The country’s power generation segment is witnessing a major shift, with renewables replacing thermal power in the installed capacity mix at a fast pace. As of August 2022, the country’s installed capacity stood at 405.8 GW with coal- and lignite-based plants (210,699.5 MW) accounting for a major share of 52 per cent and renewables (116,077.64 MW) accounting for a share of 29 per cent. The share of renewables inches further upwards to nearly 40 per cent on the inclusion of large hydro (46,850.17 MW). This is significant, given that just a few years ago, in March 2015, coal’s share in the installed capacity mix was 68 per cent vis-à-vis renewables’ share of 14 per cent (and 29 per cent on including large hydro). Going forward, the pace of energy transition is expected to accelerate, given the central government’s focus on meeting its climate change targets. Indian Infrastructure provides an overview of the country’s power generation segment…

Capacity addition and generation

Capacity addition from conventional sources (thermal, hydro and gas) stood at 4,878 MW in 2021-22, much lower than the 11,478 MW target. About 4,485 MW was added by thermal power plants (TPPs) and 393 MW was added by hydroelectric plants during the year. The conventional capacity addition has considerably slowed down in recent years, with generators as well as lenders moving away from coal/gas-based projects, owing to environmental concerns. The conventional capacity addition in the past two years has also been lower vis-à-vis targets – 5,436 MW in 2020-21 against a target of 11,197 MW and 7,065 MW in 2019-20 against a target of 12,186 MW. Meanwhile, renewables’ capacity addition has continued to grow apace and stood at 14,076.95 MW for 2021-22. Of the total capacity addition, about 90.6 per cent was accounted for by solar power (with 10 GW by ground-mounted solar, 2.2 GW by rooftop solar and 407 MW for by off-grid solar). The remaining was accounted by wind with a 7.9 per cent share in capacity addition (1.1 GW), followed by biomass with 1 per cent share (142 MW) and small hydro with 0.5 per cent share 63.75 MW).

Capacity addition from conventional sources (thermal, hydro and gas) stood at 4,878 MW in 2021-22, much lower than the 11,478 MW target. About 4,485 MW was added by thermal power plants (TPPs) and 393 MW was added by hydroelectric plants during the year. The conventional capacity addition has considerably slowed down in recent years, with generators as well as lenders moving away from coal/gas-based projects, owing to environmental concerns. The conventional capacity addition in the past two years has also been lower vis-à-vis targets – 5,436 MW in 2020-21 against a target of 11,197 MW and 7,065 MW in 2019-20 against a target of 12,186 MW. Meanwhile, renewables’ capacity addition has continued to grow apace and stood at 14,076.95 MW for 2021-22. Of the total capacity addition, about 90.6 per cent was accounted for by solar power (with 10 GW by ground-mounted solar, 2.2 GW by rooftop solar and 407 MW for by off-grid solar). The remaining was accounted by wind with a 7.9 per cent share in capacity addition (1.1 GW), followed by biomass with 1 per cent share (142 MW) and small hydro with 0.5 per cent share 63.75 MW).

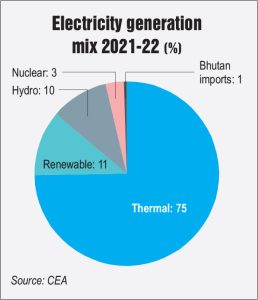

In terms of generation, the total generation stood at nearly 1,500 BUs in 2021-22, including generation from renewables and imports from Bhutan. While thermal sources accounted for 74.3 per cent of the total, renewables, including large hydro, accounted for a share of 22 per cent and the rest was contributed by nuclear (3.1 per cent) and imports from Bhutan (0.5 per cent).

During April-July 2022, only 120 MW of capacity was added. The conventional generation during this period stood at 495.55 BUs, while generation from renewables stood at 43.3 BUs. Renewable capacity addition during April-August 2022 stood at 6,192.28 MW, with solar accounting for 5,306.18, followed by wind (847.1 MW) and small hydro power (39 MW).

