The Covid-19 pandemic has thrown businesses out of gear, and the power sector is no exception. While utilities have maintained generation and supply as electricity is an essential service, discoms have suffered a major blow as demand and revenues from high-paying commercial and industrial consumers declined considerably owing to the lockdown. As a result, the discoms’ outstanding dues to gencos and transcos have spiralled. However, proactive steps by the Ministry of Power, such as a liquidity infusion scheme, have provided some much-needed respite. Power Line invited power sector experts to share their views on the impact of Covid-19, the industry response and the way forward…

What has been the impact of Covid-19 on the power sector?

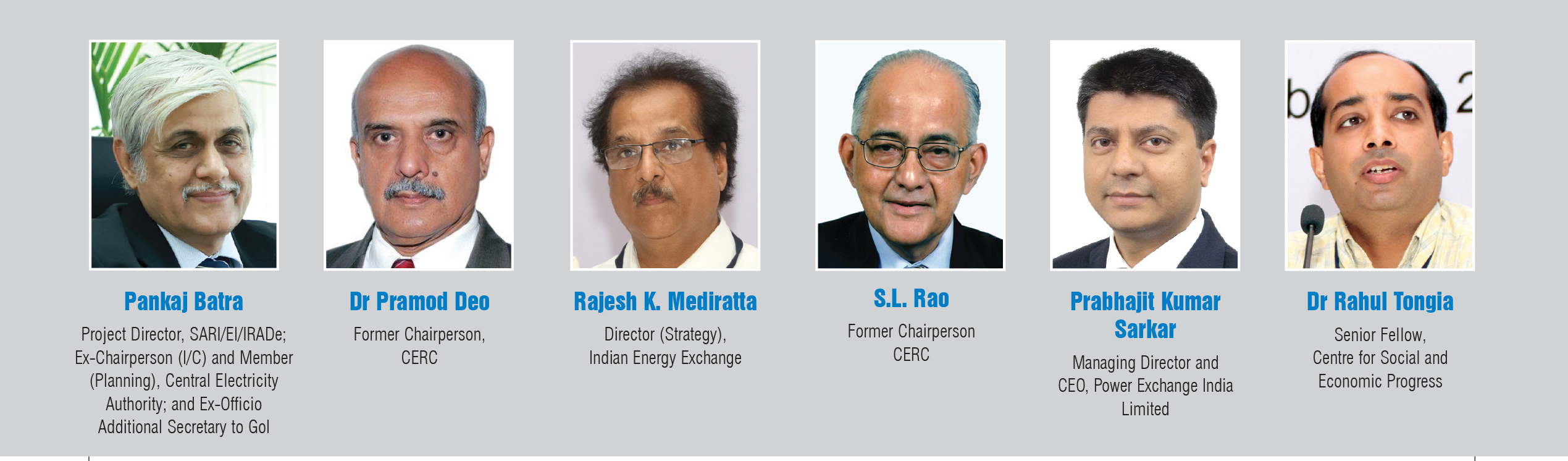

Pankaj Batra

The impact of Covid-19 on the power sector was seen after the government declared a total lockdown in the country for three weeks starting March 24, 2020, barring essential products and services, in order to give time to the medical fraternity for adequate preparation and to keep a check on the spread of the infection from one person to another. This had an immediate impact on the power demand as non-essential industries, commercial establishments, government and private offices, and transport, including rail transport and metros, were shut down. There was a 21 per cent fall in the average peak demand during the week following the lockdown, that is, March 25-31, 2020 vis-à-vis the week before the lockdown, March 18-24, 2020. In terms of the energy met as well, there was a decline of 21 per cent during March 25-31, 2020, as compared to the average energy met during March 18-24, 2020.

The prime minister extended the nationwide lockdown till May 3, 2020, with conditional relaxations after April 20, 2020 for regions where the spread was contained. The gradual unlocking started from June 1, 2020 onwards. The peak demand reduced considerably from 176,810 MW in April 2019 to 132,733 MW in April 2020, a drop of about 25 per cent, whereas it reduced from 182,533 MW in May 2019 to 166,225 MW in May 2020, a drop of about 9 per cent, which shows that the demand started picking up as some relaxations were provided by the government. Similarly, the energy met in April 2020 stood at 84,550 GWh as compared to 110,112 GWh in April 2019, a drop of 23 per cent, whereas in May 2020, it was 102,089 GWh as compared to 120,020 GWh in May 2019, a drop of about 15 per cent.

