s electricity sales are tied up under long-term PPAs and the remaining under merchant tariffs or medium-term PPAs. Its average PPA tariff increased from Rs 4.02 per unit in 2018-19 to Rs 4.09 per unit in 2019-20. Notably, both REL and REGL secured medium-term PPAs under the Pilot Scheme II managed by Power Finance Corporation Consulting. The companies are favourably placed to get PPAs of 350 MW each for a period of three years. Meanwhile, the average merchant/medium-term tariff declined from Rs 4.57 per unit in 2018-19 to Rs 3.44 per unit due to low demand and softening of spot prices on the exchanges.

The company recently expanded its thermal portfolio by signing a definitive agreement in June 2020 to acquire a 49 per cent stake in OPGC from the AES Corporation for $135 million. The company will acquire a total of 8.9 million equity shares in OPGC, representing 49 per cent of OPGC’s total issued, paid-up and subscribed equity share capital. The plant has a long-term PPA for 25 years with state-owned offtaker GRIDCO and sources fuel from a nearby captive mine. The Odisha government holds the balance 51 per cent stake in OPGC. The transaction is subject to compliance with certain applicable requirements and regulatory approvals from the Competition Commission of India and the Reserve Bank of India. The acquisition is expected to be completed in December 2020.

Upcoming projects

The company is developing the 1,600 MW (2×800) Godda ultra supercritical TPP in Jharkhand with an estimated investment of Rs 148 billion. The project is being implemented by Adani Power (Jharkhand) Limited (APJL) for the export of power to the Bangladesh Power Development Board (BPDB). APJL had signed a 25-year long-term PPA with BPDB in November 2017, for the supply of 1,496 MW of power from the Godda plant. The company has also achieved financial closure of projects by tying up debt financing with a consortium of lenders including REC Limited and PFC. REC and PFC have sanctioned a rupee term loan facility of Rs 100.75 billion in the ratio of 50:50. As of March 31, 2020, APJL has drawn Rs 21.09 billion under this facility. The land acquisition for the project has been completed and an engineering, procurement, construction (EPC) contract has been awarded to a consortium led by SEPCOIII, a subsidiary of POWERCHINA. The company expects to commission the first and second units of the project by January 2022 and May 2022 respectively; however, some delays might be expected due to disruption in work post the Covid-19 lockdown.

In addition, the company is considering brownfield expansion at a few of its existing projects as well as the development of greenfield TPPs. These include the 1,320 MW (2×660) Pench supercritical TPP in Madhya Pradesh, the 1,600 MW (2×800) Kawai Expansion TPP, the 1,600 MW (2×800) Udupi Expansion TPP and the 2,600 MW (4×660) Dahej TPP in Gujarat. All projects will be based on supercritical technology.

Pench Thermal Energy Limited, APL’s wholly owned subsidiary, which is developing the Pench TPP, reached an important milestone in May 2020 with the signing of a long-term PPA with Madhya Pradesh Power Management Company Limited (MPPMCL). The company emerged as the successful bidder in the tariff-based competitive bidding process initiated by MPPMCL for the long-term procurement of 1,230 MW of power. APL quoted the lowest bid of Rs 4.79 per unit (Rs 2.90 per unit as fixed charge and Rs 1.89 per unit variable charge), outbidding JSW Energy (Rs 3.07 per unit as fixed charge and Rs 2.33 per unit variable charge) and MB Power (Rs 3.35 per unit fixed charge and Rs 2.14 per unit variable charge). In May 2020, the Madhya Pradesh Electricity Regulatory Commission approved the tariff discovered through competitive bidding. The project will be set up on a design-build-finance-own-operate basis by sourcing fuel from the allocated coal linkage under the SHAKTI policy.