Key recent developments

To the relief of thermal generators, the Ministry of Environment, Forest and Climate Change has issued the Environment (Protection) Second Amendment Rules, 2022, extending the deadlines for TPPs to install equipment to cut sulphur emissions by two years. The deadline for TPPs within a 10 km radius of Delhi-NCR and cities with a population of more than 1 million has been extended from December 31, 2022 to December 31, 2024. For TPPs within a 10 km radius of critically polluted areas or non-attainment cities, the deadline has been pushed from December 31, 2023 to December 31, 2025. For all other TPPs across the country, the deadline has been pushed from December 31, 2024 to December 31, 2026. The power plant units declared to retire before December 31, 2027 will not be required to meet the specified norms for sulphur dioxide (SO2) emissions. This is a major relief for thermal gencos because flue gas desulphurisation systems have been implemented only across 20 units aggregating 8,290 MW out of the total capacity of over 211.6 GW of coal-based capacity spread across 600 units, as of August 2022.

High international coal prices, post-pandemic recovery in electricity demand, coupled with heatwaves in several parts of the country, and logistical constraints on coal transportation led to an increased demand of domestic coal and reduced supply during summer months. In order to prevent the power crisis from escalating further, the central government announced several policy and regulatory measures in April 2022. These include the Ministry of Power’s (MoP) directives to gencos to blend up to 15 per cent imported coal and to imported coal-based power plants to produce at their full capacity. Further, it has invoked Section 11 of the Electricity Act and advised states to allow the price of coal to be pass-through.

In another development, in March 2022, the Cabinet Committee on Economic Affairs extended the time limit by 36 months for 10 power projects, each with a capacity of over 1,000 MW, in order to furnish documents required for becoming certified “mega” projects so as to avail tax benefits and bid for tenders regarding electricity supply. Earlier, the timeline for such power projects was to get over on March 31, 2022, after which the projects would have lost their bank guarantees. The move is expected to benefit companies such as GMR, Essar, Lanco and Torrent, among others.

In view of the increasing renewable energy capacity, the government is looking at promoting storage technologies. In March 2022, the MoP notified the “Guidelines for procurement and utilisation of battery energy storage system (BESS) as part of generation, transmission and distribution assets, along with ancillary services”. The objectives of these guidelines are to facilitate the procurement of BESSs, as part of individual renewable power projects or separately, to address variability and firm up power supply from these projects.

In another positive development for the sector, the Andhra Pradesh High Court upheld the sanctity of power purchase agreements (PPAs) between developers and discoms in an order dated March 15, 2022, on the issue of PPAs being renegotiated by the Andhra Pradesh government citing poor discom health. The high court stated that the terms of the PPA cannot be altered and that tariff cannot be renegotiated unilaterally. The order overturns the previous court order, dated September 24, 2019, which was passed by a single-judge bench of the Andhra Pradesh High Court, permitting renewable energy developers to pay an interim tariff that was half the rate agreed upon, in their contracts, for all future and pending bills.

Focus on captive power

Captive power plants (CPPs) have remained an important source of power supply to commercial and industrial (C&I) consumers. Rising grid power tariffs and interruptions in electricity supply by state utilities are key drivers for industries to set up CPPs to meet their baseload and/or back-up power requirements. These CPPs provide reliable power supply at competitive rates, which is crucial for energy-intensive commercial and industrial (C&I) consumers; however, domestic coal shortages and a spike in international coal prices in recent months have crippled industries integrated with CPPs.

As per latest available estimates, the installed generating capacity of CPPs (of over 1 MW size) stood at 78 GW as of March 2020. Although coal-based CPPs have a major share in total captive power capacity, the recurrent shortages of coal and the decline in solar panel costs are driving C&I consumers towards renewable energy, especially solar. A number of large industries are installing renewable energy-based CPPs to meet their renewable purchase obligations, aside from their baseload/back-up power needs. For instance, in May 2022, Saint-Gobain India and Sembcorp Green Infra’s subsidiary Green Infra Wind Energy signed a long-term energy supply agreement under which Sembcorp will install a 33 MW captive wind-solar hybrid project to power Saint-Gobain’s manufacturing facilities in Sriperumbudur, Perundurai and Tiruvallur in Tamil Nadu. In the same month, Indian Oil Corporation Limited invited bids for the engineering, procurement and construction (EPC) of a 1.2 MW grid-connected captive solar project with a net metering facility at its LPG bottling plant at Sanand in Ahmedabad district of Gujarat. Likewise, business conglomerate DCM Shriram approved an equity investment of Rs 650 million for setting up a wind-solar hybrid renewable power project for captive use. In April 2022, Goldi Solar commissioned a 100 kW solar project in Surat’s first textile market for the Avadh Group.