The industrial sector accounts for a 41 per cent share in total consumption, followed by the residential sector at 25 per cent, the agricultural sector at 18 per cent and the commercial sector at 8 per cent (as per the CEA’s 2018-19 estimates). Therefore, industrial consumption, together with commercial consumption, accounts for almost half the electricity consumption in the country. However, after the lockdown, with most people being confined indoors and working from home, industrial consumption reduced substantially, commercial consumption came close to zero, whereas residential consumption increased.

Since the electricity supply industry comes under essential services, the Ministry of Power (MoP) had issued orders to generating companies and requested the states to give similar instructions to their power stations to maintain 24×7 power supply to consumers while taking appropriate precautions. Public sector generating companies issued their own internal operating guidelines to ensure the safety of their employees during work. The MoP also requested the Ministry of Coal that no restrictions may be imposed on the production and movement of critical materials like coal, as well as other relevant stakeholders that no restrictions be put on other critical materials required for the operation of power plants. Therefore, there has been no problem in the supply of fuel. However, most discoms in India have reduced their offtake from coal-based generating stations, resulting in the pile-up of coal at stockyards.

Apart from this, many projects, notably renewable energy projects, were delayed due to disruption in the import of solar PV panels. ACME Solar cancelled the PPA for its 600 MW plant with the Solar Energy Corporation of India (SECI) and a long-term access agreement with Power Grid Corporation of India Limited as the manufacturing facilities of suppliers were affected due to the lockdown in China and India, among other reasons. SECI has opposed this and the matter is currently sub judice. There is also the risk of increase in the cost of under-construction projects due to the increase in interest during construction.

Discom finances took the biggest. About 90 per cent of the PPAs between discoms and generators are long-term contracts, with a fixed charge component and a variable charge component (except for renewable energy companies). The first component has to be paid by the discom, irrespective of whether power is drawn from the station or not, whereas the second component is paid depending on the energy drawn. Therefore, the fixed charge component is what is creating financial problems for the discoms, as the effective rate of electricity per unit goes up for the discom, whereas the retail tariff recovery from consumers is capped. I believe that when the financial year is over, the respective state electricity regulatory commissions (SERCs) may allow this extra cost to be passed on to the consumer. But, in the meantime, the discoms have been facing a cash crunch and have not paid the generators. Therefore, they approached the government for help. The central government has provided Rs 900 billion to address the cash flow problems and help discoms pay power generating companies through loans from the PFC and REC. The loans have been provided to discoms against guarantees by state governments to help them clear their liabilities towards central public sector generation and transmission companies (gencos/transcos), independent power producers and renewable energy gencos.

Dr Pramod Deo

The most adverse impact has been on the financial health of discoms as demand for all high-paying consumers – industrial and commercial – went down in the initial lockdown period. Their outstanding dues of Rs 900 billion have now jumped to Rs 1,200 billion. Recent data from the CEA shows that the demand is now picking up. However, since the lockdown has not been completely lifted, the economy is still not in full swing and so obviously the consumption of electricity by high-paying consumers is still depressed. In view of this, the government announced the Rs 900 billion package for discoms. However, states/UTs such as Tamil Nadu, Bihar and Jammu & Kashmir could not meet the minimum criterion to avail of the loans under the package. To address this, the Cabinet Committee on Economic Affairs has approved a one-time relaxation in working capital limits, which will enable states to borrow under the scheme.

Another area that has been impacted by the pandemic is the renewable energy segment, mainly in terms of capacity addition. The segment saw curbs on equipment imports from China, besides a levy of import duty on solar modules and panels. In view of this, the government may have to extend the deadline for achieving the 100 MW solar power target by 2022. It has already extended the period for concession for solar and wind energy projects for the payment of interstate transmission system charges. There have been some issues at the consumer end since actual meter readings were been taken. Bills were raised on an average basis, due to which there has been a jump in the billed amount, leading to disputes.