Financial performance and delisting plans

Financial performance and delisting plans

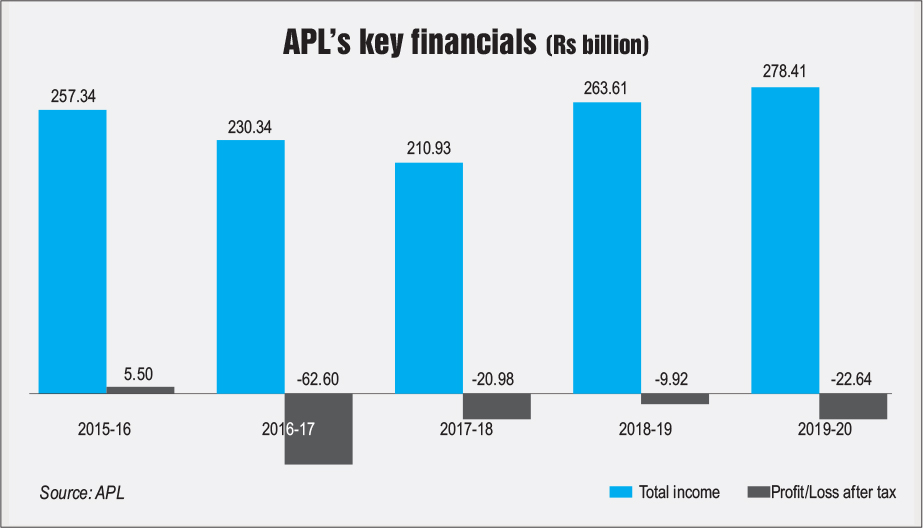

The company’s consolidated total revenue in 2019-20 stood at Rs 278.41 billion as compared to Rs 263.61 billion in 2018-19, an increase of 5.6 per cent. The revenue was higher in 2019-20, mainly due to an increase in the quantum of power sold. The consolidated net loss in 2019-20 increased to Rs 22.64 billion from Rs 9.92 billion in the previous year, mainly due to an increase in operational costs. As of March 31, 2020, the company’s consolidated outstanding debt, excluding working capital, stood at Rs 347.07 billion as compared to Rs 305.7 billion as of March 31, 2019. The debt balance at the end of March 2020 includes REL’s term debt of Rs 29.66 billion, REGL’s debt of Rs 9.42 billion, as well as a debt drawdown for the Godda project.

Further, the company’s board has recently approved the proposal to delist company shares from the stock exchanges. APL has proposed a floor price of Rs 33.82 per share to buy 9.65 million equity shares available with public shareholders for about Rs 32.64 billion. The promoter group collectively holds 74.97 per cent of the paid-up equity share capital in the company, whereas public shareholders own 25.03 per cent. As per an official statement, the objective of the delisting proposal is to enable the promoter group to obtain full ownership of the company and provide enhanced operational flexibility. Given that valuations in the stock market are depressed in current times, it is an attractive opportunity for promoters to make the companies private, providing them greater leeway to restructure or turn around businesses.

Issues and the way forward

Issues and the way forward

The immediate challenge for the company is the impact of Covid-19 on power demand and the economy. Discoms are facing liquidity crisis and payments to gencos are faltering. This poses a risk to APL since a major part of its capacity is tied up with state-owned discoms. In addition, the lockdown has affected work at its Godda under-construction project, but the company is confident of meeting project targets in a timely manner. Further, regulatory processes such as compensation for change in law events and realisation of compensatory tariffs take a significant amount of time and subject the company to cash flow mismatches. Also, a part of the company’s capacity that is untied is subject to pricing fluctuations in the spot market.

That said, despite the Covid-19 impact, APL has been able to ensure uninterrupted electricity supply from its generating units in a seamless manner and it expects that power demand will rebound in the near term. In its latest annual report, GautamAdani, chairman, Adani Group, remarked, “While we are looking at disruption in economic activity caused by the impact of an prolonged lockdown in the post Covid-19 world, the realisation that our nation must grasp an emerging, one-time opportunity to strengthen its industrial base by increasing its reliance on domestic manufacturing and attracting investments in export-oriented, high-value-added sectors could be a potential game changer in accelerating power demand.”

Going forward, APL is developing a digital transformation roadmap to leverage technology to streamline its business processes and asset management. The company also continues to be on the lookout for generation assets for acquisition to further enhance its generation footprint. Overall, APL is bullish about power demand growth in the coming years and aspires to be an integral part of the sector.