Group captives are also gaining traction among industrial consumers. These are CPPs set up by industries for collective use of multiple industrial or commercial consumers, which have 26 per cent equity in the project and must consume 51 per cent of the power produced, as per the Electricity Rules, 2005. A key benefit of the group captive model is that cross-subsidy surcharge and additional surcharges are not levied on the power procured by different consumers.

Issues and challenges

Coal shortages and outstanding dues from discoms continue to weigh on the generation segment’s growth. As of June 2022, the outstanding amount from discoms to independent power producers stood at Rs 1,017 billion, an increase of 4 per cent over the Rs 978 billion in June 2021 (as per data from PRAAPTI [payment ratification and analysis in power procurement for bringing transparency in invoicing of generators] portal). While the central government has taken adequate measures to address the current crisis, a sustainable solution needs to be looked at to resolve these issues and prevent recurrence of such crises in future.

The slow-paced resolution of stressed thermal assets is a key challenge in the sector. It is estimated that coal-based capacity of about 41 GW is stressed, owing to issues such as lack of long-term PPAs, unviable tariffs in PPAs, lack of coal linkages, delays in project implementation and promoters’ inability to secure funding for completing the projects. As of January 2022, about 15.3 GW of coal-based capacity had achieved resolution. Recently, in September 2022, NTPC acquired Jhabua Power Limited, which operates a 600 MW TPP in Madhya Pradesh, through the corporate insolvency resolution process. Further, with the integration of renewable energy into the grid, TPPs need to incorporate flexibility in their operations. At present, the TPP fleet of NTPC Limited, the country’s largest generator, can flex up to 55 per cent and some of its power plants have even tried up to 40 per cent as well, but the TPP fleet of state gencos is still operating at 70-75 per cent. The central government is taking steps to ensure that almost the entire coal-based power plant fleet is able to flex up to 40 per cent in the next two to three years. Accordingly, the Central Electricity Authority (CEA) has recently notified the draft flexible operation of TPP regulations for power plants.

Future outlook

Future outlook

The all-India installed capacity is likely to be 622,899 MW at the end of the year 2026-27 and 865,941 MW at the end of the year 2031-32 as per the CEA’s Draft National Electricity Plan for Generation. The projected electrical energy requirement and peak electricity demand on an all-India basis is estimated as 1,874 BUs and 272 GW for the year 2026-27 and 2,538 BUs and 363 GW for the year 2031-32 respectively. The plan projects the total fund requirement for the generation segment at Rs 21.49 trillion during the 10-year period between 2022-32.

The capacity addition required during 2022-27 is projected at 228,541 MW comprising 40,632 MW of conventional capacity addition (coal and lignite 33,262 MW, gas 370 MW and nuclear 7,000 MW) and 187,909 MW of renewables-based capacity addition (large hydro 10,951 MW, solar 132,080 MW, wind 40,500 MW, biomass 2,318 MW, pumped storage projects [PSP] 2,060 MW) excluding 5,856 MW of likely hydro-based imports. Further, the conventional capacity addition during 2027-32 is projected at 18,134 MW (coal 9,434 MW, nuclear 8,700 MW) and 224,908 MW of renewables based capacity addition (large hydro 10,888 MW, solar 147,400 MW, wind 53,100 (onshore 43,100 MW and offshore 10,000 MW), biomass 1,500 MW, PSP 12,020 MW) excluding 5,856 MW of likely hydro-based imports.

The draft plan also notes that apart from under-construction coal-based capacity of 25 GW, additional coal-based capacity required till 2031-32 may vary from 17 GW to around 28 GW. It is also seen that the BESS (5-hour) requirement in 2031-32 may vary from 51 GW to 84 GW. Overall, the projection of the total capacity addition is in line with the target of the country to achieve a non-fossil based installed capacity of 500 GW by the year 2029-30.