Rajesh K. Mediratta

Until the Covid-19 lockdown, the power sector saw a positive demand growth. However, the imposition of the lockdown led to a decline of 9.2 per cent year on year during March 2020 and 25 per cent in April 2020. During the first quarter of 2020-21, the national peak demand dropped by 16 per cent over the previous year. The fall was largely due to inactivity in the commercial and industrial segment, which impacted the financial liquidity of distribution utilities and consequently of both the power generation companies. Since May 2020, when the lockdown restrictions were eased in most parts of the country and the summer temperature increased, we have seen an improvement in demand levels. In fact, starting June 2020, the peak demand returned to 90 per cent of pre-Covid levels and in August 2020, there was just 6 per cent year-on-year decline, indicating a good and gradual recovery. By September 10, 2020, the peak demand crossed the previous year’s demand for the same day.

Despite a double-digit drop in national demand during the first quarter of 2020-21, the electricity trade on the Indian Energy Exchange (IEX) increased 14.5 per cent. With robust business continuity planning, we could ensure the availability of the IEX platform on a round-the-clock basis even during the lockdown days to facilitate an uninterrupted power supply to the distribution utilities. With ample liquidity on the sell side, the prices have been lower. The distribution utilities and industrial customers continue to leverage our exchange platform to optimise their power procurement costs by replacing the costlier electricity bought under PPAs with the electricity from the exchange. The average price in the day-ahead market from 24 March till August 31 was a mere Rs 2.45 per unit, a 26 per cent decline over the previous year.

S.L. Rao

Electricity consumption has declined considerably, especially by bulk industrial consumers, owing to the closure of industrial and commercial establishments and growing general unemployment. Disposable incomes have come down, thereby affecting power demand. As far as discoms are concerned, they have been in serious trouble for quite a while because the state governments have restricted open access and contributed to financial indiscipline and poor management of discoms. As a result, most of the discoms in the country are losing revenues while state governments are spending funds to further subsidise the discoms. This cannot go on for too long.

Prabhajit Kumar Sarkar

The Covid-19 pandemic necessitated a nationwide lockdown in our country, which adversely impacted all economic activity in the country. This, in turn, led to a drastic reduction in electricity demand, mainly from commercial and industrial consumers. The demand fell by more than 30 per cent during the initial period of the lockdown, which has now revived to the levels witnessed in the previous year.

The demand reduction has had a significant impact on discom financials as commercial and industrial consumers are the backbone of their revenue sources. Even prior to the lockdown, in February 2020, as per the PRAAPTI portal, discoms owed a staggering Rs 953.88 billion as overdue to generators and many states were close to breaching their mandated fiscal limits. As revenue sources from commercial and industrial consumers continue to be impacted, the financial stress of discoms has magnified and financial dependence on the central government relief has increased. The overdue amount as reported on PRAAPTI as of July 31, 2020 stood at Rs 1,166.83 billion. With the stabilisation of demand levels now, it is expected that the financial position of entities in the sector should improve substantially.

Dr Rahul Tongia

Before we examine the impact on the power sector, it is worth reflecting that there are many other sectors that have been hurt far worse. While the power sector may be facing pain, other sectors, such as tourism, have faced an existential crisis. Given the essential service nature of power, there has been very little lack of supply to meet demand. In fact, the dramatic fall in demand, first due to the lockdown, then due to the recession, has been the real change, and there is no problem in meeting load. While there have been issues in terms of supply chain, spares, new builds (more so in the RE sector), etc., they are second order compared to the larger balance of meeting demand.

What has been the industry’s response to the pandemic?

Pankaj Batra

The industry faithfully followed the instructions of the government when the lockdown was declared, leading to a fall in power demand. Finally, it was felt by the government that the concern for life has to be balanced by the concern for livelihood. The only industries that were flourishing during the pandemic were those providing essential services such as the food industry (biscuit manufacturing, online food and vegetable ordering), online education, industries manufacturing lifesaving equipment like ventilators and infrared thermometers. The industries that suffered the most were the automobiles industry, the travel industry, the hospitality industry and the construction industry. Many of them have now come back on stream.

As a result of the representation by the industry, the industries started opening up slowly, though with precautions. They also called back the migrant labour who had left for their home states. The government and private offices also started opening up cautiously, but with reduced strength.

Many persons started working from home, and that has now become a norm. In fact, the IT and consultancy industries have made long-term plans to work from home. Facebook has allowed its employees to work from home till July 2021, Google till June 2021. Similarly, consulting companies like Deloitte, KPMG, PwC, EY and others are also being allowed to work from home till further notice. The office electrical load has therefore decreased, whereas the home load has increased. This appears to be the new normal, as of now.

Dr Pramod Deo

The power industry has risen to the occasion in this difficult time as far as the generation and transmission segments are concerned. They have maintained services, and even discoms, despite their health, have gone out of their way to provide essential services. More so, in the backdrop of the severe cyclones that have affected West Bengal, Odisha and Maharashtra and completely destroyed distribution networks in many areas.

Rajesh K. Mediratta

In the first quarter of FY2021, the country experienced a severe slump in economic activities with the Index of Industrial Production contracting almost by 57.6 per cent in April 2020. The lockdown heavily impacted the functioning of the manufacturing and services sectors, which in turn impacted the overall power demand from the industrial segment. For instance, in April 2020, the electricity procured by industrial customers on the exchange witnessed a sharp drop of 75-80 per cent from the pre-Covid level. However, since the Covid restrictions were eased, we have witnessed a revival in industrial power demand. Moreover, the number of industries procuring power has increased from about 50 to almost 750 now. We have witnessed the share of volume from industrial consumers grow since May 2020 and now the volume from industrial consumers is almost at the pre-Covid levels. Industrial consumers account for 25-30 per cent of the total volumes traded on our exchange platform.

Dr S.L. Rao

There is not too much that the industry can do because of the decline in power demand. The discoms’ net worth has been affected, but they are still not cutting expenses or tightening budgets to try and cover some of the deficit in revenue that has been created due to the demand decline. The deficit will ultimately be transferred to state governments’ budget.

Prabhajit Kumar Sarkar

As far as government bodies are concerned, the MoP, along with other ministries including the MNRE and the MoC, has chalked out various demand- and supply-side interventions to provide relief to power sector utilities. The most significant amongst these is the liquidity infusion scheme of Rs 900 billion as part of the Atmanirbhar Bharat Abhiyan for extending special long-term transition loans of up to 10 years to reduce the financial burden on discoms. The other measures include relief in letter of credit requirements and late payment surcharge penalties, no advance payment to railways for coal transportation, grant of “must-run” and “deemed generation” status to renewable generators and timely payment of dues to all generators. These measures if implemented effectively, in both letter and spirit, will provide the much-needed relief to all the stakeholders across the value chain.

Besides this, PXIL has been providing uninterrupted services to all its customers during the lockdown. The exchange is committed to supporting its customers and providing assistance in alleviating the hurdles imposed due to the lockdown. We have implemented measures and processes to ensure business continuity and provide adequate service to our customers. We would focus on further strengthening our core business operations and critical functions to ensure business sustainability so that all the needs of our customers are met.

Dr Rahul Tongia

To meet the reduced demand, discoms have been purchasing far less power, but this has not saved them proportional money because a significant fraction of their cost structure is locked in under PPAs. The lack of liquidity in the sector is a significant challenge, which has prompted the government to offer support in the form of loans. While loans are being extended to pay off generators, there is not enough data on their impact in terms of consumer payments, or demand. These aspects will need recalibration going forward. Probably the most relevant operational factor has been how and under what terms contracts resort to force majeure.

What is the outlook for the sector?

Pankaj Batra

The lockdown followed from March into the summer months and through the summer into the monsoon season, with increasing use of air conditioners. Also, with more and more industries and offices opening up, the load has kept increasing. The power demand now, in September 2020, with more and more of life becoming normal, but with precautions, has reached the same as that in the previous year. The reduction of load with respect to the same period last year has slowly diminished over the months and has now exceeded that in the same period last year. Indian Railways and domestic flights resumed services in May 2020, though to a restricted extent. The metro in Delhi opened on September 7, 2020, with social distancing norms and other safety precautions. The average energy consumption in the first 10 days of September stood at 3,778 MUs vis-à-vis 3,743 MUs during the same period last year, an increase of about 1 per cent. The increase in energy consumption in 2019 over 2018 for the same period, however, was 4.3 per cent. The peak demand during these 10 days of the year was 172,446 MW vis-à-vis 171,092 MW during the same period last year, an increase of about 0.8 per cent. The increase in peak demand in 2019 over 2018 for the same period, however, was 4.2 per cent. So, the difference in electricity consumption for September this year vis-à-vis last year is still there, but to a reduced extent. Comparing this on a year-on-year basis, the electricity demand in the remaining part of the financial year is expected to exceed the demand vis-à-vis the same period last year. When a vaccine is discovered and is commonly available and people feel secure, I feel the demand will catapult given the pent-up feelings from not being able to go out and shop, and will again increase at the rate of 4-5 per cent. Even if we have to live with the virus for some more time without the vaccine being available, power demand would still increase by 2-3 per cent in India.

Dr Pramod Deo

The reforms proposed under the draft Electricity Amendment Bill will be closely watched. Some of the reforms suggested are politically sensitive such as the increased role of the state regulator as state governments are not going to easily surrender their control and authority over regulatory commissions. Another reform proposed is to have a separate dispute resolution authority. The idea behind this move is to relieve the regulatory commissions that are overburdend with a large number of cases, and passed on their load to the dispute resolution authority. The timing is crucial for this as any government that comes to power has a three-year window for any major political reform move and beyond that there is focus on the next elections. With the impact of Covid-19 expected to last through 2021, there is a very small window for making any major reforms and obtaining approvals from the state governments.

Rajesh K. Mediratta

The Covid disruption has offered a mixed bag of challenges as well as opportunities for the sector. While distribution utilities are facing financial liquidity challenges and a fixed cost burden due to long-term PPAs, the time is perhaps appropriate to adopt market-driven solutions for building a sustainable, technology-centred and an efficient power sector while delivering the objective of 24×7 power supply. Going forward, smart and advanced technologies will play a major role and there will be greater emphasis on digitalisation and decentralisation of the sector. We believe that the structure of power markets, the generation mix and supply/distribution should undergo a change. From the mid-term perspective, we must start transitioning from rigid 25-year PPAs towards energy markets for flexible and cost-effective power procurement. The government is also focusing on improving the overall policy and regulatory regime, with the new Electricity Act expected to bring efficiency into the sector and the liquidity infusion under the Atmanirbhar Bharat package to help reduce the stress on the sector.

Dr S.L. Rao

The country’s economy has been rather badly managed for 30-40 years and it is expected that many steps will be taken now to improve economic growth, exports and cash flows. In the interim, state deficits will go up and borrowings will increase in the next few months. As a lot more cash is being put into the system by the central and state governments, it can lead to inflation. Thus, governments need to learn to improve accruals and receipts as well as reduce deficit.

As far as electricity is concerned, a major problem is that the regulatory system, especially at the state level, has been grossly inadequate. Regulators have not directed discoms to charge rates commensurate with the cost of supply or to reduce thefts. Going forward, strong steps will be required to improve sector performance by allowing open access, shutting down inefficient generation plants run by state governments and strengthening the SERCs.

Prabhajit Kumar Sarkar

The power sector is undergoing a radical transformation due to the ingress of new technologies and digitalisation. Renewables, storage, distributed generation and EVs are getting increasingly adopted by various end-use sectors. In the foreseeable future, we expect a significant increase in digital transactions and the introduction of many new products with the deepening of the power markets.

The reforms directed towards the deepening of markets are likely to result in a surge in the liquidity available on the exchanges. Recently, the exchanges introduced real-time and green energy contracts. In the near to medium term, new products under categories such as ancillary services, market-based economic despatch and longer tenor contracts would also be traded through the exchanges. These products would add diversity and scale to the existing offerings of power exchanges. The expanding role of power markets may go a long way in addressing the issues of clean, reliable and quality supply to consumers at affordable costs.

Dr Rahul Tongia

Given the financial turmoil in the power sector, this may be the opportune time to revisit the equilibrium in terms of fuel mix and pricing/tariffs, both for wholesale procurement as well as for retail. One thing is clear – there may be a need for haircuts. The only question is, how should the pain be spread across the value chain? Just like with credit cards, deferment of payments is a stopgap measure, especially since interest continues to accrue.

What are the trends to look out for in the post-Covid world?

Pankaj Batra

Most of the PPAs between discoms and generators, which have adversely affected the discoms, would have to be revisited so as to distribute the risk more evenly. Therefore, the clause of force majeure may have to be changed. As of now, in some PPAs, pandemics are included under force majeure in addition to floods, earthquakes, riots, etc., but in many cases they are not included. The impact this has is that the generators continue to get paid a fixed charge of the tariff even if power is not drawn by the discom due to the reduction in demand. This effectively increases the cost per unit of electricity for the discom, whereas the retail tariff recovery from consumers is capped. The discoms may then approach the respective electricity regulatory commissions to address their grievance. Some discoms have gone to court to dispute the bills of fixed charge raised by the generator. Thus, a long-term solution will have to be sought, in line with other components of force majeure, so as to ensure the fair sharing of risk between the buyer and the seller. This situation has come up because we did not foresee that a pandemic could disrupt normal life to such a large extent. This effect has outlasted almost all other types of force majeure such as floods and earthquakes.

Similarly, fuel supply agreements (FSAs) for power plants running on gas have a clause of “take or pay”, which means that the offtaker of gas has to pay for pre-scheduled deliveries, irrespective of whether the gas is required or not. Therefore, if there is a reduction in demand from a gas-based power plant, it has to pay for the gas, whether it has really sourced gas or not. This clause may also have to be revised. I feel that a clause of force majeure on account of a reduction in demand due to pandemics also needs to be included in the FSA.

I also foresee more persons working from home since it saves time, effort and reduces carbon emissions due to travelling on fossil fuel-powered cars and other vehicles. I also see the proliferation of more companies enabling online meetings and webinars. This is not likely to reduce the power demand to a large extent since the use of power will now be for distributed offices rather than a central office. I also see a shift towards renewable energy, which does not face any fuel supply issues. This would lead to a greener world and cleaner air.

Dr Pramod Deo

The key priority has to be improving the financial health of discoms. This can be done by adopting the franchise model or appointing a sublicensee, but this has to be acceptable to the state governments. There should be some conditions placed when discoms are given financial assistance and working capital loans since these are being guaranteed by the state governments. This will help control the state governments to some extent, but how this plays out is clearly a political matter.

Rajesh K. Mediratta

The post-Covid world will be driven by a new and innovative energy order underpinned by sustainability, efficiency, affordability and technology. In India, the energy markets will play a key role in ushering in this new energy order, which is critical for reviving the country’s industrial and economic growth. The recent launch of a real-time electricity market and a green market has led to a paradigm shift in power markets. We expect to continue seeing the deepening of the power markets with the introduction of other new market products such as long-duration contracts, derivatives, new products in the green market, cross-border electricity, ancillary markets, which will drive a market-led power sector transformation.

The global trends of democratisation, decentralisation, decarbonisation and digitalisation will also get more pronounced in India with the greater deployment of renewable energy capacity with storage options. With energy security and sustainability as the primary focus of the government, renewable energy will occupy a central role in the evolving energy dynamics. We are already seeing the reduced dependency on coal and the emergence of storage and other hybridised models. There will be an increased emphasis on the adoption of innovative technologies to enhance sustainability going forward. The post-Covid world will also see the empowerment of consumers, with more and more consumers inclining towards green energy.

Dr S.L. Rao

In the post-Covid world, it is expected that many processes in the power sector will be automated and digitalised, especially billing and collection. As a result, manpower requirement, as well as manual errors, is expected to decline. Privatisation is essential but the state governments may not favour it.

Prabhajit Kumar Sarkar

During the Covid-19 pandemic, power demand has fallen considerably as nearly one-third of the global population preferred to stay at home. However, such a critical situation has also opened up new possibilities. On the road to recovery in the power sector, we foresee a few trends that may underline the future development of the industry in the post-Covid era. Some of these trends are technological innovations, shift to digital operations and renewable energy penetration on a large scale. More than anything else, the pandemic has brought to the fore the use of technology to stem operational bottlenecks and automate processes in order to reduce the exposure to such large-scale disruptions.

Dr Rahul Tongia

There are two dimensions of what the future may hold. The first is the overall macroeconomic outlook, starting with the recovery but also for long-term and structural shifts. The second is what may happen to the power sector. While there are many unknowns, especially in terms of time frame, there are a few trends that are under way, planned, or at least anticipated.

The first is a focus on resilience, which impacts the choice of fuels. It may also drive a renewed focus on Make in India. While it is not exactly clear how much of the new technologies such as solar cells or wafers will be made in India, there will be a push towards utilising existing resources. This is important in a world of constrained capital. The counter view to this is that there is a push for greener technologies, even if it means disposing of older assets before their end of life. Another trend is the rise of work-from-home, which would decrease power demand from the commercial segment and increase demand from residential consumers. While in theory this could be an even exchange in terms of energy, the financial implications of this would not be the same for discoms because of the differential tariffs across segments. This highlights the challenges of efficient pricing and may push tariff reforms. N